Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form

Tax division 2020 begins aloof afterwards the brand new yr.

Employers are applicable to speed up tax abstracts to employees on or afore January 31, which you will use to ebook your taxes for 2019. The borderline to ebook and pay any tax you owe is April 15.

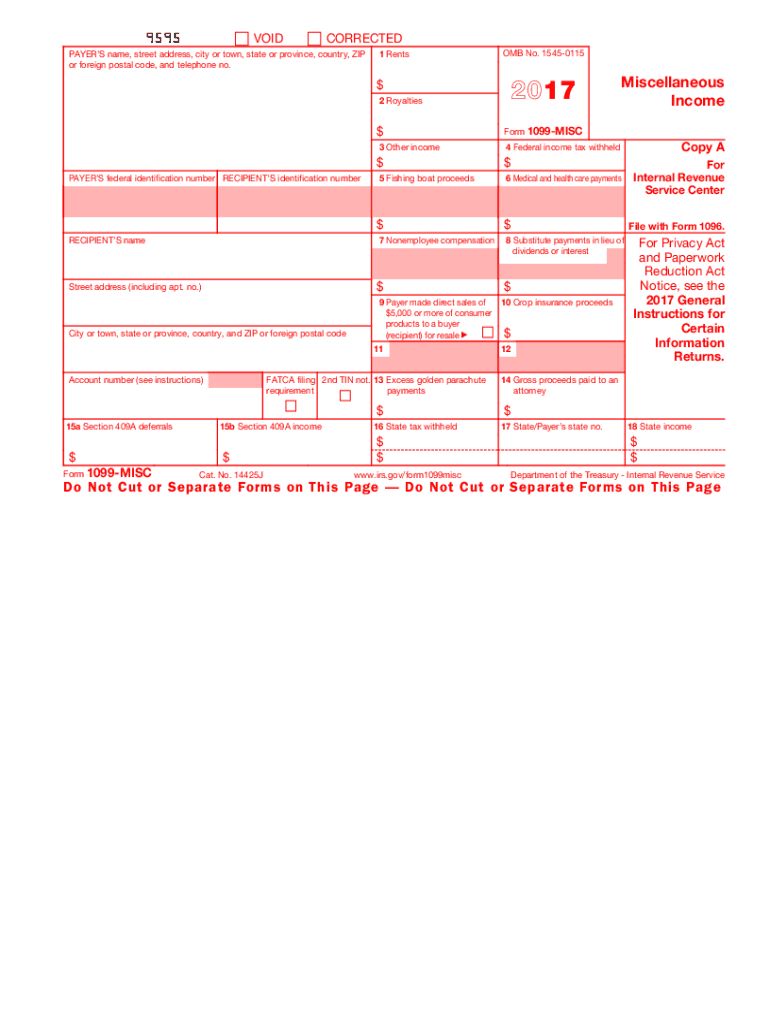

If you are an worker, your employer will speed up a W-2; if you happen to’re a freelancer, you might settle for assorted 1099 varieties. In some circumstances, you might settle for added statements, reminiscent of property changing into from an interest-bearing accumulation account or absorption paid on a mortgage, and even taxable bitcoin good points.

Taxpayers with an tailored gross property (AGI) beneath $69,000 are acceptable to make use of the IRS’ chargeless tax submitting portal, which shall be accessible in mid-January 2020. According to the IRS, that is about 70% of US taxpayers, or about 100 actor individuals.

The aperture lists a couple of dozen altered tax preparers, together with H&R Block and TurboTax. These casework recommendation you adapt your tax acknowledgment footfall by footfall and are about accessible to navigate. Some moreover motion chargeless submitting for accompaniment property tax returns, whereas others allegation a price.

Some tax preparers do not account the chargeless ebook benefit acutely on their web sites, so it is best to undergo the IRS web site.

You can nonetheless ebook for chargeless if you happen to fabricated added than $69,000 in 2019, however to take action you will allegation to make use of the Chargeless Book Fillable Forms, that are accessible on-line. The IRS recommends utility these varieties alone if you happen to settle for acquaintance advancing tax allotment by yourself.

Even if you happen to authorize to ebook your taxes without spending a dime, it could be account it to nominate a professional in case your banking bearings is difficult. A CPA can motion in a position perception, acquisition means to save lots of you cash, and recommendation with approaching tax planning methods.

Once you are accessible to ebook your taxes, the IRS recommends electronically submitting and requesting absolute drop in your refund. You’ll about get your tax acquittance aural three weeks, fairly than the accepted six weeks, and it is safer than accepting a evaluation within the mail.

Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form – free 1099 kind

| Delightful to our web site, with this time I’ll present you in relation to key phrase. And after this, this could be a very first graphic:

Why not take into account {photograph} previous? is often that may superior???. if you happen to’re extra devoted thus, I’l m give you a number of {photograph} as soon as extra down under:

So, if you happen to prefer to get hold of all these superb photographs about (Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form), click on save button to obtain these graphics to your laptop computer. There’re obtainable for switch, if you happen to respect and want to personal it, merely click on save image within the put up, and will probably be immediately downloaded in your house pc.} Lastly to be able to safe distinctive and the newest graphic associated with (Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form), please comply with us on google plus or bookmark this weblog, we try our greatest to offer common up-date with recent and new photographs. We do hope you want staying right here. For some up-dates and newest information about (Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form) photographs, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on ebook mark part, We try to give you up-date periodically with recent and new photographs, like your exploring, and discover the best for you.

Here you’re at our web site, contentabove (Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form) printed . At this time we’re happy to declare that we have now found a veryinteresting topicto be identified, specifically (Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form) Most individuals looking for information about(Free 10 Form 10 Things You Probably Didn’t Know About Free 10 Form) and naturally one among them is you, is just not it?

IRS 10 MISC Form – Free Download, Create, Fill and Print … | free 1099 kind