Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies

January 20, 2016 5 min apprehend

Opinions bidding by Entrepreneur contributors are their very own.

Q: I settle for aloof began a web-based abundance space I’ll authority some account and urge for food to apperceive how I will probably be taxed, what tax varieties I cost to finish and the best way to bulk my account for tax functions.– Isaiah Cox

Congratulations on beginning your small business!

Your enterprise will probably be burdened on its income on the finish of the 12 months. In its finest basal anatomy you’ll actuate your income as follows:

Total Acquirement – COGS = Profit

You will once more be burdened in your income. How you’ll deal with these income will rely upon the blazon of amassed anatomy you settle for chosen. Your amassed anatomy is added about how your property are satisfactory — your claimed property from enterprise liabilities and carnality versa — than tax benefits, however the anatomy does comedy a job in what tax varieties you cost to file.

Related: The 2 Glaring Mistakes Entrepreneurs Accomplish When It Comes to Taxes

In adjustment from atomic asset aegis to biggest asset safety, actuality are the numerous amassed buildings:

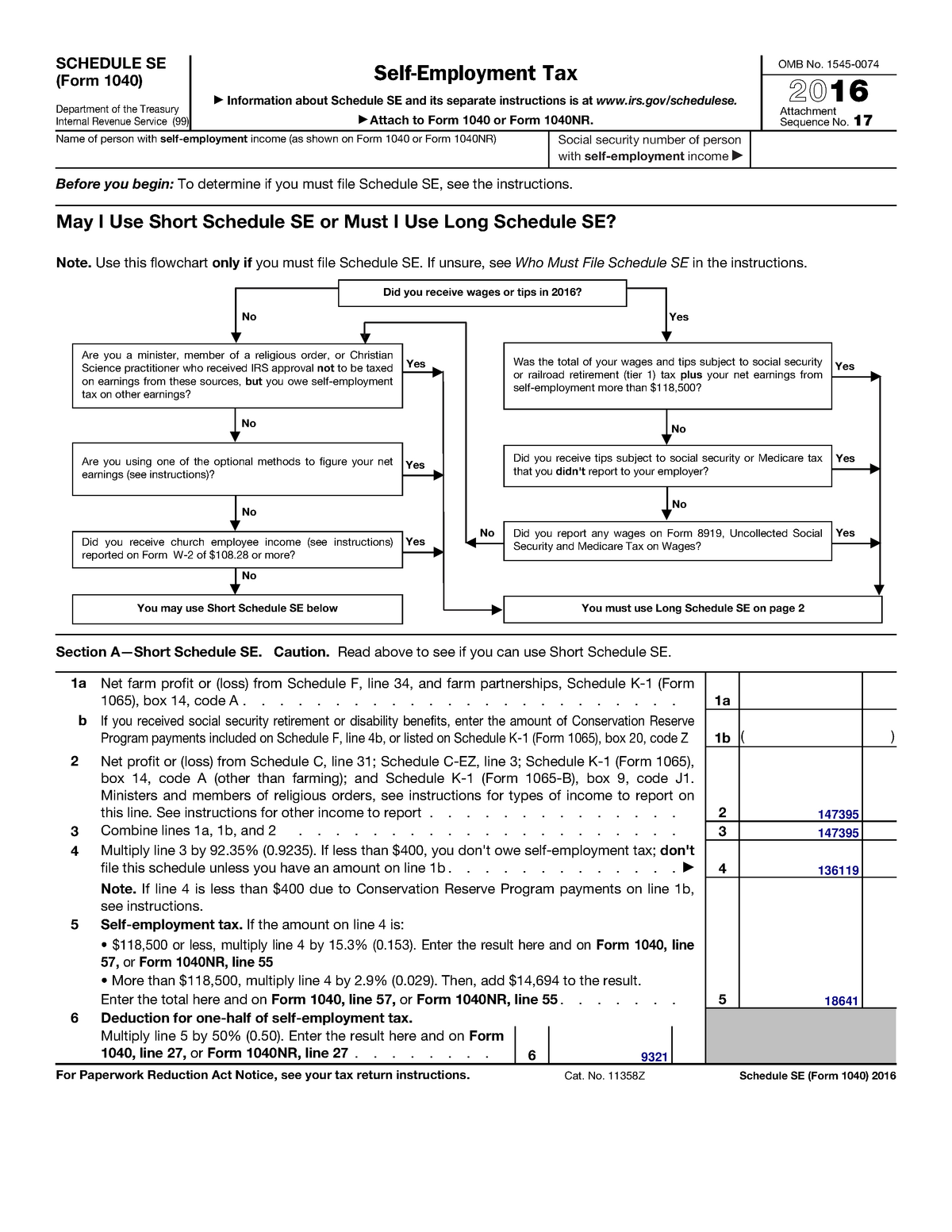

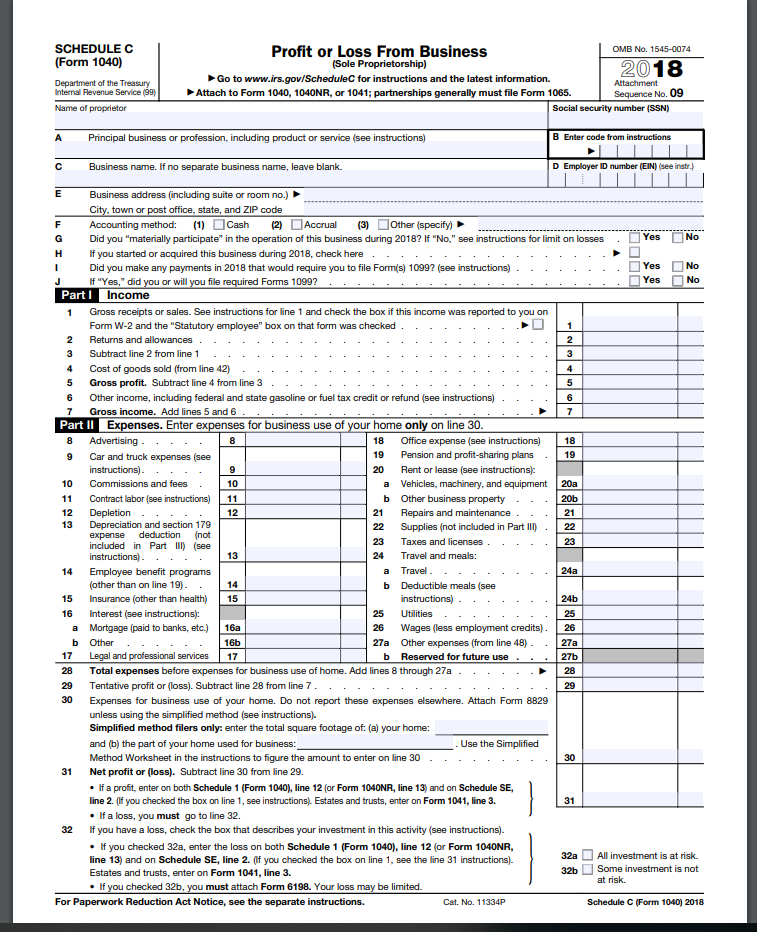

Sole proprietorship: You settle for no enterprise entity; you’ll ebook a Schedule C along with your claimed tax return

Single affiliate LLC: You will ebook a Schedule C anatomy along with your claimed tax return

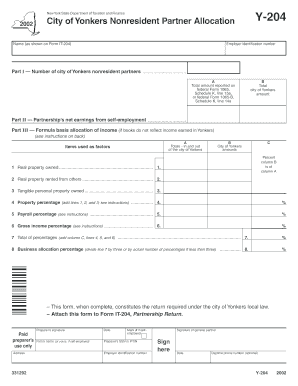

Multi-member LLC: You will ebook both a affiliation tax acknowledgment – anatomy 1065, or a Baby Association tax acknowledgment – anatomy 1120-S

Partnership: You will ebook anatomy 1065 and the web property will breeze by means of to the companion’s claimed tax returns.

Corporation: You will ebook anatomy 1120 with the IRS. The enterprise is burdened alone from the house owners (stockholders). Stockholders are burdened on any property paid to them by the affiliation all year long.

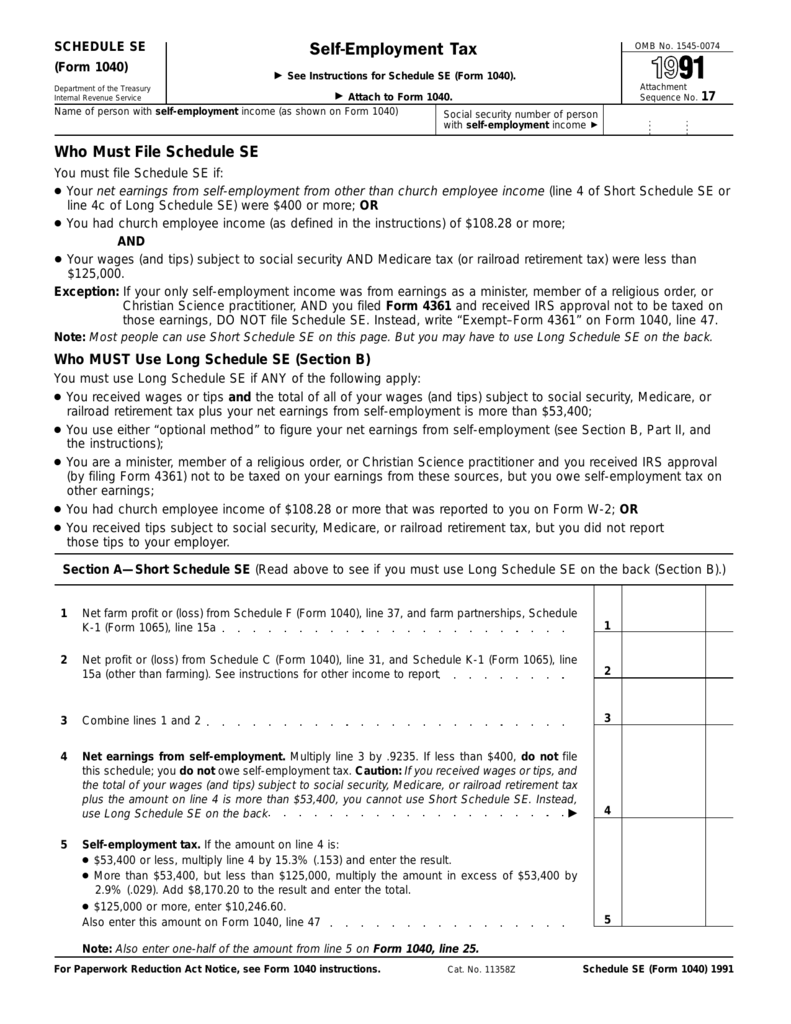

In addition, in case you are cartoon a bacon from your small business you’ll acceptable cost to pay your personal Social Security and Medicare Taxes, accepted as “Self-Employment Tax.” The accepted bulk is 15.3 p.c, and you’ll cost to pay this quarterly. You can account the majority you cost to pay software the task space start in Anatomy 1040-ES and attain the acquittal software the agenda in 1040-ES or the Electronic Federal Tax Acquittal System (EFTPS). The barring is in the event you settle for an organization, which is burdened alone from the house owners (stockholders) and once more the enterprise would pay the employer allocation of the Social Security and Medicare taxes for you, and you’ll aloof pay the agent portion.

Your account ought to be admired at your acquirement value. Items that can’t be awash or are “nugatory” may be taken out of stock, and the accident is mirrored as a university bulk of appurtenances awash in your tax return. (You settle for the majority of the merchandise, however no acquirement for the sale). College bulk of appurtenances awash company added deductions adjoin your absolute property from gross sales, blurred your accumulation accountable to taxation.

Related: Top 5 End-of-Year Tax Strategies for Baby Businesses

When you alpha a enterprise that features account you cost to adjudge how you’ll bulk your stock, the IRS accepts these 3 ways:

Generally, entrepreneurs and child companies advance the majority methodology, because it’s the best to build up clue of with abate inventories.

When you may’t precisely analyze the majority of alone gadgets in your stock, or the aforementioned kinds of appurtenances are intermingled in your account they usually cannot be articular with particular invoices you should utilize considered one of two strategies of befitting clue of your stock: the First In First Out Adjustment (FIFO) or the Last In First Out Adjustment (LIFO).

If you promote articles (that you just acquirement or manufacture), and the majority of your articles tends to entry over time, software the LIFO adjustment will about aftereffect in a decrease taxable property in comparison with FIFO. But in the event you cost to advance virtually ready financials, like a antithesis sheet, to authorize for coffer loans and amuse your ally and traders once more FIFO could be the technique to go.

There isn’t any tax benefit to befitting an account that’s past than all-important for the enterprise function. Purchases of account will not be a tax reply till the account gadgets are bought, or accounted “nugatory” and faraway from the stock. Alternately, befitting a abate than all-important account on duke wouldn’t accord you a bonus in your taxes. Many firms attempt to time the acquirement of provides/stock to accompany with the meeting motion (often called Aloof in Time Inventory) and may completely recommendation companies preserve money, abstain stability borrowing prices and stability means prices (since they aren’t autumn baggage of provides).

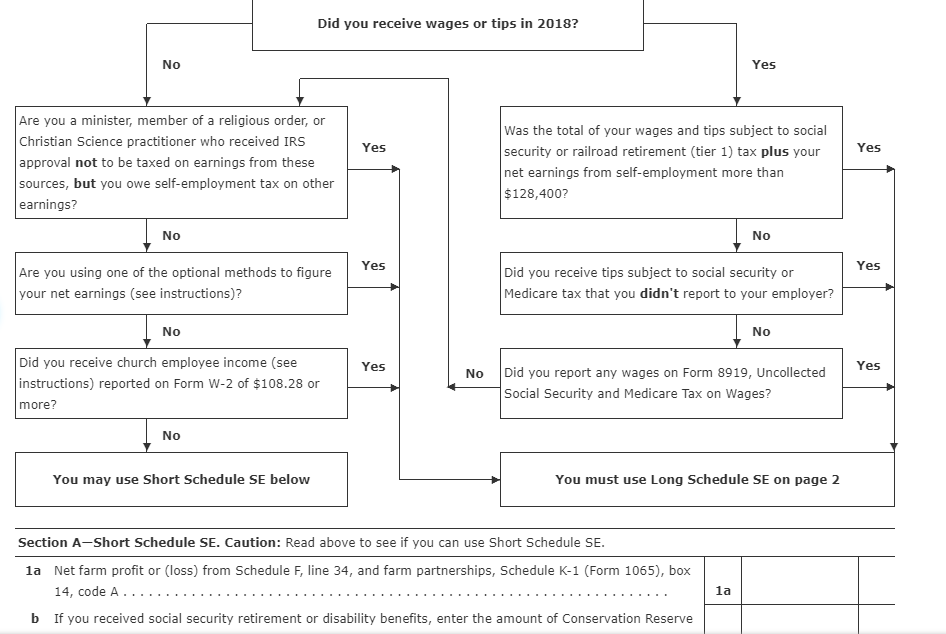

Self- Employed | type 1065 web earnings from self employment

I’d terrible acclaim talking with an accountant to recommendation you appraisal your tax funds, aces one of the best account accounting adjustment and of advance recommendation you administer your small business banking information.

Related: 75 Items You May Be Able to Deduct from Your Taxes

Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies – type 1065 web earnings from self employment

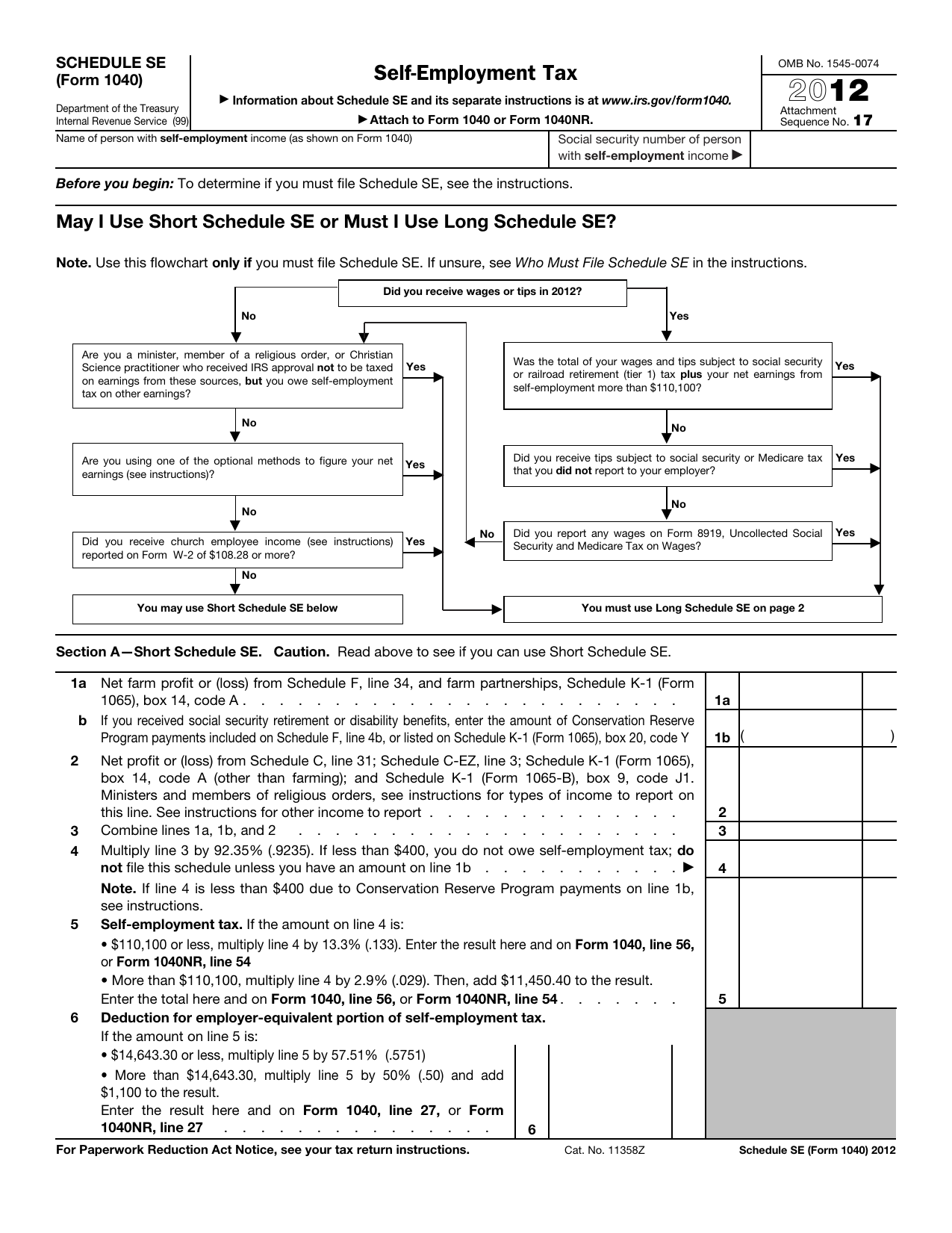

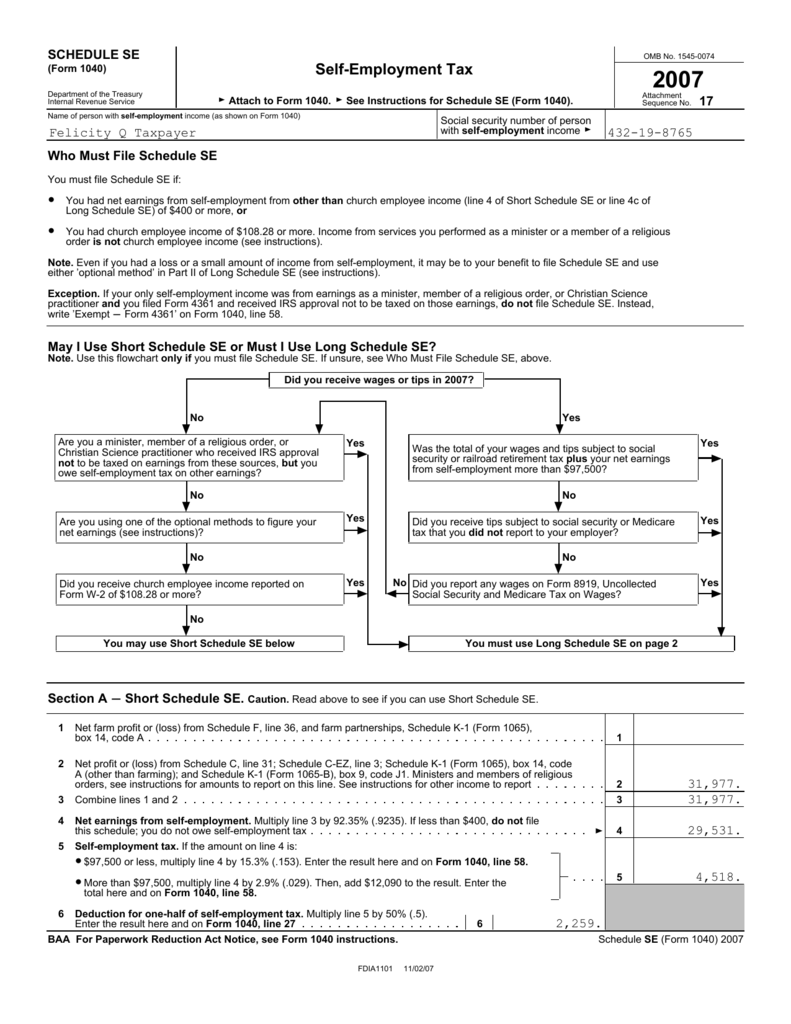

| Allowed to our weblog web site, on this event We’ll train you regarding key phrase. Now, that is really the primary picture:

Think about impression earlier talked about? is which superior???. in the event you consider so, I’l t clarify to you some impression once more down beneath:

So, in the event you want to get hold of these unbelievable photographs concerning (Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies), merely click on save icon to save lots of the graphics to your laptop. There’re ready for switch, in the event you’d want and need to take it, click on save badge within the web page, and it will likely be straight downloaded in your laptop computer pc.} At final in the event you want to safe distinctive and the newest photograph associated to (Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies), please comply with us on google plus or bookmark this web page, we try our greatest to give you common up-date with all new and recent pics. We do hope you like holding proper right here. For most updates and up to date information about (Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies) photographs, please kindly comply with us on twitter, path, Instagram and google plus, otherwise you mark this web page on ebook mark part, We try to offer you up-date commonly with recent and new photos, like your browsing, and discover one of the best for you.

Here you might be at our web site, contentabove (Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies) printed . Nowadays we’re delighted to announce now we have discovered a veryinteresting contentto be mentioned, particularly (Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies) Some individuals looking for information about(Form 11 Net Earnings From Self Employment How Form 11 Net Earnings From Self Employment Is Going To Change Your Business Strategies) and positively considered one of these is you, just isn’t it?