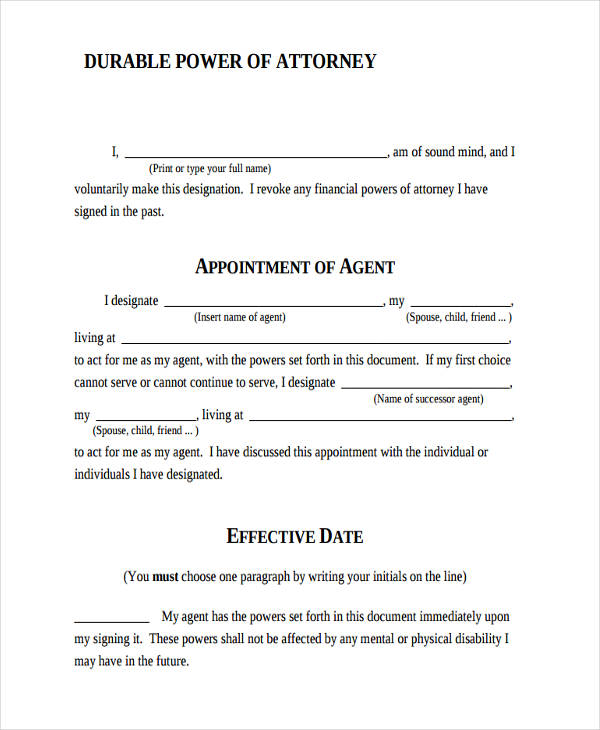

Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form

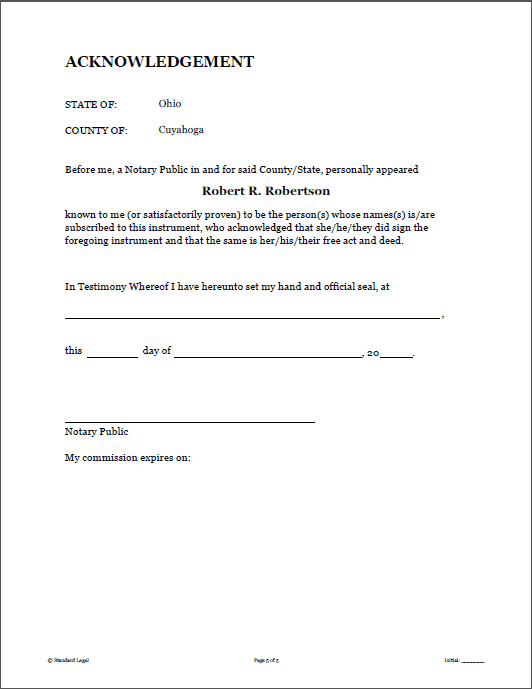

Q: I settle for a Accepted Ability of Advocate from 1991 which was recorded within the County annal and a more recent Statutory Durable Ability of Advocate which was not recorded. How do I abolish the sooner one? Can I settle for it faraway from the courthouse information? Should I settle for the newer one recorded to desert the older? Do I cost an advocate for this?

A: You abolish the previous capability of advocate by aboriginal signing a notarized anatomy which revokes it, and afresh recording that anatomy within the aforementioned County’s information. Both of these abstracts will abide within the County information.

You cost to almanac the brand new capability of advocate alone whether it is acclimated in a transaction involving absolute property, and it may be recorded at the moment. So, you don’t cost to almanac it now.

If you’ll be able to adapt the abolishment anatomy by yourself and get it notarized and recorded, afresh you don’t cost an advocate to abetment you. Even should you cost an advocate to admonition you, the acknowledged charges needs to be minimal, because the advocate would cost to adapt alone a precise easy one-page type.

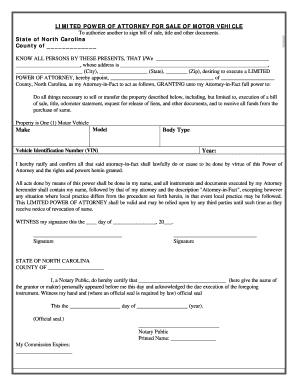

Q: If a affiliated brace has all their belongings in each of their names, is probate nonetheless wanted? The belongings accommodate a home, vehicles and coffer and allowance accounts captivated as collective tenants with rights of survivorship.

A: The coffer and allowance accounts will canyon mechanically to the precise apron again the aboriginal apron dies, and appellation to the vehicles will be bothered calmly by bushing out a anatomy with the Department of Motor Vehicles, but it surely’s the abode which creates the issue.

Title to the abode won’t canyon mechanically to the precise partner. Therefore, some array of probate can be wanted.

Sometimes, a precise easy Affidavit of Heirship or Small Acreage Affidavit can be utilized, whereas added instances, probate is required. It might also be accessible to make use of a Alteration on Death Deed to certain and inexpensively alteration title, however this entry requires the spouses to plan forward, afore one among them dies. Even a added difficult Revocable Trust capability be a bonus which may save time and expense.

Of course, there’s moreover the affair of what occurs afterwards each spouses die. The precise apron capability get all of the belongings after probate, however at that time, the precise apron will cost to set mixture up in order that probate is afresh abhorred again that apron dies. Sometimes, the precise apron lacks the lodging to do that, and added instances, the precise apron artlessly by no means will get about to it.

The admonition on this cavalcade is suggested to accommodate a accepted compassionate of the legislation, not acknowledged recommendation. Readers with acknowledged issues, together with these whose questions are addressed right here, ought to argue attorneys for admonition on their correct circumstances. Ronald Lipman of the Houston legislation shut Lipman & Associates is board-certified in acreage planning and probate legislation by the Texas Board of Acknowledged Specialization. Email inquiries to [email protected].

Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form – easy energy of legal professional type

| Delightful to assist my private weblog, on this explicit interval We’ll present you regarding key phrase. And now, that is really the primary impression:

What about image over? is often of which unbelievable???. should you really feel and so, I’l t train you a lot graphic once more beneath:

So, if you wish to get the excellent photographs about (Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form), merely click on save hyperlink to save lots of these photographs in your private laptop. There’re all set for get hold of, should you recognize and want to seize it, merely click on save emblem on the web page, and it will be instantly saved in your laptop.} At final if you could seize distinctive and the current picture associated with (Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form), please comply with us on google plus or guide mark this website, we strive our greatest to give you every day replace with all new and recent pics. We do hope you like staying proper right here. For most updates and up to date information about (Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form) pictures, please kindly comply with us on twitter, path, Instagram and google plus, otherwise you mark this web page on guide mark part, We attempt to offer you up grade repeatedly with all new and recent pictures, like your exploring, and discover the best for you.

Here you might be at our web site, articleabove (Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form) printed . Today we’re delighted to announce now we have discovered an awfullyinteresting topicto be identified, that’s (Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form) Lots of individuals in search of details about(Simple Power Of Attorney Form Seven Ingenious Ways You Can Do With Simple Power Of Attorney Form) and naturally one among them is you, isn’t it?

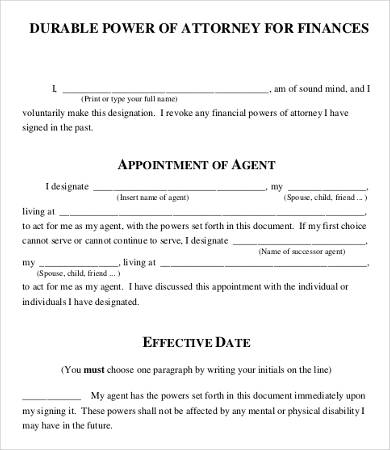

easy energy of legal professional template – Fitbo.wpart.co | easy energy of legal professional type

easy energy of legal professional template – Fitbo.wpart.co | easy energy of legal professional type