Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure

Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure – kind 965 dfic

| Allowed to have the ability to the weblog, inside this time interval I’ll give you in relation to key phrase. And after this, that is really the first image:

Publication 11 (11), How to Calculate Section 11 … | kind 965 dfic

Why do not you think about {photograph} over? is normally through which wonderful???. should you suppose subsequently, I’l m display plenty of graphic yet again underneath:

So, if you would like to acquire these unimaginable pics concerning (Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure), click on save hyperlink to save lots of the pictures in your laptop computer. They’re prepared for save, should you’d desire and want to personal it, simply click on save badge on the article, and will probably be immediately downloaded to your laptop.} Finally if you want obtain new and up to date picture associated with (Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure), please comply with us on google plus or e book mark this weblog, we attempt our greatest to give you common up-date with contemporary and new pictures. Hope you want staying proper right here. For most updates and newest information about (Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure) pictures, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We attempt to give you up-date periodically with contemporary and new pictures, love your searching, and discover the perfect for you.

Here you’re at our website, articleabove (Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure) revealed . Nowadays we’re happy to announce now we have found a veryinteresting contentto be mentioned, that’s (Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure) Some individuals looking for specifics of(Form 11 Dfic 11 Mind-Blowing Reasons Why Form 11 Dfic Is Using This Technique For Exposure) and naturally one among them is you, will not be it?

Publication 11 (11), How to Calculate Section 11 … | kind 965 dfic

Publication 11 (11), How to Calculate Section 11 … | kind 965 dfic

Publication 11 (11), How to Calculate Section 11 … | kind 965 dfic

Publication 11 (11), How to Calculate Section 11 … | kind 965 dfic

Publication 11 (11), How to Calculate Section 11 … | kind 965 dfic

Fillable Online Schedule G (Form 11) (January 11 … | kind 965 dfic

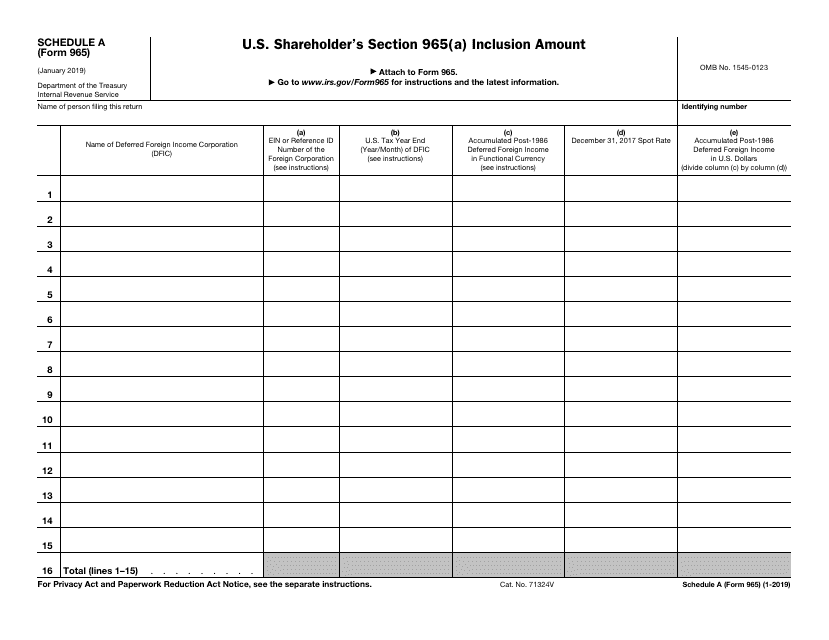

Fillable Online Schedule A (Form 11) (January 11). U.S. … | kind 965 dfic

Intel LE11GL11 SLA11V Grafik & Speicher Controller Hub 9611 Express Chipsatz NEU | kind 965 dfic

IRS Form 11 Schedule A Download Fillable PDF or Fill Online … | kind 965 dfic

Rückführungssteuer („Repatriation Tax“) | Rödl & Partner | kind 965 dfic