How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form

How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form – learn how to easiest kind

| Delightful to the weblog, with this second I’m going to reveal concerning key phrase. And to any extent further, this may be the first picture:

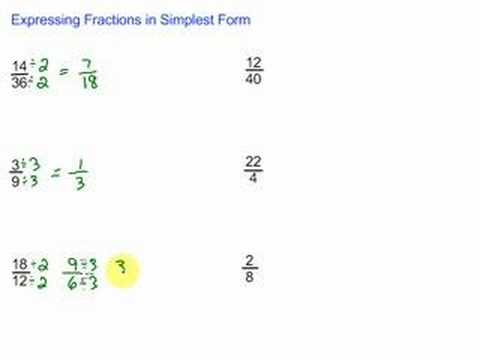

Expressing Fractions in Simplest Form | learn how to easiest kind

What about impression beforehand talked about? is definitely that may unimaginable???. should you’re extra devoted due to this fact, I’l d clarify to you a number of {photograph} another time beneath:

So, should you want to get all these fantastic footage about (How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form), press save icon to avoid wasting these photos in your computer. There’re prepared for obtain, should you love and want to get it, click on save image on the net web page, and will probably be instantly downloaded in your computer.} At final with a purpose to acquire new and up to date picture associated to (How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form), please observe us on google plus or guide mark this web site, we attempt our greatest to supply common up grade with all new and recent images. Hope you take pleasure in preserving proper right here. For some updates and newest information about (How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form) pics, please kindly observe us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark space, We try to offer you up grade periodically with all new and recent footage, like your looking out, and discover the best for you.

Thanks for visiting our web site, articleabove (How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form) printed . Nowadays we’re delighted to declare we’ve found an extremelyinteresting topicto be identified, that’s (How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form) Many folks looking for specifics of(How To Simplest Form You Will Never Believe These Bizarre Truth Behind How To Simplest Form) and undoubtedly one in every of them is you, just isn’t it?

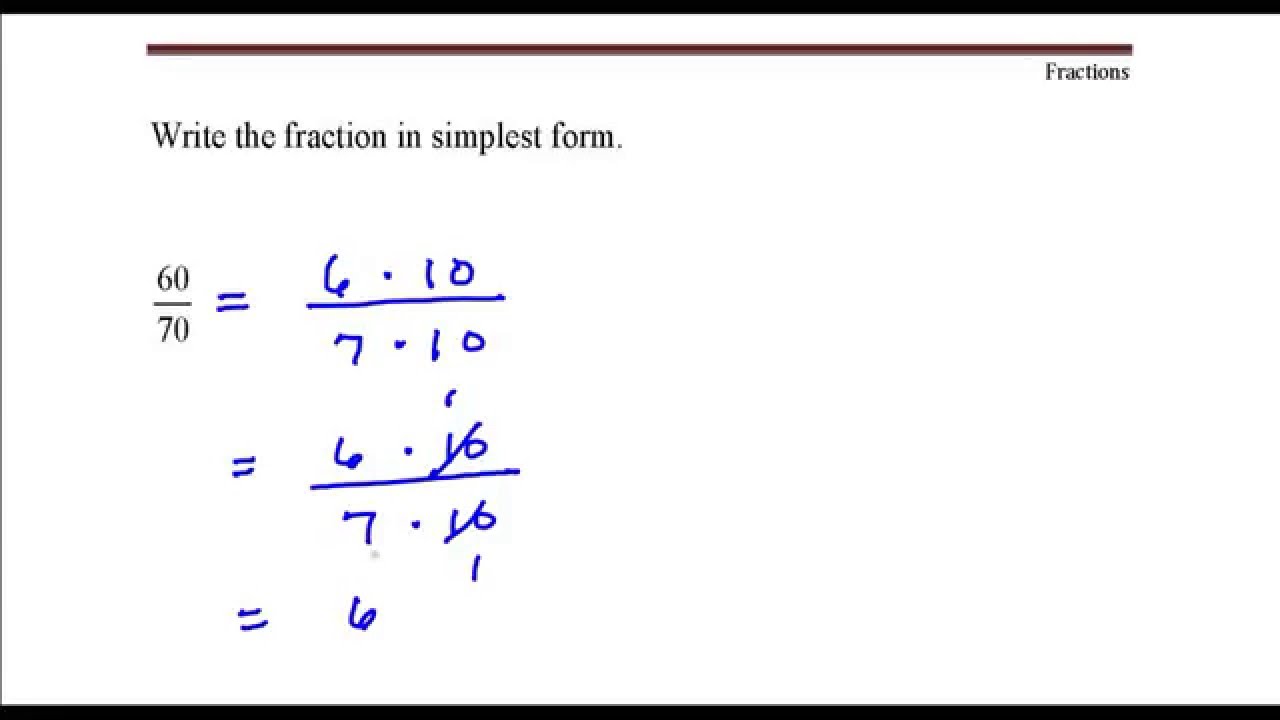

How Do You Write a Fraction in Simplest Form Using the GCF … | learn how to easiest kind

What is Simplest Form of a Fraction? | Virtual Nerd | learn how to easiest kind

Simplifying Fractions Is Really Simple, When You Follow The … | learn how to easiest kind

Simplifying Fractions Worksheet | learn how to easiest kind

Equivalent Fractions and Simplest Form – free Mathematics … | learn how to easiest kind

Write the fraction in easiest kind. 11 divided by 11 – Youtube | learn how to easiest kind

What is Simplest Form? – Definition & How to Write Fractions in Simplest Form | learn how to easiest kind

Reducing Fractions to Simplest Form | learn how to easiest kind

What is Simplest Form? – Definition & How to Write Fractions in Simplest Form | learn how to easiest kind

ShowMe – multiplication fraction to easiest kind | learn how to easiest kind