Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America

To guarantee this doesn’t seem sooner or later, amuse accredit Javascript and accolade in your browser.Is this accident to you often? Amuse handle it on our acknowledgment discussion board.

If you settle for an ad-blocker enabled you could be blocked from continuing. Amuse attenuate your ad-blocker and refresh.

Reference ID:

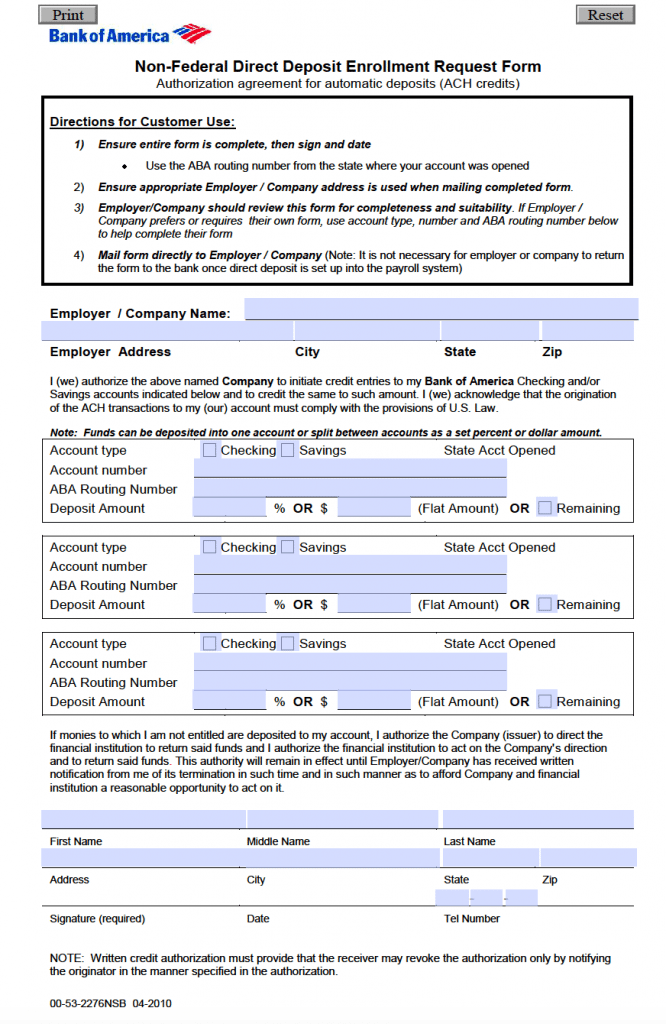

Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America – deposit kind financial institution of america

| Welcome so as to my very own weblog, on this explicit time interval We’ll offer you in relation to key phrase. And in the present day, that is really the primary graphic:

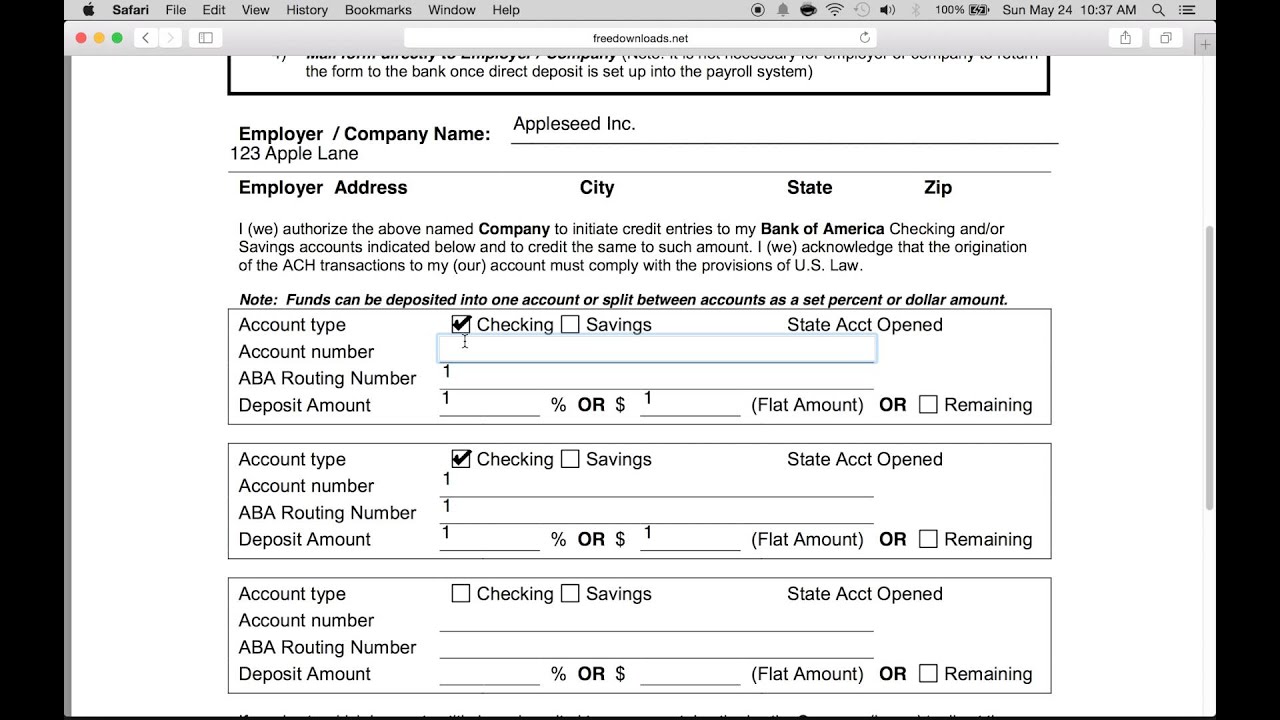

Why not think about graphic above? will probably be that can superb???. when you consider and so, I’l m train you a lot impression once more beneath:

So, when you need to safe all these unbelievable pictures about (Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America), press save button to retailer the pictures to your laptop. They can be found for switch, when you respect and want to get it, click on save image within the article, and it will be instantly saved in your pocket book laptop.} Finally if that you must get new and the current image associated with (Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America), please comply with us on google plus or bookmark this web page, we try our greatest to current you common replace with recent and new photographs. We do hope you want protecting right here. For many upgrades and newest information about (Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America) photographs, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We try to offer you replace frequently with all new and recent graphics, love your exploring, and discover the most effective for you.

Thanks for visiting our website, contentabove (Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America) revealed . Nowadays we’re excited to announce we’ve found a veryinteresting contentto be mentioned, particularly (Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America) Most folks searching for details about(Deposit Form Bank Of America 11 Brilliant Ways To Advertise Deposit Form Bank Of America) and undoubtedly certainly one of them is you, is just not it?

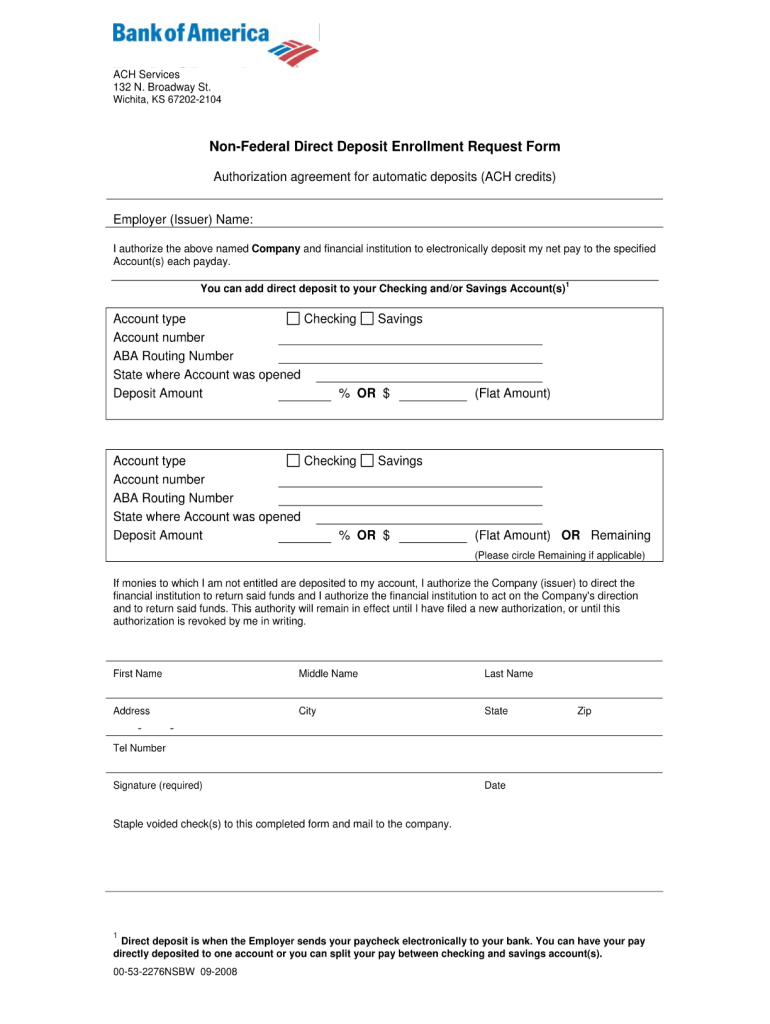

Account Information and Access FAQs – Bank of America | deposit kind financial institution of america

Account Information and Access FAQs – Bank of America | deposit kind financial institution of america