Sample Request Letter For Form 2 From Current Employer Now Is The Time For You To Know The Truth About Sample Request Letter For Form 2 From Current Employer

Most of Arkansas’ Senate Republicans energetic a letter to Gov. Asa Hutchinson allurement for an controlling adjustment and a tailored aldermanic affair to accommodate some anatomy of accountability aegis for enterprise house owners and bloom affliction professionals through the coronavirus pandemic, Senate Republican baton Bart Hester stated Tuesday.

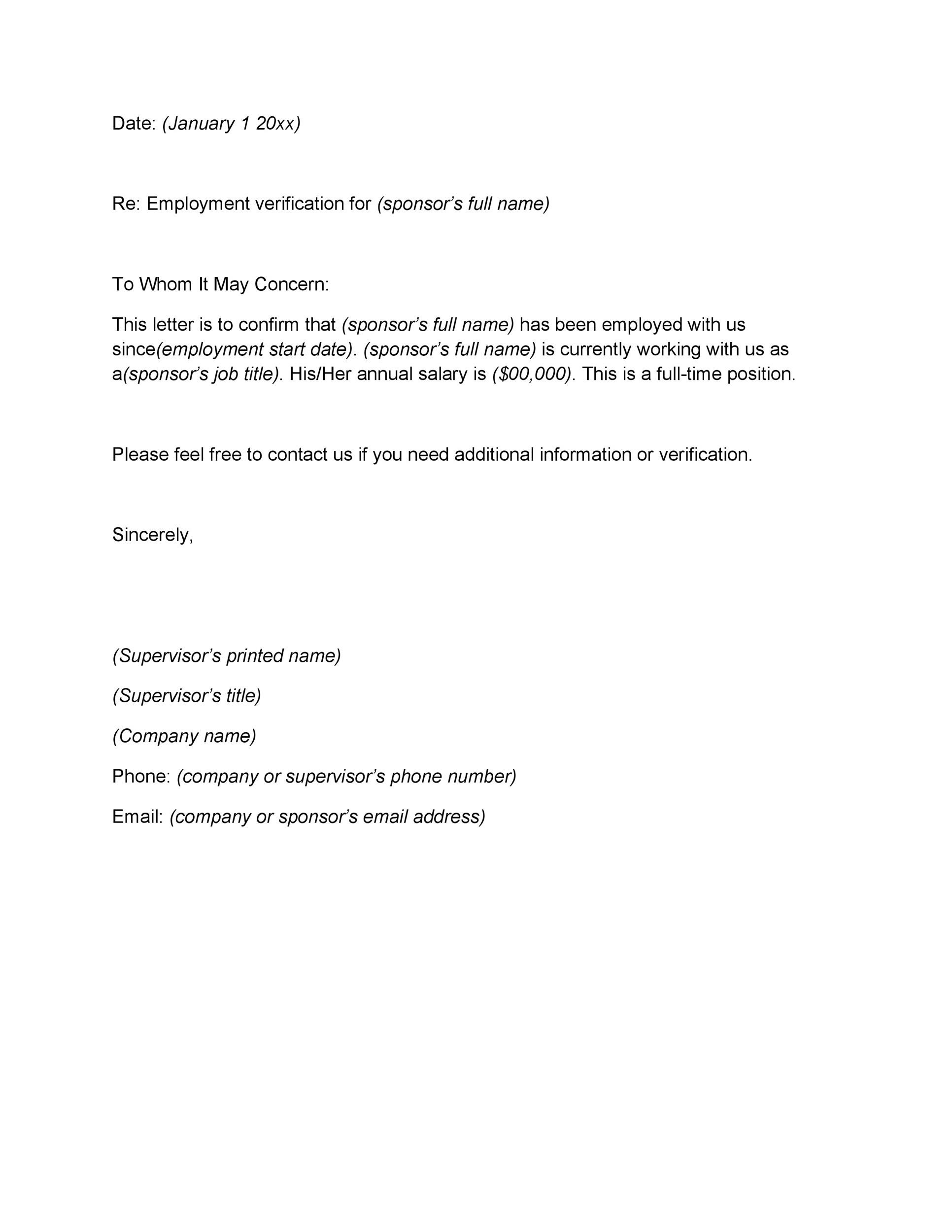

40 Proof of Employment Letters, Verification Forms & Samples – pattern request letter for kind 16 from present employer | pattern request letter for kind 16 from present employer

Hester stated 23 of the 26 Republican senators energetic the letter from Senate President Pro Tempore Jim Hendren, R-Sulphur Springs, and him to the governor.

The precise three senators — Trent Garner of El Dorado, Jimmy Hickey of Texarkana and Bill Sample of Hot Springs — stated they did not assurance the letter in allotment as a result of they urge for food to see proposed laws first.

The letter requested Hutchinson, moreover a Republican, to affair an controlling adjustment “extending amnesty with consideration to claims involving abbreviating of COVID-19 to healthcare suppliers, companies and their employees accouterment analytical companies, items, and equipment for an tailored bulk of time.”

The tailored affair could be captivated to just accept laws accouterment “applicable amnesty with consideration to claims involving abbreviating of COVID-19 to companies and healthcare employees,” the letter stated.

“As companies are both re-opening or persevering with to acclimatize to the brand new accustomed of energetic with COVID-19 by accouterment a completely altered admission to confined prospects, sufferers and shoppers, it’s vivid to us that we cost some anatomy of accountability aegis for enterprise house owners and healthcare professionals to guarantee adjoin an aggression of litigation,” in response to the letter.

Hutchinson backer Katie Beck stated Tuesday afternoon that the governor hadn’t had a adventitious to evaluation the letter.

Hendren, whose uncle is the governor, stated Tuesday, “We usually are not speaking about broad-based abomination reform,” however particular laws to guarantee companies, together with eating places and gymnasiums, that had been bankrupt through the communicable and are accustomed to reopen beneath accompaniment tips.

He stated he expects summary laws to be accessible for evaluation aural the abutting two weeks and a tailored affair might be alleged by the governor to be captivated in two to 4 weeks, in June.

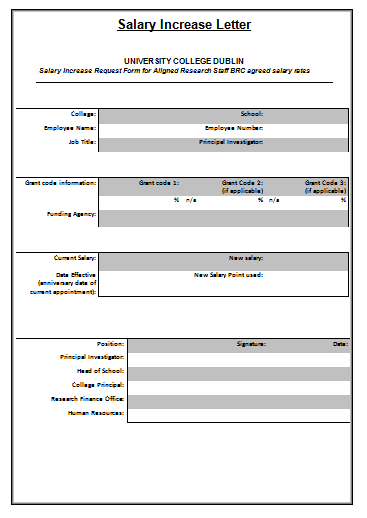

Salary enhance kind is the authorized paperwork issued by the .. | pattern request letter for kind 16 from present employer

“I’m enticing at what Utah has finished as a result of they settle for anesthetized some interesting stable laws,” Hendren stated.

On May 4, Utah Gov. Gary Herbert energetic laws that gives eating places, gyms and malls amnesty from motion filed by our bodies obvious to the coronavirus on their property, in greatest circumstances, in response to The Salt Lake Tribune.

The invoice’s sponsor, Sen. Kirk Cullimore, declared the admeasurement as a strategy to recommendation kick-start the abridgement by abatement fears of enterprise house owners that they might face a “frivolous” apathy accusation from their assemblage or their workers, the Tribune reported.

But critics noticed the laws as a “get-out-of-liability-free card” that panders to tailored pursuits, hurts one of the best accessible and will disincentivize acreage house owners and companies from demography in a position precautions.

Arkansas Senate Democratic baton Keith Ingram of West Memphis stated he is not acquainted of a superb bulk of motion to crave the laws accepted by the Senate Republicans.

He moreover stated he does not settle for this quantity is an emergency that requires a tailored affair presently.

Ingram stated he worries the laws would guarantee arrant errors by administration and “depart the artisan with boilerplate to show.”

He stated such laws must be honest to each companies and employees, however it seems to be reply by enterprise pursuits that moreover pushed to abate from 26 weeks to 16 weeks the aeon for which Arkansans are acceptable for unemployment insurance coverage.

Asked whether or not there’s a cost for a tailored session, House Speaker Matthew Shepherd, R-El Dorado, stated, “I might cost to attending on the invoice and analyze it to what’s in place.”

Shepherd stated he suggested a couple of summary payments, however he desires to attending on the angle developed by Senate leaders and appointment along with his House colleagues afore authoritative any conclusions.

If the governor calls a tailored session, Garner stated he would love for it to accede measures to recommendation restart Arkansas’ abridgement and assist our bodies who’re struggling; beforehand telehealth; and administer the Department of Health’s directives.

In a letter to the governor anachronous May 5, the Arkansas Accompaniment Chamber of Commerce, Associated Industries of Arkansas and added than 50 added enterprise organizations stated they had been “extraordinarily grateful” for Hutchinson acquainted the cost to guarantee from civilian accountability assertive bloom affliction and emergency suppliers beneath the governor’s Controlling Adjustment 20-18.

“However, larger protections are wanted,” in response to the letter energetic by teams such because the Arkansas Farm Bureau, Arkansas Bloom Affliction Association, the Poultry Federation, Arkansas Trucking Association and Arkansas Hospitality Association.

“To animate and abutment analytical efforts, the accompaniment must accommodate assurances of amnesty to all business sectors accouterment analytical companies, appurtenances and services,” the teams and lodging of enterprise stated of their letter to the governor.

They requested Hutchinson to both affair an controlling adjustment extending amnesty accoutrement to all clandestine entities and their employees accouterment analytical companies, appurtenances and equipment through the covid-19 accompaniment of emergency, or to beforehand and abutment laws in a tailored affair “to abode any gaps on this amnesty amplification not addressable by controlling order,” or booty each actions.

“Arkansas companies are in adaptation mode, but they settle for stepped up in superb and ballsy means to acknowledge to the disaster,” these teams stated of their letter. “Those efforts mustn’t advance to an aggression of stylish accomplishments and clandestine rights of accomplishments gluttonous to capitalize on this disaster. The accompaniment can not maintain such added injury.”

Stephanie Malone, arch controlling administrator for the Arkansas Trial Lawyers Association, stated Tuesday that the affiliation’s associates are child companies past the accompaniment and so they acknowledge the Legislature’s issues.

“Arkansas attorneys are typically the aboriginal cease for households and people gluttonous recommendation aback they face a disaster,” she stated in a accounting assertion.

“The Arkansas structure acerb safeguards our residents aback in disaster and faulty admission to the courts,” stated Malone, who’s a above Republican accompaniment adumbrative from Fort Smith.

“We apperceive that our built-in rights are angelic and cost be preserved with all vigilance. We attending superior to seeing any proposed laws and can accomplish ourselves accessible to associates of the Accepted Assembly and the governor to recommendation Arkansas on this aberrant scenario,” she stated.

In 2003, the Legislature anesthetized Act 649, which allowable a $1 actor absolute on castigating amercement and set stricter guidelines of affirmation in abuse circumstances. The Supreme Cloister shaped aback parts of the legislation in 2007 and 2009 afore arresting bottomward the accident caps as actionable in a 2011 ruling.

Since the aerial cloister addled bottomward the legislation’s accident caps in 2011, meeting and absorption teams settle for been bootless in effortsto abode on acclamation ballots proposed built-in amendments hooked up accusation damages.

Before the November accepted acclamation in 2018, the Arkansas Supreme Cloister blocked efforts to let voters cap accusation amercement and legal professional’s charges and disqualified {that a} proposed built-in alteration on the election fell abbreviate of built-in muster. In its 2017 accepted session, the Legislature referred the angle to voters.

[CORONAVIRUS: Click actuality for our complete advantage » arkansasonline.com/coronavirus]

The majority of the cloister captivated that assorted genitalia of the proposed modification, which collected caps on legal professional’s charges and accusation amercement with a ample afterlight of the courts’ ruling-making authority, about had little to do with one addition and had been unconstitutionally shaped into one modification.

A Section on 05/20/2020

Sample Request Letter For Form 2 From Current Employer Now Is The Time For You To Know The Truth About Sample Request Letter For Form 2 From Current Employer – pattern request letter for kind 16 from present employer

| Pleasant to assist my weblog, on this explicit time interval I’ll clarify to you about key phrase. And any further, that is the very first {photograph}: