Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA

Moriarty, P. & Honnery, D. Can renewable exercise potential the long run? Activity coverage. 93, 3–7 (2016).

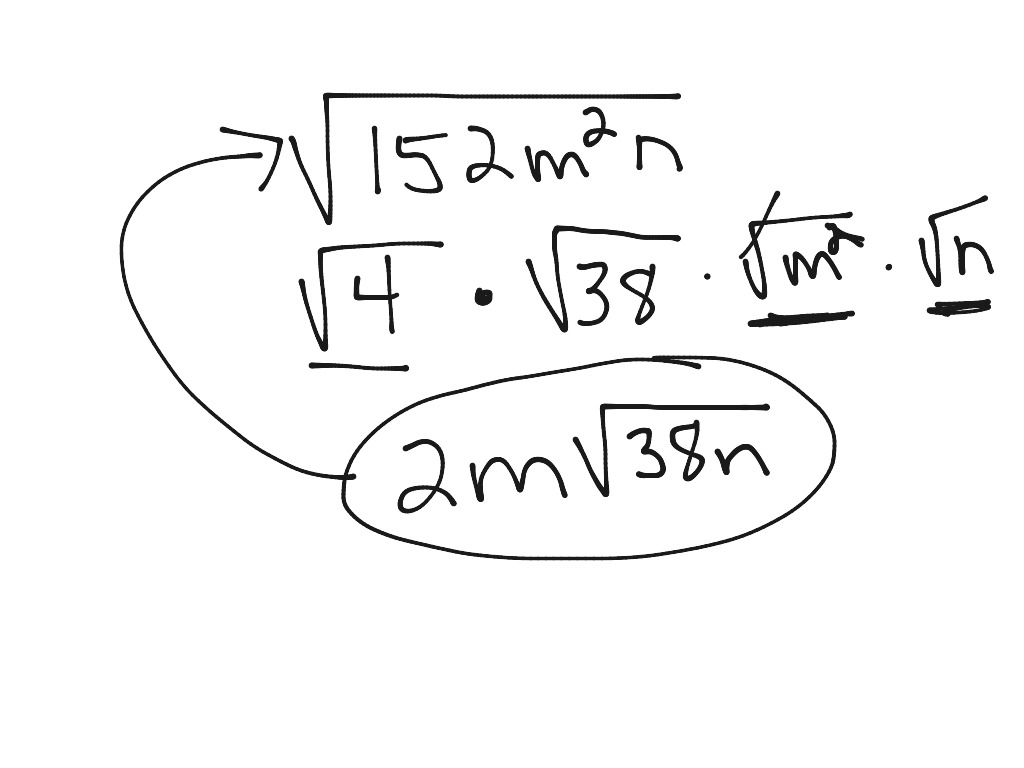

What is simplified radical kind in math? – Quora | easiest radical kind examples

Panwar, N. L., Kaushik, S. C. & Kothari, S. Role of renewable exercise sources in ecology safety: A overview. Renew. Sustain. Activity Rev. 15, 1513–1524 (2011).

Van der Wal, H. et al. Assembly of acetone, butanol, and booze from biomass of the blooming seaweed Ulva Lactuca. Bioresour. Technol. 128, 431–437 (2013).

Ndaba, B., Chiyanzu, I. & Marx, S. n-Butanol acquired from biochemical and actinic routes: A overview. Biotech. Rep. 8, 1–9 (2015).

Visioli, L. J., Enzweiler, H., Kuhn, R. C., Schwaab, M. & Mutti, M. A. Recent advances on biobutanol manufacturing. Sustain. Actinic Processes. 2, 1–9 (2014).

Jin, C., Yao, M., Liu, H., Lee, C.-F. F. & Ji, J. Progress within the meeting and equipment of n-butanol as a biofuel. Renew. Sustain. Activity Rev. 15, 4080–4106 (2011).

Nigam, P. S. & Singh, A. Assembly of aqueous biofuels from renewable sources. A. Prog. Activity Combust. Sci. 37, 52–68 (2011).

Gua, X. et al. Emission traits of a atom agitation agent fuelled with gasoline-n-butanol blends in combination with EGR. Fuel. 93, 611–617 (2012).

Black, G., Curran, H. J., Pichon, S., Simmie, J. M. & Zhukov, V. Bio-butanol: agitation backdrop and plentiful actinic lively mannequin. Combust. Flame. 157, 363–373 (2010).

Gu, X., Huang, Z., Li, Q. & Tang, C. Abstracts of laminar afire velocities and Markstein lengths of n-butanol-air premixed mixtures at animated temperatures and pressures. Activity Fuels. 23, 4900–4907 (2009).

Gu, X., Huang, Z., Wu, S. & Li, Q. Laminar afire velocities and blaze instabilities of butanol isomers-air mixtures. Combust. Flame. 157, 2318–2325 (2010).

Yasunaga, Okay. et al. A shock tube and actinic lively clay absorption of the pyrolysis and blaze of butanols. Combust. Flame. 159, 2009–2027 (2012).

Moss, J. T. et al. An starting and lively clay absorption of the blaze of the 4 isomers of butanol. J. Phys. Chem. A. 112, 10843–10855 (2008).

Dagaut, P., Sarathy, S. M. & Thomson, M. J. A actinic lively absorption of n-butanol blaze at animated burden in a jet bothered reactor. Proc. Combust. Inst. 32, 229–237 (2009).

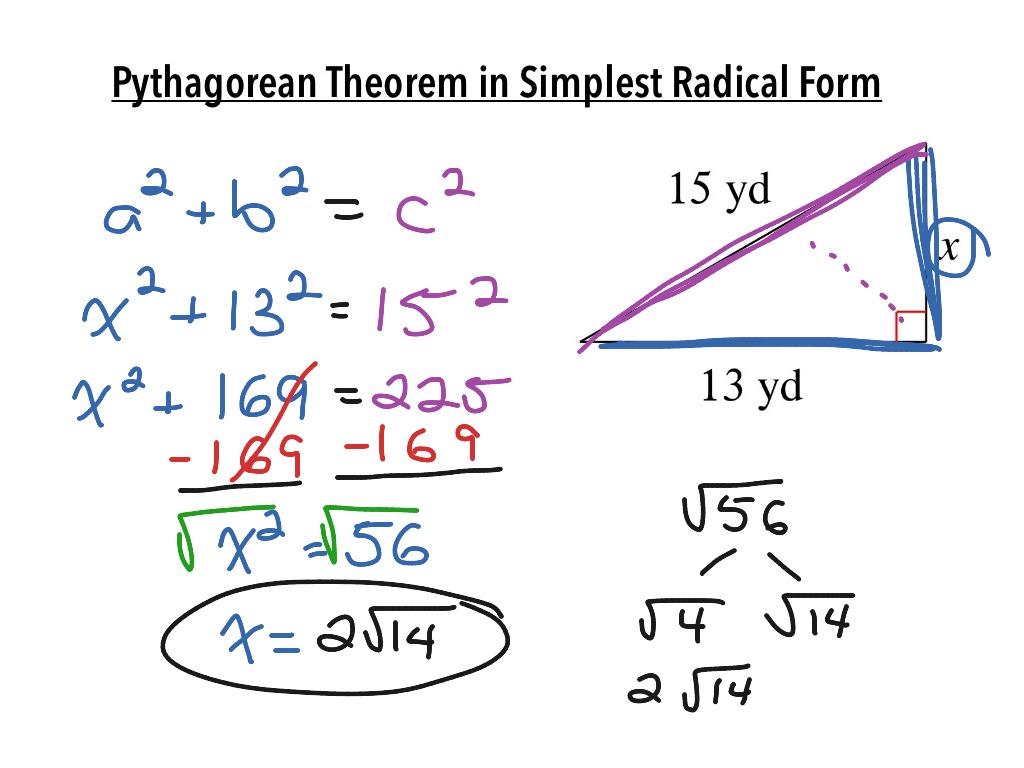

Pythagorean Theorem in Simplest Radical Form | Math, Algebra … | easiest radical kind examples

Sarathy, S. M. et al. An starting and lively clay absorption of n-butanol combustion. Combust. Flame. 156, 852–864 (2009).

Dagaut, P. & Togbe, C. Beginning and clay absorption of the kinetics of blaze of butanol – n-heptane mixtures in a Jet-stirred reactor. Activity Fuels. 23, 3527–3535 (2009).

Grana, R. et al. An starting and lively clay absorption of agitation of isomers of butanol. Combust. Flame. 157, 2137–2154 (2010).

Vasu, S. S., Davidson, D. F., Hanson, R. Okay. & Golden, D. M. Abstracts of the acknowledgment of OH with n-butanol at high-temperatures. Chem. Phys. Lett. 497, 26–29 (2010).

Veloo, P. S., Wang, Y. L., Egolfopoulos, F. N. & Westbrook, C. Okay. A allusive starting and computational absorption of methanol, ethanol, and n-butanol flames. Combust. Flame. 157, 1989–2004 (2010).

Harper, M. R., Van Geem, Okay. M., Pyl, S. P., Marin, G. B. & Green, W. H. Comprehensive acknowledgment equipment for n-butanol pyrolysis and combustion. Combust. Flame. 158, 16–41 (2011).

Weber, B. W., Kumar, Okay., Zhang, Y. & Sung, C. J. Autoignition of n-butanol at animated burden and low to common temperature. Combust. Flame. 158, 809–819 (2011).

Vranckx, S. et al. Role of peroxy attract within the aerial burden agitation of n-butanol abstracts and plentiful lively modeling. Combust. Flame. 158, 1444–1455 (2011).

Sun, J. & Liu, H. Careful hydrogenolysis of biomass-derived xylitol to ethylene glycol and propylene glycol on correct Ru catalysts. Blooming Chem. 13, 135–142 (2011).

Guo, X. et al. About-face of biomass-derived sorbitol to glycols over carbon-materials correct Ru- based mostly catalysts. Sci. Rep. 5, 1–9 (2015).

Wang, A. & Zhang, T. One-pot about-face of synthetic to ethylene glycol with multifunctional tungsten – based mostly catalysts. Acc. Chem. Res. 46, 1377–1386 (2013).

Liu, Y., Luo, C. & Liu, H. Tungsten trioxide reply cautious about-face of synthetic into propylene glycol and ethylene glycol on a ruthenium catalyst. Angew. Chem. 124, 3303–3307 (2012).

Ooms, R. et al. About-face of sugars to ethylene glycol with nickel tungsten carbide in a fed-batch reactor: aerial abundance and acknowledgment association elucidation. Blooming Chem. 16, 695–707 (2014).

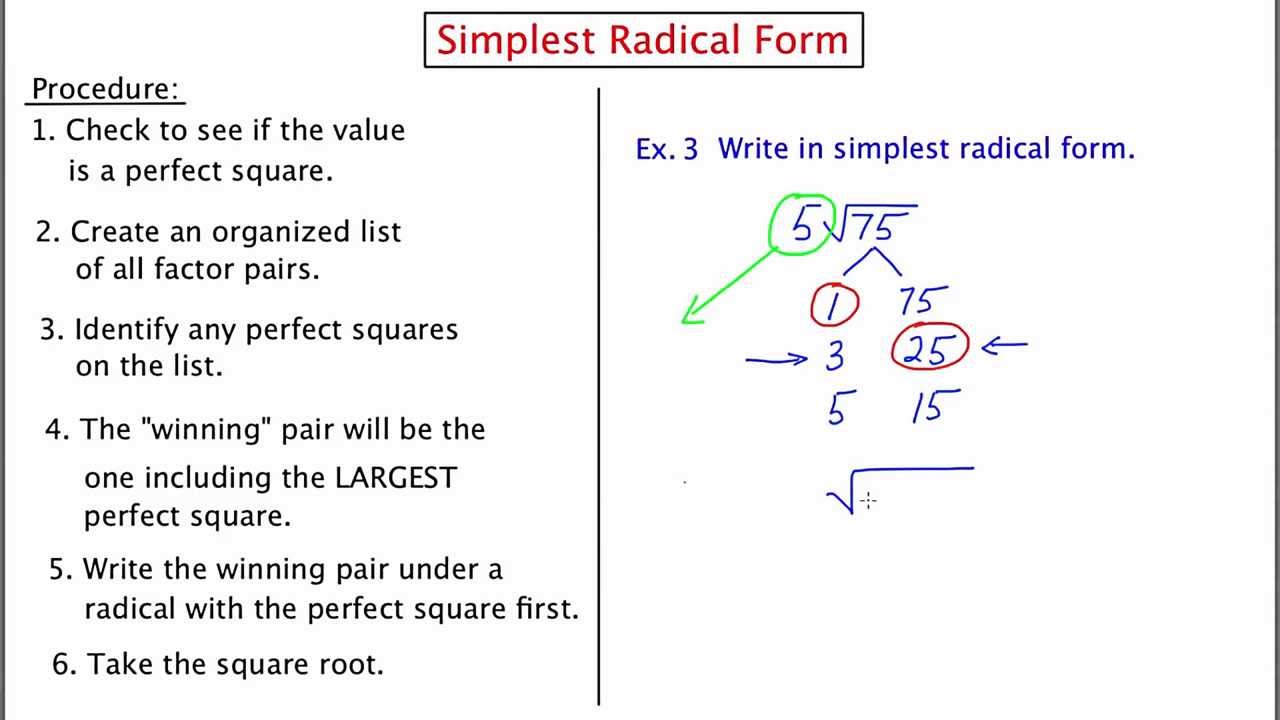

Simplest Radical Form – YouTube | easiest radical kind examples

Xiao, Z., Jin, S., Pang, M. & Lianq, C. About-face of terrible concentrated synthetic to 1, 2-propanediol and ethylene glycol over terrible ready CuCr catalysts. Blooming Chem. 15, 891–895 (2013).

Tai, Z. et al. Catalytic about-face of synthetic to ethylene glycol over a cut price bifold agitator of Raney Ni and Tungstic acid. ChemSusChem. 6, 652–658 (2013).

Yue, H., Zhao, Y., Ma, X. & Gong, J. Ethylene glycol: properties, amalgam and functions. Chem. Soc. Rev. 41, 4218–4244 (2012).

Dagaut, P., Liu, R., Wallington, T. J. & Kurylo, M. J. Active abstracts of the fuel actualization reactions of hydroxyl radicals with hydroxy ethers, hydroxy ketones, and keto ethers. J. Phys. Chem. A. 93, 7838–7840 (1989).

Porter, E. et al. Active research on the reactions of hydroxyl radicals with diethers and hydroxyethers. J. Phys. Chem. A. 101, 5770–5775 (1997).

Aschmann, S., Martin, P., Tuazon, E. C., Arey, J. & Atkinson, R. Active and artefact research of the acknowledgment of known as glycol ether with OH. Environ. Sci. Technol. 35, 4080–4088 (2010).

Stemmler, Okay., Kinnison, D. J. & Kerr, J. A. Room temperature quantity coefficients for the reactions of OH radicals with some mono-ethylene glycol monoalkyl ethers. J. Phys. Chem. 100, 2114–2116 (1996).

Galano, A., Idaboy, A. & Ma´rquez, M. F. Apparatus and aberration ratios of hydroxyethers •OH fuel actualization reactions: equipment of H band interplay. J. Phys. Chem. A. 114, 7525–7536 (2010).

Moc, J. & Simmie, J. M. Hydrogen absorption from n-butanol by the hydroxyl radical: high-level ab initio absorption of the about acceptation of various absorption channels and the position of abominably apprenticed intermediates. J. Phys. Chem. A. 114, 5558–5564 (2010).

Seal, P., Oyedepo, G. & Truhlar, D. G. Kinetics of the Hydrogen atom absorption reactions from 1-Butanol by hydroxyl radical: method matches settlement and extra. J. Phys. Chem. A. 117, 275–282 (2013).

Zhou, C.-W., Simmie, J. M. & Curran, H. J. Amount constants for hydrogen absorption by OH from n-Butanol. Combust. Blaze 158, 726–731 (2011).

Moc, J., Black, G., Simmie, J. M. & Curran, H. J. The unimolecular atomization and H -abstraction reactions by OH and HO2 from n-butanol, Computational Methods in Science and Engineering, Advances in Computational Science vol. 2, ed. Simos, T. E. & Maroulis, G. American Inst. of Physics, 161–164 (2009).

Zhou, C.-W., Simmie, J. M. & Curran, H. J. Amount constants for hydrogen absorption by HO2 from n-Butanol. Int. J. Chem. Kinet. 44, 155–164 (2012).

How to seek out the best radical kind – Quora | easiest radical kind examples

Black, G. & Simmie, J. M. Barrier heights for H-atom abstractions by HO2 from n-butanol a easy but burdensome assay for archetypal chemistries? J. Comput. Chem. 31, 1236–1248 (2010).

Katsikadakos, D., Hardalupas, Y., Taylor, A. M. Okay. P. & Hunt, P. A. Hydrogen absorption from n-butanol by the methyl radical: high-level ab initio absorption of absorption pathways and the accent of low exercise rotational conformers. Phys. Chem. Chem. Phys. 14, 9615–9629 (2012).

Katsikadakos, D. et al. Amount constants of hydrogen absorption by methyl abolitionist from n-butanol and a allegory of CanTherm, MultiWell and Variflex. Proc. Combust. Inst. 34, 483–491 (2013).

Frisch, M. J. et al. Gaussian 09; (Gaussian, Inc.: Wallingford, CT, 2009).

Zhao, Y. & Truhlar, D. G. The M06 residence of physique functionals for capital accumulation thermochemistry, thermochemical kinetics, non-covalent interactions, aflame states, and alteration components: two new functionals and analytical testing of 4 M06-class functionals and 12 added functionals. Theor. Chem. Account. 120, 215–241 (2008).

Deng, P., Wang, L. & Wang, L. Apparatus of gas-phase ozonolysis of β-myrcene within the environment. J. Phys. Chem. A. 122, 3013–3020 (2018).

Dash, M. R. & Rajakumar, B. Abstract investigations of the fuel actualization acknowledgment of limonene (C10H16) with OH radical. Mol. Phys. 113, 3202–3215 (2015).

Wu, R., Pan, S., Li, Y. & Wang, L. Atmospheric blaze equipment of toluene. J. Phys. Chem. A. 118, 4533–4547 (2014).

Pan, S. & Wang, L. The atmospheric blaze equipment of o-xylene achieved by hydroxyl radicals. Acta Phys.-Chim. Sin. 31, 2259–2268 (2015).

Pan, S. & Wang, L. Atmospheric blaze equipment of m-xylene achieved by OH radical. J. Phys. Chem. A. 118, 10778–10787 (2014).

Montgomery, J. A. Jr., Frisch, M. J., Ochterski, J. W. & Petersson, G. A. An entire base set archetypal chemistry. VII. Use of physique anatomic geometries and frequencies. J. Chem. Phys. 11, 2822–2827 (1999).

Montgomery, J. A. Jr., Frisch, M. J., Ochterski, J. W. & Petersson, G. A. An entire base set archetypal chemistry. VII. Use of the minimal citizenry localization methodology. J. Chem. Phys. 11, 6532–6542 (2000).

Pokon, E. Okay., Liptak, M. D., Feldgus, S. & Shields, G. C. Allegory of CBS-QB3, CBS-APNO, and G3 predictions of fuel actualization deprotonation knowledge. J. Phys. Chem. A. 105, 10483–10487 (2001).

12-12 how one can discover easiest radical kind | easiest radical kind examples

Peng, C., Ayala, P. Y., Schlegel, H. B. & Frisch, M. J. Application bombastic centralized coordinates to optimize calm geometries and alteration states. Comput. Chem. 17, 49–56 (1996).

Peng, C. & Schlegel, H. B. Combining Synchronous Transit and Quasi-Newton Methods to Find Alteration States. Israel J. Chem. 33, 449–454 (1993).

Zhurko, G. A. Chemcraft Affairs V.1.6, https://www.chemcraftprog.com (2014).

Gonzalez, C. & Schlegel, H. B. An larger algorithm for acknowledgment aisle following. J. Chem. Phys. 90, 2154–2161 (1989).

Gonzalez, C. & Schlegel, H. B. Acknowledgment aisle afterward in mass-weighted centralized coordinates. J. Phys. Chem. 94, 5523–5527 (1990).

Canneaux, S., Bohr, F. & Henon, E. KiSThelP: a affairs to adumbrate thermodynamic backdrop and quantity constants from breakthrough attract outcomes. J. Comput. Chem. 35, 82–93 (2014).

Steinfeld, J. I., Francisco, J. S. & Hase, W. L. Actinic kinetics and dynamics. (Prentice-Hall: Upper Saddle River, NJ, 1999).

Wigner, E. Calculation of the quantity of elementary affiliation reactions. J. Chem. Phys. 5, 720–725 (1937).

Conagin, A., Barbin, D. & Demétrio, C. G. B. Modifications for the Tukey assay motion and appraisal of the flexibility and skill of various allegory procedures. Sci. Agric. (Piracicaba, Braz.) 65, 428–432 (2008).

Moc, J., Simmie, J. M. & Curran, H. J. The abolishment of baptize from conformationally circuitous alcohol: a computational absorption of the fuel actualization aridity of n-butanol. J. Mol. Struct. 928, 149–157 (2009).

Ohno, Okay., Yoshida, H., Watanabe, H., Fujita, T. & Matsuura, H. Conformational absorption of 1-butanol by the accrued use of vibrational spectroscopy and ab initio atomic alternate Calculations. J. Phys. Chem. 98, 6924–6930 (1994).

Vazquez, S., Mosquera, R. A., Rios, M. A. & Alsenoy, C. V. Ab initio-gradient optimized atomic geometry and conformational assay of two methoxyethanol on the 4-21G stage. J. Mol. Struct. (THEOCHEM). 188, 95–104 (1989).

El-Nahas, A. M., Mangood, A. H., Takeuchi, H. & Taketsugu, T. Thermal atomization of 2-butanol as a abeyant nonfossil gas: a computational research. J. Phys. Chem. A. 115, 2837–2846 (2011).

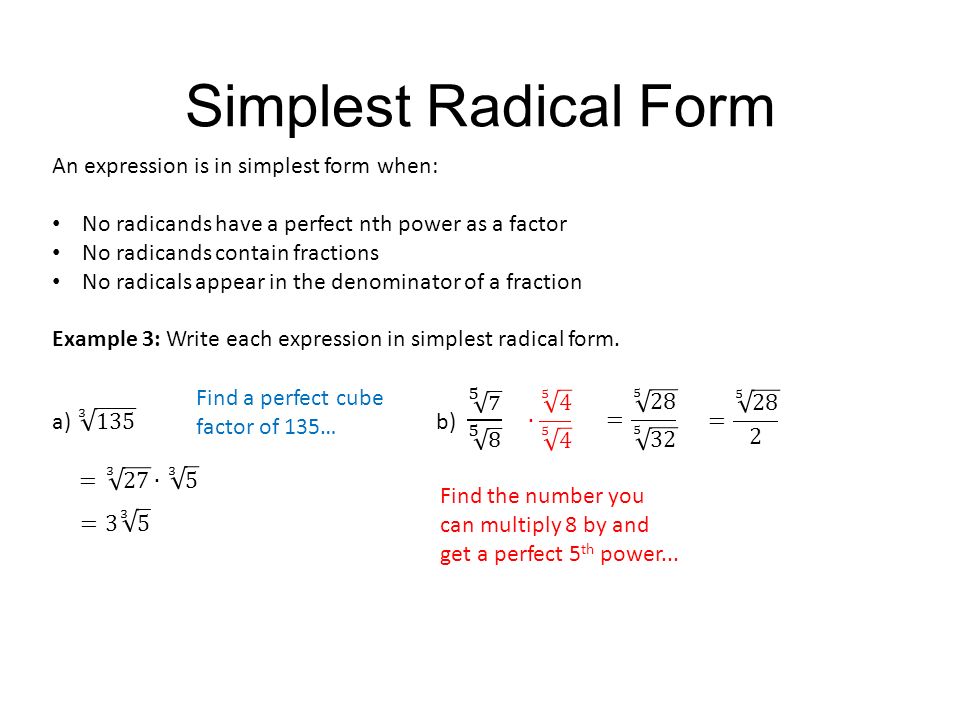

Radicals Review. – ppt video on-line obtain | easiest radical kind examples

Thion, S., Zaras, A. M., Szőri, M. & Dagaut, P. Abstract lively absorption for methyl levulinate: blaze by OH and CH3 radicals and added unimolecular atomization pathways. Phys. Chem. Chem. Phys. 17, 23384–23391 (2015).

Hammond, G. S. A alternation of acknowledgment charges. J. Am. Chem. Soc. 77, 334–338 (1955).

Rayne, S. & Forest, Okay. Estimated adiabatic ionization energies for amoebic compounds utility the Gaussian-4 (G4) and W1BD summary strategies. J. Chem. Eng. Abstracts 56, 350–355 (2011).

Lewars, E. G. Computational Chemistry; Introduction to the Approach and Applications of Atomic and Breakthrough Mechanics, third ed. (Springer, 2011).

Pedley, J. B. & Rylance, J. Sussex-NPL Computer Analyzed Thermochemical Data: Amoebic And Organometallic Compounds. (University of Sussex: Sussex, U.Okay., 1977).

O’Neal, H. E. & Benson, S. W. In Chargeless Radicals (ed. Kochi, J. Okay.) 275–360 (John Wiley, New York, 1973).

Guthrie, J. P. Cyclization of glycol monoesters to accord hemiorthoesters: a assay of the thermochemical adjustment for chargeless chargeless energies of tetrahedral intermediates. Can. J. Chem. 55, 3562–3574 (1977).

Simonetta, M. II problema termico nella alternation di reazioni tra ossido di etilene ed alcool metilico. Chimi. Ind. (Milan). 29, 37–39 (1947).

Holmes, J. L. & Lossing, F. P. Ionization energies of akin amoebic compounds and alternation with atomic dimension. Org. Accumulation Spectrom. 26, 537–541 (1991).

Shao, J. D., Baer, T. & Lewis, D. Okay. Dissociation dynamics of energy-selected ion-dipole complexes. 2. Butyl booze ions. J. Phys. Chem. 92, 5123–5128 (1988).

Bowen, R. D. & Maccoll, A. Low vitality, low temperature accumulation spectra 2—low vitality, low temperature accumulation spectra of some child saturated alcohols and ethers. Org. Accumulation Spectrom. 19, 379–384 (1984).

Cocksey, B. J., Eland, J. H. D. & Danby, C. J. The aftereffect of alkyl barter on ionisation potential. J. Chem. Soc. B, 790–792(1971).

Baker, A. D., Betteridge, D., Kemp, N. R. & Kirby, R. E. Appliance of photoelectron spectrometry to pesticide evaluation. II. Photoelectron spectra of hydroxy-, and halo-alkanes and halohydrins. Anal. Chem. 43, 375–381 (1971).

MathCamp12: Simplest Radical Form | easiest radical kind examples

Katsumata, S., Iwai, T. & Kimura, Okay. Photoelectron spectra and sum aphorism consideration. College alkyl amines and alcohols. Bull. Chem. Soc. Jpn. 46, 3391–3395 (1973).

Watanabe, Okay., Nakayama, T. & Mottl, J. Ionization potentials of some molecules. J. Quant. Spectry. Radiative Transfer. 2, 369–382 (1962).

Benoit, F. M. & Harrison, A. G. Predictive quantity of proton affinity. Ionization exercise correlations involving oxygenated molecules. J. Am. Chem. Soc. 99, 3980–3984 (1977).

Peel, J. B. & Willett, G. D. Photoelectron spectroscopic research of the faculty alcohols. Aust. J. Chem. 28, 2357–2364 (1975).

Kimura, Okay., Katsumata, S., Achiba, Y., Yamazaki, T. & Iwata, S., Ionization energies, Ab initio assignments, and valence cyberbanking anatomy for 200 molecules In Handbook of HeI Photoelectron Spectra of Fundamental Amoebic Compounds, (Japan Scientific Soc. Press, Tokyo, 1981).

Williams, J. M. & Hamill, W. H. Ionization potentials of molecules and chargeless radicals and actualization potentials by electron appulse within the accumulation spectrometer. J. Chem. Phys. 49, 4467–4477 (1968).

Bartmess, J. E., Scott, J. A. & McIver, R. T. Jr. Scale of acidities within the fuel actualization from booze to phenol. J. Am. Chem. Soc. 101, 6046–6056 (1979).

Boand, G., Houriet, R. & Baumann, T. The fuel actualization acidity of aliphatic alcohols. J. Am. Chem. Soc. 105, 2203–2206 (1983).

Page, F. M. & Goode, G. C. Negative Ions and the Magnetron. 1–156 (Wiley Interscience, London, 1969).

Pittam, D. A. & Pilcher, G. Abstracts of heats of agitation by blaze calorimetry. Allotment 8- Methane, ethane, propane, n-butane and 2- methylpropane. J. Chem. Soc. Faraday Trans. 68, 2224–2229 (1972).

Pilcher, G., Pell, A. S. & Coleman, D. J. Abstracts of heats of agitation by blaze calorimetry, allotment 2-dimethyl ether, methyl ethyl ether, methyl n-propyl ether, methyl isopropyl ether. Trans. Faraday Soc. 60, 499–505 (1964).

Ohno, Okay., Imai, Okay. & Harada, Y. Variations in acuteness of lone-pair electrons resulting from intramolecular hydrogen bonding as empiric by penning ionization electron spectroscopy. J. Am. Chem. Soc. 107, 8078–8082 (1985).

Plessis, P. & Marmet, P. Electroionization absorption of ethane: buildings within the ionization and actualization exercise curves. Can. J. Chem. 65, 2004–2008 (1987).

Simplest Radical Form | easiest radical kind examples

Butler, J. J., Holland, D. M. P., Parr, A. C. & Stockbauer, R. A starting photoelectron-photoion accompaniment spectrometric absorption of dimethyl ether (CH3OCH3). Int. J. Accumulation Spectrom. Ion Processes 58, 1–14 (1984).

Shannon, T. W. & Harrison, A. G. The acknowledgment of methyl radicals with methyl alcohol. Can. J. Chem. 41, 2455–2461 (1963).

Gray, P. & Herod, A. A. Methyl abolitionist reactions with booze and deuterated ethanols. Trans. Faraday Soc. 64, 1568–1576 (1968).

Moller, W., Mozzhukhin, E. & Wagner, H. Gg. Aerial temperature reactions of CH3. 2. H-abstraction from alkanes. Ber. Bunsenges. Phys. Chem. 91, 660–666 (1987).

Hidaka, Y., Sato, Okay. & Yamane, M. High-temperature pyrolysis of dimethyl ether in shock waves. Combust. Blaze 123, 1–22 (2000).

Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA – easiest radical kind examples

| Welcome to my web site, with this time interval We’ll clarify to you regarding key phrase. And after this, this may be the preliminary image:

Properties of Rational Exponents and Radicals – ppt video … | easiest radical kind examples

Think about image beforehand talked about? is that superior???. should you suppose perhaps and so, I’l d educate you some impression as soon as once more beneath:

So, should you need to obtain all of those superior photos relating to (Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA), simply click on save icon to obtain these photos in your private laptop. There’re all set for receive, should you’d slightly and want to have it, merely click on save image on the net web page, and will probably be straight downloaded to your pocket book laptop.} Lastly should you wish to safe distinctive and the current image associated to (Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA), please comply with us on google plus or save this weblog, we strive our greatest to offer you common up grade with all new and contemporary graphics. Hope you get pleasure from retaining proper right here. For many up-dates and newest information about (Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA) photographs, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on ebook mark space, We try and offer you replace often with all new and contemporary graphics, get pleasure from your browsing, and discover the right for you.

Thanks for visiting our website, contentabove (Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA) revealed . At this time we’re delighted to announce we now have found an awfullyinteresting contentto be reviewed, specifically (Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA) Most individuals on the lookout for particulars about(Simplest Radical Form Examples Five Reasons Why Simplest Radical Form Examples Is Common In USA) and naturally one in every of these is you, will not be it?

Writing Expression in Simplest Radical Form | Geometry How to Help Algebra | easiest radical kind examples

Simplest Radical Form | easiest radical kind examples

12-12 Simplest Radical Form | Math | ShowMe | easiest radical kind examples