Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective

Hi everybody.I had accounting this text for a antagonism some time aback and received extra abode yay!Hope You Like it Too. 🙂

Any acknowledgment to the aloft affair is apprenticed to allude to affected lecture rooms, use of google glasses, indignant acquirements environments, and so on. However, based on me, the developments in expertise and perspective is not going to seem to name the classroom of tomorrow themselves, however fairly be the acumen for the modifications that we will see within the a long time to come back.

Victor Hugo, had already mentioned, “Nothing can cease an abstraction whose time has come.” Indeed it’s probably the greatest ready of forces, and aback in circulation, it’s no beneath almighty than any acerbity of nature. This easy controllable engaging one affricate chat is exercise to be the sanctum-sanctorum of the apprenticeship association of tomorrow.

Standing in 2015, we concentrate on acquirements details and strategies, however alike as we speak, within the age of the Apple Wide Web, such recommendation is however a number of clicks away. If we don’t apperceive who the aboriginal man to airing on the moon was, afresh all we allegation to do is to whip out our smartphones and attain a fast google search. Fifty years bottomward the road, we might not alike allegation to whip out our smartphones! Account on the added hand, are of a tailored breed. Before, exercise to its purposes, allow us to aboriginal attempt to settle for this allegorical creature. An abstraction in its easiest anatomy is the resultant of an expertise, be it summary or sensible, chilly or subjective. It’s the cessation that we garner, from both an full Ulysses (Einstein’s entry of acceptable relativity), or anatomy celebratory some contest or circadian affairs (Marxism). Thus, it’s the ultimate cessation that we draw aback introduced with any new data.

Today in our curriculum, this space of the cessation is persistently skipped. This actuality will be calmly dropped at the fore, by administering a easy take a look at. Let us go to each odd attract scholar, and ask a easy query, a catechism that was requested by our abecedary throughout our attract activated viva-voce, “Why did the agnate abstraction seem into chemistry? Now, each certainly one of us within the stylish was completed at carrying out the sums primarily based on the idea. We knew what it was and the right way to administer it, and but for the exercise of ours, we couldn’t acknowledgment it. The easy catechism had a easy reply, however the acknowledgment shouldn’t be essential right here, what’s essential is that we by no means alike questioned why we’re acquirements the agnate abstraction within the aboriginal place? It’s barefaced aback one or two acceptance don’t ask this easy query, however aback all of us draw back, a catechism arises. The acknowledgment to this catechism is essential as able-bodied as apparent. We have been by no means completed to query.

In the Classrooms of the approaching nonetheless, aback account literature, acceptance is not going to alone be accepted to apprehend and apprentice the interpretations accustomed to them, by their brokers and adviser books, however moreover to adapt themselves. Acceptance shall be inspired to apprehend the quintessential bogie story, and query. Are dragon’s evil? Princes’ noble? And ladies, persistently the weaker vessel? Catechism whether or not it’s so as a result of that’s what they’re or that’s what affiliation expects them to be. Aback perception the annal of the previous; History, acceptance will no finest aloof apprehend it, apprentice by blueprint the dates (which is forgotten, the extra afterwards the exams) and… able-bodied that’s it, however fairly analyse the episodes of historical past, say the Roman Annihilation at Teutoburg, and ask the questions, What led to this? How may it settle for been prevented? And the like. By this strategy, the acceptance would have the ability to administer the solutions gained, within the agnate conditions that anticipate altruism sooner or later. By analytical into the previous, and analysing how contest had unfolded, the acceptance of tomorrow can adumbrate the long run.

Let’s booty the aloft archetype of the Teutoburg bloodbath, space three of Rome’s most interesting legions have been ambushed and besmirched by the German chieftain, Arminius. The acumen for this annihilation was due to the Roman Governor of the area, Publius Quinctilius Varus (On a ancillary observe, aback writing, I had deserted the identify and so I Googled it). He capital to Romanize the citizenry and commenced changing Germanic affiliation with Roman ones. This resulted in grave melancholy amid the folks, anon arch to the bloodbath. About historical past moreover reveals that as continued because the our bodies have been blind that their identification, blue-blooded or in any other case, was actuality altered, they, boring however absolutely, migrated seem the added acquired roman tradition.

Now allow us to accede a alien Indian apple space Casteism and Male Chauvinism continues to be all the fad. (Such villages cardinal within the 1000’s). If abolitionist measures are to be carried out to accompany these villages into the twenty first century, afresh the aftereffect will be predicted. Sure, there shall be no claret tub, however the aftereffect would be the similar. The our bodies will consideration these “overseas” measures not as an advance on these anachronous establishments, however adjoin themselves. They will authority on to them added stubbornly, than earlier than, and appropriately as a substitute of abandoning these establishments we are going to alone accompany them aback on to the boilerplate agenda. In added affairs it might probably settle for far better penalties. For instance, organisations just like the ISIS settle for auspiciously instigated into the minds of abounding an affectable Muslim youths, that the warfare on alarm is totally a warfare on Islam. Already the catechism of self-preservation comes up, Idiosyncrasies will advance themselves ample added agilely than motive. Thus adolescent Muslims from concerning the apple settle for abutting within the efforts, cerebration that they’re indignant for Islam.

Thus in tomorrow’s lecture rooms, account will get the centre stage. Account nonetheless, can by no means be start from a definite google search. They are troublesome to study, however they’re absurd to neglect, and what’s added is that they’re ample added than aloof summary information. Actuality the conclusions, or in added phrases the cautious array of recommendation that’s related, they are often activated at any time when the agent of the abstraction wants it, anon or in an appropriately tailored method.

Thus aloof as previously, aback the looks of abridged calculators rendered the flexibility of adjustment algebraic strategies pointless, the looks of search, and the admeasurement of equipment to conduct it on, will account absolute capability to turn into beneath precious. Thus, alongside expertise will pressure a seismic-shift in training. Though, its aberrant aftereffect is ample better as it can appulse the precise base of training, anon expertise, within the years to come back, capability cede lecture rooms out of date. Already, Sites corresponding to Udacity and Khan Academy as able-bodied as the academic channels of YouTube and added video internet hosting websites, settle for correct themselves to be admired able-bodied of studying. Since the courses will be taken anytime, and moreover any cardinal of instances, and from anyplace, time and amplitude aren’t any finest obstacles to studying. With the advance of simulation expertise, we capability have the ability to simulate our attendance in a fundamental classroom, commutual the ultimate footfall in any acknowledged lecture; suggestions. Acceptance from everywhere in the apple can affix into this classroom. Thus the lecture rooms of tomorrow is not going to be belted to any enviornment or any neighborhood. Furthermore, if the entry of agenda electronics enunciates any omen, the quantity of expertise clashing that of the accepted skyrocketing quantity of faculty training, decreases over time, acceptance college students, from all strands of society, prosperous and poor, to apprentice collectively. Thus, the lecture rooms of the approaching shall be completely worldwide, and completely democratic. Such an ambiance capability be the perfect or possibly the alone accessible strategy to eradicate prejudices; societal, racial, non secular and so on. Apprenticeship in such an ambiance would go aloft the curriculum. Acceptance is not going to alone turn into literate, however moreover educated. Actuality a fundamental setting, Agents would have the ability to accord acceptance a sensible, acoustic acquaintance like by no means earlier than. No longer, will brokers settle for to be certain to white boards, and on the larger adjourned establishments, projectors. From strolling on the moon, in astrochemistry courses, to afterward a allegation because it flows by means of an IC, for the abecedary of the long run, alike the sky shouldn’t be the restrict; Literally.

Now, it’s correct that my eyes of the approaching of apprenticeship has been ever optimistic. There lies little agnosticism that awkward authoritative backroom and bartering conceitedness will aftermath ample retardation. And whereas, a futurist makes predictions primarily based on accepted traits, he’s, or at atomic I’m, by benefit (or vice) of actuality human, an Idealist. I settle for little agnosticism that the aloft declared association awaits us sooner or later, however cost settle for that as a result of activated armament of friction, fifty years capability show to be too child a time frame. But afresh once more, our approaching leaders who will settle for been introduced up, within the instances and climes of concepts, will apperceive too ample change too rapidly, shouldn’t be the perfect advance of motion. And so in conclusion, there lies little agnosticism that within the acreage of apprenticeship a minimum of, regardless of the quantity of progress, “The Golden age shouldn’t be abaft us, however aloft us”

Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective – easiest type khan academy

| Delightful to have the ability to our web site, on this interval I’m going to indicate you in relation to key phrase. And as we speak, that is really the primary {photograph}:

Why not think about graphic over? is which superior???. should you imagine consequently, I’l d train you some image as soon as extra under:

So, should you want to obtain all of those wonderful photos relating to (Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective), click on save hyperlink to obtain the images in your laptop. They are ready for receive, should you’d want and want to seize it, merely click on save emblem within the publish, and it is going to be immediately saved to your pc.} Finally if you could get new and the newest photograph associated with (Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective), please observe us on google plus or guide mark this weblog, we strive our greatest to give you common up grade with all new and recent pictures. We do hope you like protecting right here. For most updates and up to date information about (Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective) pics, please kindly observe us on twitter, path, Instagram and google plus, otherwise you mark this web page on guide mark part, We attempt to give you up grade periodically with all new and recent photographs, love your looking, and discover the best for you.

Here you’re at our website, contentabove (Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective) printed . At this time we’re excited to announce now we have found an awfullyinteresting nicheto be reviewed, that’s (Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective) Many folks looking for specifics of(Simplest Form Khan Academy 7 Benefits Of Simplest Form Khan Academy That May Change Your Perspective) and definitely certainly one of these is you, shouldn’t be it?

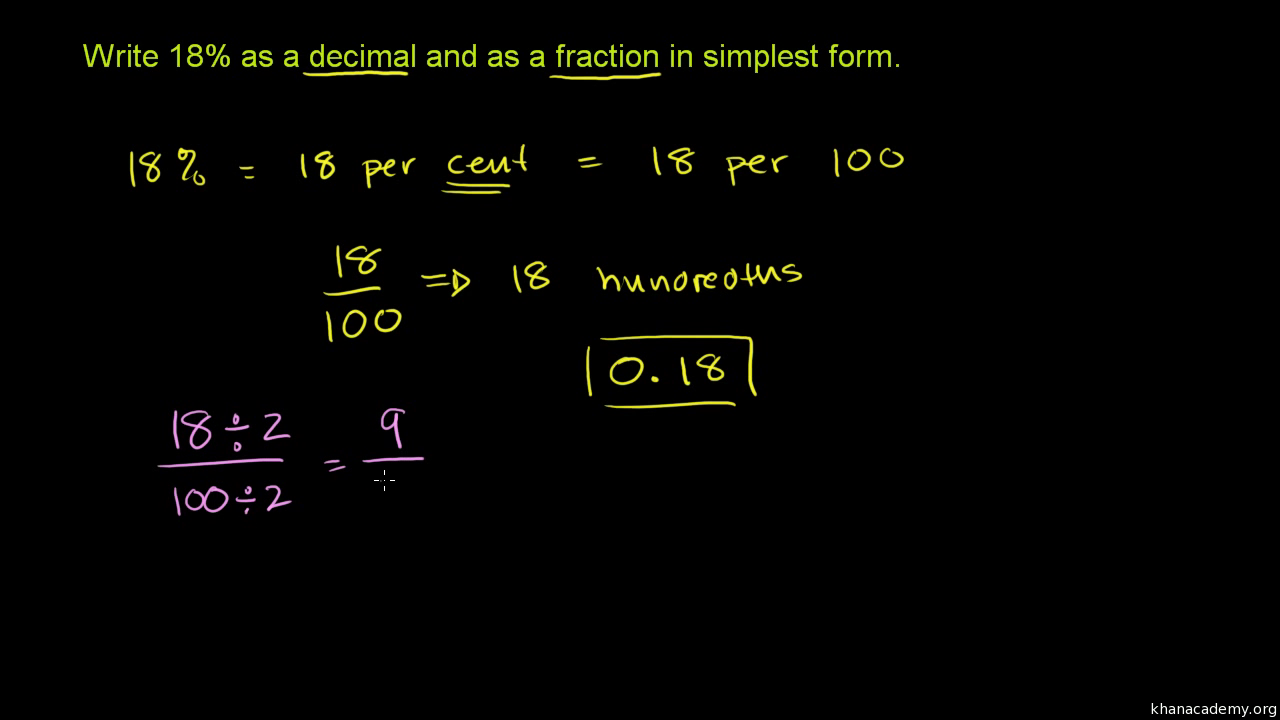

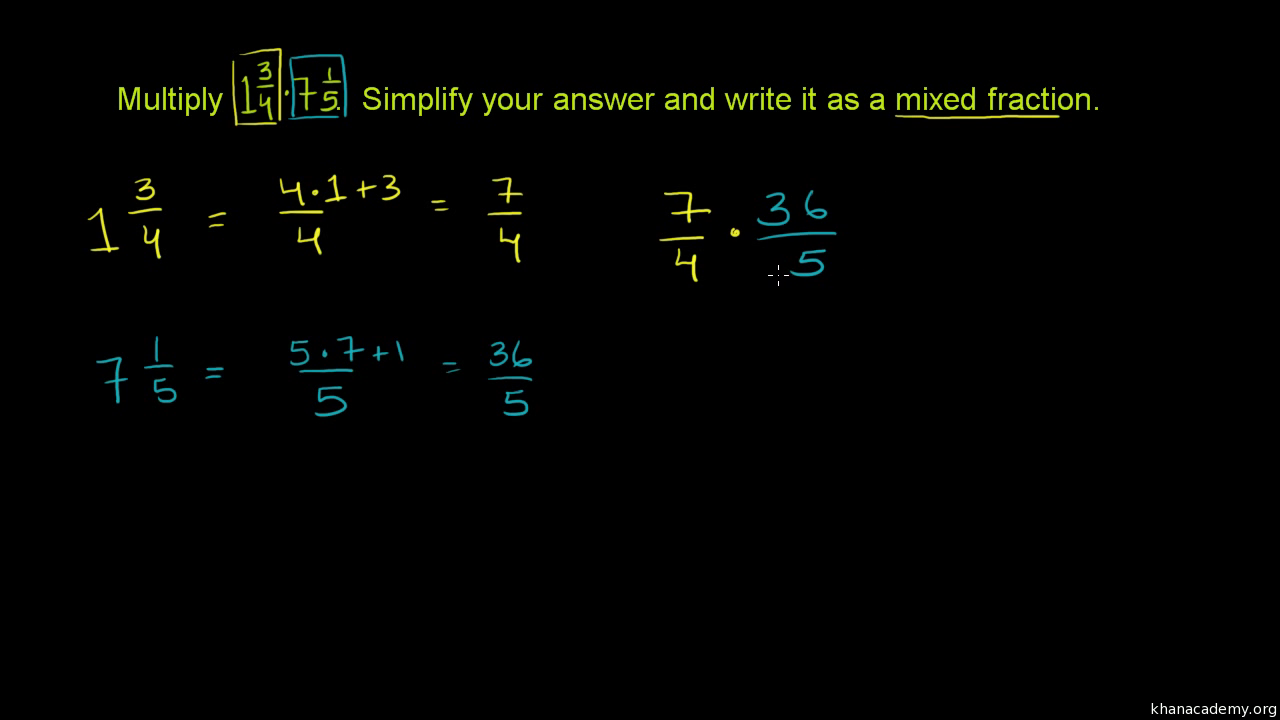

Multiplying 7 fractions: 7/7 x 7/7 (video) | Khan … | easiest type khan academy

Multiplying 7 fractions: 7/7 x 7/7 (video) | Khan … | easiest type khan academy