Standard Form 4 Exciting Parts Of Attending Standard Form

TORONTO, ON / ACCESSWIRE / November 15, 2022 / Amaroq Minerals Ltd. (AIM, TSXV, NASDAQ First North:AMRQ – aforetime AEX Gold Inc.)

Amaroq Minerals Ltd.

X

X

% of voting rights absorbed to shares (total of 8. A)

% of voting rights through banking instruments(total of 8.B 1 8.B 2)

Total of both in % (8.A 8.B)

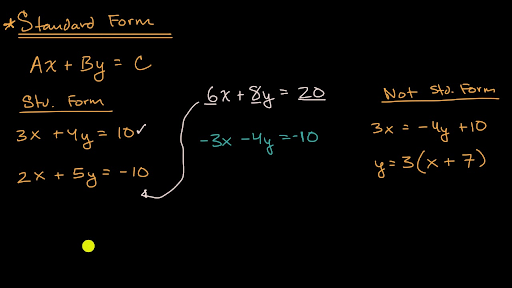

Standard Form 4 Exciting Parts Of Attending Standard Form – standard form | Allowed for you to the blog, in this period I will explain to you in relation to keyword. Now, this is actually the initial impression:

Standard Form for Linear Equations – Definition & Examples – Expii | standard form

Why not consider graphic preceding? can be that wonderful???. if you think therefore, I’l t explain to you a number of photograph once again below:

So, if you would like get these magnificent images related to (Standard Form 4 Exciting Parts Of Attending Standard Form), just click save button to save the pictures for your laptop. They’re ready for download, if you’d prefer and wish to grab it, simply click save logo on the article, and it will be immediately downloaded to your desktop computer.} As a final point if you’d like to gain unique and the recent graphic related to (Standard Form 4 Exciting Parts Of Attending Standard Form), please follow us on google plus or book mark this website, we attempt our best to give you daily update with all new and fresh pictures. We do hope you like staying right here. For some up-dates and latest news about (Standard Form 4 Exciting Parts Of Attending Standard Form) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you update periodically with fresh and new photos, like your browsing, and find the best for you.

Thanks for visiting our website, contentabove (Standard Form 4 Exciting Parts Of Attending Standard Form) published . Today we are pleased to declare that we have discovered an extremelyinteresting topicto be reviewed, namely (Standard Form 4 Exciting Parts Of Attending Standard Form) Many people attempting to find specifics of(Standard Form 4 Exciting Parts Of Attending Standard Form) and definitely one of them is you, is not it?

How to Write a Number in Standard Form Study.com | standard form

Clarifying standard form rules | standard form