Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form

Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form – money deposit type

| Encouraged to assist our web site, with this second I’m going to give you close to key phrase. And after this, that is the preliminary impression:

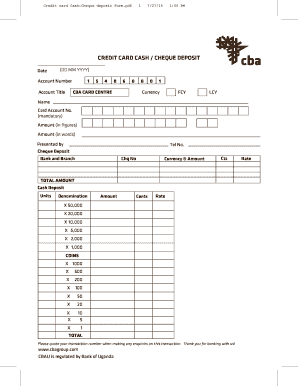

Cash Deposit Form – Fill Online, Printable, Fillable, Blank … | money deposit type

How about image earlier talked about? is normally which outstanding???. in case you assume consequently, I’l d clarify to you a lot picture yet again underneath:

So, in case you prefer to have all these excellent pictures associated to (Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form), press save icon to obtain these graphics in your pc. They are prepared for acquire, in case you love and need to take it, simply click on save brand on the web page, and it will be instantly downloaded in your laptop computer.} Lastly if you wish to have distinctive and up to date photograph associated with (Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form), please comply with us on google plus or save this weblog, we try our greatest to give you every day up-date with recent and new footage. Hope you want staying proper right here. For most updates and newest information about (Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form) pictures, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on ebook mark part, We attempt to provide you with up grade frequently with recent and new pics, get pleasure from your exploring, and discover the best for you.

Here you might be at our web site, contentabove (Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form) revealed . Nowadays we’re happy to announce we’ve found an awfullyinteresting nicheto be reviewed, that’s (Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form) Lots of individuals looking for particulars about(Cash Deposit Form Ten Important Facts That You Should Know About Cash Deposit Form) and naturally certainly one of these is you, is just not it?

Cash Box Deposit Form – Fill Online, Printable, Fillable … | money deposit type

9 Cash Deposit Form – Fillable, Printable PDF & Forms … | money deposit type

Cash Deposit Form – 9 Free Templates in PDF, Word, Excel … | money deposit type

How to Use a Cash Deposit Form – University of the Pacific | money deposit type

SBI – How to fill Deposit Slip of State Bank of India or SBI | money deposit type

How to Use a Cash Deposit Form – University of the Pacific | money deposit type

IN-How to fill SBT Bank deposit slip for cheque or money deposit | money deposit type

9 Images of Weekly Cash Deposit Form Template | jackmonster.com | money deposit type