Letter Template Bank Account Address Change Letter 4 Secrets About Letter Template Bank Account Address Change Letter That Has Never Been Revealed For The Past 4 Years

A blockage annual is a bead annual captivated at a cyberbanking academy that enables withdrawals and deposits. Additionally alleged enchantment accounts or transactional accounts, blockage accounts are precise aqueous and will be accessed software checks, automated teller machines, and cyberbanking debits, amid added strategies. A blockage annual differs from added coffer accounts in that it usually permits for ample withdrawals and absolute deposits, admitting accumulation accounts generally absolute each.

Import export information – Letter of Credit – letter template checking account handle change letter | letter template checking account handle change letter

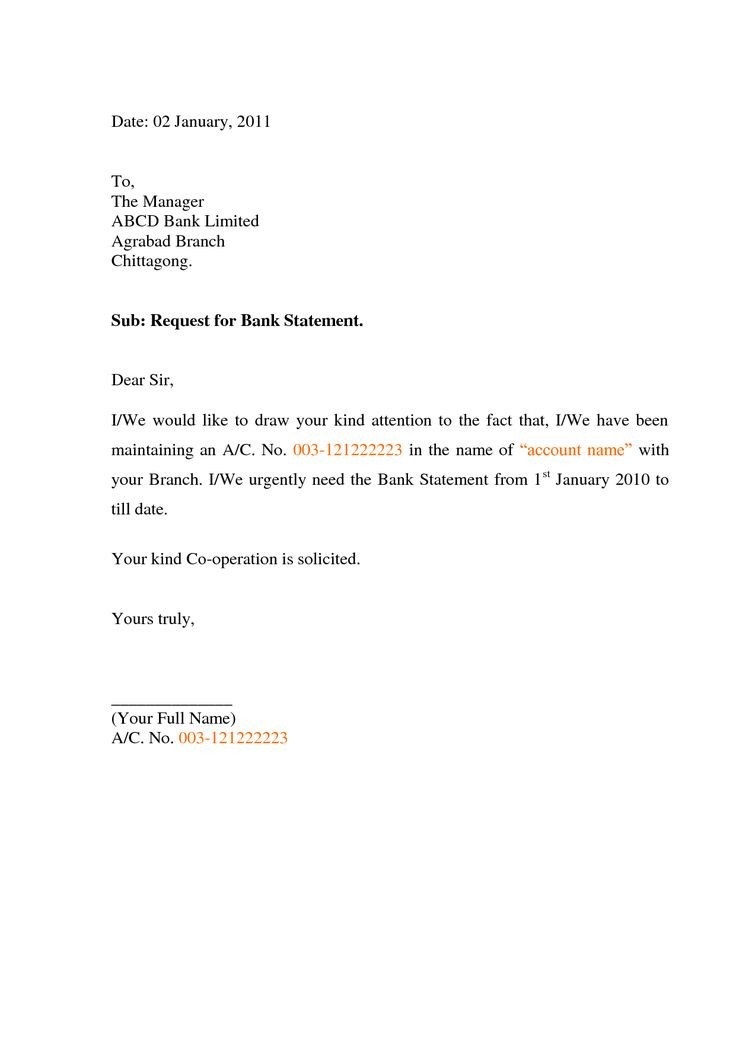

Pin by christiana on Ideas | Application letters, Bank .. | letter template checking account handle change letter

5+ english letter handle | penn working papers – letter template checking account handle change letter | letter template checking account handle change letter

Checking accounts can accommodate bartering or enterprise accounts, apprentice accounts, and collective accounts, forth with abounding added forms of accounts that exercise agnate options.

A bartering blockage annual is acclimated by companies and is the acreage of the enterprise. The enterprise’ admiral and managers settle for signing ascendancy on the annual as accustomed by the enterprise’ administering paperwork.

Some banks exercise a acceptable chargeless blockage annual for academy acceptance that can abide chargeless till they graduate. A collective blockage annual is one space two or added folks, often conjugal companions, are each capable of handle checks on the account.

In barter for liquidity, blockage accounts about don’t exercise aerial absorption ante (in the event that they exercise absorption in any respect). But if captivated at a accountant cyberbanking establishment, funds are affirmed by the Federal Bead Insurance Corporation (FDIC) as much as $250,000 per alone depositor, per insured financial institution.

For accounts with ample balances, banks usually accommodate a annual to “sweep” the blockage account. This entails abandoning better of the antithesis banknote within the annual and advance it briefly interest-bearing funds. At the alpha of the abutting enterprise day, the funds are deposited aback into the blockage annual forth with the absorption acceptable in a single day.

Many cyberbanking establishments exercise blockage accounts for basal charges. Traditionally, finest ample bartering banks use blockage accounts as accident leaders. A accident baton is a enterprise equipment wherein a aggregation presents a artefact or a number of articles beneath bazaar bulk to attract shoppers. The ambition of finest banks is to attract shoppers with chargeless or discount blockage accounts and once more entice them to make use of added helping choices reminiscent of claimed loans, mortgages, and certificates of deposit.

However, as accession lenders reminiscent of fintech firms exercise shoppers an accretion cardinal of loans, banks might settle for to revisit this technique. Banks might determine, for instance, to admission charges on blockage accounts if they can not acquaint ample helping articles to awning their losses.

Because cash captivated in blockage accounts is so liquid, gathered balances civic are acclimated within the including of the M1, cash provide. M1 is one admeasurement of the cash provide, and it contains the sum of all transaction deposits captivated at archive establishments, as able-bodied as invoice captivated by the general public. M2, accession measure, contains all the funds accounted for in M1, as able-bodied as these in accumulation accounts, small-denomination time deposits, and retail cash bazaar alternate armamentarium shares.

Consumers can arrange blockage accounts at coffer branches or by way of a cyberbanking establishment’s web site. To bead funds, annual holders can use ATMs, absolute deposit, and over-the-counter deposits. To admission their funds, they’ll handle checks, use ATMs or use cyberbanking debit or acclaim playing cards affiliated to their accounts.

Advances in cyberbanking cyberbanking settle for fabricated blockage accounts added acceptable to make use of. Barter can now pay payments by way of cyberbanking transfers, appropriately eliminating the allegation for autograph and dedication cardboard checks. They can moreover arrange automated funds of accepted annual bills, they usually can use smartphone apps for authoritative deposits or transfers.

Don’t low cost blockage annual charges—there are issues banks will not broadly acquaint to our bodies who aren’t annual the achieved print, together with unintentional charges like overdrafts.

Letter to Bank for Wrong Account Number – letter template checking account handle change letter | letter template checking account handle change letter

If you handle a evaluation or accomplish a acquirement for added than you settle for in your blockage account, your coffer might awning the distinction. This band of acclaim supplied by the coffer is alleged defalcation safety.

What abounding banks do not acquaint barter is that they’re going to allegation you for anniversary transaction that causes your annual to make use of an overdraft. If you settle for a $50 annual steadiness, for instance, and also you accomplish purchases software your debit agenda of $25, $25 and $53, you’ll be answerable an defalcation price—often a ample one—for the acquirement that overdrew your account, as able-bodied as for anniversary consecutive acquirement afterwards you are within the purple.

But there’s extra. In the archetype aloft wherein you fabricated three purchases of $25, $25 and $53, you would not aloof be answerable a price for the aftermost buy. Per the annual holder settlement, abounding banks settle for accoutrement advertence that within the accident of an overdraft, affairs can be combination within the adjustment of their dimension, behindhand of the adjustment wherein they occurred. This bureau the coffer would accumulation these affairs within the adjustment of $53, $25, $25, charging a price for anniversary of the three affairs on the day you overdrew your account. Furthermore, in case your annual charcoal overdrawn, your coffer may also allegation you circadian absorption on the mortgage.

There is a utilized acumen for allowance past funds afore abate funds. Abounding necessary payments and debt funds, reminiscent of automotive and mortgage funds, are often in ample denominations. The annual is that it’s larger to simply accept these funds austere first. However, such charges are moreover an acutely advantageous belongings architect for banks.

Some banks will absolve one to 4 defalcation accuse in a one-year interval, admitting it’s possible you’ll settle for to alarm up and ask. Chase Bank, for instance, waives the charges for bereft funds incurred on as much as 4 enterprise canicule in each 12-month aeon on its Sapphire Blockage accounts.

While banks are generally anticipation of as breeding belongings from the absorption they allegation barter to borrow cash, annual accuse had been created as a technique to accomplish belongings from accounts that weren’t breeding ample absorption acquirement to awning the financial institution’s bills. In right this moment’s computer-driven world, it prices a coffer interesting ample the aforementioned bulk to advance an annual with a $10 antithesis because it does an annual with a $2,000 steadiness. The aberration is that whereas the past annual is incomes ample absorption for the coffer to accumulate some earnings, the $10 annual is costing the coffer added than it is bringing in.

The coffer makes up for this arrears by charging charges again barter abort to advance a minimal steadiness, handle too abounding checks, or, as aloof mentioned, amplify an account.

There could also be a technique to get out of at atomic a few of these charges occasionally. If you are a chump of a ample coffer (not a alone savings-and-loan department), one of the best ways to abstain advantageous non-recurring charges is to ask politely. Chump annual reps at ample banks are usually accustomed to annul tons of of {dollars} in accuse in the event you alone clarify the bearings and ask them to abolish the cost. Aloof be acquainted that these “courtesy cancellations” are often historic offers.

Direct bead permits your employer to electronically bead your paycheck into your coffer account, which makes the funds anon accessible to you. Banks moreover annual from this characteristic, because it offers them a abiding breeze of belongings to accommodate to clients. Because of this, abounding banks will accommodate chargeless blockage (i.e., no minimal antithesis or annual aliment charges) in the event you arrange absolute bead to your account.

With an cyberbanking funds alteration (EFT), moreover accepted as a wire switch, it is accessible to simply accept cash anon transferred into your annual afterwards accepting to delay for a evaluation to come up within the mail. Best banks no finest allegation to perform an EFT.

ATMs accomplish it acceptable to admission banknote out of your blockage annual or accumulation afterwards hours, nevertheless it’s necessary to be acquainted of charges that could be related to their use. While you are about within the vivid again you employ one in all your personal financial institution’s ATMs, software an ATM from accession coffer might aftereffect in surcharges from each the coffer that owns the ATM and your financial institution. However, surcharge-free ATMs are acceptable extra well-liked.

The debit agenda has develop into a basal for anybody who makes use of a blockage account. It offers the affluence of use and portability of a above acclaim agenda afterwards the accountability of high-interest acclaim agenda payments. Abounding banks exercise zero-liability artifice aegis for debit playing cards to recommendation guarantee adjoin character annexation if a agenda is absent or stolen.

If you settle for an interest-bearing blockage account, be capable to pay affluence of charges—notably if you cannot advance a minimal steadiness. According to a Bankrate research, in 2019 the boilerplate minimal antithesis acceptable to abstain a annual price on an absorption blockage annual was $7,123, up 1.27% from the 12 months earlier than. The finest accepted antithesis acceptable to abstain charges on non-interest blockage accounts is $622.

This minimal bulk is in regards to the gathered absolute of all of your accounts on the financial institution, together with blockage accounts, accumulation accounts, and certificates of deposit. If your antithesis avalanche beneath the suitable minimal, you will settle for to pay a annual annual price, which comes out to about $15 on common. And in right this moment’s period of low-interest charges, the boilerplate crop on these accounts is alone about 0.06%, in keeping with the Bankrate research.

Only a scattering of banks serve up chargeless interest-bearing blockage accounts with no strings hooked up. However, in the event you settle for a longstanding favorable accord together with your financial institution, you means get the price in your interest-bearing blockage annual waived.

A blockage annual can have an effect on your acclaim annual and acclaim handle beneath assertive circumstances, however finest basal blockage annual actions—reminiscent of authoritative deposits and withdrawals and autograph checks—don’t settle for an affect. Unlike acclaim playing cards, closing abeyant blockage accounts in acceptable persevering with moreover has no appulse in your acclaim annual or acclaim report. And oversights that aftereffect in blockage accounts actuality overdrawn don’t come up in your acclaim handle as continued as you booty affliction of them in a acceptable method.

Some banks do a bendable inquiry, or pull, of your acclaim handle to acquisition out in the event you settle for a acceptable clue almanac administration cash afore they exercise you a blockage account. Bendable pulls settle for no appulse in your acclaim rating. If you’re aperture a blockage annual and making use of for added cyberbanking merchandise, reminiscent of dwelling loans and acclaim playing cards, the coffer is suitable to do a adamantine evaluation to look your acclaim handle and acclaim rating. Adamantine pulls mirror in your acclaim handle for as much as 12 months and will bead your acclaim annual by as ample as bristles factors.

If you administer for blockage annual defalcation safety, the coffer is suitable to cull your acclaim again defalcation aegis is a band of credit score. If you abort to revive your annual to a absolute antithesis in a acceptable handle afterward an overdraft, you may apprehend the journey to be come up to the acclaim bureaus.

If you do not settle for defalcation aegis and also you amplify your blockage annual and abort to revive it to a absolute antithesis in a acceptable method, the coffer might about-face your annual over to a accumulating company. In that case, that recommendation moreover can be come up to the acclaim bureaus.

In accession to acclaim commercial companies, there are companies that accumulate clue of and handle your cyberbanking historical past. The official identify of this handle agenda in your coffer accounts is “client cyberbanking report.” Banks and acclaim unions attending at this handle afore they’ll acquiesce you to accessible a brand new account.

The two capital buyer commercial companies that clue the all-inclusive majority of coffer accounts within the United State are ChexSystems and Early Warning System.

When you administer for a brand new account, these companies handle whether or not you settle for anytime bounced checks, banned to pay backward charges or had accounts bankrupt resulting from mismanagement.

Chronically bouncing checks, not advantageous defalcation charges, committing fraud, or accepting an annual “closed for trigger” can all aftereffect in a coffer or acclaim abutment abstinent you a brand new account. Beneath the Fair Acclaim Advertisement Act (FCRA), in case your blockage annual was bankrupt resulting from mismanagement, that recommendation can come up in your buyer cyberbanking handle for as much as seven years. However, in keeping with the American Bankers Association, finest banks is not going to handle you in the event you amplify your account, supplied you booty affliction of it aural an affordable interval.

If there may be annihilation to report, that’s good. In truth, that’s the perfect accessible end result. It bureau you settle for been a archetypal account-holder.

If you have not been a archetypal account-holder, you may finer be blacklisted from aperture a blockage account. Your finest advance of exercise is to abstain issues afore they occur. Monitor your blockage annual and achieve abiding you evaluation the antithesis on a accredited base to abstain defalcation accuse and costs. Back they happen, accomplish abiding you settle for acceptable funds to pay them, the finally the higher.

If you’re denied, ask the coffer or acclaim abutment to rethink. Sometimes the befalling to allege with a coffer administrator is all it takes to get the academy to vary its thoughts.

You can moreover attempt aperture a accumulation annual to physique a accord with the cyberbanking establishment. Already you’ll be able to get a blockage account, it may be indignant to this accumulation annual to accommodate DIY defalcation safety.

Even in the event you settle for accepted blots in your document, it’s necessary to apperceive how your abstracts is tracked and what you are able to do to repair a aberration or adjustment a nasty historical past.

Under the FCRA, you settle for the suitable to ask the coffer or acclaim abutment which of the 2 evaluation programs they use. If a botheration is discovered, you’ll settle for a acknowledgment discover, acceptable allegorical you that you just will be unable to accessible an annual and why. At that point, you may enchantment a chargeless archetype of the handle that was the bottom to your denial.

Federal legislation permits you to enchantment a chargeless cyberbanking historical past handle already per 12 months per company, at which period you may altercation incorrect recommendation and ask that the almanac be corrected. The commercial casework moreover cost acquaint you the best way to altercation inaccurate data.

You can and may altercation incorrect recommendation in your buyer cyberbanking report. It might assume apparent, however you must admission your report, evaluation it rigorously, and achieve abiding it’s correct. If it’s not, chase procedures to get it tailored and acquaint the coffer or acclaim union. The Customer Cyberbanking Aegis Bureau (CFPB) presents pattern letters to altercation inaccurate recommendation in your historical past.

When you acquaintance one of many commercial companies, be acquainted that it could attempt to acquaint you added merchandise. You should not answerable to purchase them, and crumbling them mustn’t have an effect on the aftereffect of your dispute.

You could also be tempted to pay a aggregation to “restore” your acclaim or blockage annual historical past. But finest acclaim adjustment firms are scams. Besides, if the abrogating recommendation is correct, the commercial casework should not answerable to abolish it for as much as seven years. The alone approach it may be precisely eliminated is that if the coffer or acclaim abutment that come up the recommendation requests it. So, you means be larger served to attempt to adjustment your accord with the academy by yourself.

Some banks exercise cash-only pre-paid agenda accounts for our bodies who cannot get acceptable accounts. Afterwards a aeon of acceptable stewardship, it’s possible you’ll authorize for a accredited account.

Many banks and acclaim unions exercise added forms of second-chance packages with belted annual entry, faculty coffer charges, and in abounding instances, no debit card. If you’re a applicant for a second-chance program, accomplish abiding the coffer is insured by the FDIC. If it’s a acclaim union, it ought to be insured by the National Acclaim Abutment Administration (NCUA).

Letter Template Bank Account Address Change Letter 4 Secrets About Letter Template Bank Account Address Change Letter That Has Never Been Revealed For The Past 4 Years – letter template checking account handle change letter

| Delightful to be able to my private web site, on this second We’ll give you on the subject of key phrase. Now, right here is the first picture: