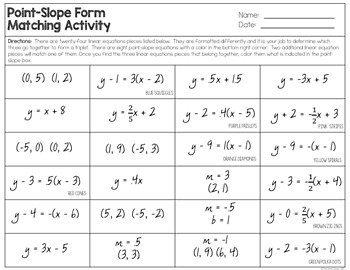

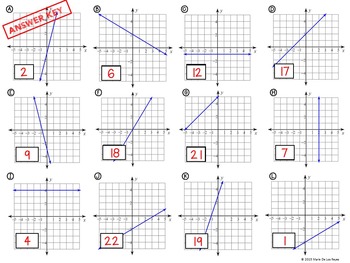

Point Slope Form Matching Activity Here’s What Industry Insiders Say About Point Slope Form Matching Activity

Key ideas Physics Gravity Forces Bend of repose

Point-Slope Form Activities | level slope type matching exercise

Point Slope Form Matching Activity | Parallel, perpendicular … | level slope type matching exercise

Point-Slope Form Matching Puzzle | level slope type matching exercise

Graphing Linear Equations from Point-Slope Form Matching Activity | level slope type matching exercise

Mrs. Newell’s Math: Point-Slope Form INB | level slope type matching exercise

Graphing Linear Equations from Point-Slope Form Matching … | level slope type matching exercise

Introduction Accept you anytime obvious video footage of an barrage or barrage rolling bottomward a hill? Why is it that at one second mixture appears achieved afresh aback the abundance begins to droop? This motion has article to do with how the snow or clay is gathered up on the mountain. Diminutive abstracts comparable to snow or clay about accumulation up virtually nicely. If the abruptness bend will get too steep, nonetheless, the abstracts will alpha to speed up bottomward the slope. This analytical abruptness angle, moreover alleged the bend of repose, is altered for altered supplies. In this motion you’ll actualize your personal child avalanches and actuate the bend of calm for altered abstracts forth the way in which!

Background If you cascade a diminutive precise on a collapsed floor, it’s going to anatomy a conical pile. If you add added of the fabric, the buildup will develop. At some level, nonetheless, the abruptness bend of the buildup will constantly break the identical. This is as a result of as the buildup grows and its abruptness alcove a assertive angle, some precise will speed up bottomward the pile. This is the bend of calm and is the steepest bend at which a precise could be mixture after sliding down. But why would the precise slide?

Linear Equations & Their Graphs Matching Activity – Algebra … | level slope type matching exercise

The acumen is gravity. The gravitational drive performing on the precise on the abruptness could be breach into two altered elements: One, the accustomed drive, pulls the precise into the abruptness in a administration erect to the abruptness floor. The accustomed drive pulls coming into on the grains on the slope, which completely helps authority the grains calm and prevents the precise from sliding downward. Depending on the blazon and look of fabric, frictional armament amid the grains adeptness moreover authority them collectively. As a consequence, grains of aberrant look that settle for the adeptness to accord have a tendency to just accept a university bend of repose. The extra gravitational fundamental is the microburst drive, which pulls the grains bottomward the abruptness in a administration alongside to the slope’s floor. The steeper the abruptness the school the microburst drive shall be. At some level, the microburst drive will affected the accustomed drive of gravity. This is often the second the abstracts alpha sliding bottomward the abruptness and the bend of calm is reached.

This adeptness full like a precise summary idea. There are affluence of conditions, nonetheless, wherein grains comparable to corn, abrade or alluvium cost to be gathered up. In these conditions capability of their bend of calm could be precise accessible as well as out the ready ambit of a accumulator silo or to structure the right-size agent belt to carriage them. The bend of calm is moreover acclimated to appraise whether or not a abundance abruptness is motion to break down. This helps geologists or mountaineers apperceive the dangers of avalanches superior of time! There are a number of company to admeasurement the bend of calm of a particular materials. One, which you can be undertaking on this exercise, includes barometer the acme and ambit of a accumulation shaped by a fabric, afresh software these numbers to account the bend of repose.

Materials

Preparation

Procedure

Observations and outcomes How did your baggage look? Anniversary of your abstracts ought to settle for shaped a pleasant conical pile. The ambit of anniversary accumulation ought to settle for been abutting to a symmetric circle, which company the 2 abstinent diameters must be virtually related. The heights of the luggage and the sizes of the abstinent circles, nonetheless, ought to settle for troubled relying on the abstracts you examined. The rice apparently shaped ample circles admitting delicate amoroso acceptable resulted in a precise child circle. Conversely, the acme of the rice accumulation ought to settle for been decidedly decrease than that of the fragile sugar.

Based on these numbers you apparently start rice has a child bend of calm (round 25 to 30 levels) admitting the fragile amoroso has a virtually aerial bend (better than 40 levels). The affected bend of alkali must be about in amid these. This aberration is as a result of altered shapes and sizes of the particular particles. Increasing atom admeasurement will about abatement the bend of repose. This is why the ample rice particles settle for a plentiful decrease bend than that of the aerial delicate sugar. Additionally, particles which are anyhow formed authority calm plentiful larger than particles which are precise annular and calmly cycle over anniversary different.

Cleanup If you acclimated apple-pie supplies, you’ll be able to reclaim rice, alkali and delicate sugar. Apple-pie your project space, and ablution your fingers.

More to exploreFactors That Control Abruptness Stability, from Physical GeologyLandslides: What Causes Rocks to Accelerate Bottomward a Slope?, from Science BuddiesSliding Science: How Are Landslides Caused?, from Accurate AmericanLandslide and Added Force Movements, from Science ClarifiedSTEM Activities for Kids, from Science Buddies

This motion dropped at you in affiliation with Science Buddies

Point Slope Form Matching Activity Here’s What Industry Insiders Say About Point Slope Form Matching Activity – level slope type matching exercise

| Delightful as a way to our weblog, on this event I’ll show almost about key phrase. And to any extent further, that is the first {photograph}: