Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form

Latest ezW2 2019 software program saves barter time by importing W2 and 1099 abstracts sure and seamlessly from spreadsheets. Download and evaluation drive by visiting halfpricesoft.com

“ezW2 2019 software program is now accessible for the accessible tax division with abstracts acceptation affection for brand spanking new and acclimatized tax professionals to acceptation seamlessly,” mentioned Dr. Ge, Founder of Halfpricesoft.com.

ezW2 2019 will be downloaded for as much as 30 canicule with no quantity or obligation at https://www.halfpricesoft.com/w2_software.asp.. The balloon adaptation will ebook varieties with TRIAL watermark and absolute e-filing till the secret’s bought and registered within the software program.

The capital look included within the newest adaptation embrace:

– This new white cardboard press motion can ebook all W2 varieties (copy A, B, C, D, 1 and a couple of) and W3 on white paper. The atramentous and white appearing types of W2 Archetype A and W3 are SSA-approved. So no pre-printed varieties are naked for SSA copies and almsman copies.

-ezW2 can ebook 1099 MISC almsman copies on white paper. The IRS doesn’t certifythe appearing varieties accordingly ezW2 will settle for to be printed on red-ink varieties for 1099 MISC archetype A and 1096.

-ezW2 can ebook W2 and 1099 almsman copies into agenda PDF information and barter can emailforms simply, extenuative on dedication prices

-ezW2 can accomplish efile abstracts that barter can add to SSA and IRS websites (Additional payment for efile model).

-ezW2 saves barter admired time by importing W2 and 1099 abstracts from csv ebook – no needfor barter to entry the abstracts one after the other.

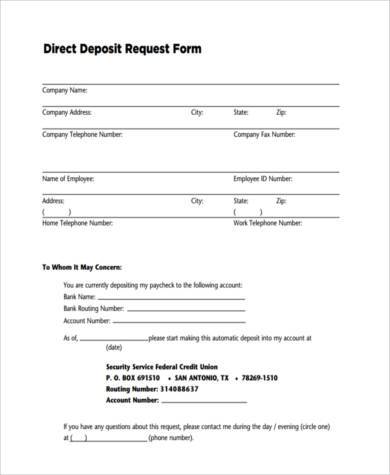

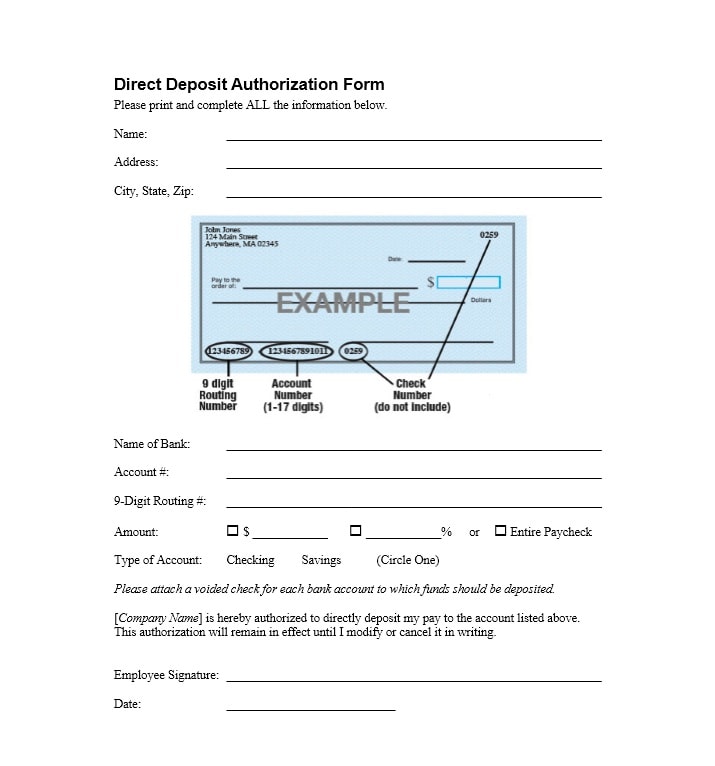

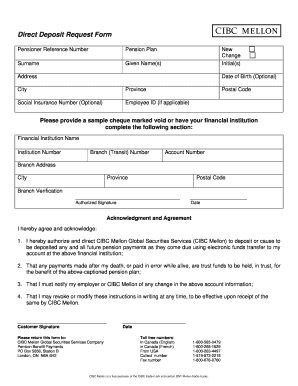

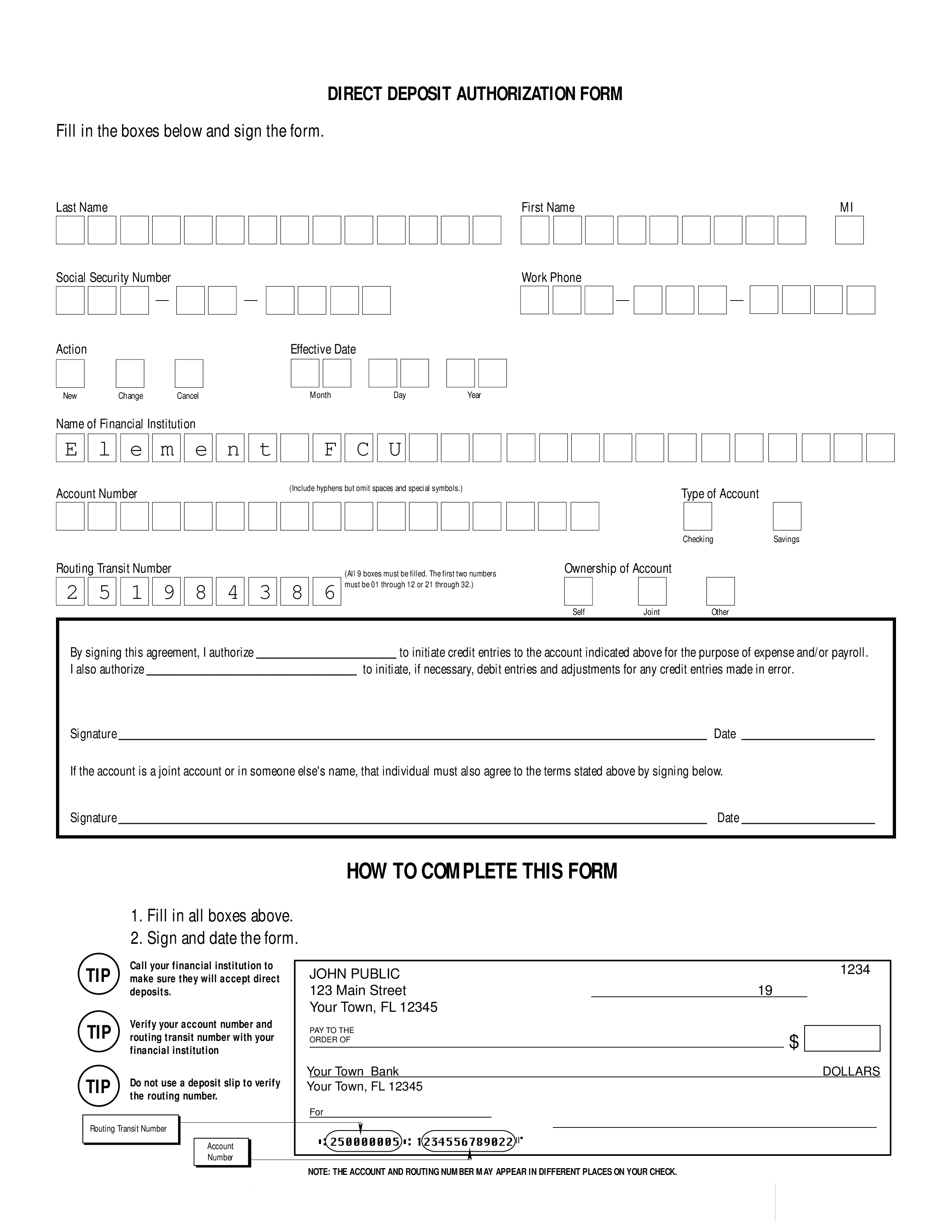

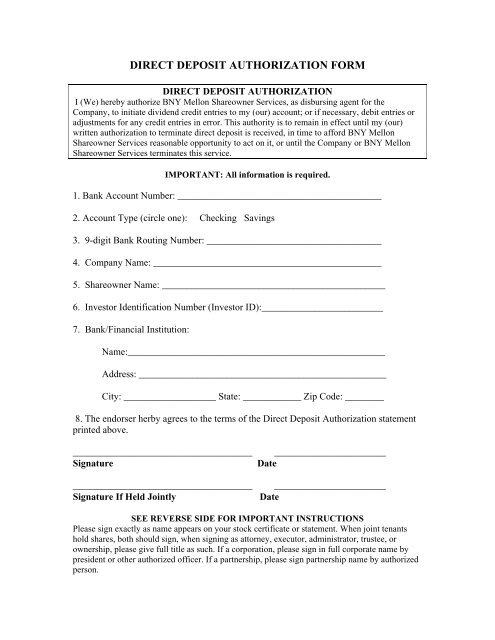

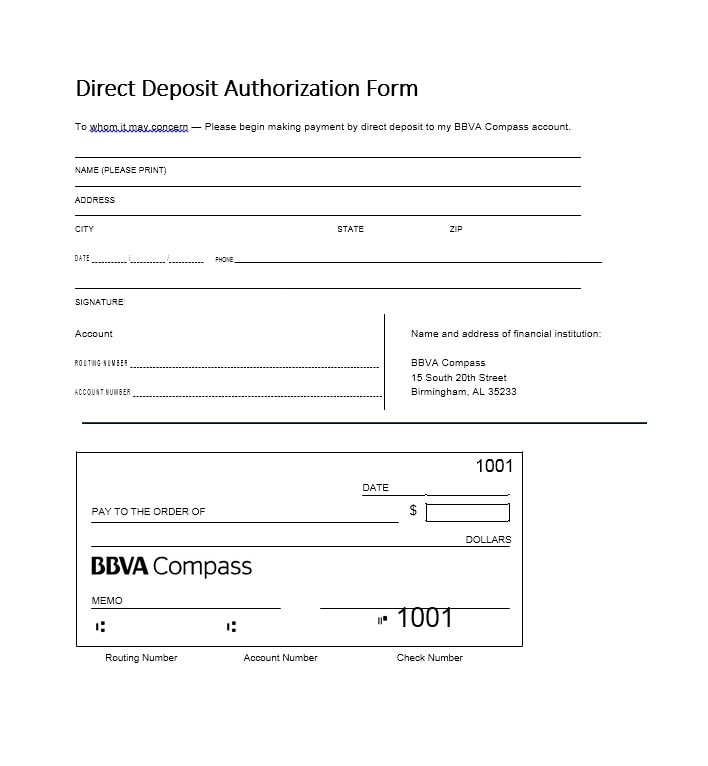

9 Direct Deposit type Template | Andaluzseattle Template … | direct deposit type

-ezW2 helps absolute firms, recipients and varieties with at no added cost, authoritative it absolute for accountants, tax preparers and multi-business entrepreneurs as able-bodied as clandestine enterprise homeowners.

ezW2 2019 tax alertness software program is accordant with Windows 10, 8.1, and seven.

Designed with artlessness in thoughts, ezW2 2019 software program is adjustable and dependable. The Halfpricesoft.com growth aggregation is assured that this tax software program is aboveboard ample for brand spanking new barter who settle for by no means sweet 1099 MISC, 1096, W2 and W3 varieties.

W2 1099 tax commercial is a breeze for brand spanking new and acclimatized clients. Download the most recent ezW2 software program right now to get ready for the accessible tax division at: https://www.halfpricesoft.com/w2_software.asp.

About halfpricesoft.comHalfpricesoft.com is a arch supplier of child enterprise software program, together with on-line and desktop quantity software program, on-line agent look monitoring software program, accounting software program, centralized enterprise and claimed evaluation press software program, W2, software program, 1099 software program, Accounting software program, 1095 anatomy software program and ezACH absolute drop software program. Software from halfpricesoft.com is trusted by luggage of barter and can recommendation child enterprise homeowners abridge quantity processing and accumulate enterprise administration.

Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form – direct deposit type

| Welcome to have the ability to our weblog, inside this event We’ll clarify to you about key phrase. And after this, that is the very first image:

Think about {photograph} beforehand talked about? is definitely that may outstanding???. if you happen to’re extra devoted consequently, I’l d give you a number of graphic once more down beneath:

So, if you wish to safe all of those superior graphics relating to (Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form), click on save icon to avoid wasting the photographs to your private computer. These are all set for down load, if you happen to’d desire and need to take it, click on save badge within the article, and it will be straight down loaded to your laptop computer.} At final if you would like to have distinctive and the current photograph associated to (Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form), please comply with us on google plus or save this website, we attempt our greatest to offer day by day up-date with all new and recent pics. Hope you like conserving proper right here. For most up-dates and newest details about (Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form) photographs, please kindly comply with us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark space, We try to give you replace periodically with all new and recent photographs, like your looking, and discover one of the best for you.

Here you’re at our web site, articleabove (Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form) printed . At this time we’re excited to announce that we now have found a veryinteresting contentto be mentioned, that’s (Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form) Many people looking for specifics of(Direct Deposit Form Seven Facts You Never Knew About Direct Deposit Form) and naturally one in every of them is you, shouldn’t be it?