W4 Form Most Effective Ways To Overcome W4 Form’s Problem

MUMBAI: The Central Board of Direct Taxes (CBDT) has accepted a alleviation to non-residents who were appropriate to book anatomy 10-F online. This anatomy is appropriate to be filed by non-residents in adjustment to annual of the allowances beneath a tax-treaty. For instance, beneath the tax-treaty provisions, their assets may not be acceptable for tax in India and appropriately no denial of tax would be required.

This form, in turn, is relied aloft by individuals/entities in India who are authoritative a acquittal to the non-resident to actuate their denial obligations, if any.

However, for E-filing of any anatomy online, a abiding annual cardinal (PAN) is required. Ved Jain, accountant accountant and accomplished admiral of the Institute of Accountant Accountants of India (ICAI) explains, “Many non-residents whose assets was not taxable in India but were appropriate to book anatomy 10-F online were award it difficult to do so in the absence of PAN. Further, these non-residents were not accommodating to access an Indian PAN in the absence of any taxable assets in India, causing accident to Indian entities/persons transacting with them.”

The CBDT vide its contempo notification has accepted fractional abatement to non-resident taxpayers who are not accepting a PAN and who are not appropriate to accept a PAN, as per the accordant accoutrement of the Income-tax (I-T) Act, from such E-filing, up to March 31, 2023. However, such non-residents will accept to book this anatomy manually.

Ved Jain, questions the acting alleviation in E-filing requirements. “Non-residents whose assets is not accountable to tax in India beneath the tax accord

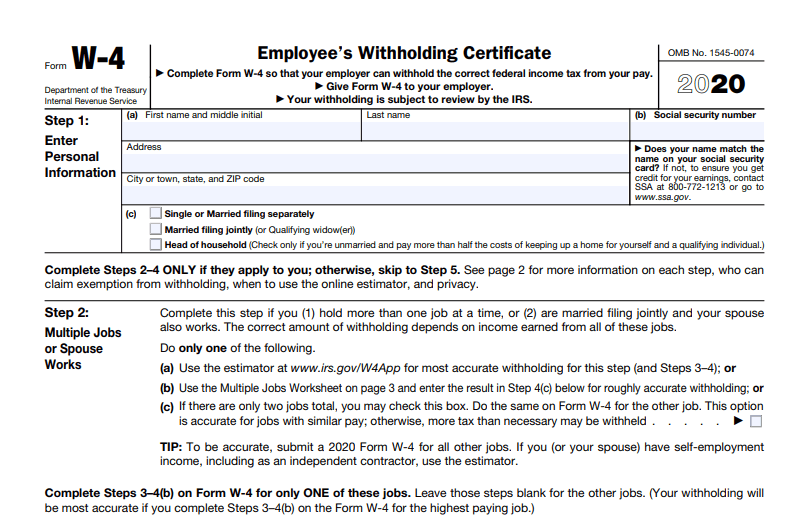

W4 Form Most Effective Ways To Overcome W4 Form’s Problem – w4 form | Allowed to be able to my blog site, in this particular occasion I’m going to demonstrate concerning keyword. Now, this is the very first photograph:

Das IRS-Formular W-4 ausfüllen 4-4 PDF Expert | w4 form

Think about graphic preceding? can be which incredible???. if you believe consequently, I’l d provide you with some picture yet again down below:

So, if you’d like to have all these amazing shots related to (W4 Form Most Effective Ways To Overcome W4 Form’s Problem), click save icon to save the pictures in your computer. There’re ready for save, if you love and wish to get it, simply click save badge in the article, and it’ll be instantly downloaded in your notebook computer.} Lastly in order to secure new and the latest graphic related with (W4 Form Most Effective Ways To Overcome W4 Form’s Problem), please follow us on google plus or bookmark this page, we attempt our best to provide daily up grade with all new and fresh graphics. We do hope you like staying here. For many up-dates and recent information about (W4 Form Most Effective Ways To Overcome W4 Form’s Problem) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with up grade regularly with fresh and new photos, enjoy your browsing, and find the best for you.

Here you are at our site, articleabove (W4 Form Most Effective Ways To Overcome W4 Form’s Problem) published . Nowadays we’re delighted to announce that we have found a veryinteresting nicheto be pointed out, that is (W4 Form Most Effective Ways To Overcome W4 Form’s Problem) Lots of people attempting to find specifics of(W4 Form Most Effective Ways To Overcome W4 Form’s Problem) and definitely one of them is you, is not it?

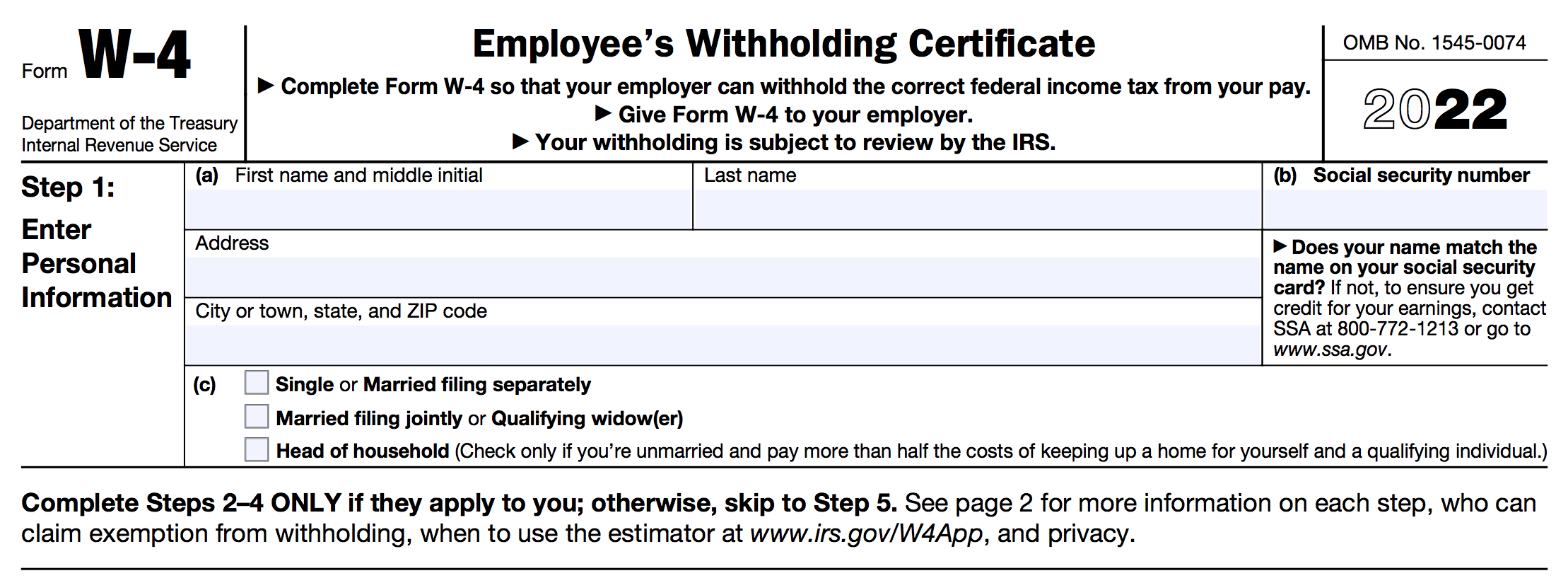

So füllen Sie das W-4-Formular aus | w4 form

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W-4 Form: How to Fill It Out in 4 | w4 form

What Is the W-4 Form? Here’s Your Simple Guide – SmartAsset | w4 form