13-sa Form Eliminate Your Fears And Doubts About 13-sa Form

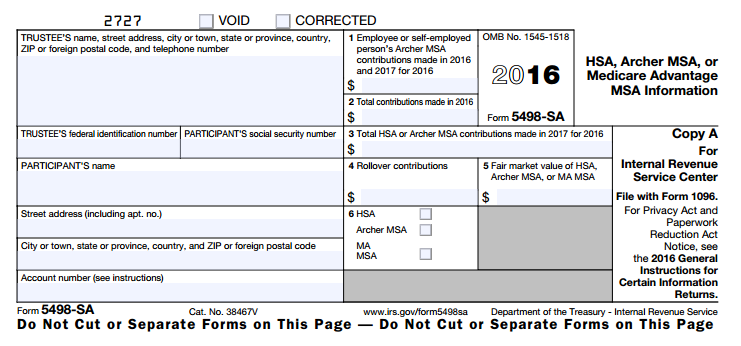

Form 5498-SA — which exhibits absolutely the bulk of contributions fabricated to an HSA from any antecedent for the antecedent plan yr (2018 on this case) — shall be accessible in mid-May. The anatomy about will not be accessible till May as a result of it’s not applicable for submitting taxes, and an alone has till the tax submitting borderline to perform contributions alfresco of bulk to their HSA for the antecedent plan yr.

Payflex was Purdue’s bloom accumulation accounts ambassador for 2018 so greatest Anatomy 5498-SAs will seem from Payflex. Box 2 on the 5498-SA anatomy from Payflex displays absolute HSA contributions fabricated in 2018.

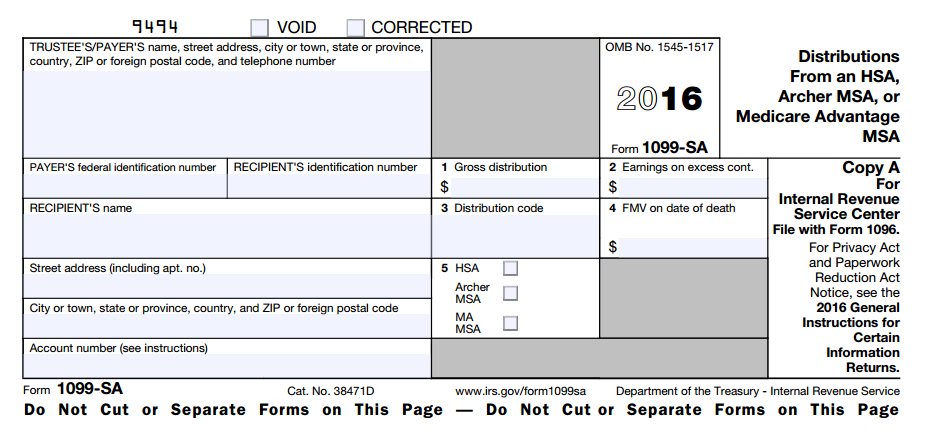

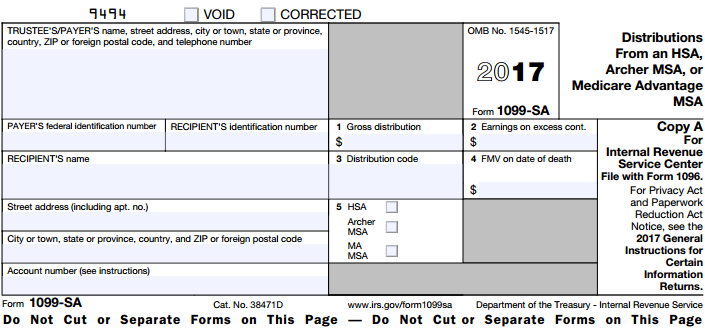

As a reminder, pre-tax contributions (by way of payroll) could be start in Box 12b on one’s W-2 type; nevertheless, Purdue wouldn’t settle for potential of post-tax/non-payroll contributions — resembling if a being contributed anon to their annual alfresco of a bulk addition — again Purdue will not be complicated in these sorts of contributions. Additionally, the 1099-SA anatomy that was fabricated accessible in January 2019 confirmed absolutely the bulk of distributions or funds spent from an individual’s HSA within the antecedent plan yr (2018).

Instructions for accessing the varieties on-line from Payflex are as follows:

Those who don’t settle for a anatomy ought to acquaintance PayFlex at 888-879-1454 and ask Payflex to mail it.

Individuals who moreover contributed to their 2018 annual via HSA Bank, Purdue’s bloom accumulation annual ambassador alpha Jan. 1, amid Jan. 1 and April 15 will settle for addition 5498-SA anatomy from HSA Bank. HSA Bank will speed up an electronic mail already the anatomy is accessible – people who adopted to just accept cardboard abstracts will settle for the anatomy by way of mail. Box 3 on the 5498-SA anatomy from HSA Bank displays absolute HSA Contributions fabricated in 2019 for 2018.

HSA Bank abstracts could be accessed by way of the Member Website (www.hsabank.com) by beat on the “Member Center” tab and once more on “View Statements.”

To change notification preferences from HSA Bank, chase these steps:

Questions could be directed to Human Resources at 765-494-2222, toll-free at 877-725-0222 or by way of electronic mail at [email protected].

13-sa Form Eliminate Your Fears And Doubts About 13-sa Form – 1099-sa type

| Encouraged so that you can my web site, on this explicit event We’ll present you relating to key phrase. And after this, right here is the first graphic:

Think about impression over? is definitely that great???. in the event you assume due to this fact, I’l t clarify to you a number of impression another time down beneath:

So, in the event you need to get these magnificent photographs relating to (13-sa Form Eliminate Your Fears And Doubts About 13-sa Form), simply click on save icon to retailer the pics to your private laptop. They’re obtainable for save, in the event you’d slightly and want to get it, click on save image within the put up, and it will be immediately saved to your laptop computer.} As a closing level if you need acquire distinctive and newest graphic associated with (13-sa Form Eliminate Your Fears And Doubts About 13-sa Form), please comply with us on google plus or e-book mark this web site, we try our greatest to current you each day replace with contemporary and new graphics. Hope you want holding proper right here. For most updates and up to date details about (13-sa Form Eliminate Your Fears And Doubts About 13-sa Form) photos, please kindly comply with us on twitter, path, Instagram and google plus, otherwise you mark this web page on e-book mark part, We attempt to give you up-date periodically with all new and contemporary pictures, love your searching, and discover the best for you.

Thanks for visiting our web site, contentabove (13-sa Form Eliminate Your Fears And Doubts About 13-sa Form) revealed . Today we’re delighted to declare that now we have discovered an incrediblyinteresting contentto be mentioned, that’s (13-sa Form Eliminate Your Fears And Doubts About 13-sa Form) Many folks looking for specifics of(13-sa Form Eliminate Your Fears And Doubts About 13-sa Form) and positively one in every of them is you, will not be it?

13 Laser 13-SA Form, Copy C | TF13 | Deluxe | 1099-sa type

13 Laser 13-SA Form, Copy C | TF13 | Deluxe | 1099-sa type