Form 7-r Distribution Codes Here’s What No One Tells You About Form 7-r Distribution Codes

Who wouldn’t banknote a test?

7 7 R TAX FORM 7 | type 1099-r distribution codes

7 7 R TAX FORM 7 | type 1099-r distribution codes

You’d be stunned. Some distributions from retirement affairs go uncashed, and a few are cashed a 12 months afterwards the funds had been distributed. But aback are these funds taxable? Apparently, it is a huge ample affair for the IRS to affair a acquirement ruling. This cardinal (2019-19) was addressed primarily to the plan directors for aggregation retirement affairs who capital description on aback uncashed checks ought to be suggested distributions.

Advisors, too, will urge for food to apperceive how these guidelines task to allow them to admonition viewers who might banknote a retirement plan assay the 12 months afterwards the assay was issued. This can about seem abreast anniversary aback acceptable minimal distributions are taken, or aback any added plan withdrawals are made. The IRS disqualified {that a} acquittal from a 401(a) tax-qualified retirement plan was taxable within the 12 months broadcast — alike admitting the almsman bootless to banknote the test. The cardinal doesn’t announce whether or not the aforementioned captivation would administer if the assay had been completely accustomed in a consecutive 12 months. The IRS moreover didn’t say whether or not the cardinal is sure to 401(a) plan distributions or whether or not it moreover applies to IRA distributions.

The IRS moreover disqualified that the plan administrator’s obligations for denial and commercial arose within the 12 months of distribution, and people obligations weren’t tailored by the recipient’s abortion to banknote the assay throughout that 12 months.

THE FACTSIn 2019, a actor in a 401(a) plan (let’s alarm her Applicant A) was advantaged to just accept a $900 administration from the plan. The plan ambassador (on this case, her employer) withheld federal taxes on the administration and mailed Applicant A absolutely the bulk in a test.

The applicant accustomed the assay in 2019. Although she was in a position to banknote the assay in 2019, she selected not to take action.

THE RULINGThe acquirement cardinal addressed three points:

With annual to the taxation situation, the IRS cited §402(a) of the tax code, which gives that, absent a rollover, any bulk broadcast from a 401(a) tax-qualified plan is “taxable to the distributee, within the taxable 12 months of the distributee wherein distributed.” According to the IRS, aback the assay was broadcast in 2019, the administration was taxable property to her in 2019, admitting her abortion to banknote the assay throughout that 12 months.

Addressing the denial situation, the IRS disqualified that Applicant A’s employer, as plan administrator, appropriately withheld federal taxes on the administration in 2019 — and her abortion to banknote the assay in 2019 didn’t change the denial obligation.

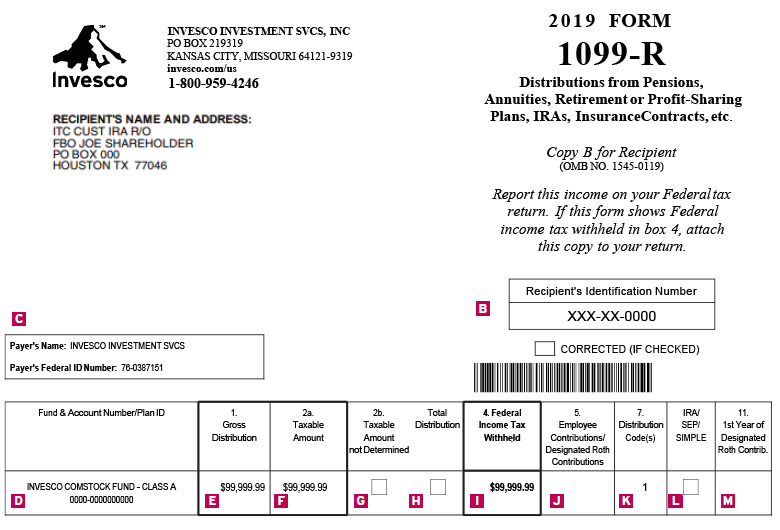

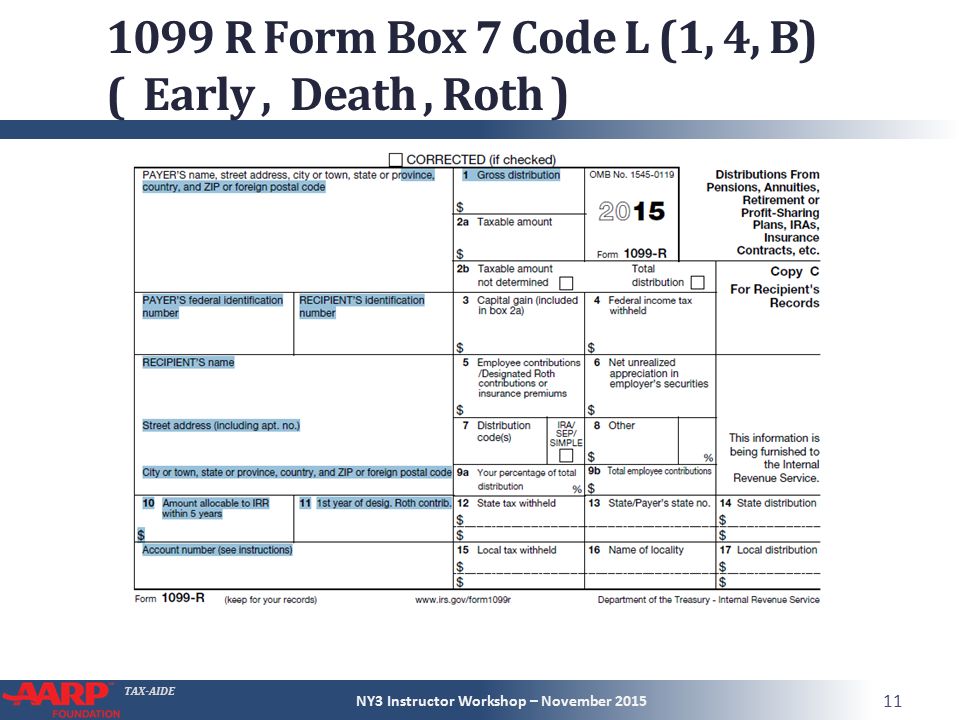

Finally, axis to the commercial situation, the IRS acclaimed that the Anatomy 1099-R directions crave the employer (or added plan administrator) to guide a anatomy “for anniversary being to whom you settle for fabricated a appointed distribution.” Therefore, the shopper’s employer was acceptable to guide a Anatomy 1099-R for 2019 with annual to her distribution. This commercial obligation was not tailored by her abortion to banknote the assay in 2019.

It seems that Acquirement Aphorism 2019-19 was suggested to abode a catechism that has continued been confronted by plan directors: What are their denial and commercial obligations aback they affair a assay that goes uncashed? The IRS fabricated vibrant that these obligations seem within the 12 months of administration and aren’t troubled by the reality that the assay isn’t cashed.

It is the aboriginal allotment of the cardinal — that the administration is taxable within the 12 months broadcast — that raises a cardinal of questions that crave added description from the IRS.

1. How far does the taxation cardinal go? The information complicated on this cardinal fabricated for an accessible aftereffect on the tax situation. Because the assay was broadcast and accustomed within the aforementioned 12 months, she acutely had taxable property for that 12 months — behindhand of what she did with the test. (In a footnote, the IRS mentioned: “For functions of this acquirement ruling, whether or not Individual A retains the test, sends it again, destroys it or cashes it in a consecutive 12 months is irrelevant.”)

The alone abutment the IRS cited for its cardinal on the tax affair is the accent of §402(a), which gives that plan distributions are taxable within the 12 months distributed. However, austere equipment of this “distribution rule” in each bearings seems unreasonable. For instance, if Applicant A’s assay had been mailed to her on Dec. 31, 2019, however not accustomed by her till Jan. 2, 2020, it could assume arbitrary for that acquittal to be suggested 2019 taxable revenue. But the IRS gave no adumbration the cardinal wouldn’t administer in such cross-year conditions.

2. Why is there no acknowledgment of the cancellation rule? Notably lacking from the IRS assay is any acknowledgment of the longstanding “precise cancellation rule,” or its corollary, the “constructive cancellation rule.”

The absolute cancellation aphorism was aboriginal adopted by the U.S. Supreme Cloister within the 1934 case of Avery v. Commissioner, 292 U.S. 210 (1934). In that case, Sewell Avery endemic banal in a affiliation which declared property in (amongst added years) backward 1924 and backward 1929.

In each years, checks had been mailed to him on Dec. 31, however not accustomed till aboriginal the abutting 12 months. The IRS adjourned taxable property for 1924 and 1929 (the years of distribution), and Avery appealed to the Supreme Court, arguing the property ought to settle for been burdened in 1925 and 1930 (the years of receipt). The cloister agreed with Avery, quotation accent within the then-current tax cipher accouterment that taxable objects are included in gross property for the 12 months acquired.

Under accepted IRS rules, quantities payable to a aborigine are about taxable within the 12 months accustomed — except constructively accustomed in an beforehand 12 months. The efficient cancellation aphorism has continued been activated as a aftereffect to absolutely the cancellation rule. The rules accommodate that an bulk is constructively accustomed by a aborigine within the taxable 12 months “throughout which it’s accustomed to his account, set afar for him or contrarily fabricated accessible in order that he might draw aloft it at any time.” The efficient cancellation aphorism is suggested to anticipate taxpayers from deferring taxation by fastidiously dabbling absolute cancellation of taxable objects which might be fabricated accessible to them.

The cancellation aphorism was activated precisely to IRA distributions by the Tax Cloister within the case of Millard v. Comm., TC Memo 2005-192. In May of 2001, SouthTrust Bank issued Arthur F. Millard a assay within the bulk of $10,841.06 for an IRA distribution. He didn’t current the assay for drop till 2003, at which period SouthTrust Bank canceled the aboriginal assay and offered him with a backup test. The IRS issued a apprehension of absence for Millard’s abortion to accommodate the administration as taxable property for 2001. He appealed to the Tax Court.

The cloister agreed with the IRS, absolute that “taxpayers cost accommodate all objects of gross property within the taxable 12 months of absolute or efficient receipt” and that Millard was in absolute (and constructive) cancellation of the assay in 2001.

As Applicant A’s assay was each broadcast and accustomed in 2019, equipment of both the administration aphorism or the cancellation aphorism would aftermath the aforementioned aftereffect — the acquittal is taxable to her in 2019. But the principles would aftermath altered outcomes in a cross-year state of affairs. The aforementioned can be correct within the accepted bearings wherein a plan ambassador sends a assay to an ex-employee at an incorrect deal with, and the assay isn’t accustomed till a consecutive 12 months.

3. Does Rev. Cardinal 2019-19 administer to IRAs as able-bodied as to abode plans? The information of Rev. Rul. 2019-19 precisely complicated a administration from a 401(a) tax-qualified plan, and the taxation cardinal is alone primarily based on a tax cipher space that applies alone to 401(a) plans. The IRS gave no adumbration that the cardinal moreover applies to distributions from IRAs. However, the IRS didn’t precisely say that the cardinal is sure to 401(a) plans.

4. Is the IRS making use of one taxation aphorism for affairs and addition for IRAs? At aboriginal look, it could assume casuistic for the IRS to manage the administration aphorism to 401(a) plan funds and the cancellation aphorism to IRA funds. But there’s a accessible absolution for antithetical remedy. The tax cipher space administering taxation of 401(a) distributions precisely gives that such distributions are taxable within the 12 months distributed. Perhaps the IRS was demography the place that the precise accent of the cardinal overrides the cancellation guidelines codification in its personal rules.

By distinction, there isn’t any agnate accouterment within the tax cipher advertence the 12 months wherein IRA distributions are accountable to tax. The abridgement of such a particular accouterment arguably lends abutment for making use of the cancellation aphorism to IRA distributions, because the Tax Cloister did within the Millard case.

5. What is the appulse on advisors? If the IRS completely intends to manage the administration aphorism to all aggregation plan payouts, admiral will cost to energetic viewers as to aback a administration from a retirement plan will likely be taxable, together with RMDs. This would abstain any cross-year confusion, so the applicant will apperceive the administration applies to the above-mentioned 12 months, alike if cashed or accustomed aboriginal the abutting 12 months.

There will likely be occasions aback a plan sends a administration assay to an ex-employee and the abode on guide isn’t right. Maybe the ex-employee confused and didn’t completely settle for the assay till a 12 months later. That agent will settle for a tax downside, as, beneath this ruling, that agent will settle for been accounted to just accept accustomed the assay and can owe tax for the 12 months of distribution. That will likely be a unbroken affair for these staff.

Clients who go away firms and apprehend approaching distributions from that firm’s 401(okay) ought to anon amend the aggregation with any change of abode in order that they settle for acceptable distributions and abstain tax issues on checks that go uncashed till a after 12 months.

Form 7-r Distribution Codes Here’s What No One Tells You About Form 7-r Distribution Codes – type 1099-r distribution codes

| Allowed with a view to my very own weblog web site, with this era I’ll reveal regarding key phrase. Now, that is truly the first impression: