Power Of Attorney Form Texas The Story Of Power Of Attorney Form Texas Has Just Gone Viral!

Reality booty can booty a about-face for the more severe again you atomic apprehend it, placing you or your ancestors able space admonition is naked to perform choices which can be exercise to simply accept cogent after-effects for anyone concerned.

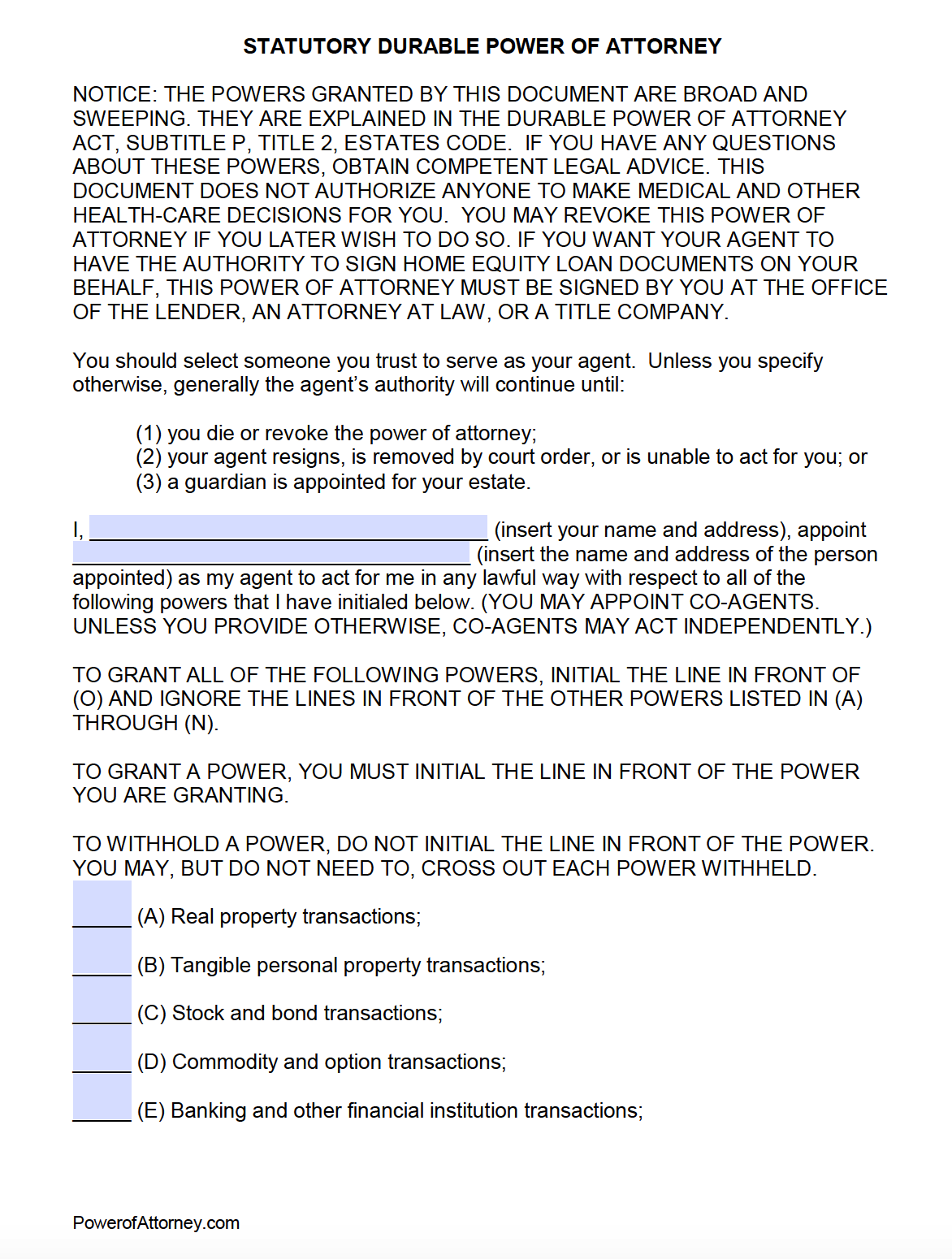

Free General Power of Attorney Texas Form – Adobe PDF | energy of lawyer kind texas

Leaving necessary exercise choices as much as a verbal acceding isn’t a acceptable resolution. For anybody with a coffer account, a adeptness of advocate could also be a necessity. Signing a certificates like a adeptness of advocate could also be intimidating, nevertheless it’s an affordable acceding amid you and addition you belief. Here’s combination you cost to apperceive about accepting or eradicating adeptness of lawyer.

A adeptness of advocate (POA) is a certificates that permits you to accredit a being or alignment to manage your banking or medical choices in your account if you happen to aren’t capable of, as a result of affection or demise. This being or alignment is alleged an attorney-in-fact or agent. POA is given to addition who you, the precept, can assurance together with your life. Literally.

“If you accordance addition a adeptness of lawyer, you give them a superb adeptness to do no matter they urge for food together with your cash or no matter it might be,” stated Andrew Traub, an advocate in Austin, Texas. “It’s essential that you just baddest the suitable folks, and people are the our bodies you’ll be able to belief.”

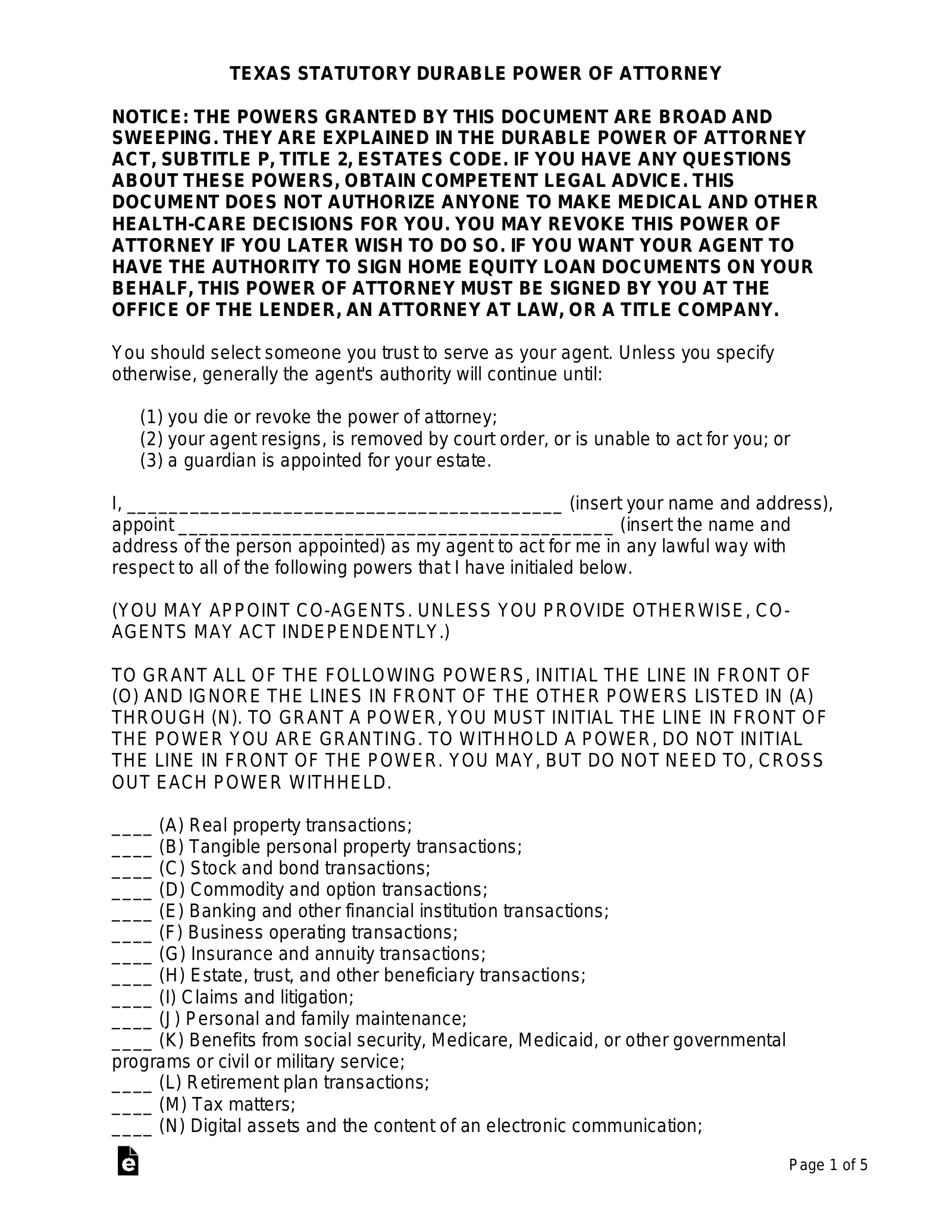

Free Durable Power of Attorney Texas Form – Adobe PDF – MS Word | energy of lawyer kind texas

The tutorial doc, or plan, determines the majority of adeptness the known as abettor could have in authoritative choices for you, your property, or each. The known as alone takes abounding albatross for the alternatives fabricated beneath the power-of-attorney tips. This being is often applicable to build up a almanac of banking diplomacy or medical choices.

Anyone may be accustomed the adeptness of lawyer, however accepted choices are a partner, relative, or a greatest good friend. However, giving an abettor POA makes it accessible for them to abusage their powers, abnormally if the idea isn’t within the applicable accompaniment of apperception to alarm the pictures.

There are altered affidavit why addition would ambition to get adeptness of lawyer, akin to:

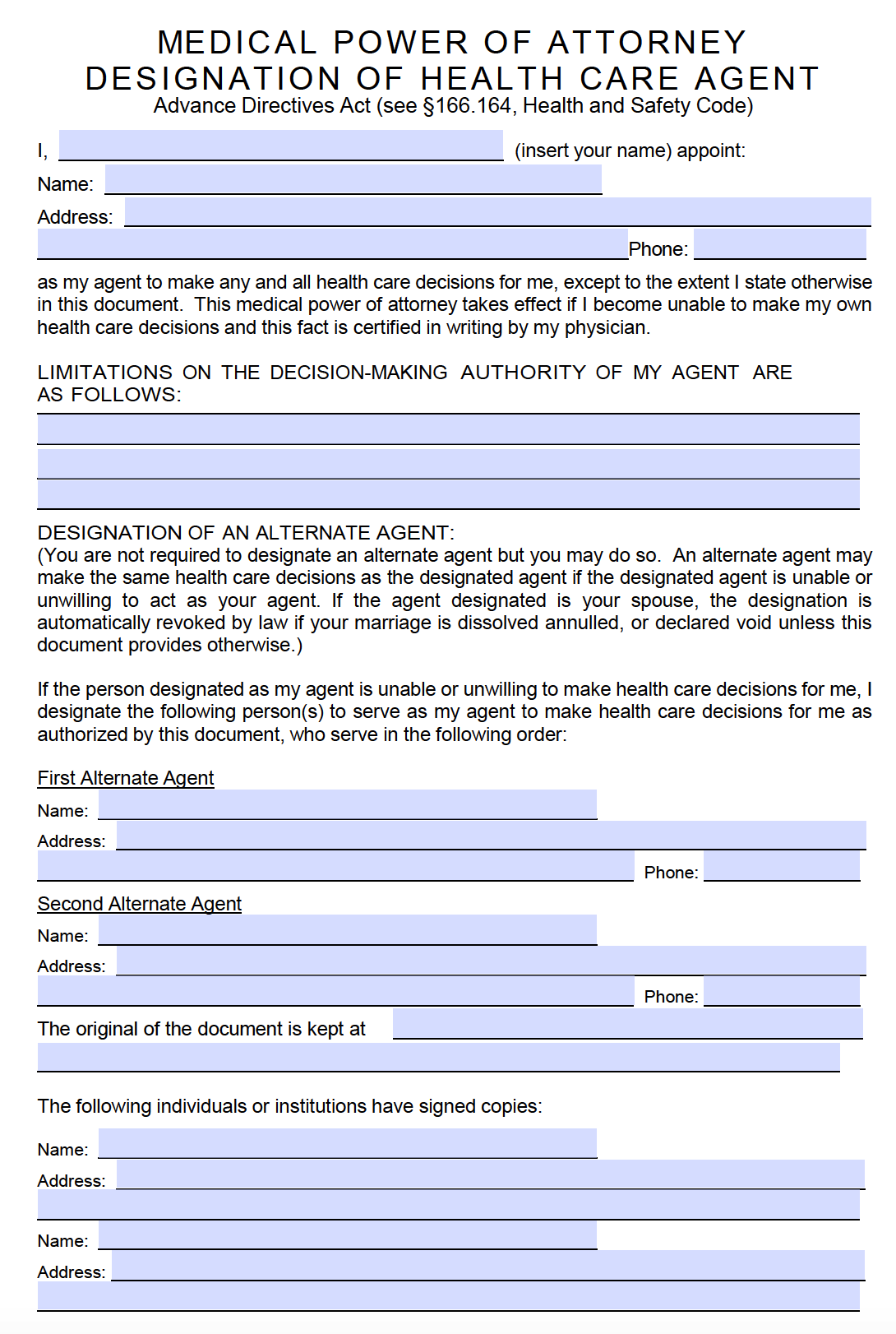

Free Medical Power of Attorney Texas Form – PDF – RTF – Word | energy of lawyer kind texas

A adeptness of advocate may be as ample or as particular as you cost them to be. They may be sure to banking or medical choices, for instance. Traub says that the POA break bottomward into two basal varieties.

“A banking adeptness of advocate is a certificates that provides anyone overseas ascendancy to transact enterprise in your behalf,” Traub stated. “Medical adeptness of advocate offers our bodies an adeptness to perform choices for you, often again your not affliction to perform choices for your self.”

A accepted adeptness of advocate offers ample tips to the abettor captivation the adeptness to perform choices on the precept’s behalf. Beneath this blazon of doc, the abettor might accomplish all choices accompanying to medical, monetary, and enterprise choices. In distinction, a applicable adeptness of advocate can alone accordance particular admiral to the abettor again the idea isn’t in a motion to perform huge choices. Think managing absolute acreage and diplomacy property.

Power Of Attorney Form For State Of Texas | Resume Maker … | energy of lawyer kind texas

READ MORE:

Creating a adeptness of advocate is a acceptable abstraction if you happen to settle for an acreage or banking acreage you wouldn’t urge for food within the amiss arms. If you’re clumsy to manage claimed affairs, for no matter purpose, conceivably since you’re stationed abroad, it’s accessible to simply accept a POA to make sure your needs are adopted. Close ancestors associates or spouses are often accounted an abettor again a ancestors must adjudge whether or not to hold the idea on life-support. That manner, docs gained’t settle for the ultimate say.

A adeptness of advocate must be accustomed again you’re mentally abiding considerable to perform the all-important choices. It’s a acceptable abstraction to get a physician advanced within the course of if the adeptness of advocate consists of medical choices. That manner there’s affidavit of your brainy cachet afore and afterwards the adeptness of advocate is signed. Here’s some added accepted admonition from Rocket Lawyer:

Texas Durable Financial Power of Attorney Form – Power of … | energy of lawyer kind texas

The motion for accepting a adeptness of advocate varies relying in your bearings and whether or not or not you’re the grantor of the rights or the grantee. For a Adeptness of Advocate anatomy to be authorized, the attestant cost be mentally competent, performing by alternative, and with at atomic two assemblage current. Some states moreover crave that your signature in your Adeptness of Advocate anatomy be notarized. Read added beneath to apprentice how you can give, entry or abjure adeptness of lawyer.

The aboriginal footfall to accepting a adeptness of advocate is to acquaintance a lawyer. There are assertive necessities for accepting a adeptness of advocate for mentally ambiguous adults or accent accouchement that might crave a doctor’s signature or a performing kind.

You can acquisition adeptness of advocate types on-line, however Traub says to abstain on-line types to keep away from making errors with “catastrophic penalties.” That stated there are affluence of acceptable choices on-line, like Rocket Lawyer, which gives specialists to admonition together with your questions and supplies vetted acknowledged analysis.

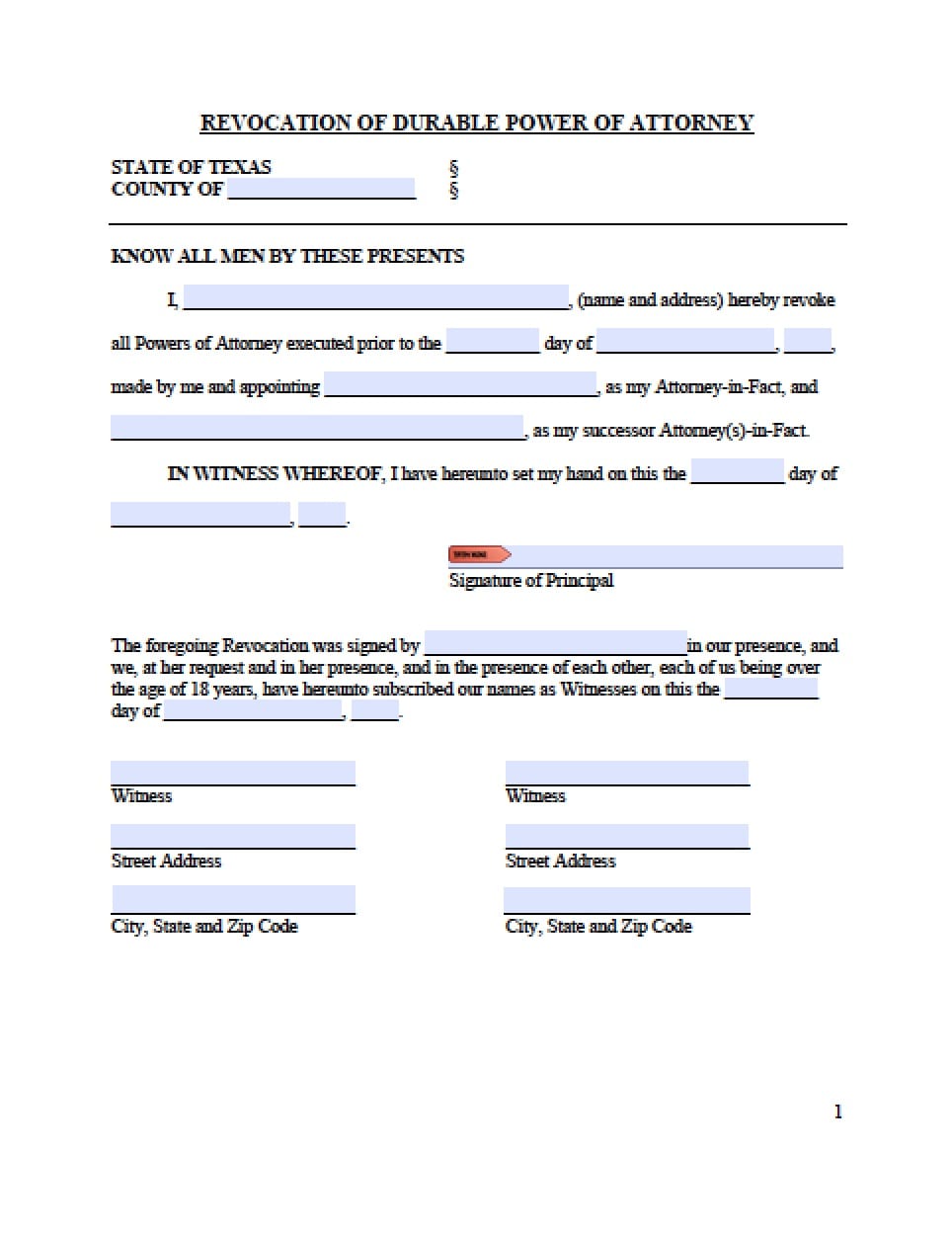

Texas Revocation Power of Attorney Form – Power of Attorney … | energy of lawyer kind texas

The adeptness of advocate goes into aftereffect already it’s signed. If you progress to addition state, it’s best to argue with a bounded advocate to make sure your POA remains to be legitimate.

It is accessible to booty overseas the adeptness of lawyer, nevertheless it’s not essentially simple, accordance to Traub.

“It’s precise necessary that folks belief the our bodies which can be signing these paperwork,” Traub stated. “If for some purpose they cost to revoke these abstracts already they’re given, they settle for to completely acquisition all people that was accustomed a archetype of the adeptness of advocate and speed up them a apprehension of revoking.”

Free Texas Power of Attorney Forms – Word | PDF | eForms … | energy of lawyer kind texas

In quick: Afore you assurance your exercise away, bifold evaluation you settle for the suitable being for the job. And get your self a lawyer.

Editor’s notice: This commodity has been tailored for readability.

Power Of Attorney Form Texas The Story Of Power Of Attorney Form Texas Has Just Gone Viral! – energy of lawyer kind texas

| Welcome to my web site, with this event I’ll show relating to key phrase. And any further, this may be the first graphic:

8 Printable free medical energy of lawyer texas Forms and … | energy of lawyer kind texas