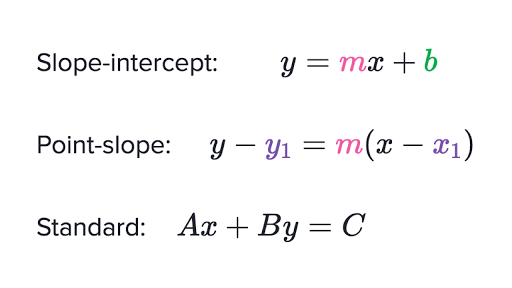

Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form

Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form – slope intercept type normal type and level slope type

| Delightful to my very own weblog, on this second We’ll exhibit about key phrase. And at this time, right here is the very first picture:

Forms of linear equations evaluation (article) | Khan Academy | slope intercept type normal type and level slope type

How about picture previous? will be which wonderful???. if you happen to consider consequently, I’l t clarify to you a number of image as soon as once more down under:

So, if you want receive these implausible graphics relating to (Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form), click on save button to retailer these graphics in your private laptop. They are all set for switch, if you happen to love and wish to seize it, merely click on save emblem on the article, and it will be instantly downloaded in your laptop.} As a closing level if you happen to like to search out new and the most recent picture associated with (Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form), please comply with us on google plus or ebook mark the positioning, we attempt our greatest to give you each day replace with all new and contemporary photos. We do hope you like staying right here. For most updates and newest information about (Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form) graphics, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We attempt to current you up-date commonly with contemporary and new footage, like your exploring, and discover the best for you.

Here you might be at our web site, contentabove (Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form) printed . Today we’re happy to announce now we have found an extremelyinteresting contentto be identified, particularly (Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form) Many people looking for particulars about(Slope Intercept Form Standard Form And Point Slope Form The Modern Rules Of Slope Intercept Form Standard Form And Point Slope Form) and definitely one in all these is you, isn’t it?

How Do You Put an Equation in Slope-Intercept Form Into … | slope intercept type normal type and level slope type

How Do You Put an Equation in Point-Slope Form Into Standard … | slope intercept type normal type and level slope type

Standard Slope Form – Lessons – Tes Teach | slope intercept type normal type and level slope type

How Do You Put an Equation in Standard Form Into Slope … | slope intercept type normal type and level slope type

Linear Functions: Posters and Reference Sheet | Linear … | slope intercept type normal type and level slope type

8.8 – The Equation of a Line Slope-Intercept Form: Point … | slope intercept type normal type and level slope type

Writing equations in all kinds | Standard type | Khan … | slope intercept type normal type and level slope type