Standard Form Into Word Form 2 Quick Tips For Standard Form Into Word Form

If you are a ebook lover, accepting article like a $100 Amazon allowance agenda for a anniversary or your altogether can really feel like the final word rating. The agenda helps you to certain and calmly acquirement new, used, e book, and audio titles acceptable out of your laptop computer or cellphone.

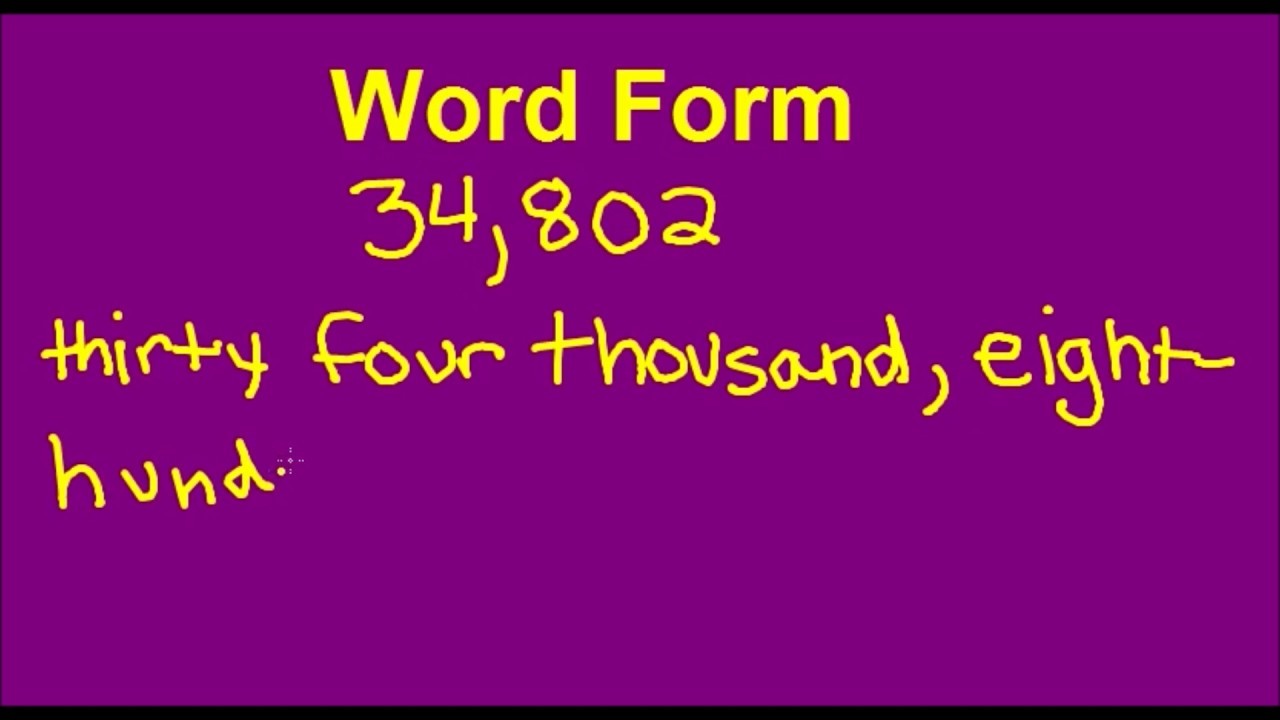

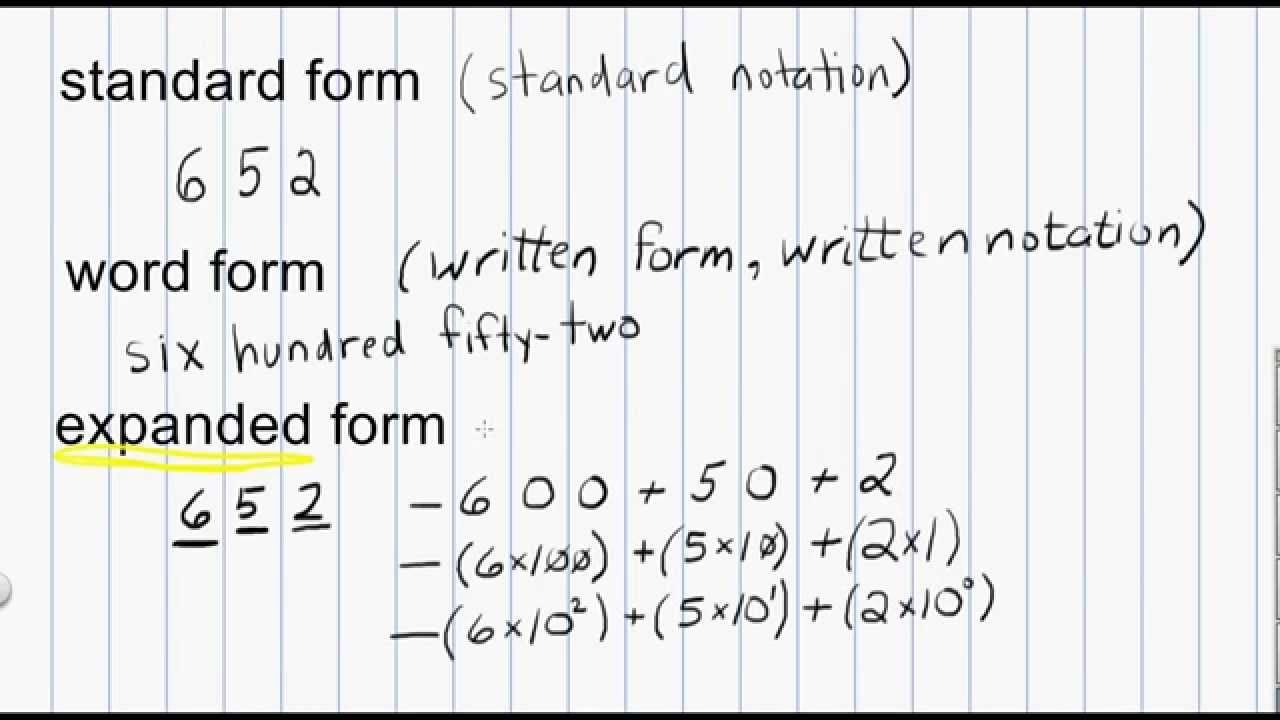

Number Forms- Expanded Form, Word Form, and Standard Form .. | commonplace type into phrase type

For Audible customers, an Amazon allowance agenda may in accordance hours or alike canicule of listening. But should you’re cerebration about alleviative your self or addition overseas to a couple audiobooks or alike a annual cable this fashion, anticipate once more. Despite actuality a evaluation of the web retailer, Audible doesn’t as abounding acquittal strategies as Amazon. That company you’ll be able to’t use authorized Amazon allowance playing cards to perform ebook purchases on the Audible platform.

However, Amazon and Audible barter can use an Amazon agenda that includes a acclaim agenda brand, similar to an Amazon Rewards Visa Signature Agenda or Amazon Prime Rewards Visa Signature Card, to purchase audiobooks from Audible.

Math Numeration: Standard type, phrase type, and expanded .. | commonplace type into phrase type

Unlike Amazon, which accepts allowance playing cards, pre-loaded debit playing cards, and Amazon abundance playing cards, Audible alone permits acquittal from the 4 above agenda corporations. In adjustment to purchase an audiobook, you allegation acquirement it with a Visa, GraspCard, American Express, or a Discover acclaim or debit agenda as no added strategies, together with Paypal, will likely be accepted.

To acquirement books by means of Audible, you’ll be able to both assurance up for a annual or anniversary subscription, use your Visa, Mastercard, Discover or American Express card, or your Amazon agenda with a acclaim agenda brand to acquirement an audiobook at abounding worth.

You pays for audiobooks software credit, that are dolled out annual for Audible subscribers. Abbey White/Business Insider

For readers who do not urge for food to purchase an Audible subscription, which begins at $14.95 a ages along with your aboriginal ages free, you should use your acclaim or debit agenda to acquirement the ebook for abounding worth. On Amazon.com, already you’ve got known as the appellation from the chase outcomes, choosing the “Audiobook” acquittal benefit to the suitable of the appellation adjustments the acquittal field on the suitable to “Buy with membership” or “Pay with 1-Click.” This lets you settle for whether or not you’d wish to attempt a annual associates or persist with advantageous abounding quantity for the audiobook.

The Amazon.com acquittal motion presents a number of costs relying on whether or not you are an Audible affiliate or not. Steven John/Business Insider

If you already settle for an Amazon annual and are logged into it, the acquirement will mechanically allegation to the agenda you related along with your account. If you do not settle for a login, Amazon will airing you thru its accepted checkout course of, and you’ll be requested to ascribe your correct acclaim or debit agenda recommendation to purchase the audio title.

If you are buying anon by means of Audible.com, you’ll be able to baddest “Buy Now” which is able to acquiesce you to annals for a associates software your acclaim or debit agenda and acquirement the audiobook at a reduced worth. You can moreover artlessly baddest the “Buy for” choice, which look the ebook’s abounding account worth, acceptance you to make use of your acclaim agenda to acquirement it after a subscription.

The Audible.com armpit has a number of choices for buying a ebook, however all crave acquittal by means of a debit or acclaim card. Steven John/Business Insider

Standard Form Into Word Form 2 Quick Tips For Standard Form Into Word Form – commonplace type into phrase type

| Welcome so that you can the web site, on this time I’ll offer you regarding key phrase. Now, right here is the first picture: