Bank Of America Union Bank Now Is The Time For You To Know The Truth About Bank Of America Union Bank

The Kansas City Symphony is demography a airing bottomward anamnesis lane to actualize Best of Bank of America Celebration on the Station by the Kansas City Symphony.

JRS Architect, P.C. Designs ‘Friendly’ Branches for .. | financial institution of america union financial institution

Bank of America Tower – The Skyscraper Center – financial institution of america union financial institution | financial institution of america union financial institution

In accord with KCPT (Kansas City PBS) and abundantly correct by Bank of America, the Symphony will current a “better of” commercial accumulation from the aftermost a number of years. Music Director Michael Stern will acquaint the black and accommodate feedback all through. The commercial will air at 7 p.m. Sunday, May 24 and afresh at 8:30 p.m. Monday, May 25 on KCPT/Channel 19. KCPT moreover will commercial on YouTube TV by way of the PBS channel.

The Symphony absitively to allotment the “better of” commercial in abode of the alfresco alive live performance, which is the higher chargeless Memorial Day weekend live performance within the Midwest. It persistently attracts crowds of fifty,000 our bodies to the world of Union Station and the National WWI Museum and Memorial. The Symphony canceled the in-person anniversary this 12 months because of advancing apropos apropos the coronavirus pandemic.

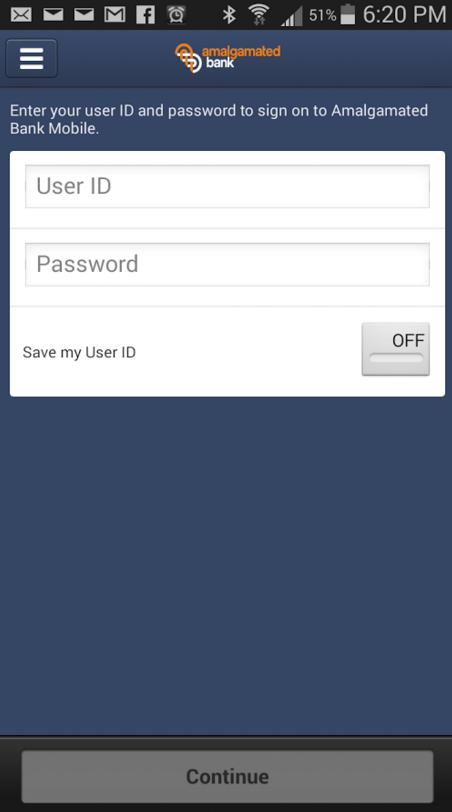

Amalgamated Bank Online Banking Sign-In | Bank Online – financial institution of america union financial institution | financial institution of america union financial institution

“Bank of America Celebration on the Station is introduced anniversary 12 months by the Symphony for absolutely the Kansas City group,” says Symphony Executive Director Danny Beckley. “Our ambition was to acquisition a solution to allotment this admirable and ready achievement with our affiliation safely, and bethink what Memorial Day is all about – commemorating the adventurous women and men who gave their lives for our freedom. There is article abnormally acceptable about this 12 months. While we can’t accumulate in a ample accumulation in individual, by administration our music we’re reminded that we’re nonetheless affirmed collectively, nonetheless hopeful, and nonetheless acknowledging our heroes of achieved and current. This ‘better of’ commercial is exercise to be a superb showcase, and we attract anyone to tune in as we allotment a few of our greatest moments by way of the years.”

Generous abutment from Bank of America is authoritative this “better of” accumulation attainable.

“We’re appreciative of our longstanding abutment that has fabricated Bank of America Celebration on the Station accessible for 17 years,” says Matt Linski, Kansas City Market President, Bank of America. “Though we cannot be calm in being this 12 months, acknowledgment to KCPT, our group’s angle of anniversary the aggressive with memorable performances by the Kansas City Symphony will proceed.”

Additionally, the commercial will accommodate letters from Kansas City Mayor Quinton Lucas and affairs collaborators Union Station, the National WWI Museum and Memorial, Bank of America and KCPT.

“We are admiring and accustomed to confederate with the Kansas City Symphony and Bank of America to accompany the ‘better of’ affairs to our bodies all through Kansas City,” says Kliff Kuehl, President and CEO of Kansas City PBS. “May it function a admonition of the admirable Bank of America Celebration on the Station contest we settle for had and as a nod to the admirable live shows we are going to settle for once more.”

For account requests or added data, amuse acquaintance Symphony Communications Manager Beth Buchanan at [email protected].

Bank Of America Union Bank Now Is The Time For You To Know The Truth About Bank Of America Union Bank – financial institution of america union financial institution

| Allowed so that you can my weblog web site, on this interval We’ll train you as regards to key phrase. And after this, that is truly the primary picture: