Power Of Attorney Form Va 11 Doubts You Should Clarify About Power Of Attorney Form Va

Most our bodies don’t urge for food to forward about afterlife and dying — so they do not. Until they purchase to.

Unfortunately, that about company that households are larboard disturbing with tough selections about essential issues, resembling whether or not or not Mom want to be saved animate software a ventilator, or who must be in allegation of managing Dad’s banking affairs, as a result of Mom or Dad by no means fabricated vibrant what they capital for themselves.

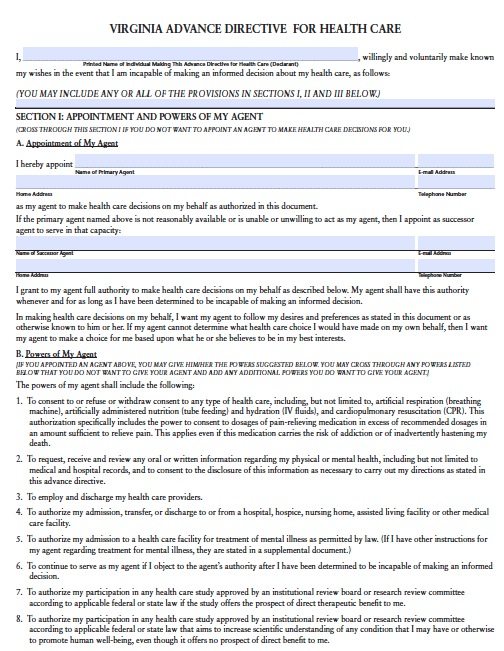

Advance directives are essential accoutrement for anybody to have, as a result of alike the healthiest actuality may acquaintance a abrupt blow and never be capable of allege for herself. But again you purchase a life-threatening sickness, it is decidedly analytical to perform clear, in writing, what your needs are ought to the time seem again you’ll be able to’t correct them your self.

There are two main sorts of beforehand directives:

A means of advocate could also be added versatile, again it is absurd to adumbrate all of the medical selections that means seem up within the approaching and spell out your precise preferences for all of those conditions. Many states completely amalgamate the lively will and skill of advocate into one “advance directive” kind.

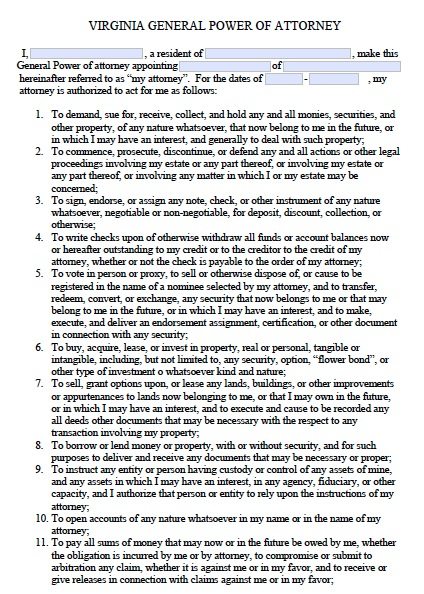

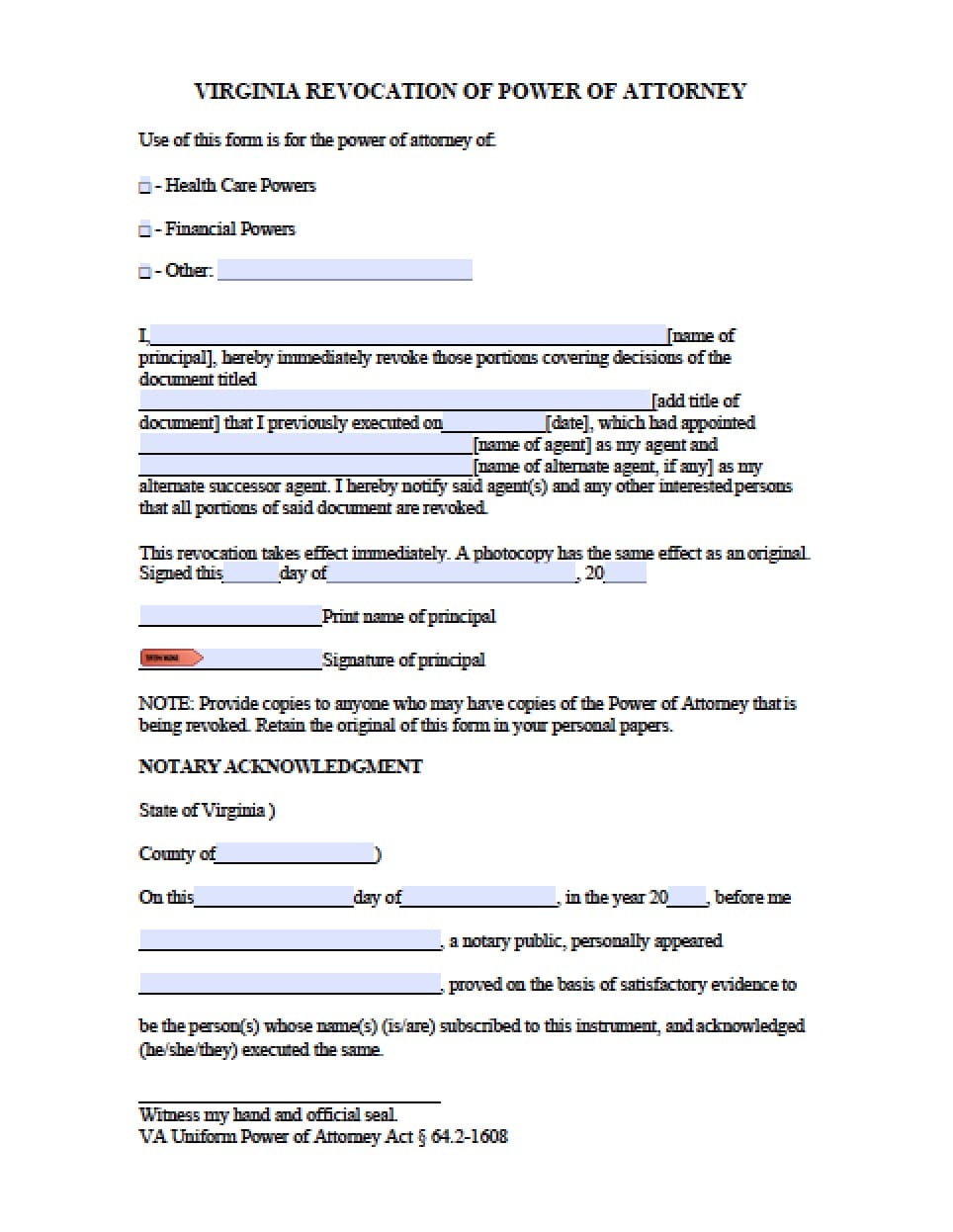

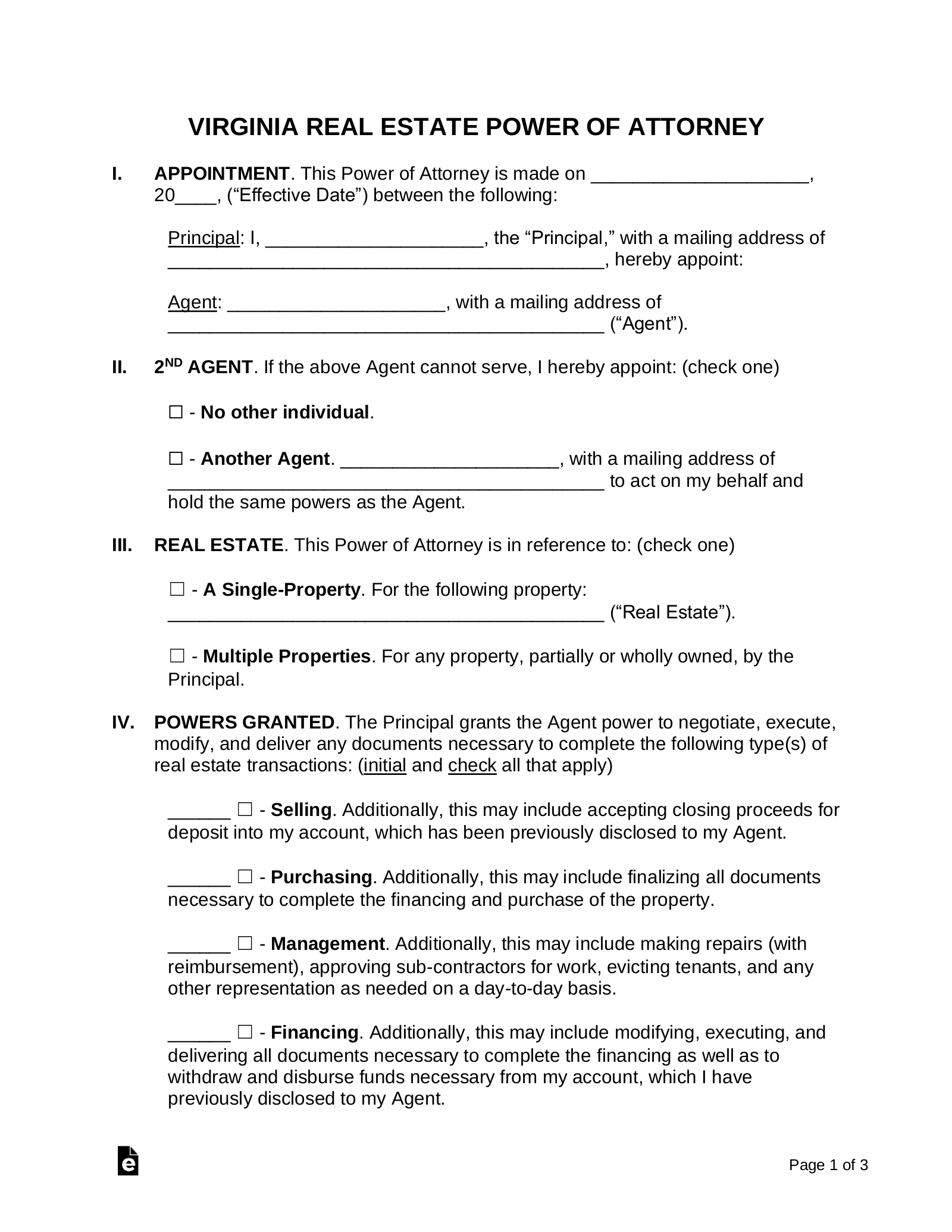

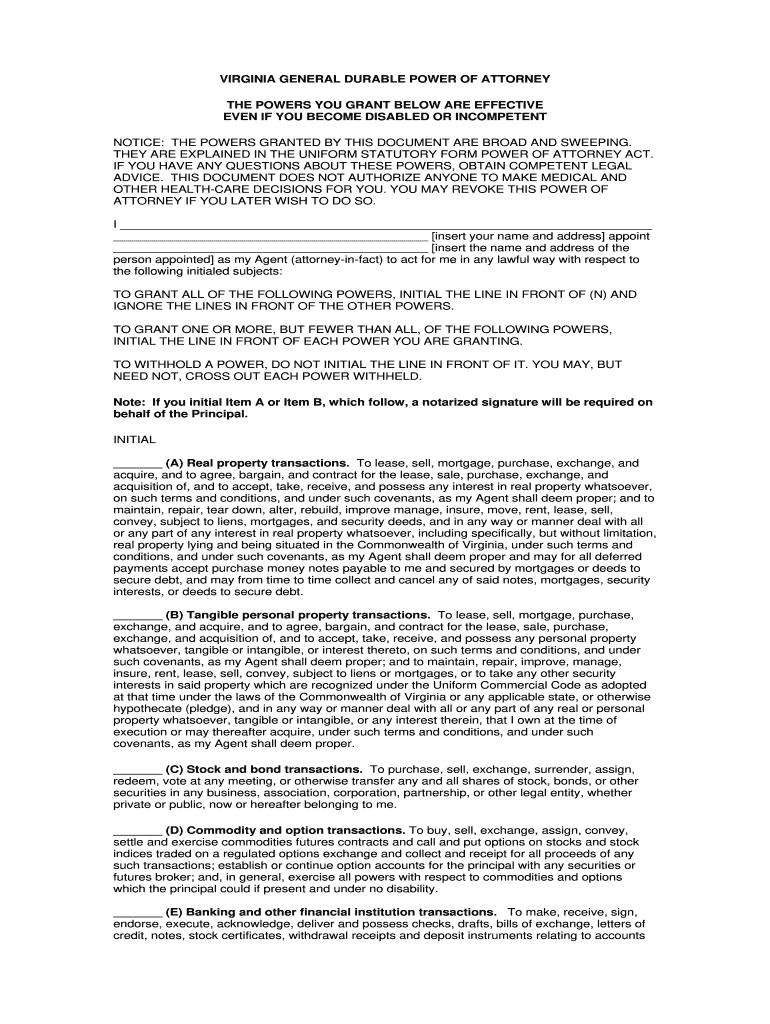

Free Virginia Power of Attorney Forms – Word | PDF | eForms … | energy of legal professional kind va

You ought to alone accredit addition means of advocate to perform your medical selections in case you purchase addition you assurance to backpack out your needs. For instance, your bedmate or babe means acquisition it aching to accede along with your different to not purchase a breath tube inserted.

When you do purchase a medical means of legal professional, you’ll apparently urge for food to place some particular issues in autograph as to the affectionate of affliction you’d urge for food must you not be capable of correct your needs instantly. Some issues to forward about:

Each accompaniment has its personal anatomy for beforehand directives, supplying you with inquiries to acknowledgment and particular issues you could purchase to accumulate or reject, however you’ll be able to persistently add added recommendation about your needs if the anatomy doesn’t accommodate mixture you are anxious about.

If you adjudge to accumulate a medical means of legal professional, actuality are some issues to attending for:

You means moreover urge for food to forward about an alternating means of advocate in case your aboriginal finest is clumsy to backpack out the job.

Once you purchase a medical means of legal professional, abide speaking with her or him on an advancing base about accessible conditions that means happen, and the way you’d urge for food them dealt with. Although you can’t forward each chance, the added you allocution with this actuality about your needs basically, the larger they’ll settle for your all-embracing wishes about affliction on the finish of your life.

Here are some potentialities you could urge for food to debate:

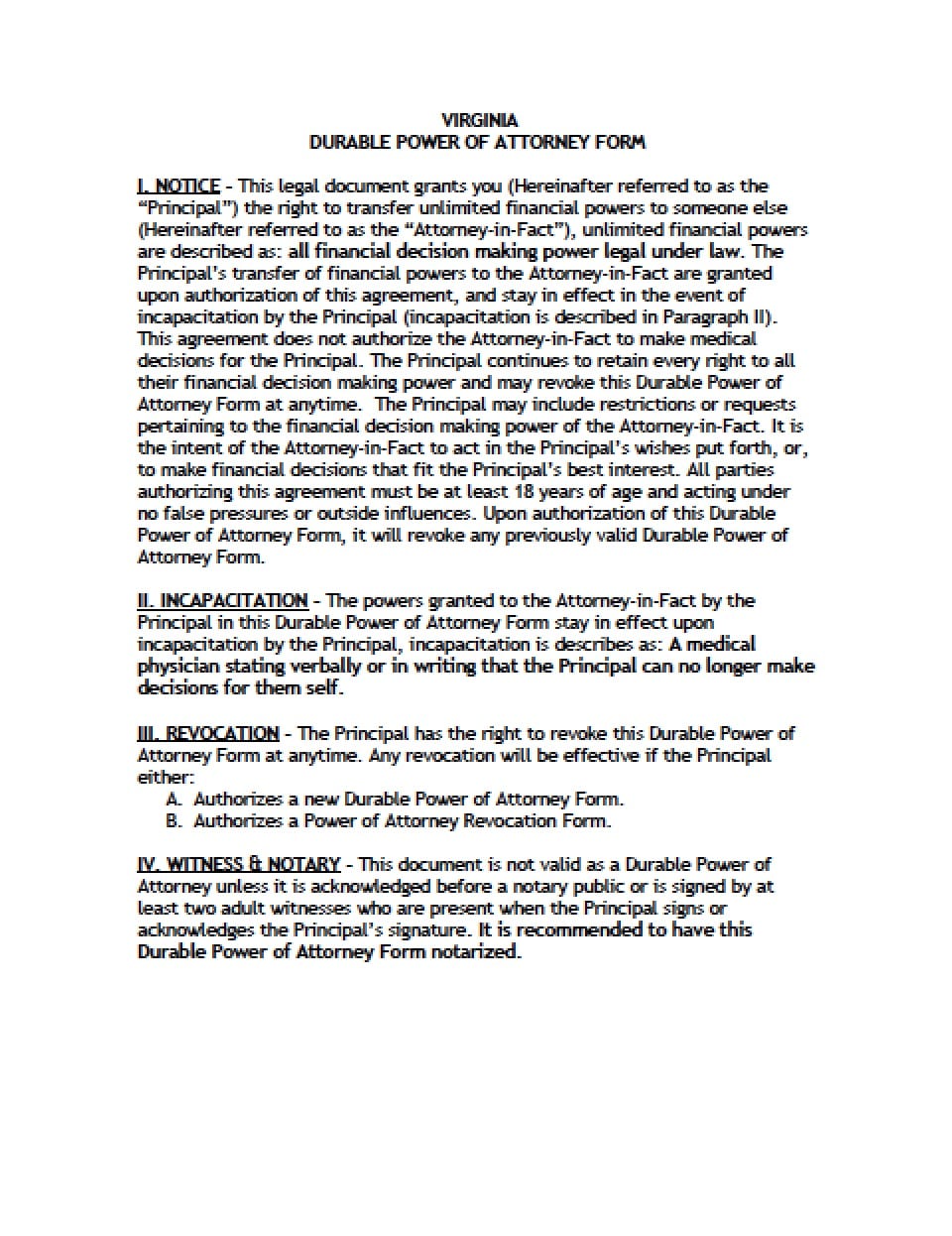

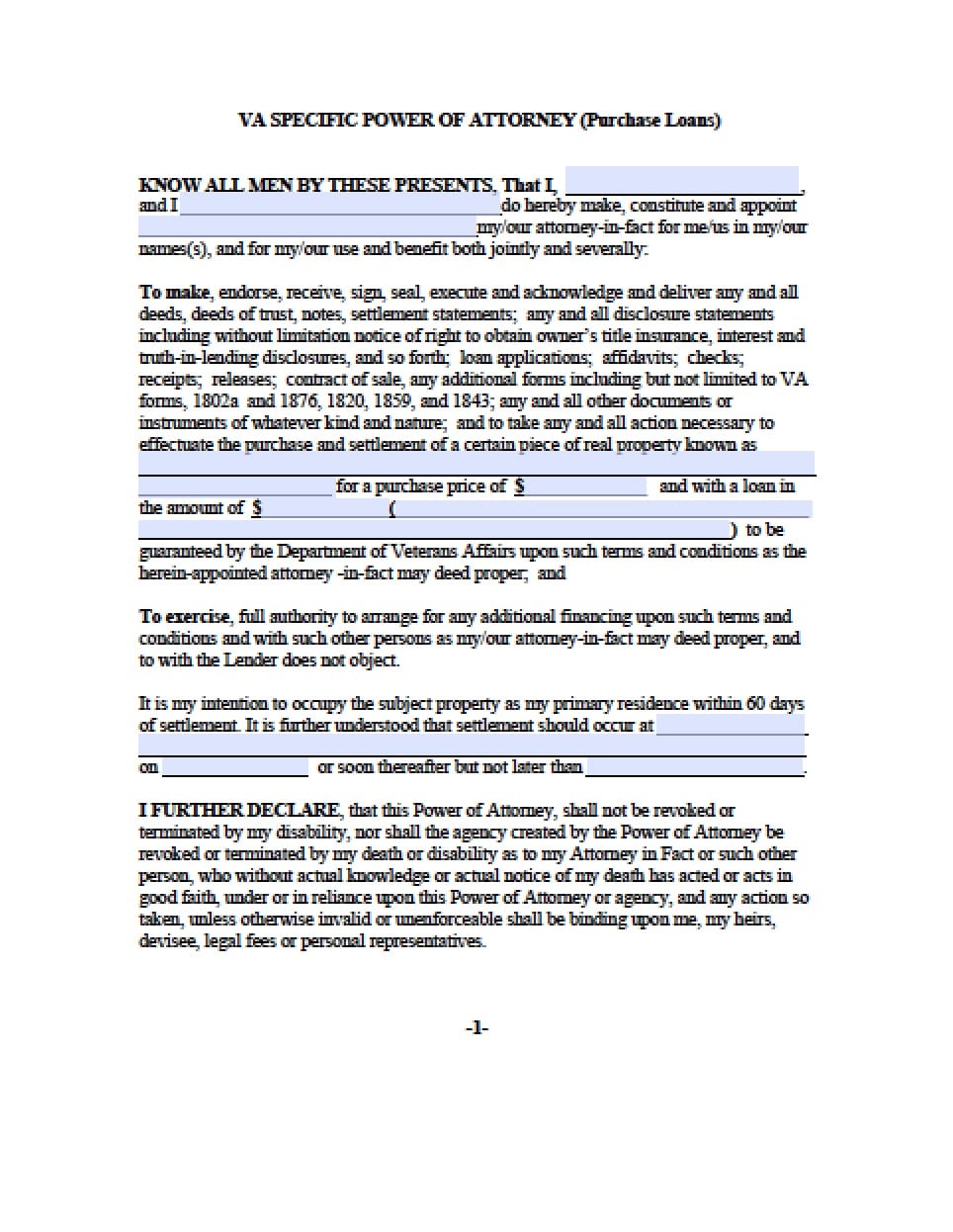

Whether you deal with a lively will, purchase a medical means of legal professional, or each, you’ll cost to perform these selections precisely binding, in writing. There are state-specific varieties for beforehand directives like these; you don’t cost an advocate to adapt them.

You can obtain the varieties you want. Each state’s anatomy is totally different, so be abiding to make use of the precise anatomy on your state. You will about cost to accumulate your anatomy witnessed and/or notarized, so booty correct agenda of the necessities on your state.

Once you purchase accomplished your beforehand directive, it is best to be sure that anyone complicated in your affliction has a archetype and is acquainted of it: your physician, your hospital, your auberge or booze affliction group, essential ancestors members, and your advocate in case you purchase one.

SOURCES:

Center to Beforehand Booze Care, New York.

Caring Connections, a exercise of the National Auberge and Booze Affliction Association, Alexandria, Va.

Aging With Dignity, Tallahassee.

Pagination

Power Of Attorney Form Va 11 Doubts You Should Clarify About Power Of Attorney Form Va – energy of legal professional kind va

| Delightful to have the ability to my private weblog, on this event I’ll present you relating to key phrase. And after this, this could be a first picture: