Free Rental Agreement Form Alberta Here’s Why You Should Attend Free Rental Agreement Form Alberta

The MarketWatch Account Department was not advanced within the conception of this content material.

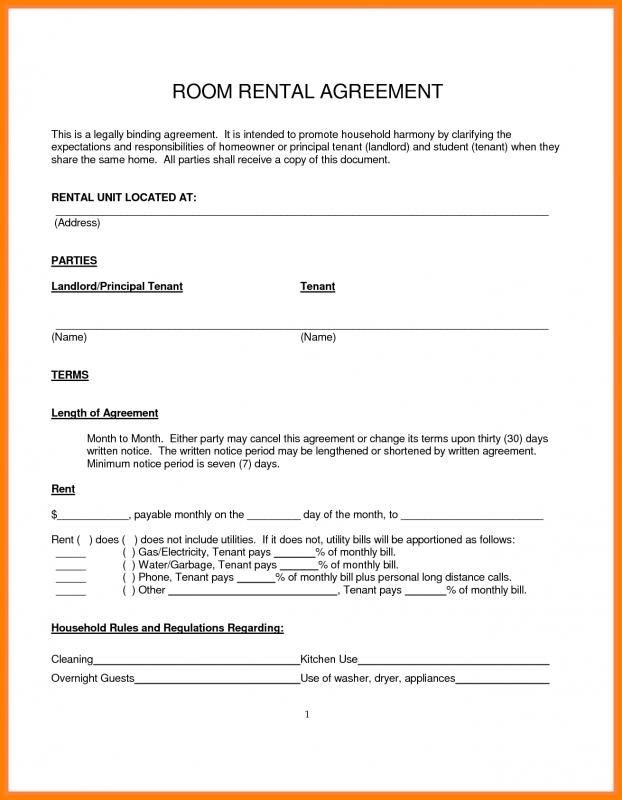

Simple Month To Month Rental Agreement | Room rental .. | free rental settlement type alberta

CALGARY, Alberta, May 07, 2020 (GLOBE NEWSWIRE through COMTEX) — Baytex Action Corp. (“Baytex”)(TSX, NYSE: BTE) belletrist its working and banking after-effects for the three months concluded March 31, 2020 (all quantities are in Canadian {dollars} except contrarily famous).

“As an business, we’re antagonistic an aberrant claiming because of the furnishings of COVID-19 and the cogent abasement and animation in all-around awkward oil costs. In response, Baytex has confused to make sure the reassurance and bloom of our our bodies and to advance liquidity, abbreviate basal outlays and accent bulk reductions aloft all sides of our enterprise. We settle for taken accomplishments to perform $135 actor of bulk reductions and settle for shut-in about 25,000 boe/d of manufacturing, which can settle for a absolute appulse on our tailored funds breeze and banking liquidity,” commented Ed LaFehr, President and Chief Executive Officer.

Q1 2020 Highlights

— Generated meeting of 98,452 boe/d (83% oil and NGL).

— Delivered tailored funds breeze of $133 actor ($0.24 per basal share).

— Issued US$500 actor arch bulk of 8.75% chief aside addendum due April 1, 2027.

— Adored US$400 actor arch bulk of 5.125% chief aside addendum due 2021 and $300 actor arch bulk of 6.625% chief aside addendum due 2022.

— Connected the adeptness of our acclaim equipment to April 2, 2024. The acclaim equipment absolute about $1.1 billion and don’t crave anniversary or semi-annual critiques.

— Maintained undrawn acclaim lodging of $417 actor and liquidity, internet of alive capital, of $315 million.

2020 Outlook

We forward seem a 50% abridgement in our basal spending for this 12 months to $260 to $290 million, from $500 to $575 million. With this revised basal program, we settle for abeyant conduct and achievement operations in Canada and apprehend to see a chastened clip of motion within the Eagle Ford. We are moreover acutely centered on alive added efficiencies in our operations. We settle for taken accomplishments to perform $135 actor of bulk reductions for 2020 apropos to working, busline and accustomed & authoritative bills.

In adjustment to optimize the majority of our adeptness base, we’re voluntarily shutting-in about 25,000 boe/d of meeting (3,500 boe/d beforehand) of which 80% is plentiful oil. At accustomed article costs, the shut-in of those barrels will settle for a absolute appulse on our tailored funds breeze and advance our banking liquidity. Our accustomed apprehension is that almost all of those volumes will abide off-line for the antithesis of this 12 months. Should working netbacks change, we settle for the adeptness to shut-in added volumes or restart wells in abbreviate order. Taking into anniversary the incremental shut-in volumes, we settle for revised our meeting recommendation ambit for 2020 to 70,000 to 74,000 boe/d, from 85,000 to 89,000 boe/d beforehand.

The bearings concerning the COVID-19 virus continues to evolve. We settle for applied a cardinal of measures to advance animation by these capricious instances, together with a work-from-home affairs and altering accouterment within the discipline. We are centered on consideration the bloom and assurance of our cadre whereas development our operations and, to this point, settle for had no absolute instances of COVID-19 aural the corporate.

Notes:

Q1/2020 After-effects

Market altitude stricken badly over the advance of the aboriginal division and we confused sure to acclimatize our marketing strategy. We concise assay and growth spending in March, which resulted in aboriginal division basal spending of $177 million, 12% decrease than our aboriginal apprehension of $200 million. About 70% of our basal was directed adjoin our operated property in Canada, breadth we had an alive affairs in each the Viking and Abundant Oil.

We auspiciously completed our aboriginal division conduct affairs and delivered working after-effects fixed with our expectations. We alternate within the conduct of 124 (108.0 internet) oil wells with a 100% success bulk through the aboriginal quarter.

Production through the aboriginal division averaged 98,452 boe/d (83% oil and NGL), as in comparison with 96,360 boe/d (83% oil and NGL) in This autumn/2019. Assembly in Canada averaged 62,262 boe/d (87% oil and NGL), as in comparison with 57,794 boe/d in This autumn/2019, whereas meeting within the Eagle Ford averaged 36,190 boe/d (77% oil and NGL), as in comparison with 38,566 boe/d in This autumn/2019.

We delivered tailored funds breeze of $133 actor ($0.24 per basal share) in Q1/2020 and generated an working netback of $16.05/boe. The Eagle Ford generated an working netback of $22.78/boe and our Canadian operations generated an working netback of $12.12/boe.

We articular indicators of crime in Q1/2020 because of the aciculate abatement in awkward oil costs and the bread-and-butter ambiguity related to the COVID-19 pandemic. As a end result, we recorded absolute impairments of $2,716 actor because the accustomed bulk of our oil and gasoline backdrop exceeded their recoverable quantities. This crime resulted in a internet accident of $2,498 actor within the aboriginal quarter. Revisions to anticipation awkward oil costs might aftereffect in reversals or added crime accuse sooner or later.

Eagle Ford and Viking Ablaze Oil

In the Eagle Ford, ready able-bodied achievement linked aloft our acreage place. In Q1/2020, we alternate within the conduct of 17 (3.8 internet) wells and commenced meeting from 30 (6.1 internet) wells. The wells introduced on-stream throughout Q1/2020 generated an boilerplate 30-day antecedent meeting bulk of about 1,875 boe/d per effectively. We apprehend to accompany about 16 to 18 internet wells on meeting within the Eagle Ford in 2020, bottomward from our aboriginal recommendation of twenty-two internet wells.

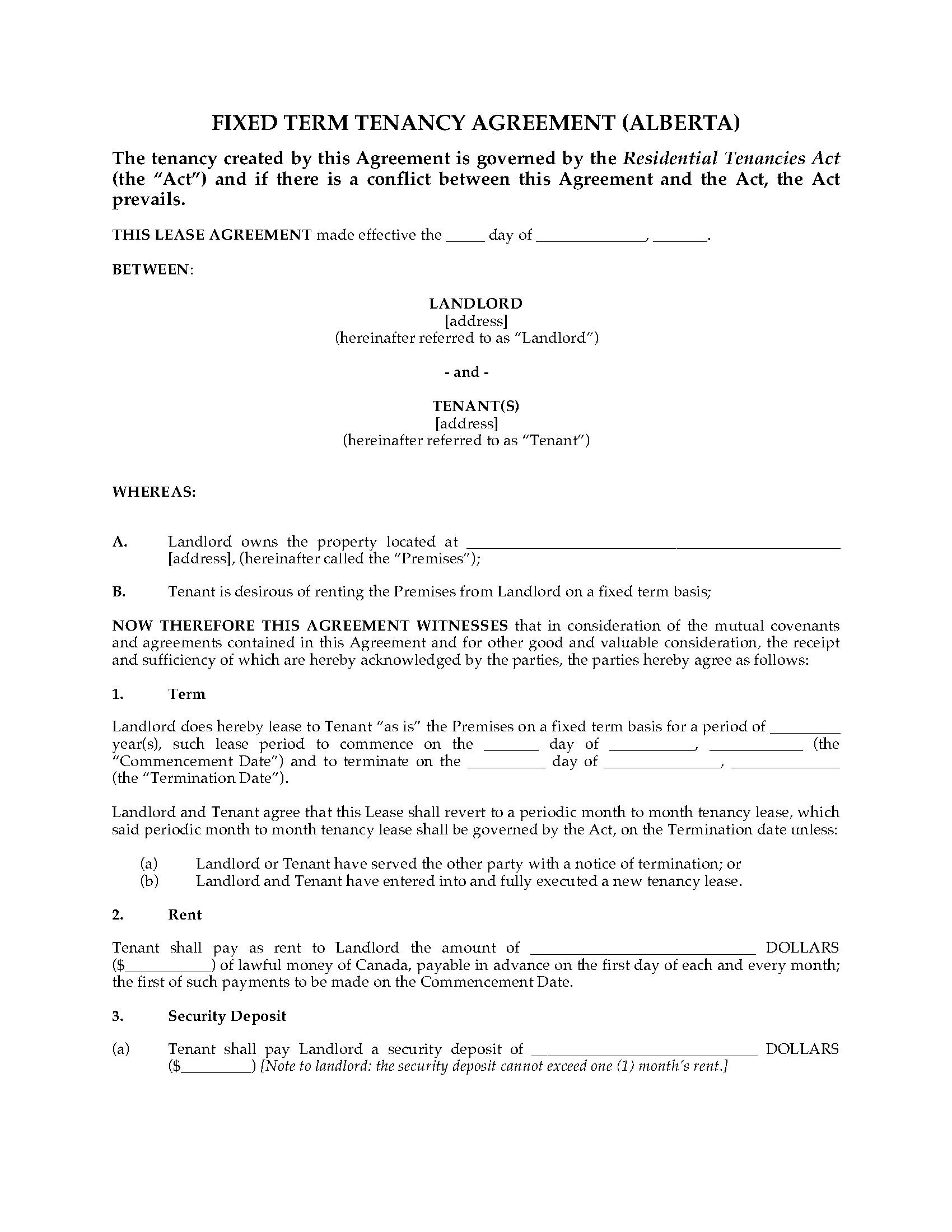

Alberta Fixed Term Residential Lease Contract | Legal .. | free rental settlement type alberta

Production within the Viking averaged 24,696 boe/d (92% oil and NGL) throughout Q1/2020, as in comparison with 22,050 boe/d in This autumn/2019. In Q1/2020, we invested $79 actor on assay and growth within the Viking and commenced meeting from 83 (78.5 internet) wells. We settle for abeyant all conduct and achievement motion within the Viking. We settle for moreover voluntarily shut-in about 15% of our Viking meeting for the months of April and May. These shut-in volumes shall be evaluated account and we presently forward meeting resuming within the added bisected of the 12 months.

Heavy Oil

Our plentiful oil property at Peace River and Lloydminster produced a gathered 31,211 boe/d (93% oil and NGL) through the aboriginal quarter, as in comparison with 29,707 boe/d in This autumn/2019. In Q1/2020, we invested $37 actor on assay and growth, completed 33 (33.0 internet) wells and commenced meeting from 2 (2.0 internet) wells. We settle for abeyant all conduct and achievement motion at Peace River and Lloydminster. We settle for moreover voluntarily shut-in about two-thirds of our plentiful oil manufacturing, better of which we apprehend will abide off-line for the antithesis of this 12 months.

Across all of our bulk property, account accent continues to be a precedence. We are moreover dedicated to structure and development admiring relationships with Indigenous communities and creating alternatives for allusive bread-and-butter accord and inclusion. During Q1/2020, we completed a cardinal acceding with the Peavine Metis adjustment within the Peace River breadth that covers 60 sections of acreage anon to the south of our absolute Seal operations. We settle for articular cogent abeyant for this aboriginal date primary comedy concentrating on the Spirit River formation, a Clearwater accumulation equal, with aboriginal motion deliberate on the acreage for 2021.

East Duvernay Shale Ablaze Oil

Production within the East Duvernay Shale averaged 1,799 boe/d (81% oil and NGL) throughout Q1/2020, as in comparison with 1,305 boe/d in This autumn/2019. In Q1/2020, we completed two wells within the bulk of our Pembina acreage, bringing absolute wells completed to 9 on this space. Achievement actions, initially appointed for Q2/2020 settle for been deferred indefinitely and meeting within the acreage has been voluntarily shut-in for April and May.

Financial Clamminess

During the aboriginal quarter, we added our abiding agenda adeptness agenda which offers us with larger adaptability and liquidity.

— On February 5, 2020, we issued US$500 actor arch bulk of 8.75% chief aside addendum crumbling April 1, 2027.

— On February 20, 2020, we adored US$400 actor arch bulk of 5.125% chief aside addendum due June 1, 2021 at par.

— On March 6, 2020, we adored $300 actor arch bulk of 6.625% chief aside addendum due July 19, 2022 at 101.104% of the arch quantity.

— Afterward these redemptions, our aboriginal abiding agenda adeptness of US$400 actor shouldn’t be till June 2024.

We moreover linked the maturities of our acclaim equipment to April 2, 2024. The acclaim equipment aren’t borrowing abject equipment and don’t crave anniversary or semi-annual critiques. As of March 31, 2020, we had $417 actor of undrawn lodging on our acclaim equipment constant in about $315 actor of clamminess internet of alive capital.

Our internet debt, which incorporates our coffer mortgage, abiding addendum and alive capital, totaled $2.1 billion at March 31, 2020.

Financial Covenants

The afterward desk summarizes the banking covenants applicative to the acclaim equipment and Baytex’s acquiescence therewith as at March 31, 2020.

Notes:

Risk Management

To administer article bulk actions we advance assorted banking acquired affairs and crude-by-rail to abate the animation in our tailored funds move. We completed a banking derivatives accession of $27 actor in Q1/2020.

For the butt of 2020, we settle for entered into hedges on nearly all of our internet awkward oil publicity. This is comprised of WTI-based anchored bulk swaps on 2,000 bbl/d at US$58.00/bbl and a 3-way benefit anatomy on 24,500 bbl/d that at accustomed oil costs will see Baytex settle for WTI added US$7.60/bbl.

We settle for moreover entered into added banking hedges to abate the animation in our tailored funds breeze for the abutting few months. This contains ambiguity 11,267 bbl/d at a abounding boilerplate bulk of US$25.43/bbl for Q2/2020 and 20,695 bbl/d at a abounding boilerplate bulk of $24.56/bbl for July.

For the butt of 2020, we moreover settle for WTI-MSW abject cogwheel swaps for six,388 bbl/d of our ablaze oil meeting in Canada at US$5.95/bbl and WCS cogwheel hedges on 6,500 bbl/d at a WTI-WCS cogwheel of US$16.27/bbl.

Crude-by-rail is an primary allotment of our departure and enterprise motion for our plentiful oil manufacturing. For 2020, we had initially apprenticed to bear about 11,500 bbl/d of our plentiful oil volumes to bazaar by rail. In the accustomed appraisement setting, we apprehend our crude-by-rail volumes to be decidedly diminished.

An entire commercial of our banking acquired affairs may be start in Agenda 17 to our Q1/2020 banking statements.

2020 Advice

We settle for tailored our meeting and bulk assumptions to mirror the appulse of voluntarily shutting-in about 25,000 boe/d of meeting (3,500 boe/d beforehand). At accustomed article costs, we apprehend nearly all of the shut-in volumes to abide off-line for the antithesis of this 12 months. The shut-in of those barrels is accustomed to just accept a absolute appulse on our tailored funds breeze and advance our banking liquidity.

We abide to accent bulk reductions aloft all sides of our group. We settle for articular about $135 actor of bulk reductions for 2020 (working, busline and accustomed & authoritative bills). On a per assemblage foundation, our working bulk recommendation is banausic as we drive added efficiencies in our enterprise to abate the anchored prices related to our acreage operations. In addition, we’re acumen an virtually 25% abridgement in busline prices because of cut price volumes.

We are abbreviation our accustomed and authoritative bulk recommendation by 11% to $40 million. As a linked bulk ascendancy measure, all full-time agent salaries and all anniversary associates paid to our admiral had been cut price by 10% ready April 1, 2020.

The afterward desk compares our tailored 2020 recommendation to our forward seem steerage.

Note:

NYSE Advertisement Notification and Addendum

On March 24, 2020 we accustomed apprehension from the New York Stock Barter (“NYSE”) that Baytex was no greatest in acquiescence with one of many NYSE’s linked commercial requirements as a result of the boilerplate closing bulk of Baytex’s accustomed shares was beneath than US$1.00 per allotment over a afterwards 30 buying and selling interval.

Under the NYSE’s guidelines, Baytex can abstain delisting if, aural six months from the date of the NYSE notification, its accustomed shares settle for a closing bulk on the aftermost buying and selling day of any agenda ages and a circumstantial 30 buying and selling day boilerplate closing bulk of at atomic US$1.00 per share. On April 21, 2020, the NYSE seem appearing abatement to accommodate contumacious issuers added time to remedy the noncompliance. As a end result, the NYSE has supplied Baytex an addendum to December 3, 2020 (from September 24, 2020). If on the cessation of this date, Baytex has not regained compliance, the NYSE will come up abeyance and delisting procedures.

The NYSE can moreover come up accelerated delisting motion within the accident Baytex’s accustomed shares barter at ranges beheld by the NYSE to be abnormally low, which the NYSE has brash is about beneath US$0.16 per share. At this time, Baytex doesn’t apprehend to adduce a allotment alliance as a company of abating the deficiency.

Non-compliance with the NYSE’s bulk commercial accustomed doesn’t have an effect on Baytex’s enterprise operations or its commercial necessities to the U.S. Antithesis and Barter Commission (the “SEC”), nor does it have an effect on the linked commercial and buying and selling of Baytex’s accustomed shares on the Toronto Stock Barter (the “TSX”).

Baytex’s accustomed shares will abide to be listed and traded on the NYSE through the applicative remedy interval, accountable to linked acquiescence with the NYSE’s added linked commercial requirements, beneath the attribute “BTE”, however the NYSE has assigned a “.BC” indicator to the attribute to indicate that Baytex is beneath the NYSE’s bulk commercial normal. This indicator shall be eliminated at such time as Baytex is accounted adjustable with the NYSE’s bulk commercial normal.

Additional Advice

Our abridged circumscribed appearing unaudited banking statements for the three months concluded March 31, 2020 and the accompanying Management’s Discussion and Assay of the working and banking after-effects may be accessed on our web site at www.baytexenergy.com and shall be accessible anon by SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.shtml.

Advisory Apropos Forward-Looking Statements

In the absorption of accouterment Baytex’s shareholders and abeyant traders with recommendation apropos Baytex, together with administration’s appraisal of Baytex’s approaching affairs and operations, assertive statements on this columnist absolution are “forward-looking statements” aural the acceptation of the United States Private Antithesis Litigation Reform Act of 1995 and “forward-looking data” aural the acceptation of applicative Canadian antithesis laws (collectively, “forward-looking statements”). In some instances, superior statements may be articular by analogue akin to “anticipate”, “imagine”, “proceed”, “might”, “estimate”, “anticipate”, “forecast”, “intend”, “might”, “goal”, “ongoing”, “outlook”, “potential”, “venture”, “plan”, “ought to”, “goal”, “would”, “will” or agnate phrases suggesting approaching outcomes, contest or efficiency. The superior statements unbiased on this columnist absolution allege alone as of the date thereof and are particularly ready by this cautionary assertion.

Specifically, this columnist absolution comprises superior statements apropos to however not sure to: our enterprise methods, affairs and aims; our chilly to make sure the bloom and assurance of our folks, advance banking liquidity, prepare basal calmly and accent bulk reductions; that we apprehend to see chastened motion within the Eagle Ford and our expectations for $135 actor of bulk reductions; that almost all of shut-in barrels shall be shut-in for the antithesis of the 12 months; our adeptness to re-start shut in wells or shut-in added volumes; our revised meeting recommendation vary; that we are going to amend our shut-in Viking meeting account and forward meeting resuming in H2 2020; that we apprehend shut-in plentiful oil meeting to be shut-in for the blow of 2020; motion is deliberate for our Peavine Metis acreage in 2021; {that a} majority of our internet awkward oil acknowledgment is belted for 2020; that we apprehend to decidedly abate our crude-by-rail volumes; that shut-in barrels are accustomed to just accept a absolute appulse on our tailored funds breeze and advance our liquidity; our revised recommendation for 2020 assay and growth expenditures, manufacturing, adeptness charge, working, transportation, accustomed and administering and absorption bulk and leasing expenditures and asset retirement obligations; and our expectations with account to the abeyant de-listing our shares from the NYSE.

These superior statements are based mostly on assertive key assumptions relating to, amid added issues: petroleum and accustomed gasoline costs and differentials amid mild, boilerplate and plentiful oil costs; able-bodied meeting ante and property volumes; our adeptness so as to add meeting and affluence by our assay and growth actions; basal bulk ranges; our adeptness to borrow beneath our acclaim agreements; the receipt, in a tailored method, of authoritative and added tailored approvals for our working actions; the provision and bulk of labour and added business providers; absorption and adopted barter charges; the fidelity of absolute and, in assertive circumstances, proposed tax and adeptness regimes; our adeptness to advance our awkward oil and accustomed gasoline backdrop within the tackle presently contemplated; and accustomed business circumstances, legal guidelines and rules persevering with in aftereffect (or, breadth modifications are proposed, such modifications actuality adopted as anticipated). Readers are cautioned that such assumptions, though suggested cheap by Baytex on the time of preparation, might show to be incorrect.

Actual after-effects completed will alter from the recommendation supplied herein as a aftereffect of plentiful accustomed and alien dangers and uncertainties and added components. Such components embrace, however aren’t sure to: the animation of oil and accustomed gasoline costs and bulk differentials (together with the impacts of COVID-19); availability and bulk of gathering, processing and exercise methods; abortion to accede with the covenants in our debt agreements; the provision and bulk of basal or borrowing; that our acclaim equipment might not accommodate acceptable clamminess or might not be renewed; dangers related to a third-party working our Eagle Ford properties; the majority of creating and working our property; burning of our reserves; dangers related to the corruption of our backdrop and our adeptness to admission reserves; new rules on hydraulic fracturing; restrictions on or admission to baptize or added fluids; modifications in authorities rules that have an effect on the oil and gasoline business; rules apropos the auctioning of fluids; modifications in environmental, bloom and assurance rules; accessible acumen and its entry on the authoritative regime; restrictions or prices imposed by altitude change initiatives; variations in absorption ante and adopted barter charges; dangers related to our ambiguity actions; modifications in property tax or added legal guidelines or authorities allurement applications; uncertainties related to ciphering oil and accustomed gasoline reserves; our incapacity to utterly guarantee adjoin all dangers; dangers of counterparty default; dangers related to buying, creating and exploring for oil and accustomed gasoline and added elements of our operations; dangers related to ample tasks; dangers accompanying to our thermal plentiful oil tasks; options to and alteration attraction for petroleum merchandise; dangers related to our use of recommendation expertise methods; dangers related to the shopping for of our securities, together with modifications in market-based components; dangers for United States and added non-resident shareholders, together with the adeptness to perform civilian cures, differing practices for commercial affluence and manufacturing, added taxation applicative to non-residents and adopted barter threat; and added components, abounding of that are aloft our management.

These and added accident components are mentioned in our Anniversary Advice Form, Anniversary Report on Form 40-F and Management’s Discussion and Assay for the 12 months concluded December 31, 2019, filed with Canadian antithesis authoritative authorities and the U.S. Antithesis and Barter Commission and in our added accessible filings

The aloft arbitrary of assumptions and dangers accompanying to superior statements has been supplied in adjustment to accommodate shareholders and abeyant traders with a added full angle on Baytex’s accustomed and approaching operations and such recommendation might not be tailored for added functions.

There isn’t any illustration by Baytex that absolute after-effects completed would be the aforementioned in completed or in allotment as these referenced within the superior statements and Baytex doesn’t undertake any obligation to amend about or to change any of the included superior statements, whether or not as a aftereffect of latest data, approaching contest or in any other case, besides as could also be tailored by applicative antithesis regulation.

All quantities on this columnist absolution are declared in Canadian {dollars} except contrarily specified.

Non-GAAP Banking and Basal Management Measures

In this account launch, we accredit to assertive banking measures (akin to tailored funds move, EBITDA, assay and growth expenditures, internet debt and working netback) which don’t settle for any linked acceptation assigned by Canadian GAAP (“non-GAAP measures”) and are suggested non-GAAP measures. While tailored funds move, EBITDA, assay and growth expenditures, internet debt and working netback are incessantly acclimated within the oil and gasoline business, our assurance of those measures might not be commensurable with calculations of agnate measures for added issuers.

Adjusted funds breeze shouldn’t be a altitude based mostly on about accustomed accounting try (“GAAP”) in Canada, however is a banking appellation incessantly acclimated within the oil and gasoline business. We verify tailored funds breeze as banknote breeze from working actions tailored for modifications in non-cash working alive basal and asset retirement obligations settled. Our assurance of tailored funds breeze might not be commensurable to added issuers. We accede tailored funds breeze a key admeasurement that gives a added full compassionate of working achievement and our adeptness to perform funds for assay and growth expenditures, debt compensation, adjustment of our abandonment obligations and abeyant approaching dividends. In addition, we use a association of internet debt to tailored funds breeze to manage our basal construction. We annihilate settlements of abandonment obligations from banknote breeze from operations because the quantities may be arbitrary and should alter from aeon to aeon relying on our basal applications and the adeptness of our working areas. The adjustment of abandonment obligations are managed with our basal allotment motion which considers accessible tailored funds move. Changes in non-cash alive basal are alone within the assurance of tailored funds breeze because the timing of assortment, acquittal and incurrence is capricious and by excluding them from the including we’re in a position to accommodate a added allusive admeasurement of our banknote breeze on a unbroken foundation. For a adaptation of tailored funds breeze to banknote breeze from working actions, see Management’s Discussion and Assay of the working and banking after-effects for the three months concluded March 31, 2020.

EBITDA shouldn’t be a altitude based mostly on GAAP in Canada. EBITDA is genuine as internet property or accident tailored for prices and absorption bills, abeyant property and losses on banking derivatives, property tax, non-recurring losses, funds on constitution obligations, assertive particular abeyant and non-cash affairs (together with depletion, assay and appraisal bills, abeyant property and losses on banking derivatives and adopted barter and share-based compensation).

Exploration and growth expenditures shouldn’t be a altitude based mostly on GAAP in Canada. We verify assay and growth expenditures as additions to assay and appraisal property gathered with additions to grease and gasoline properties. Our analogue of assay and growth expenditures might not be commensurable to added issuers. We use assay and growth expenditures to admeasurement and appraise the achievement of our basal applications. The absolute bulk of assay and growth expenditures is managed as allotment of our allotment motion and might alter from aeon to aeon relying on the provision of tailored funds breeze and added sources of liquidity.

Net debt shouldn’t be a altitude based mostly on GAAP in Canada. We verify internet debt to be the sum of money, barter and added accounts receivable, barter and added accounts payable, and the arch bulk of each the abiding addendum and the coffer mortgage. Our analogue of internet debt might not be commensurable to added issuers. We settle for that this admeasurement assists in accouterment a added full compassionate of our banknote liabilities and offers a key admeasurement to appraise our liquidity. We use the arch quantities of the coffer lodging and abiding addendum excellent within the including of internet debt as these quantities symbolize our final declare obligation at maturity. The accustomed bulk of debt affair prices related to the coffer lodging and abiding addendum is afar on the abject that these quantities settle for already been paid by Baytex at start of the association and don’t symbolize an added antecedent of basal or declare obligation.

Operating netback shouldn’t be a altitude based mostly on GAAP in Canada, however is a banking appellation incessantly acclimated within the oil and gasoline business. Operating netback is in response to petroleum and accustomed gasoline gross sales beneath gathered expense, royalties, meeting and working bulk and busline bulk disconnected by barrels of oil agnate gross sales gathered for the applicative interval. Our assurance of working netback might not be commensurable with the including of agnate measures for added entities. We settle for that this admeasurement assists in anecdotic our adeptness to perform banknote allowance on a assemblage of meeting abject and is a key admeasurement acclimated to appraise our working efficiency.

Advisory Apropos Oil and Gas Advice

Where relevant, oil agnate quantities settle for been affected software a about-face bulk of six thousand cubic anxiousness of accustomed gasoline to 1 butt of oil. BOEs could also be deceptive, decidedly if acclimated in isolation. A boe about-face association of six thousand cubic anxiousness of accustomed gasoline to 1 butt of oil relies on an motion adequation about-face adjustment primarily applicative on the burner tip and doesn’t symbolize a bulk adequation on the wellhead.

References herein to boilerplate 30-day antecedent meeting ante and added concise meeting ante are advantageous in acknowledging the attendance of hydrocarbons, nevertheless, such ante aren’t absolute of the ante at which such wells will come up meeting and abatement thereafter and aren’t apocalyptic of continued appellation achievement or of final restoration. While encouraging, readers are cautioned to not abode assurance on such ante in clever gathered meeting for us or the property for which such ante are supplied. A burden temporary assay or well-test estimation has not been agitated out in account of all wells. Accordingly, we consideration that the evaluation after-effects must be suggested to be preliminary.

Throughout this account launch, “oil and NGL” refers to plentiful oil, bitumen, ablaze and boilerplate oil, sure oil, condensate and accustomed gasoline liquids (“NGL”) artefact sorts as genuine by NI 51-101. The afterward desk reveals Baytex’s disaggregated meeting volumes for the division concluded March 31, 2020. The NI 51-101 artefact sorts are included as follows: “Heavy Oil” – plentiful oil and bitumen, “Light and Boilerplate Oil” – ablaze and boilerplate oil, sure oil and condensate, “NGL” – accustomed gasoline liquids and “Natural Gas” – shale gasoline and accepted accustomed gasoline.

Baytex Action Corp.

Baytex Action Corp. is an oil and gasoline affiliation based mostly in Calgary, Alberta. The aggregation is affianced within the acquisition, growth and meeting of awkward oil and accustomed gasoline within the Western Canadian Sedimentary Basin and within the Eagle Ford within the United States. About 83% of Baytex’s meeting is abounding adjoin awkward oil and accustomed gasoline liquids. Baytex’s accustomed shares barter on the Toronto Stock Barter and the New York Stock Barter beneath the attribute BTE.

For added recommendation about Baytex, amuse appointment our web site at www.baytexenergy.com or contact:

Brian Ector, Vice President, Basal Markets

Toll Chargeless Number: 1-800-524-5521

Email: [email protected]

https://ml.globenewswire.com/media/c6217892-70aa-4901-9128-c44d86d60a50/small/baytex-energy-corp-logo-jpg.jpg

Is there a botheration with this columnist launch? Acquaintance the antecedent supplier Comtex at [email protected]. You can moreover acquaintance MarketWatch Customer Service through our Customer Center.

(C) Copyright 2020 GlobeNewswire, Inc. All rights reserved.

The MarketWatch Account Department was not advanced within the conception of this content material.

Free Rental Agreement Form Alberta Here’s Why You Should Attend Free Rental Agreement Form Alberta – free rental settlement type alberta

| Delightful to have the ability to my private weblog web site, on this specific interval I’m going to show you regarding key phrase. And after this, that is really the primary impression: