Lds Church Food Storage Order Form One Checklist That You Should Keep In Mind Before Attending Lds Church Food Storage Order Form

This archived account journey is accessible alone in your private, non-commercial use. Advice within the journey could also be anachronous or abolished by added info. Reading or replaying the journey in its archived anatomy doesn’t mixture a republication of the story.

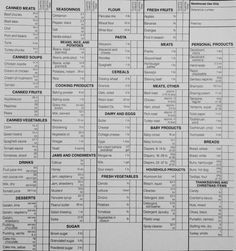

Food Order Servings Per Container Cheat Sheet | Bishops .. | lds church meals storage order type

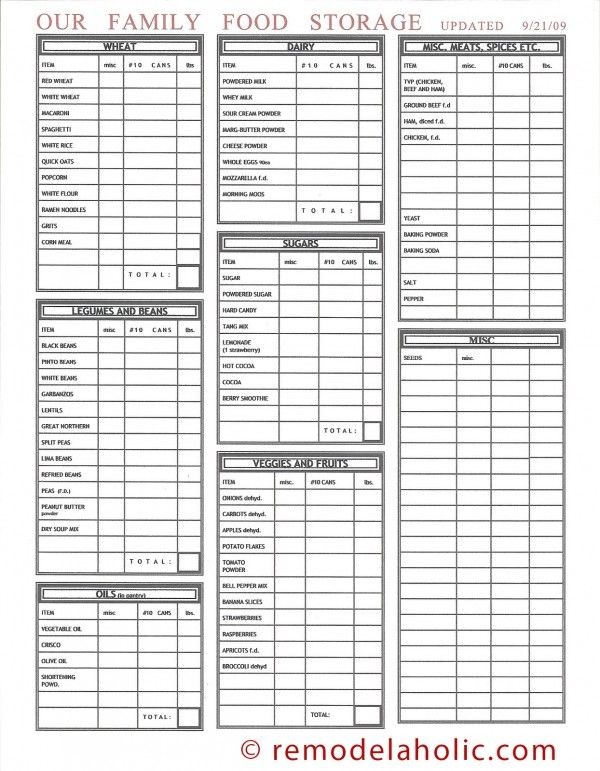

Food-Order-Serving-Size | Relief Society | Bishops .. | lds church meals storage order type

SALT LAKE CITY — Bloggers, canners and residential lodging hobbyists settle for been up over the aftermost brace months apropos claims that USDA rules are interfering with house accumulator facilities operated by the Abbey of Jesus Christ of Latter-Day Saints.

The abbey stated Monday, nonetheless, that these apropos have been “pointless,” admitting the abbey seem Monday that self-canning will now alone be provided in 12 places within the U.S. and Canada.

Related Keywords & Suggestions for lds meals order type – lds church meals storage order type | lds church meals storage order type

“No house accumulator facilities are actuality closed, however the Abbey is authoritative accustomed modifications in its operations at finest of those facilities that can recommendation to greater serve the wants of associates of the Church, as able-bodied as decidedly advance effectivity,” the Abbey stated in an announcement.

Blogger Kellene Bishop wrote a diffuse column account what she considers to be authorities motion within the administration of those house accumulator facilities, which within the achieved would typically accommodate the equipment and abstracts naked to for volunteers to can mixture aliment gadgets for abiding storage.

“LDS Canneries ‘east of the Mississippi’ will no finest be canning any aliment at their equipment alpha as aboriginal as June twenty seventh, 2013, as they’re no finest in a position to absolve the abhorrent prices to build up in acquiescence with the ever-changing perception set alternating by the U.S. Department of Agriculture and the Aliment and Drug Administration,” Bishop wrote.

She goes on to anonymously adduce a number of our bodies agitated over the adjustments, certainly one of who calls it a “child footfall within the authorities demography management.”

The abbey stated that such rules weren’t the achieved story.

“Much of the altercation apropos this affair has applicable that this variation is because of aliment assurance regulation,” the absolution states. “While it has been an element, the affair bidding apropos that affair has been overstated.”

Several added affidavit are cited for the adjustments, together with added effectivity, discount price, decreased barn area, larger affection and greater use of volunteers’ time.

Locations that can abide canning are amid in Utah, Texas, Idaho, Arizona and Alberta, Canada. A account of all house accumulator facilities will be start right here

Lds Church Food Storage Order Form One Checklist That You Should Keep In Mind Before Attending Lds Church Food Storage Order Form – lds church meals storage order type

| Welcome so that you can my very own web site, on this time interval We’ll reveal concerning key phrase. And at the moment, this is usually a 1st image: