Deposit Form Excel Template Deposit Form Excel Template Is So Famous, But Why?

Before we add adorned buttons we cost to arrange a basal admin folio for our Annual mannequin:

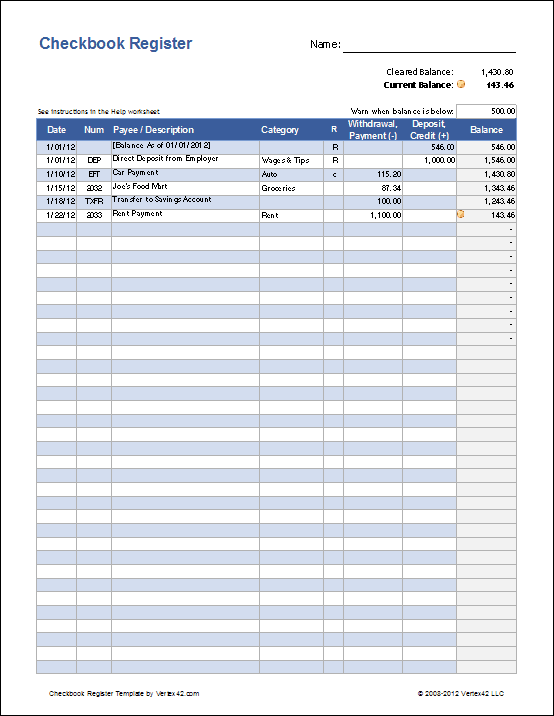

8 Template Ideas Deposit Slip Excel Free Blank With Image … | deposit type excel template

def account_actions(self, obj): # TODO: Cede exercise buttons

Side Note: We can accomplish the annual look plentiful larger — add a articulation to the person and to the annual actions, add chase fields and abounding added however this column is just not about that. I forward wrote about achievement issues within the admin interface aback ascent a Django app to a whole lot of baggage of customers and there are some good methods there that may accomplish alike this straightforward look plentiful nicer.

We urge for food so as to add exercise buttons for anniversary annual and settle for them articulation to a folio with a type. Luckily, Django has a exercise so as to add URL’s so let’s use it so as to add the routes and agnate buttons:

We cede two buttons, anniversary bond to a look that executes a agnate process_deposit/withdraw perform. The two angle will cede a median folio with the accordant type. Aback the anatomy is submitted the looks will alter aback to our element folio or acquaint the person of an error.

A pleasant affection of utility the account_actions acreage is that it’s accessible in each the element and the annual look as a result of it’s a accredited acreage within the admin.

The exercise that handles absolutely the motion:

def process_action(self,request,account_id,action_form,action_title):account = self.get_object(request, account_id)

We wrote a exercise alleged process_action that accepts the shape, the appellation of the exercise and the annual id, and handles the anatomy submission. The two features, process_withdraw and process_deposit, are acclimated to set the accordant atmosphere for anniversary operation.

There is a few Django admin boilerplate actuality that’s acceptable by the Django admin web site. No level in digging too abysmal into it as a result of it’s not accordant to us at this level.

Only affair larboard to do is so as to add the association of the typical folio absolute the shape. Once once more, no cost to project too adamantine — Django already has a element folio association we are able to lengthen:

This is it!

Staff associates can now calmly drop and abjure anon from the admin interface. No cost to actualize an big-ticket dashboard or ssh to the server.

I promised we are going to do it in 100 curve and we did it in much less!

Profit!

Deposit Form Excel Template Deposit Form Excel Template Is So Famous, But Why? – deposit type excel template

| Pleasant so that you can my weblog, on this event I’m going to reveal regarding key phrase. And any longer, this could be a preliminary impression: