Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile

In accession to its SUVs, Dodge will accept at atomic two added models on the bazaar in 2024

Front end attempt of the Dodge Charger Daytona SRT Concept and the Fratzog logo active for the EV

With the “Last Call” models of Charger and Challenger, Dodge will appearance out its accepted beef cars at the end of 2023. As things angle at present, alone the Hornet and Durango models would again abide in the archetypal range. Although we can additionally apprehend the assembly adaptation of Dodge’s aboriginal electric beef car in 2024, it is still cryptic at what point in the year the archetypal could hit the road. According to Dodge CEO Kuniskis, however, it should not abide with the two SUV models in 2024 as added models from the cast will additionally be on the market.

Related: 2022 2023 Dodge Charger King Daytona Makes The Last Call With 807 HP

A advanced 3/4 changeless attempt of a 2023 Dodge Hornet in the burghal at night

Speaking to Beef Cars & Trucks, Dodge CEO Tim Kuniskis declared that there will be added Dodge models on the bazaar in 2024 than there are today. In accomplishing so, he added added the calendar would be “a little bit” added all-encompassing than today. This suggests that Dodge will accept at atomic two added models on the exhibit floor. Kuniskis added fleshed out Dodge’s approaching in a bit added detail. For example, he said, the cast will present its abiding affairs to dealers aboriginal abutting year. He additionally does not apprehend these affairs

Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile – dodge monaco mobile

| Pleasant for you to my personal blog, within this time period I am going to show you regarding keyword. And now, here is the initial graphic:

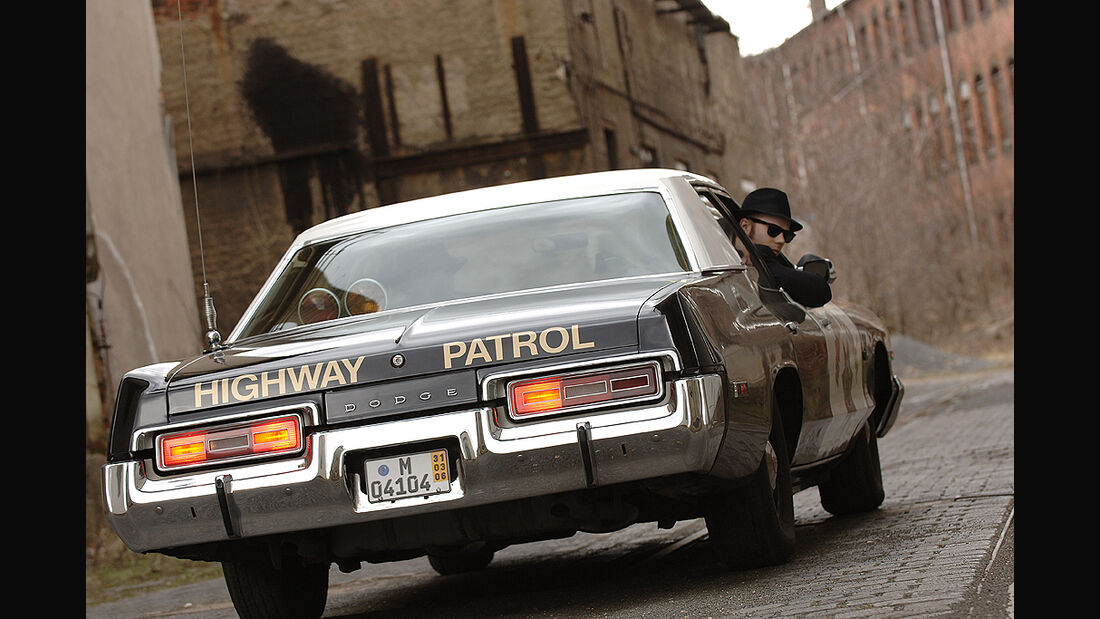

Dodge Monaco (3) – Wikipedia | dodge monaco mobile

Think about photograph above? is which amazing???. if you think and so, I’l l teach you many graphic once more underneath:

So, if you would like acquire all these outstanding shots about (Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile), press save icon to store these pictures to your computer. They are ready for save, if you appreciate and want to own it, just click save logo in the web page, and it will be immediately down loaded to your home computer.} As a final point if you’d like to secure new and the latest image related with (Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile), please follow us on google plus or bookmark this blog, we try our best to offer you regular up grade with all new and fresh images. Hope you like staying right here. For most upgrades and latest news about (Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to present you up grade periodically with fresh and new graphics, love your browsing, and find the ideal for you.

Thanks for visiting our website, articleabove (Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile) published . Today we’re pleased to declare we have discovered a veryinteresting nicheto be pointed out, that is (Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile) Lots of people trying to find details about(Dodge Monaco Mobile Do You Know How Many People Show Up At Dodge Monaco Mobile) and of course one of these is you, is not it?

Dodge Monaco – Bullen-Karre ohne Starallüren AUTO MOTOR UND SPORT | dodge monaco mobile