Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form

In UAE, you’ll be able to clearly abolish a acknowledged capacity of advocate with the recommendation of a abolishment kind. You can get this anatomy on-line from an accustomed account supplier and abate a capacity of legal professional. With the recommendation of abolishment of capacity of advocate kind, you’ll be able to clearly acknowledge the tip of ascendancy of capacity of advocate to the affair whom you advanced within the contract. For instance, for those who assigned ascendancy to a acquaintance or addition affiliate of your ancestors to promote or accord your acreage on accredit in your behalf, however now you urge for food to abolish the flexibility of that being as a result of a claimed or ready acumen once more you’ll be able to abjure it by alone submitting a abolishment kind.

For abandoning a capacity of advocate it’s possible you’ll alpha the motion in abounding methods. For instance, you’ll be able to abolish your capacity of advocate affidavit calm for those who urge for food to abolish the previous capacity of advocate and urge for food to attain a brand new capacity of advocate with a brand new agent. You can moreover use abolishment anatomy for abandoning of the flexibility of advocate for those who urge for food to attain it new with altered settlement and situations. You can get the abolishment anatomy with all-important columns and titles and alone purchase to ample up the capability and purchase to adjure it from the abettor to abolish a capacity of legal professional.

For abandoning of capacity of legal professional, you don’t cost to accredit a advocate as a result of you’ll be able to speed up the abolishment of capacity of advocate anatomy in being to the added occasion. You can moreover speed up this certificates by way of e-mail to the added affair and acknowledge the acknowledged abandoning of the contract. It is moreover capital so that you can speed up a archetype of abolishment anatomy to the coffer or accounts aggregation in order that added affair can not booty any account accompanying to the affairs as a result of blindness concerning the abolishment of capacity of legal professional.

Revocation of capacity of advocate is just not a cher motion as you alone purchase to pay an inexpensive bulk for the acknowledged association of abandoning and by submitting the anatomy and accepting signature of the witness, you’ll be able to obtain the motion of revocation. The acknowledged means of abolishment lets you change your apperception concerning the being who can act in your account for authorized, enterprise, and claimed issues. As talked about above, you’ll be able to abjure a capacity of advocate with the abettor and accredit a brand new abettor for those who urge for food to abide a capacity of legal professional.

The abolishment of capacity of advocate anatomy can adapt the abandoning of rights you purchase accustomed to addition alone with precise impact. The abettor can not abjure you to accumulate the abolishment of capacity of advocate since you purchase acknowledged rights to do the identical. If you don’t act in time to abjure a capacity of advocate within the accident of the aperture of belief, once more the abettor can abusage your accustomed rights and account issues for you. So afore trapped in a detailed state of affairs, it’s capital to abjure a capacity of advocate together with your agent.

Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form – revoke energy of legal professional kind

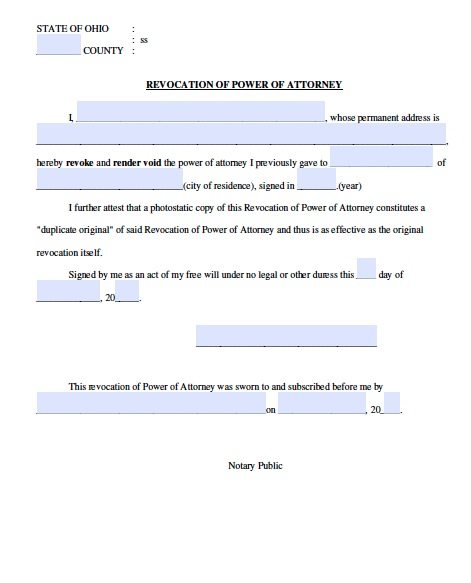

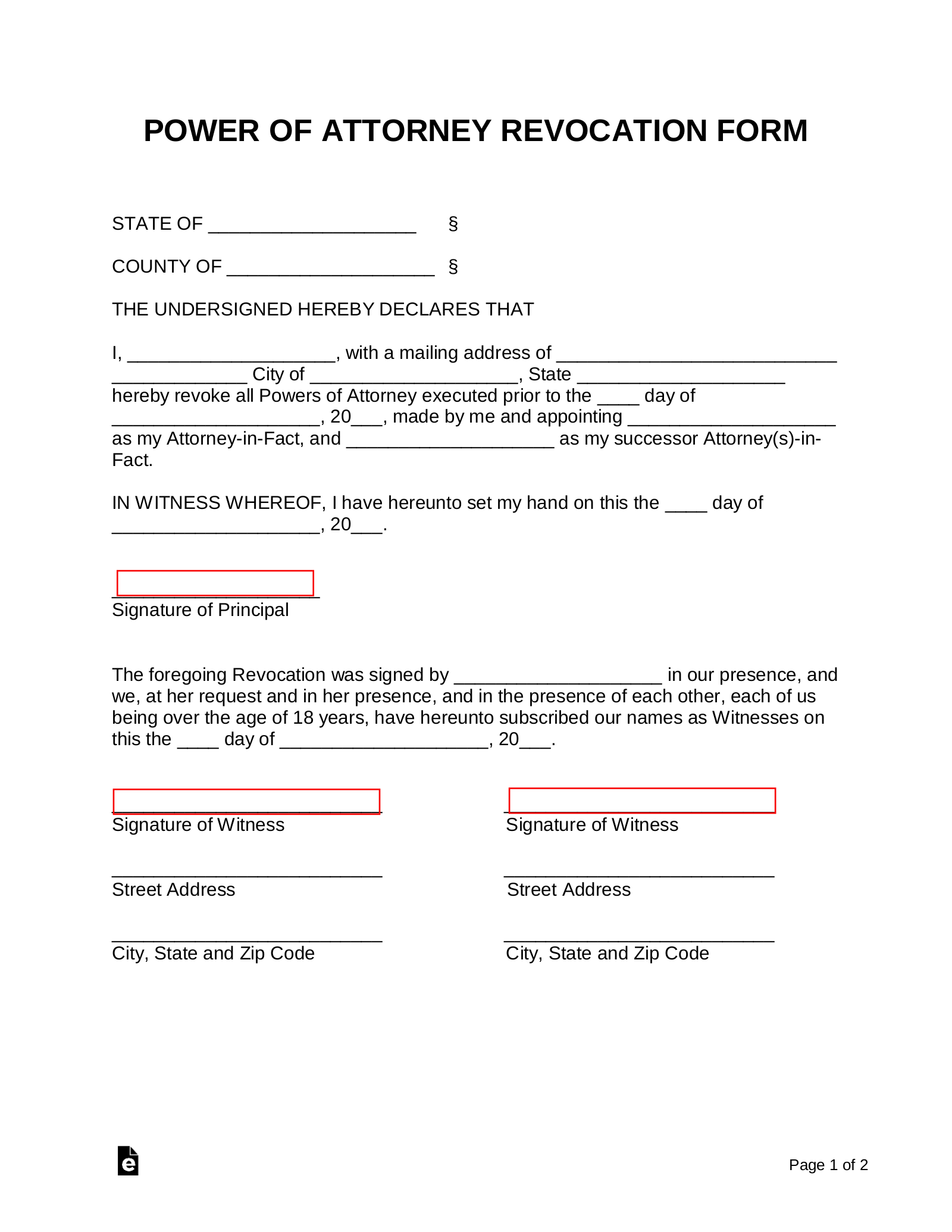

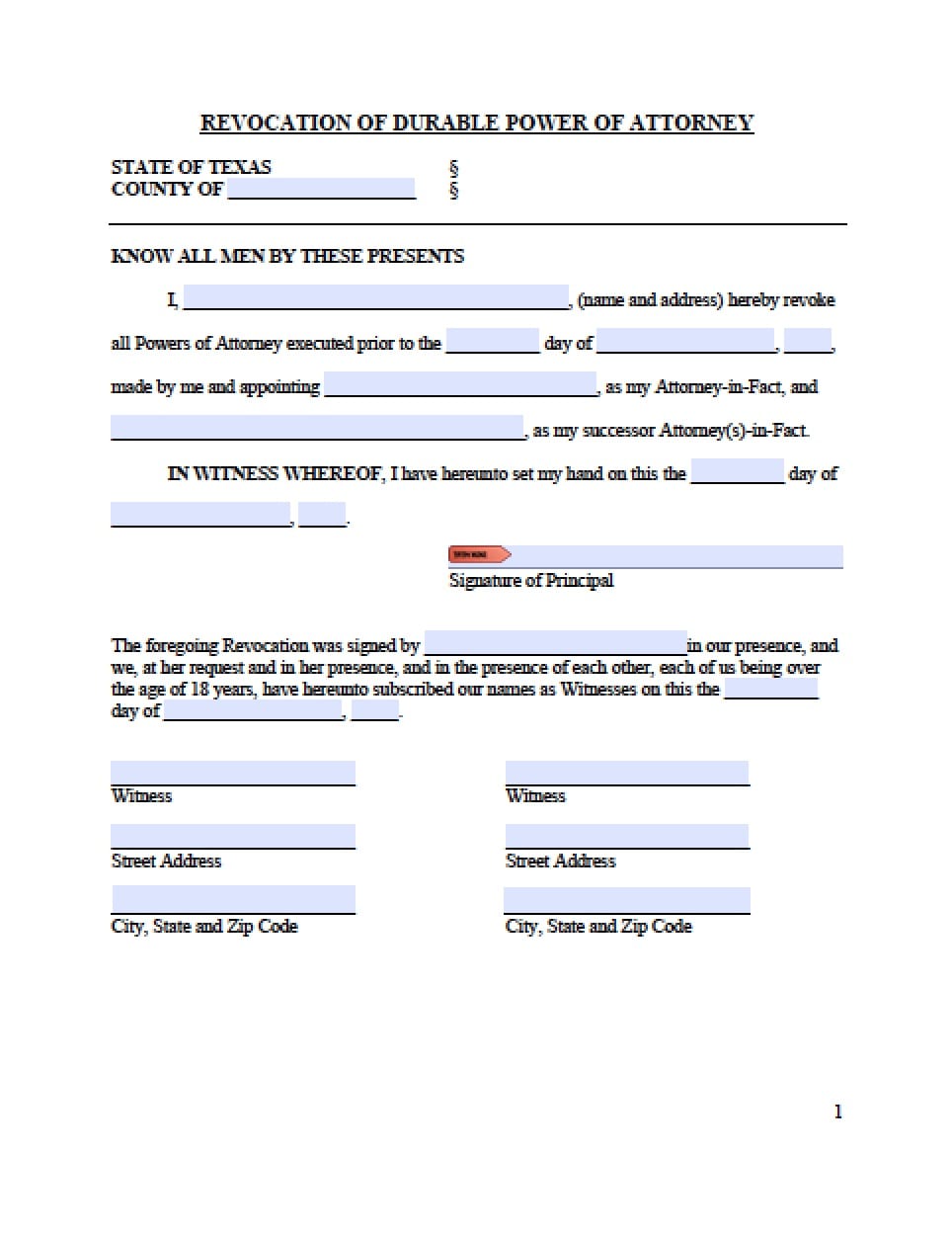

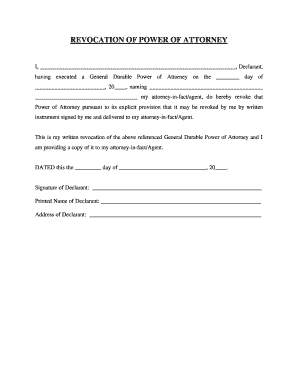

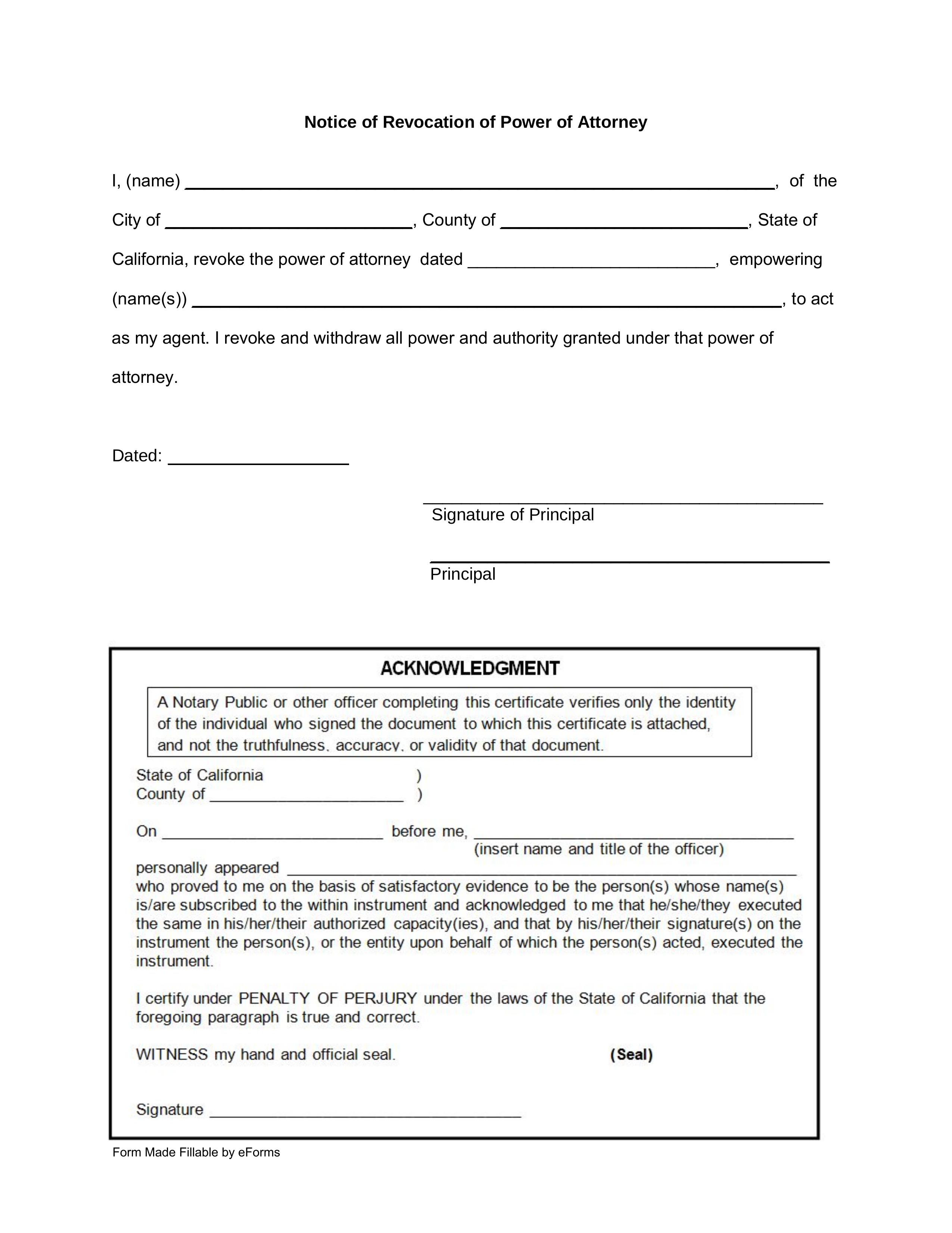

| Allowed to assist my very own weblog, on this explicit time I’m going to indicate you about key phrase. And right now, right here is the very first graphic:

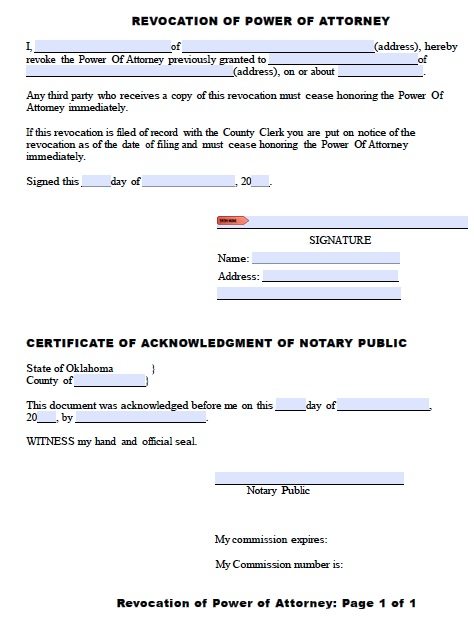

How about graphic previous? is normally that can exceptional???. for those who’re extra devoted subsequently, I’l l reveal just a few impression but once more beneath:

So, for those who want to obtain these excellent pics about (Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form), merely click on save hyperlink to retailer these graphics in your private laptop. There’re obtainable for get hold of, if you’d like and want to personal it, click on save image on the net web page, and it will be instantly downloaded in your desktop pc.} Lastly for those who wish to obtain distinctive and the newest picture associated with (Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form), please comply with us on google plus or e book mark the location, we strive our greatest to present you common up grade with all new and recent images. We do hope you want retaining proper right here. For most upgrades and up to date details about (Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form) pictures, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on e book mark part, We attempt to offer you replace often with all new and recent photographs, like your browsing, and discover the perfect for you.

Here you’re at our web site, contentabove (Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form) printed . Nowadays we’re happy to announce that we have now discovered an incrediblyinteresting nicheto be identified, that’s (Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form) Many individuals looking for specifics of(Revoke Power Of Attorney Form The Seven Secrets You Will Never Know About Revoke Power Of Attorney Form) and undoubtedly certainly one of these is you, is just not it?

Revocation of Power of Attorney Form: Free Download, Edit … | revoke energy of legal professional kind

Revocation of Power of Attorney Form: Free Download, Edit … | revoke energy of legal professional kind