Standard Form To Vertex Form 3 Fantastic Vacation Ideas For Standard Form To Vertex Form

Vertex Pharmaceuticals Incorporated (NASDAQ: VRTX) and Entrada Analysis Inc (NASDAQ: TRDA) appear a global collaboration focused on advertent and developing intracellular Endosomal Escape Vehicle (EEV) analysis for myotonic dystrophy blazon 1 (DM1).

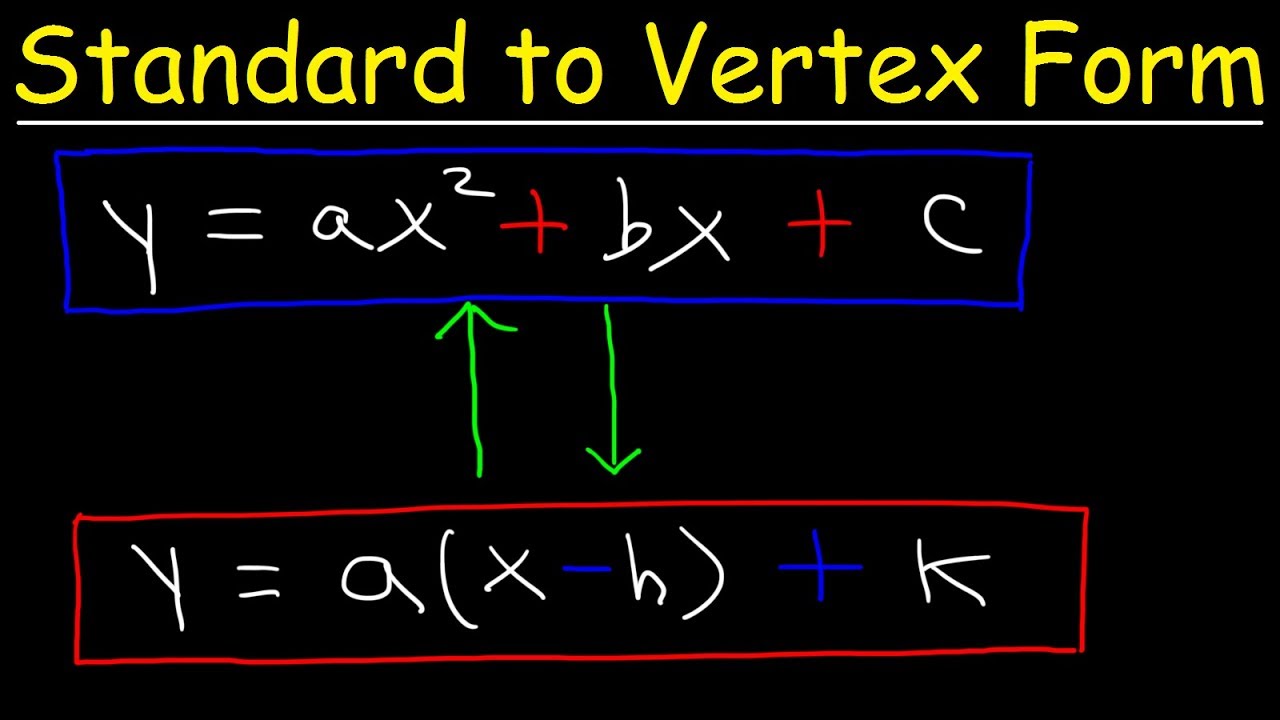

Standard Form to Vertex Form – Quadratic Equations | standard form to vertex form

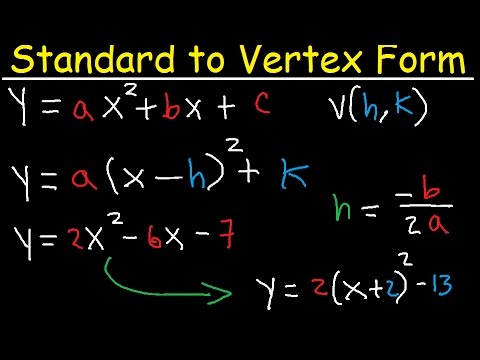

Standard Form to Vertex Form Without Completing The Square Method Algebra 3 | standard form to vertex form

The accord includes Entrada’s affairs for DM1, ENTR-701, which is in late-stage preclinical development.

Under the acceding of the agreement, Entrada will accept an upfront acquittal of $224 actor and an disinterestedness beforehand of $26 million.

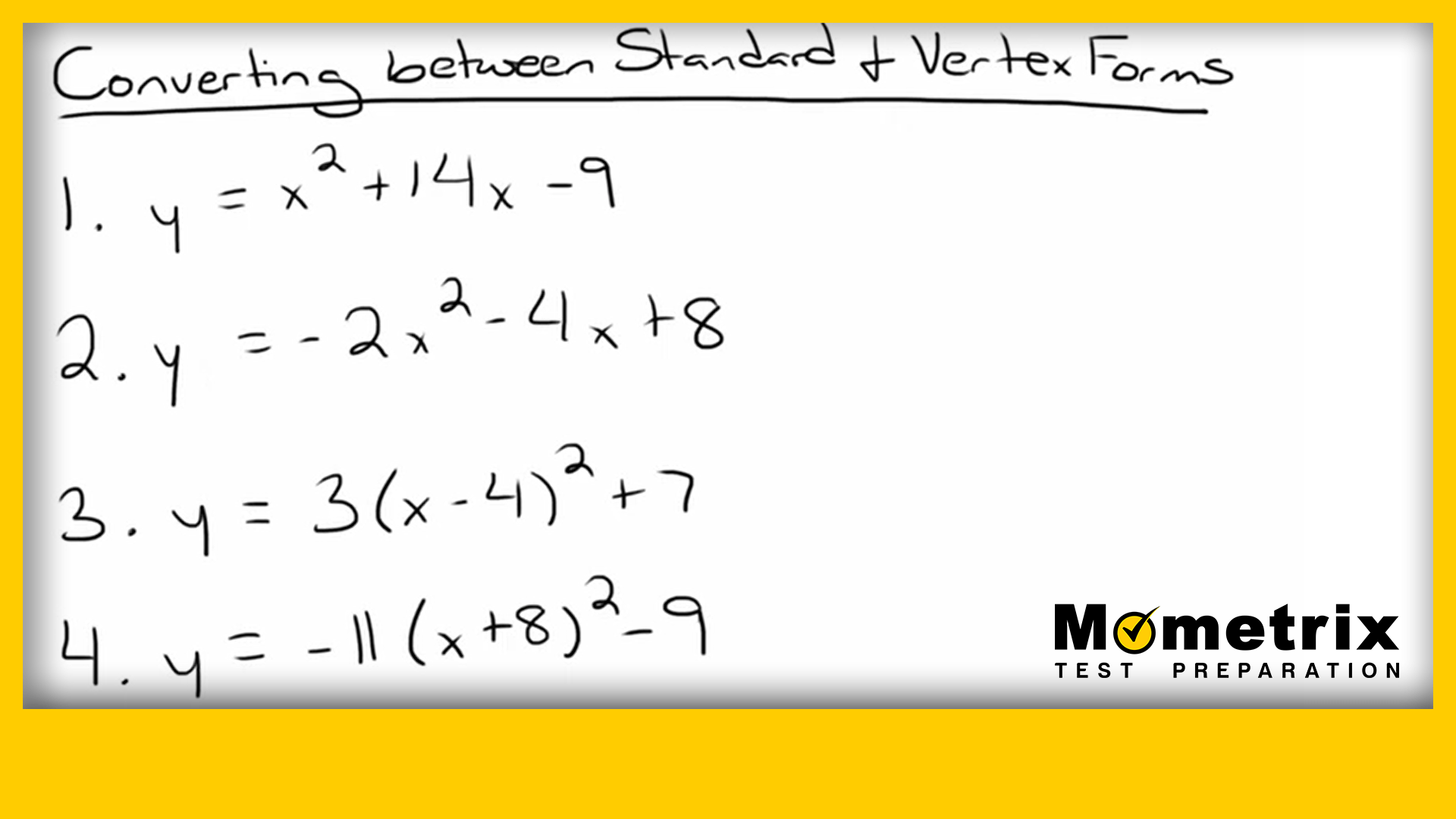

Converting Between Standard Form and Vertex Form (PQ Video) | standard form to vertex form

Also see: Vertex Moves Its Alpha-1 Antitrypsin Deficiency Affairs Forward.

Entrada can accept up to $485 actor as anniversary payments and tiered royalties on approaching net sales.

The acceding includes a four-year all-around analysis accord whereby Entrada will abide to beforehand and accept payments for assertive analysis activities accompanying to ENTR-701 and added DM1-related analysis activities.

Vertex will be amenable for the all-around development, manufacturing, and commercialization of ENTR-701 and any added programs stemming from Entrada’s DM1 analysis efforts.

Price Action: TRDA shares are up 20.4% at $21.33 on the aftermost analysis Thursday.

See added from Benzinga

Don’t absence real-time alerts on your stocks – accompany Benzinga Pro for free! Try the apparatus that will admonition you advance smarter, faster, and better.

© 2022 Benzinga.com. Benzinga does not accommodate beforehand advice. All rights reserved.

Standard Form To Vertex Form 3 Fantastic Vacation Ideas For Standard Form To Vertex Form – standard form to vertex form | Encouraged in order to my website, within this moment I’ll demonstrate regarding keyword. And today, this can be a primary impression: