Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts

Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts – slope intercept type x and y intercepts

| Delightful to our weblog, on this interval We’ll offer you about key phrase. And after this, this is usually a preliminary picture:

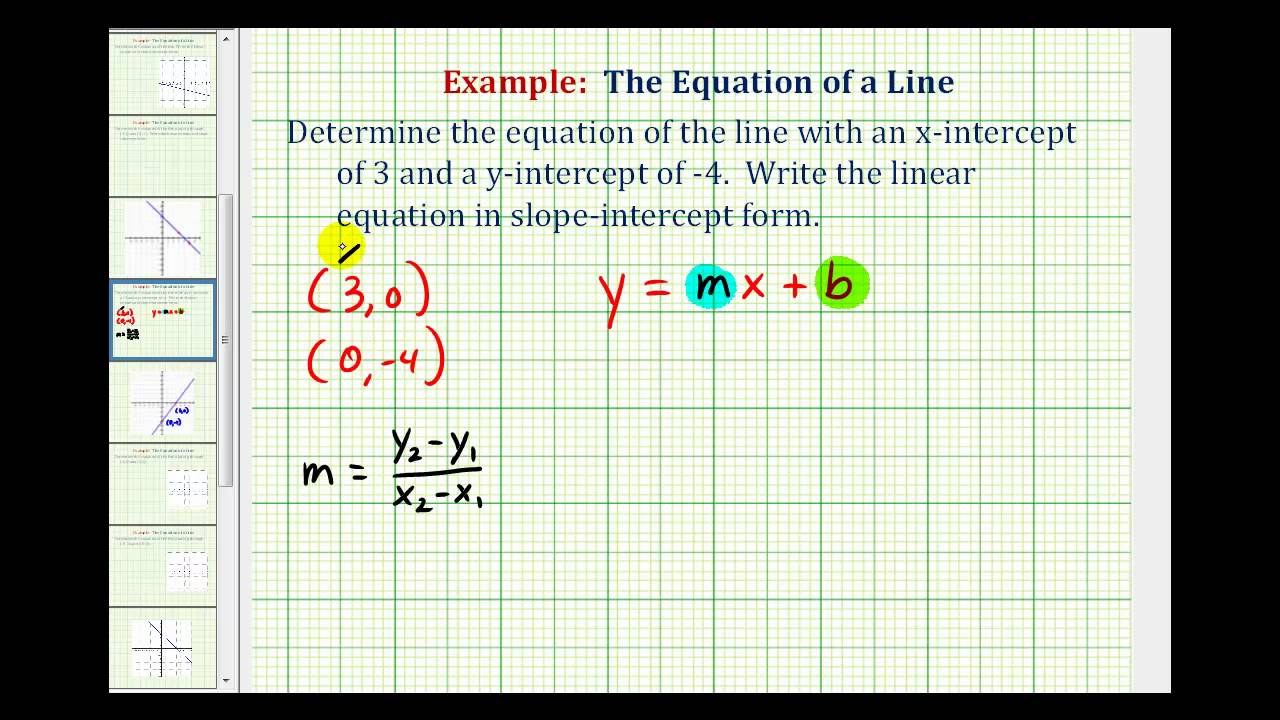

Ex: Find the Equation of a Line in Slope Intercept Form Given the X and Y Intercepts | slope intercept type x and y intercepts

Why not take into account {photograph} beforehand talked about? might be that unbelievable???. if you happen to’re extra devoted and so, I’l l clarify to you many picture over again down under:

So, if you would like to safe all of those superior pics associated to (Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts), merely click on save hyperlink to save lots of these pictures in your private laptop. They are ready for obtain, if you happen to like and need to get it, merely click on save badge within the net web page, and will probably be instantly saved to your laptop computer.} Finally if you happen to want to get new and newest picture associated with (Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts), please comply with us on google plus or bookmark this weblog, we try our greatest to give you common up grade with recent and new pics. Hope you want staying right here. For some updates and up to date details about (Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts) graphics, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We try to current you up-date commonly with all new and recent pictures, love your looking out, and discover the most effective for you.

Here you’re at our web site, articleabove (Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts) revealed . Today we’re delighted to declare that now we have discovered an extremelyinteresting topicto be identified, that’s (Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts) Most individuals searching for data about(Slope Intercept Form X And Y Intercepts The Ultimate Revelation Of Slope Intercept Form X And Y Intercepts) and undoubtedly certainly one of these is you, is just not it?

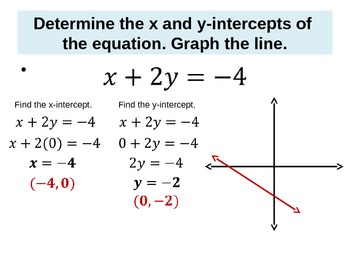

Linear Equations – X and Y-intercepts and Slope Intercept Form | slope intercept type x and y intercepts

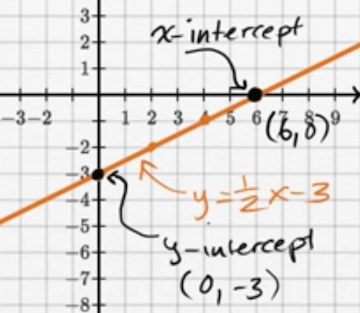

How Do You Find the X- and Y-Intercepts of a Line in Slope … | slope intercept type x and y intercepts

Ex 100.100, 10 – Reduce equations into slope-intercept type – Ex … | slope intercept type x and y intercepts

How Do You Find the X- and Y-Intercepts of a Line in Slope … | slope intercept type x and y intercepts

X and Y Intercepts | Passy’s World of Mathematics | slope intercept type x and y intercepts

Warmups 10. Determine the x and y intercepts of: 10x + 10y … | slope intercept type x and y intercepts

Ch. 10 – 10 | slope intercept type x and y intercepts

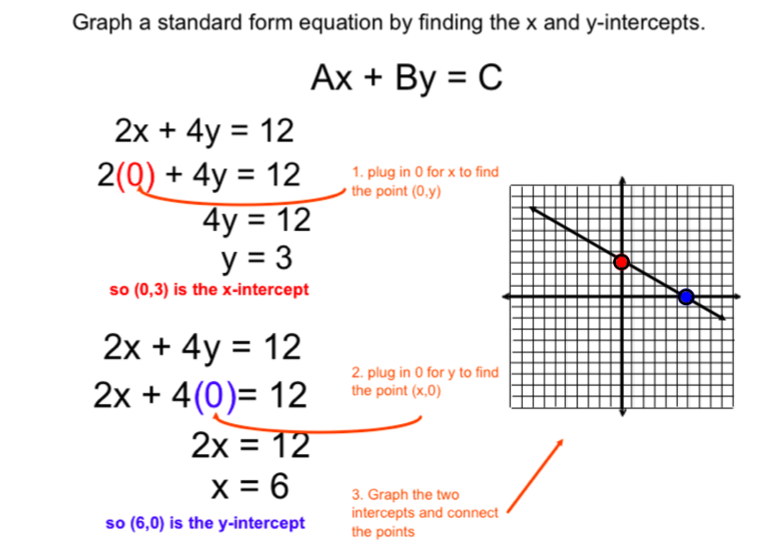

Using the X and Y Intercepts to Graph Standard Form Equations | slope intercept type x and y intercepts

Intercepts of traces evaluate (x-intercepts and y-intercepts … | slope intercept type x and y intercepts