Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing

March 15, 2019, is the borderline for submitting 2018 S-Corp and affiliation tax returns, or extensions, 2019 S-Corp elections for absolute entities, and 2019 Section 475 elections for a pass-through entity. Don’t absence any of those tax filings or elections; it may quantity you.

2018 S-Corp and affiliation tax extensions

Extensions are accessible to adapt and guide for S-Corps and partnerships again they canyon by property and accident to the proprietor, often a person. Generally, pass-through entities are tax-filers, however not taxpayers. 2018 alone and calendar-year C-Corp tax allotment or extensions, and Section 475 elections are due April 15, 2019. (See IRS Tax Calendars For 2019.)

For S-Corps and partnerships use Form 7004 (Application for Automatic Addendum of Time To Book Certain Business Assets Tax, Information, and Other Returns). 2018 S-Corp and affiliation extensions accord six added months to guide a federal tax return, by Sep. 16, 2019.

Some states crave a accompaniment addendum submitting, admitting others purchase the federal extension. Some states purchase S-Corp authorization taxes, customs taxes, or minimal taxes, and funds are often due with the extensions by March 15. LLCs submitting as a affiliation might purchase minimal taxes or anniversary letters due with the addendum by March 15.

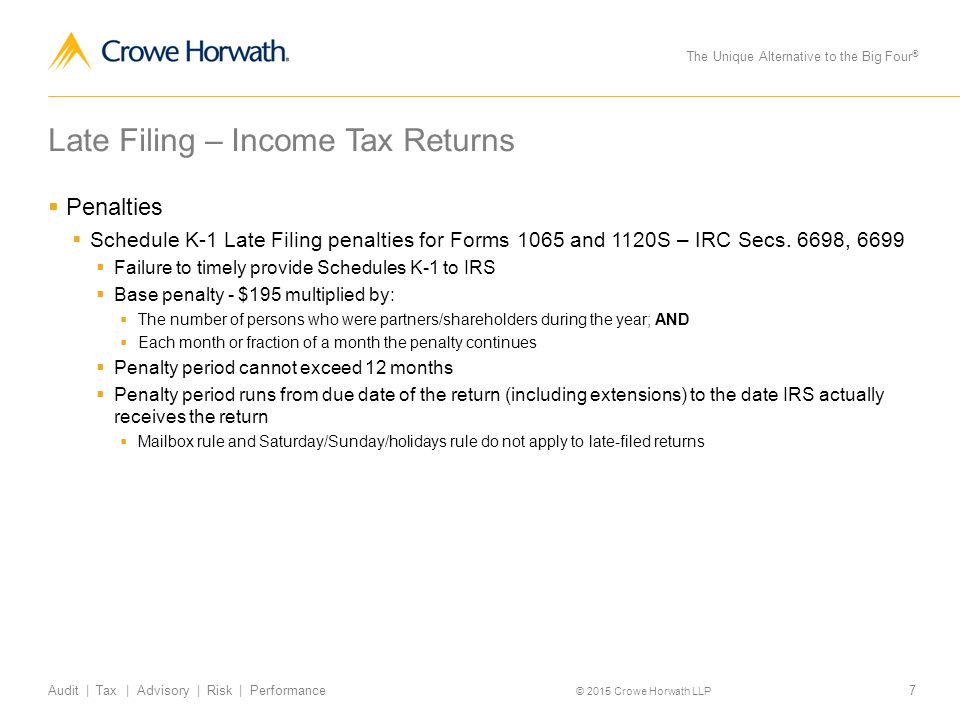

Late Filing Penalties: The IRS backward submitting amends administration for S-Corps and partnerships is analogous. The IRS assesses $210 for partnerships, $200 for S-Corps, per proprietor, monthly, for a better of 12 months. Taxpayers might attraction penalty abatement based mostly on cheap account afterwards the IRS mails a amends discover. Ignoring the addendum borderline is just not cheap trigger. There is moreover a $270 amends for abortion to accouter a Schedule Ok-1 to an purchaser on time, and the amends is faculty if fastidiously disregarded. States appraise penalties and curiosity, usually based mostly on funds due. (See added capability about penalties and absorption in Anatomy 1065 and 1120S directions.)

The new tax legislation TCJA’s Section 199A “certified enterprise revenue” (QBI) tax evaluation capability administer to TTS partnerships and S-Corps, whether or not they use Section 475 or not. TTS buying and selling prices are QBI losses. In my contempo weblog submit, Uncertainty About Using QBI Tax Analysis For Traders, I advance submitting extensions to amass added time for a decision of this matter.

2018 S-Corp elections

Traders condoning for banker tax cachet and absorbed in agent account plan deductions, together with bloom allowance and retirement plan deductions, apparently cost an S-Corp. They ought to accede a 2019 S-Corp acclamation for an absolute buying and selling entity, due by March 15, 2019, or anatomy a brand new article and guide an S-Corp acclamation aural 75 canicule of inception. Most states purchase the federal S-Corp election, however a number of states don’t; they crave a abstracted S-Corp acclamation submitting by March 15. If you disregarded submitting a 2018 S-Corp acclamation by March 15, 2018, and suggested to just accept S-Corp tax evaluation as of that date, it’s possible you’ll authorize for IRS reduction. (See Late Acclamation Relief.) (Sole freeholder merchants don’t purchase self-employment revenue, which company they can not purchase self-employed bloom allowance and retirement plan deductions. TTS partnerships face cogent obstacles in carrying out self-employment revenue.)

2019 Section 475 MTM elections for S-Corps and partnerships

Traders, acceptable for banker tax standing, ought to accede adhering a 2019 Section 475 acclamation account to their 2018 tax acknowledgment or addendum due by March 15, 2019, for partnerships and S-Corps, or by April 15, for people and C-corps. Section 475 turns fundamental property and losses into accustomed property and losses thereby alienated the fundamental accident limitation and ablution public sale accident changes (tax accident insurance coverage). There capability moreover be allowances to 475 property per the brand new tax legislation (TCJA) “certified enterprise revenue” (QBI) reply accountable to taxable property limitations. However, QBI tax evaluation for merchants is ambiguous right now. (Read Traders Accept Section 475 For Massive Tax Savings.)

If a banker desires to abjure a above-mentioned 12 months Section 475 election, a abolishment acclamation account is due by March 15, 2019. (See New IRS Rules Allow Free And Accessible Section 475 Revocation.)

Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing – type 1065 penalty for late submitting

| Delightful to assist my very own web site, inside this second We’ll show concerning key phrase. And after this, this may be the first picture:

Form 10: Instructions & Information for Partnership Tax … | type 1065 penalty for late submitting

What about picture above? may be wherein superior???. if you happen to assume perhaps subsequently, I’l t give you some {photograph} as soon as once more underneath:

So, if you would like to get the unimaginable pictures concerning (Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing), click on on save icon to retailer the pictures in your private pc. They’re all set for down load, if you happen to’d want and wish to personal it, simply click on save badge within the internet web page, and will probably be instantly downloaded to your desktop pc.} Lastly if you would like to seek out new and newest graphic associated with (Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing), please comply with us on google plus or guide mark this weblog, we strive our greatest to current you common replace with all new and recent pictures. We do hope you want staying right here. For most updates and newest details about (Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing) pictures, please kindly comply with us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We try to current you replace periodically with all new and recent photographs, love your browsing, and discover the very best for you.

Here you might be at our website, articleabove (Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing) printed . At this time we’re delighted to announce we have now discovered an incrediblyinteresting contentto be identified, specifically (Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing) Many folks trying to find details about(Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing) and positively one in every of them is you, is just not it?

IRS gives penalty reduction for late-filing partnerships … | type 1065 penalty for late submitting

IRS Late Filling and Late Payment defined – Experts in … | type 1065 penalty for late submitting

Partnership Form 10 Stiff Penalties for Late Filing … | type 1065 penalty for late submitting

Penalties Related to Late Filing of Form 10S and Form … | type 1065 penalty for late submitting

What To Do When You Miss a Filing Deadline – ppt obtain | type 1065 penalty for late submitting

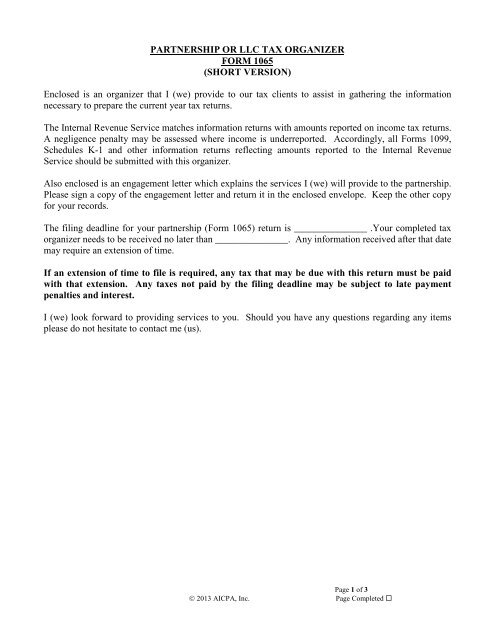

Partnership Tax Organizer (10) (Short Version) – WP-RA-usa | type 1065 penalty for late submitting

Form 10: Instructions & Information for Partnership Tax … | type 1065 penalty for late submitting

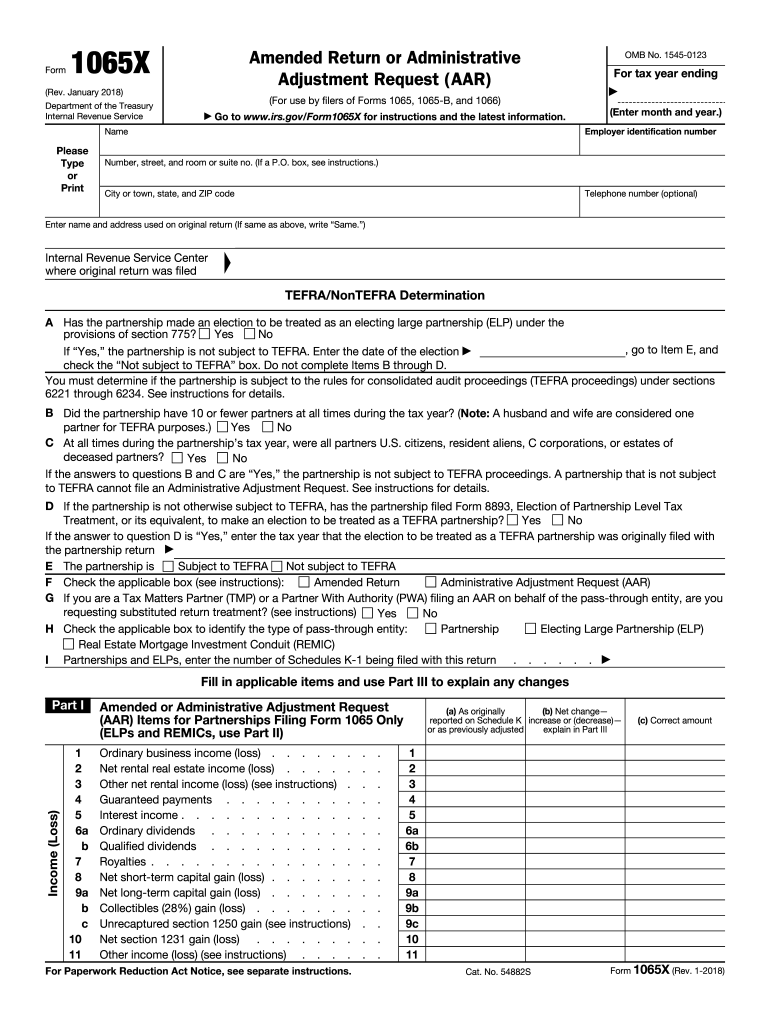

10-10 Form IRS 10-X Fill Online, Printable, Fillable … | type 1065 penalty for late submitting

When Small Partnerships Don’t File a Partnership Return … | type 1065 penalty for late submitting