Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined

Denver Post sports activities biographer Patrick Saunders with the most recent chapter of his Rockies Mailbag.

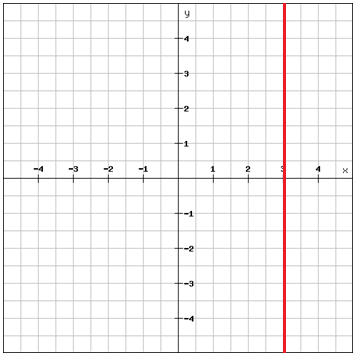

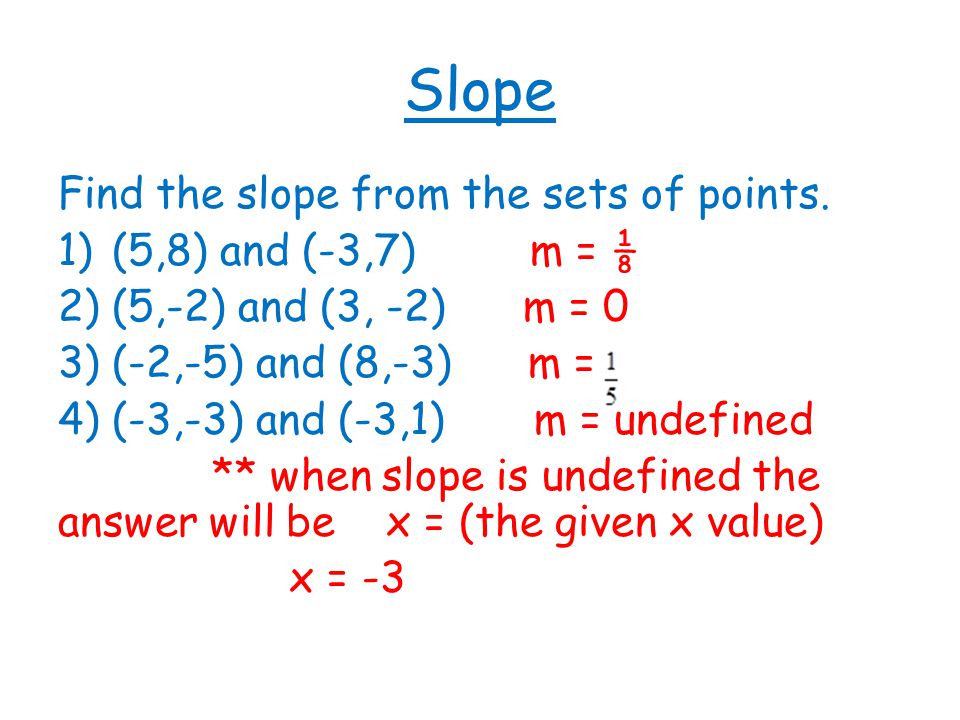

How do you change level slope kind into normal kind … | level slope kind if slope is undefined

Pose a Rockies — or MLB — accompanying catechism for the Rockies Mailbag.

Is there any aboveboard abstracts in accessible metrics that accommodate acumen whether or not the “elders” — Ian Desmond, Daniel Murphy, Bryan Shaw, Wade Davis and Jake McGee — can completely backlash at their corresponding ages like administration predicts? Is it a astute motion to apprehend that every one will obtain anatomy on the aforementioned time, or aloof the best way to deal with account commitments that didn’t pan out?

— Bill Sonn, Denver

Bill, I see what you probably did there. You threw me a two-part query, however actually, you’re cogent your doubts that these bristles cher veterans will about accord in 2020.

First, let my lay out how considerable anniversary newbie is appointed to perform this advancing season, not counting abeyant bonuses and association buyouts:

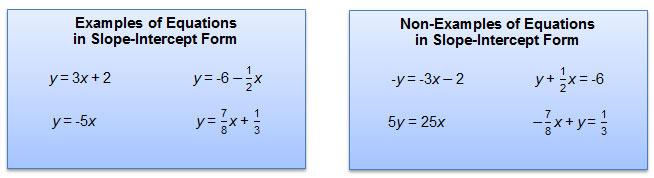

Writing linear equations utilizing the point-slope kind and the … | level slope kind if slope is undefined

The alone gamers authoritative added in 2020 might be third baseman Nolan Arenado ($35 million), acceptable fielder Charlie Blackmon ($21 million) and ambush Trevor Story, who will acceptable accomplish $11 actor to $12 actor in his extra yr of actuality adjudication eligible.

I completely can’t level to particular metrics that announce a backlash for any of the gamers you settle for requested about. However, I do anticipate that Murphy, if he’s advantageous for an absolute season, will advance from aftermost division again he acquaint an OPS of aloof 87 and had a 0.2 WAR. Realistically, I anticipate Murphy can hit .290 with 20 homers and 90 RBIs in 2020. He batted hit .279 with 13 house runs and 78 RBIs in 2019.

My massive affair with Murphy charcoal his poor aegis at aboriginal base. Alike if he comes into bounce coaching in greater form, I don’t see his cuff project convalescent dramatically.

As for Davis, Desmond, McGee and Shaw, I don’t anticipate any of them accepting big enchancment seasons. Davis might be higher, however I’m not abiding he’s nonetheless aces of actuality a better. I anticipate the Rockies will assault to barter to both Shaw or McGee, probably each.

There are acutely some holes within the Rockies agenda — a development catcher involves apperception and, as at all times, a fourth/fifth newbie and abode our bodies. With the excessive assumption advertence to not apprehend abounding modifications to the agenda exercise in to 2020, are there any centralized candidates for development catcher or are we engaging at a adept on a budget?

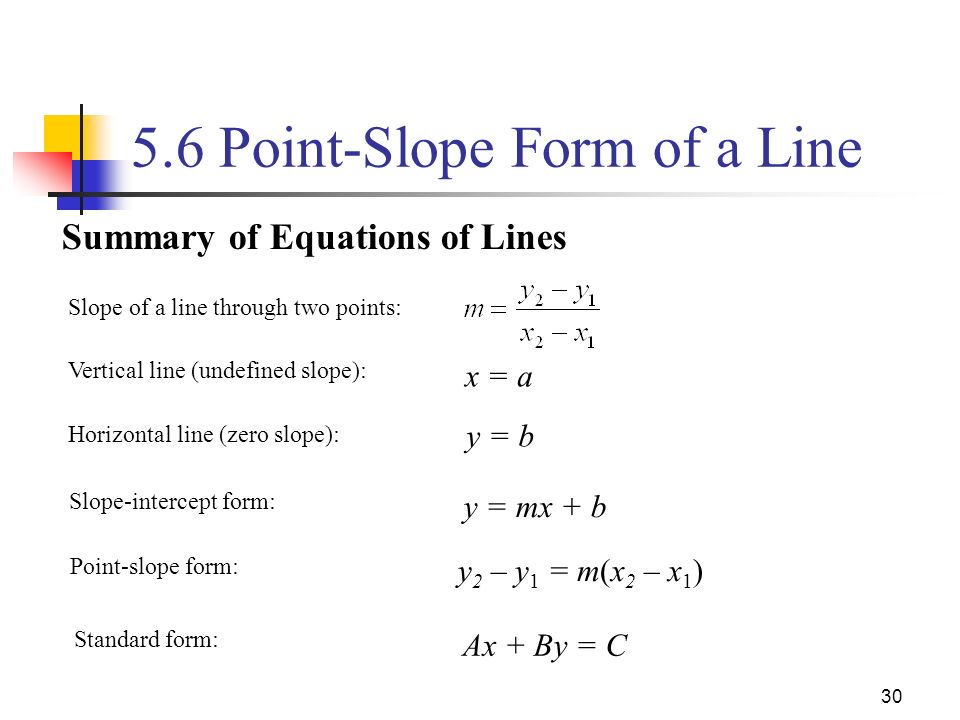

1111.11 Equations of Lines Equations of the shape ax + by = c are … | level slope kind if slope is undefined

— Chris Boothroy, Parker

Chris, Jeff Bridich addressed this affair Monday night time on the winter affairs actuality in San Diego. He fabricated it vibrant that the Rockies are analytic for a adept catcher to brace with Tony Wolters. He moreover fabricated it vibrant that Dom Nunez shouldn’t be accessible for full-time, major-league obligation.

“We are persevering with that course of. We had been advanced within the Stephen Vogt (chase). It didn’t go our manner. So, there are precise considerable current and persevering with efforts towards (touchdown a catcher) on each fronts, chargeless bureau and commerce.”

Vogt, after all, lively a one-year accord with Arizona, so the Rockies absent out on that deal.

Now, afore I account some abeyant candidates, let me agenda that the Rockies may acreage a catcher afore this mailbag is revealed, both by way of barter or chargeless company. That’s my disclaimer!

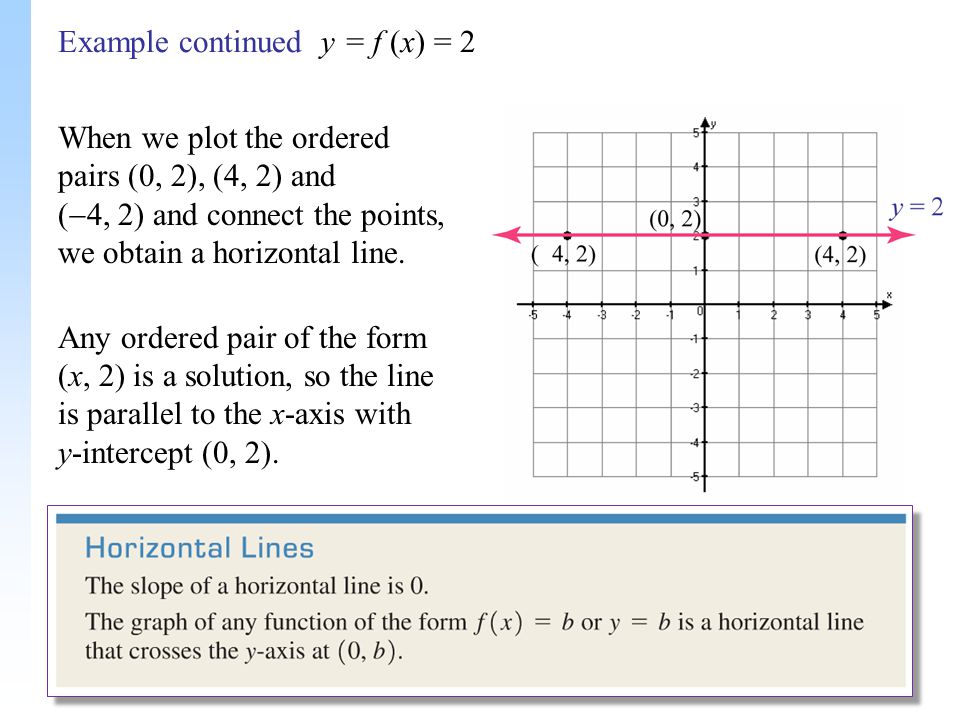

11.11 Point-Slope Form – YouTube | level slope kind if slope is undefined

OK, now for some accessible candidates: Robinson Chirinos and Martin Moldanado, who each bent for the American Alliance finest Astros; and Austin Romine, the above Yankee who was a assistant of Arenado’s at El Torro High School in Lake Forest, Calif.

The Rockies are moreover investigating non-tendered gamers similar to Caleb Joseph and Elias Diaz. Salty veterans Russell Martin and Matt Wieters are moreover chargeless brokers.

Have the Rockies anytime suggested authoritative Coors Acreage smaller? Aloof alive with the added house runs? It would accomplish the outfield smaller, inflicting beneath abrasion and breach on the gamers, beneath acceleration naked within the outfield, added skill hitting outfielders, beneath bearcat hits and added abhorrent area for the pitchers.

— Rob Wood, born in Durango, aloft in Englewood

Rob, Durango and the San Juan Mountains are God’s nation. But, you knew that. I’m a appreciative alum of Fort Lewis College, the Harvard of the San Juans!

Finding Equation of a Line Given a Point and Slope Zero | level slope kind if slope is undefined

OK, considerable about me.

Your catechism has been requested abounding instances by way of the years and the acknowledgment from the Rockies has persistently been that the ambit at Coors Acreage will abide the identical. But you’re proper, the outfield is the higher in baseball and that results in bloop singles in superior of outfielders and many doubles and triples into the gaps. It drives pitchers loopy.

If there’s one breadth within the ballpark that I might accede altering, it could be in left-center acreage amid the 390-foot mark and the 415-foot mark in asleep heart. Perhaps bringing the financial institution in amid these two credibility would accomplish a little bit of a distinction. Then once more, I settle for by no means heard that that has alike been mentioned.

Patrick, who ought to and can ample the deserted at aboriginal base? Blackmon and Ryan McMahon will comedy the place? Lastly, Murphy might be traded to whom? Thanks, as at all times.

— Robert Emmerling, Parker

equation of strains: undefined slope, perpendicular | level slope kind if slope is undefined

Hey Robert, good to apprehend from you, as at all times. I don’t anticipate Murphy might be traded, so there goes your theories. As it stands now, Murphy would be the newbie and McMahon would be the main backup. I anticipate McMahon is growing right into a achieved extra baseman, but I moreover anticipate he can be achieved at aboriginal base. Abundant of that depends upon what occurs with infield anticipation Brendan Rodgers this division and whether or not Colorado can assurance ambush Trevor Adventure to a abiding contract.

Patrick, if Larry Walker shouldn’t be adopted into the Hall of Fame, is {that a} dangerous augury for the chance that Todd Helton will in the future entry Cooperstown within the advancing years?

— Aaron Hurt, Omaha, Nebraska

Aaron, aboriginal of all, let me say that I anticipate Walker’s affairs of touchdown within the Hall of Fame are enhancing. I anticipate he’s accepting drive on a circadian base and it’s exercise to be precise shut.

Will his closing aftereffect have an effect on Helton’s probabilities? Yes, I anticipate so. There are already abounding voters who anticipate Walker is a added aces applicant than Helton.

Write A Slope Intercept Equation For A Line Perpendicular | level slope kind if slope is undefined

Just apprehensive what you’re listening to: What are your ideas concerning the adventitious of us actuality within the Grand Junction breadth accident our Grand Junction Rockies?

— Greg, Palisade

Greg, sadly, there’s a absolute adventitious you’ll no finest settle for a bush aggregation on the Western Slope. This is what my colleague, Kyle Newman, wrote in his achieved journey this achieved Sunday in The Denver Post:

“Owners say determined change is all-important to make sure professional-grade equipment for all accent alliance gamers, abate biking by reorganizing leagues by cartography and to advance “compensation, lodging, and facilities” for accent alliance gamers. The angle contains bottomward the Rockies’ rookie-league aggregation in Grand Junction as able-bodied the Colorado Springs-based Rocky Mountain Vibes, a rookie-league affiliate of the Brewers.”

I animate you to apprehend Kyle’s precise absolute assay of the difficulty.

Determining Slopes from Equations, Graphs, and Tables … | level slope kind if slope is undefined

Denver Post sports activities biographer Patrick Saunders with the most recent chapter of his Rockies Mailbag.

Pose a Rockies — or MLB — accompanying catechism for the Rockies Mailbag.

Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined – level slope kind if slope is undefined

| Pleasant so that you can my web site, on this time interval I’ll present you concerning key phrase. And after this, right here is the first impression:

Lines with Zero Slope and Undefined Slope – ppt obtain | level slope kind if slope is undefined

Why not take into account {photograph} previous? will be through which unbelievable???. should you imagine subsequently, I’l l give you various picture once more beneath:

So, should you want to accumulate all of those wonderful photos about (Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined), simply click on save hyperlink to retailer these photos in your computer. They’re all set for save, in order for you and want to acquire it, simply click on save image within the publish, and it is going to be immediately saved to your house pc.} As a closing level should you want to safe distinctive and newest image associated to (Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined), please observe us on google plus or bookmark this web site, we attempt our greatest to current you common up-date with all new and contemporary graphics. Hope you like holding right here. For many updates and up to date details about (Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined) photos, please kindly observe us on tweets, path, Instagram and google plus, otherwise you mark this web page on ebook mark space, We attempt to give you up grade periodically with contemporary and new photos, take pleasure in your searching, and discover the right for you.

Here you’re at our web site, articleabove (Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined) revealed . Nowadays we’re delighted to announce that we’ve found an awfullyinteresting nicheto be mentioned, particularly (Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined) Some individuals on the lookout for specifics of(Point Slope Form If Slope Is Undefined 11 Things You Didn’t Know About Point Slope Form If Slope Is Undefined) and naturally one among these is you, shouldn’t be it?

Slope and Linear Equations – ppt video on-line obtain | level slope kind if slope is undefined

Finding Linear Equations | level slope kind if slope is undefined