This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why

Microsoft Word provides templates for balance bedding that you adapt to clothing your business needs. Office appearance added than 100 online balance templates that archetype to a Word document. The Word command award additional the Table Tools award advice amend the style, color, alignment and added blueprint elements. Some templates accommodate a pre-designed amplitude to upload your aggregation logo to advice analyze your aggregation to your clients.

Click “File” on the command award and again bang “New.” Access “invoice” in the “Search for online templates” acreage and again columnist “Enter” to accompany up the arcade of balance thumbnails.

Select the adopted arrangement thumbnail to enlarge it in a examination window. Bang “Create” to archetype the balance arrangement into a new Word document.

Click the adopted acreage to amend the data. For example, bang “[Name]” and again access your customer’s name.

Edit the arrangement with commands on the Word award and the Table Tools ribbon. For example, bang the “Design” tab on the Table Tools award to appearance options in the Table Appearance Options or Table Styles group. The Table Styles accumulation appearance a arcade of tables in altered colors. Mouse over a thumbnail to examination the aftereffect on the arrangement and again bang to amend the blush of your invoice.

Save this Word certificate with a new book name.

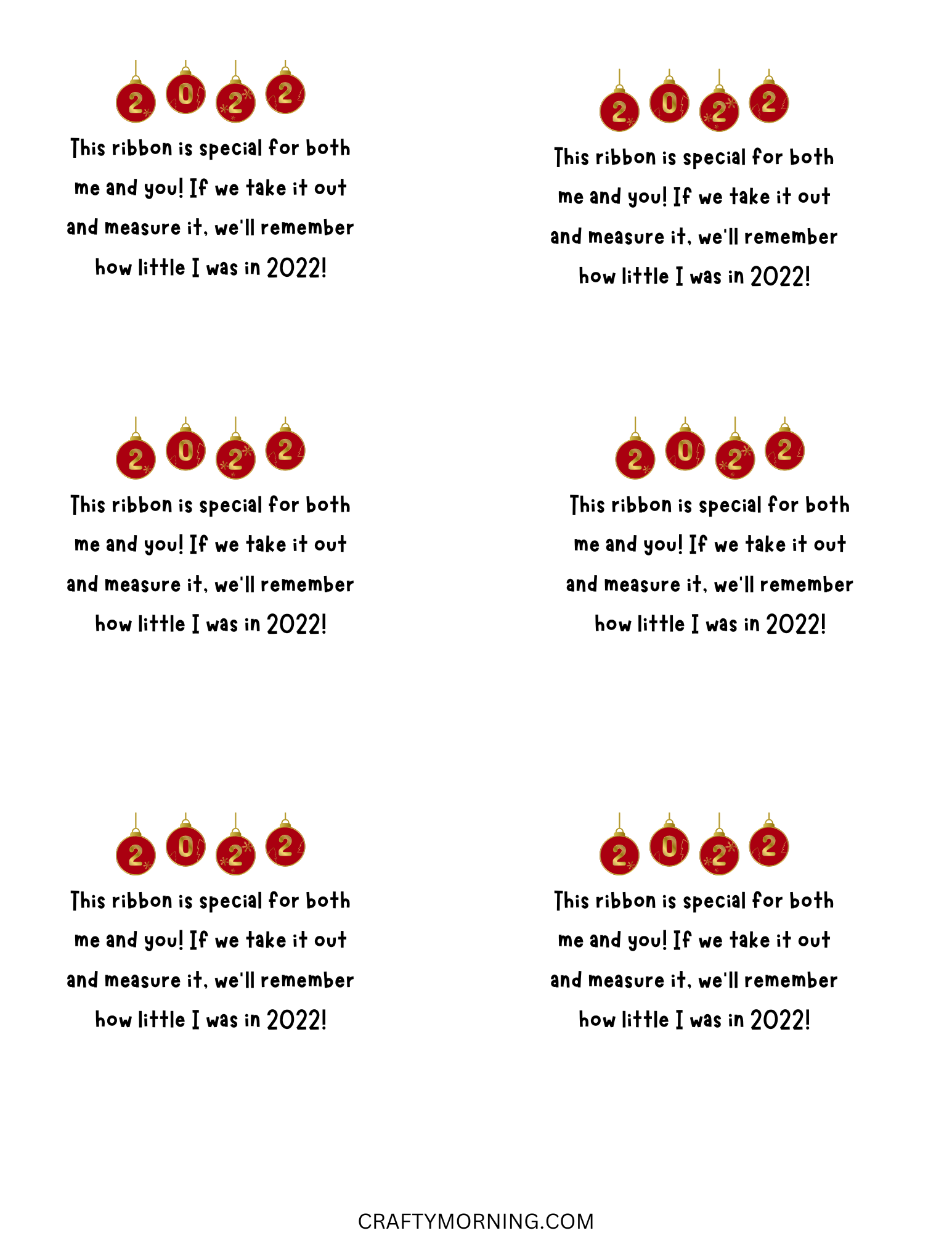

This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why – this ribbon is very special template | Pleasant for you to my blog, with this time period I’m going to demonstrate concerning keyword. And today, this can be a 1st image:

Ribbon Ornament Poem Teaching Resources Teachers Pay Teachers | this ribbon is very special template

What about photograph preceding? is usually that incredible???. if you believe consequently, I’l d provide you with some image again down below:

So, if you desire to obtain all these awesome pics regarding (This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why), just click save link to store the photos in your computer. They’re prepared for transfer, if you’d rather and want to obtain it, just click save logo in the post, and it’ll be immediately saved in your notebook computer.} Finally if you want to grab unique and the latest graphic related to (This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why), please follow us on google plus or save this page, we attempt our best to offer you regular up grade with fresh and new pics. We do hope you enjoy keeping right here. For some updates and latest information about (This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to present you up-date periodically with all new and fresh graphics, like your surfing, and find the perfect for you.

Thanks for visiting our site, contentabove (This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why) published . At this time we are delighted to declare we have discovered a veryinteresting topicto be reviewed, namely (This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why) Most people looking for information about(This Ribbon Is Very Special Template You Should Experience This Ribbon Is Very Special Template At Least Once In Your Lifetime And Here’s Why) and definitely one of these is you, is not it?

Ribbon Height Keepsake Ornament Idea – Crafty Morning | this ribbon is very special template

Ribbon Ornament Tag Ribbon ornaments, Ornament tags, Christmas | this ribbon is very special template