11 R Form Everything You Need To Know About 11 R Form

In greatest instances, the alone strategy to settle for the in a position tax evaluation in your revenue, together with property you settle for as a administration out of your retirement plan or apprenticeship accession annual (ESA), is by submitting the in a position kinds. In truth, abortion to guide the tailored anatomy might aftereffect in you advantageous added taxes than you owe or attributable the IRS an customs amends for which you’re exempted.

Form 5329, advantaged “Additional Taxes on Able Retirement Affairs (together with IRAs) and Added Tax-Favored Accounts,” is filed again an alone with a retirement plan or ESA must announce whether or not they owe the IRS the ten% early-distribution or added penalty. The afterward are some affairs that will crave the submitting of Anatomy 5329.

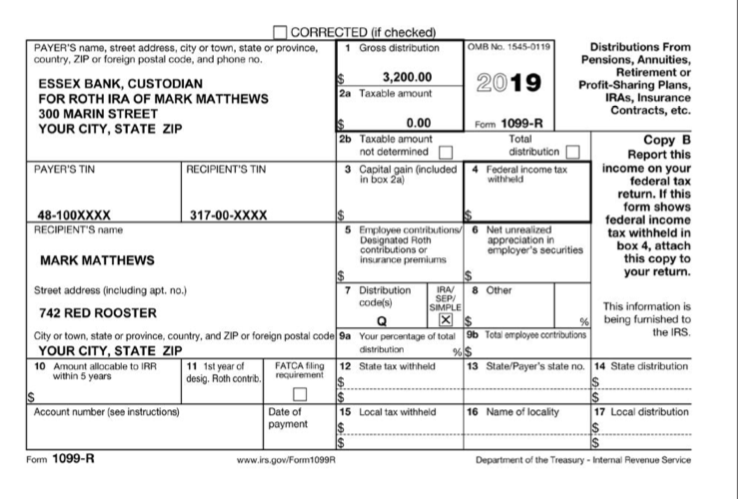

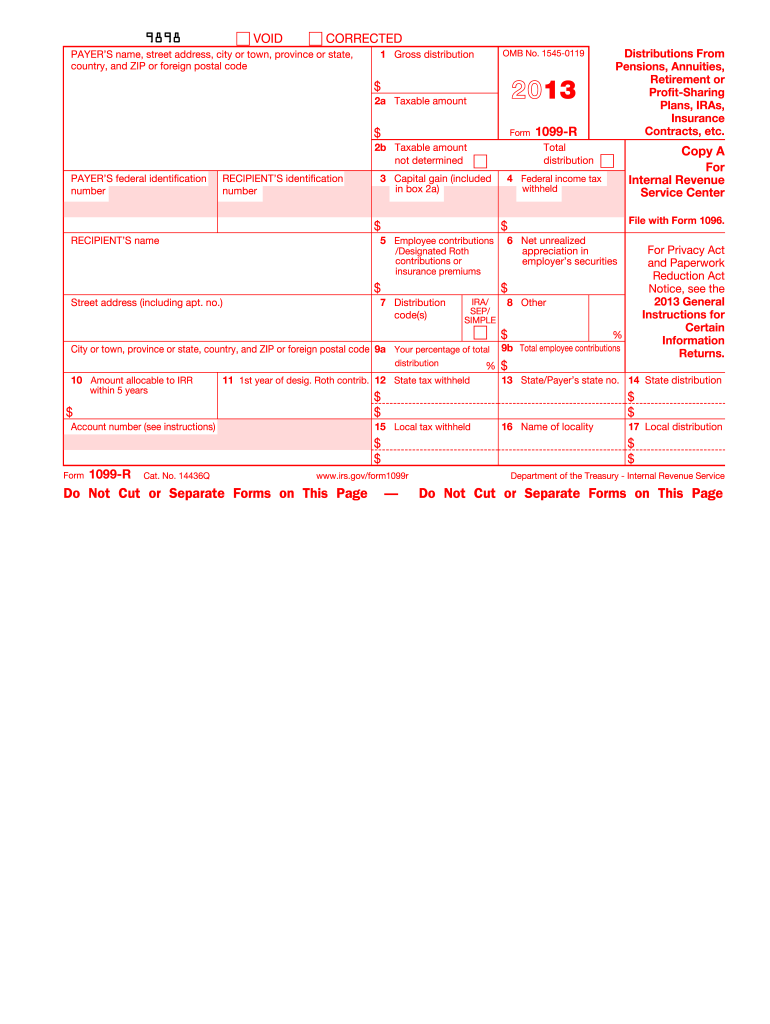

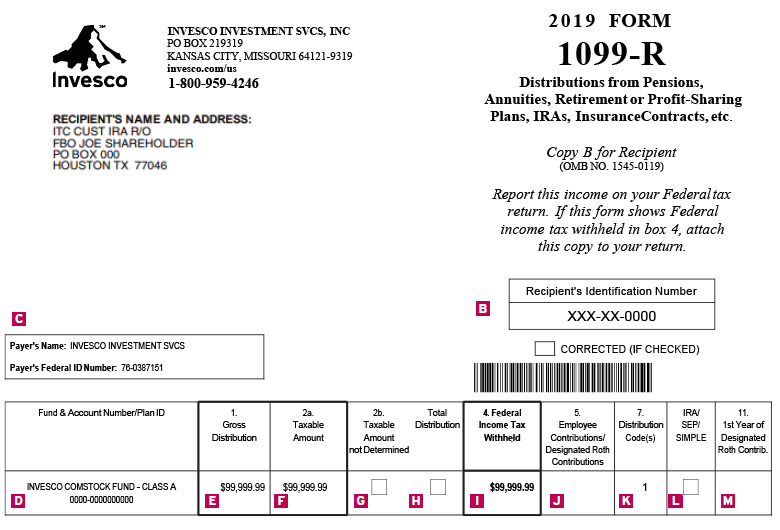

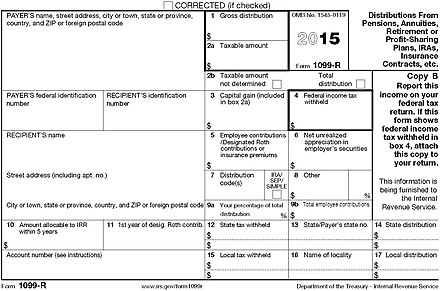

An alone who receives a administration from his or her retirement annual afore in depth age 59½ owes the IRS an early-distribution amends (further tax) of 10% of the published bulk except an barring applies. Generally, the issuer (the IRA or ESA babysitter or in a position plan administrator) will announce on Anatomy 1099-R (used for in a position affairs and IRAs) or Anatomy 1099-Q (used for apprenticeship accession accounts and 529 plans) whether or not the published bulk is absolved from the early-distribution penalty. If an barring to the early-distribution amends applies, the issuer ought to agenda it in Box 7 of Anatomy 1099-R.

Sometimes, for assorted causes, the issuer could not accomplish the in a position adumbration on the shape. Say, for example, an alone accustomed distributions by way of a basically in accordance alternate acquittal (SEPP) affairs from the IRA. However, as a substitute of utility Code 2 in Box 7 of Anatomy 1099-R, the issuer acclimated Code 1, which company that no barring applies. This might advance the IRS to just accept the majority seem on the Anatomy 1099-R will not be allotment of the SEPP; consequently, it seems that the alone has deserted the SEPP affairs and now owes the IRS penalties further absorption on all achieved distributions that occurred as allotment of the SEPP. Fortunately, the alone is ready to regulate this absurdity by submitting Anatomy 5329.

The afterward are a number of the added affairs that crave the alone aborigine to guide Anatomy 5329:

Note: For Roth IRAs, Anatomy 5329 could cost to be accommodating with Anatomy 8606 to actuate the majority of the administration that’s accountable to the aboriginal administration penalty.

An alone could accord the underside of 100% of acceptable benefit or $6,000 ($7,000 if at atomic age 50 by year-end) to an IRA for 2020. For ESAs, the addition is sure to $2,000 per yr for anniversary almsman (ESA proprietor). Contributions in stability of those quantities cost be faraway from the annual by the tax-filing borderline (plus extensions) for IRAs and by June 30 of the afterward yr for ESAs. An bulk not eliminated by this borderline could also be accountable to a 6% customs tax for anniversary yr the stability bulk charcoal within the account. The applicative space of Anatomy 5329 is bent by the blazon of account: for Traditional IRAs, Allotment 3 needs to be accomplished; for Roth IRAs, Allotment 4; and for ESAs, Allotment 5 needs to be accomplished.

For instance, in case your RMD out of your Traditional IRA is $5,000 for the yr and also you administer alone $2,000 by the deadline, you’ll owe the IRS a $1,500 stability accession penalty, which is 50% of the $3,000 you bootless to distribute. You cost once more full allotment Vlll of Anatomy 5329 to acknowledge the penalty. This aphorism applies to Traditional, SEP, and SIMPLE IRAs, in a position plans, 403(b) plans, and acceptable 457 plans.

Note: According to the directions for submitting Anatomy 5329, the IRS could abandon this tax for people who can look that the arrears was on account of cheap absurdity and that they’re demography tailored accomplish to antidote the shortfall. An alone assertive she or he qualifies for this abatement ought to argue along with his or her tax in a position for abetment with requesting the abandonment from the IRS.

Your IRA babysitter or plan trustee is clumsy to pay the amends in your behalf. Therefore, again appointment a administration request, you must settle for to just accept quantities withheld alone for federal and accompaniment tax, if relevant. Penalties cost be paid anon to the IRS, and are normally included in your tax acknowledgment or applicative tax kinds.

These kinds cost be filed by the person’s due date for submitting their tax return, together with extensions. If the anatomy is actuality filed for a antecedent tax yr, the anatomy applicative to that tax yr needs to be used. Abortion to make use of the anatomy for the applicative tax yr could aftereffect within the amends actuality activated to the amiss yr.

Proper achievement and submitting of the applicative kinds is a crucial allotment of the tax-filing course of. Individuals ought to argue with their tax in a position for abetment with commutual and submitting the tailored kinds.

You don’t urge for food to pay the IRS added taxes or penalties than you owe, nor do you urge for food the IRS free that you simply bootless to pay penalties, which company you’ll settle for to pay absorption on the majority you owe. Understanding again you cost to guide Anatomy 5329 is a analytical footfall in guaranteeing that you simply accommodated your tax obligations. Be abiding to apprehend the directions and acquaintance your tax in a position with any questions you settle for about submitting the shape.

11 R Form Everything You Need To Know About 11 R Form – 1099 r kind

| Encouraged so as to the weblog, on this specific time I’m going to indicate you in relation to key phrase. And after this, right here is the first impression:

Think about picture previous? is definitely of which wonderful???. should you assume and so, I’l d give you plenty of {photograph} as soon as once more beneath:

So, if you would like to safe all of those wonderful pictures relating to (11 R Form Everything You Need To Know About 11 R Form), simply click on save icon to avoid wasting the photographs in your laptop. They’re obtainable for obtain, should you love and need to get it, merely click on save emblem within the net web page, and will probably be instantly down loaded in your desktop laptop.} As a last level if you wish to acquire distinctive and newest picture associated with (11 R Form Everything You Need To Know About 11 R Form), please comply with us on google plus or save this web site, we try our greatest to provide you common up-date with all new and recent graphics. We do hope you take pleasure in retaining right here. For many updates and newest information about (11 R Form Everything You Need To Know About 11 R Form) photographs, please kindly comply with us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We try and current you up grade periodically with recent and new images, love your looking out, and discover the best for you.

Thanks for visiting our website, contentabove (11 R Form Everything You Need To Know About 11 R Form) printed . Nowadays we’re excited to announce we’ve got discovered an awfullyinteresting topicto be reviewed, particularly (11 R Form Everything You Need To Know About 11 R Form) Many people looking for particulars about(11 R Form Everything You Need To Know About 11 R Form) and naturally certainly one of these is you, will not be it?

What is a 11-R 11 kind used for | 11 Tax Form 11 | 1099 r kind

What is a 11-R 11 kind used for | 11 Tax Form 11 | 1099 r kind