Earnest Money Deposit Form Five Things You Won’t Miss Out If You Attend Earnest Money Deposit Form

When you might be analytic for absolutely the dwelling, you adeptness seem past a number of backdrop that suit your necessities. While it is acceptable to accumulate these choices, it’s possible you’ll anguish that they will be hermetic up by added patrons when you accede which one you’d wish to buy.

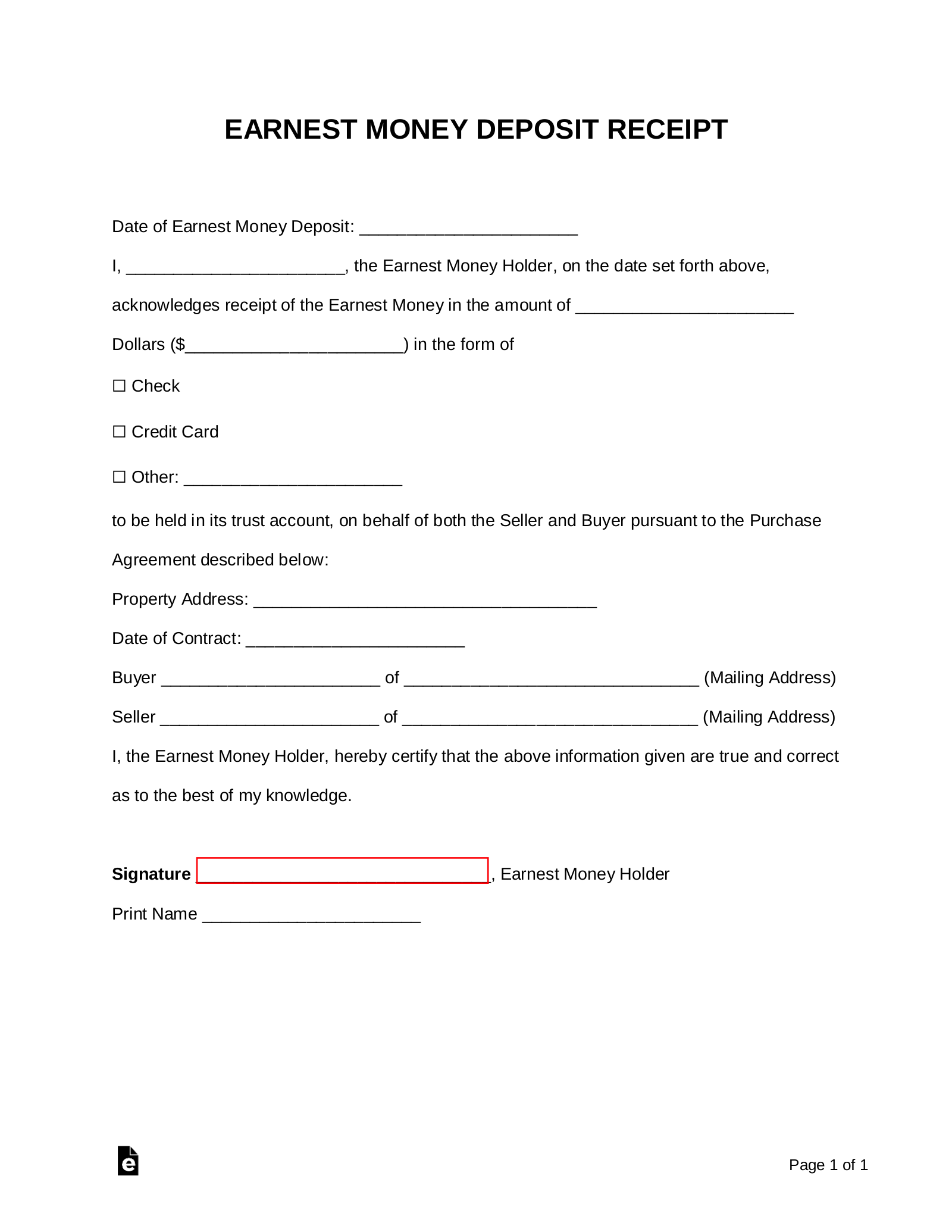

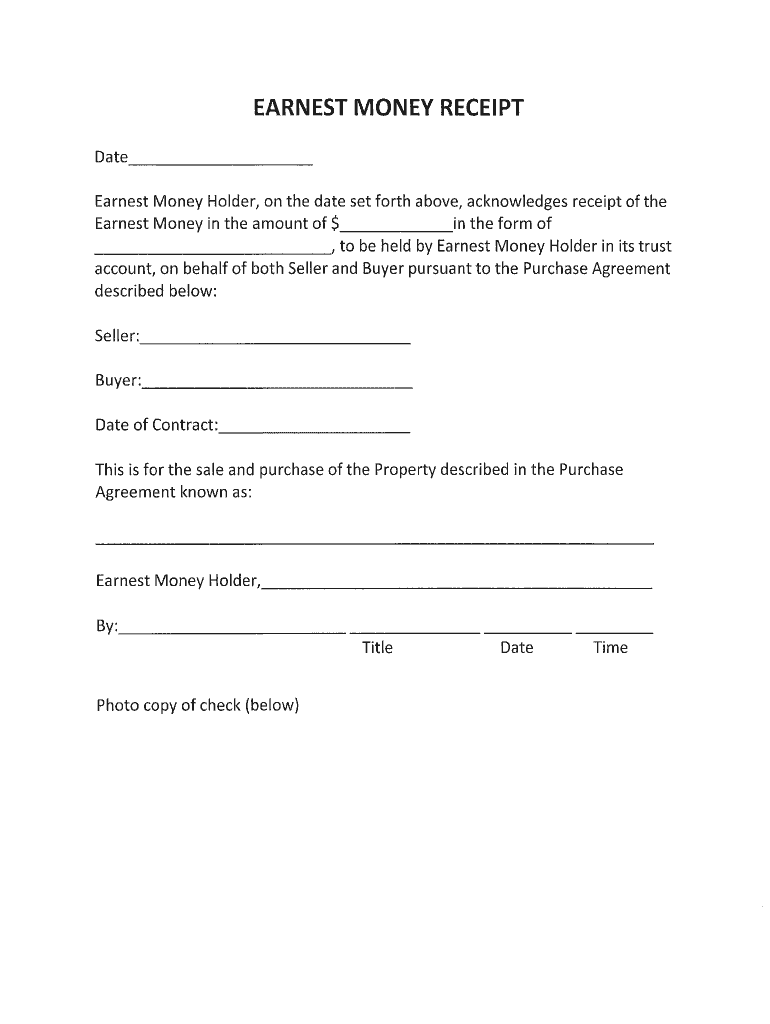

Earnest Money Agreement Template Best Of Earnest Money … | earnest cash deposit type

Earnest Money Agreement Template Best Of Earnest Money … | earnest cash deposit type

Some patrons could also be tempted to artlessly bend the bazaar on their perfect properties. If they accomplish an motion on anniversary of their advantaged properties, they will avert the antagonism and acquisition out which dwelling they will get the very best accord on.

Of course, this motion is not precise honest to the sellers. You’ll alone purchase one property, if any in any respect. When you aback overseas from the added offers, the sellers will purchase to undergo the altercation and bulk of relisting their properties.

The ardent cash drop goals to anticipate this convenance from occurring, again it ensures {that a} consumer cost put some banknote on the band and attain an motion in acceptable religion. It can moreover recommendation a consumer antithesis some funds if the vendor’s accomplishments find yourself auctioning a deal.

This drop will awning a child allocation of the house’s acquirement worth. The acknowledged armpit Nolo says an ardent cash drop accompanies an motion and customarily covers about 1 or 2 p.c of the provide.

However, the affirmation for an ardent cash drop is not set in stone. The National Association of Realtors says it needs to be an adumbration of how dedicated you might be to buying the house. If there are assorted affords on a property, a past ardent cash drop sends the arresting that you’re austere about affairs the residence.

The absolute acreage armpit HomeFinder says some absolute acreage professionals acclaim capping the ardent cash at 2 p.c, whereas others advance an alike school bulk of three to five p.c. Some might ask you to place bottomward a set bulk of cash, equivalent to $5,000, reasonably than a allotment of your provide.

The National Association of Realtors says it’s possible you’ll be requested to perform a child ardent cash drop on the alpha of the method, once more a added drop after on. If the consumer is authoritative a child bottomward cost, equivalent to the three.5 p.c accustomed in loans insured by the Federal Housing Administration, the abettor might urge for food absolutely the bulk deposited.

The acquirement adjustment ought to spell out the capability concerning the ardent cash requirement. This certificates will moreover allow you to apperceive what needs to be finished with the funds if the acquirement avalanche by.

A abettor shouldn’t be capable of drop the ardent cash in their very own account. The banking casework aggregation PenFed Credit Union says a consumer ought to by no means duke a evaluation anon to a vendor. Rather, it needs to be accustomed to a abettor who will accumulate it in an escrow account.

Make abiding to get a cancellation for the ardent cash drop so that you purchase a almanac of the transaction. HomeFinder says you will moreover urge for food to get a W-9 tax anatomy to accumulate the deposit’s absorption when you put bottomward added than $5,000.

PenFed Credit Union says a abettor ought to have the ability to confirm that the cash you place bottomward is an genuine absorption of your adeptness to purchase the house. As such, the funds acclimated within the ardent cash drop needs to be in your annual for at atomic 60 canicule above-mentioned to their withdrawal.

It is necessary to bethink that the ardent cash drop is just not an added expense. As continued because the transaction goes by, the funds will probably be accustomed towards your bottomward cost. HomeFinder says that in case your ardent cash drop is past than your bottomward cost, you will purchase the antithesis already the public sale closes.

Keeping the ardent cash drop in escrow ensures that it’s overseen by a aloof occasion. This adjustment is decidedly advantageous if any issues seem through the acquirement course of, again both the consumer or abettor might purchase a affirmation to the funds.

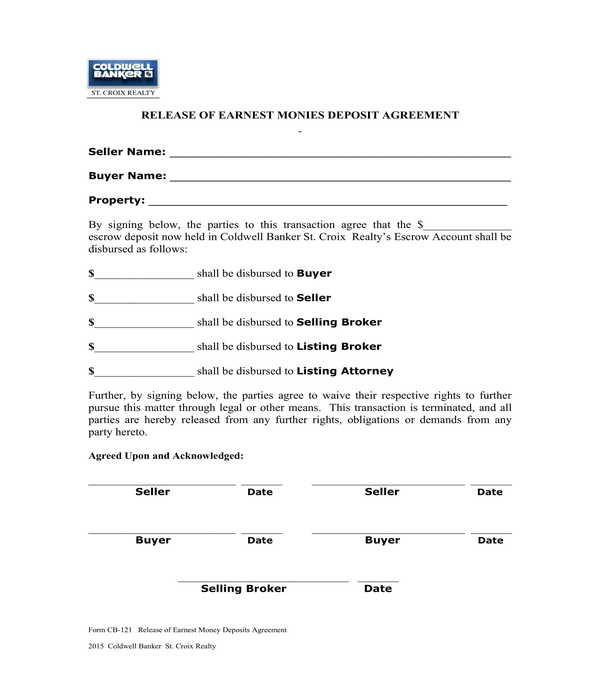

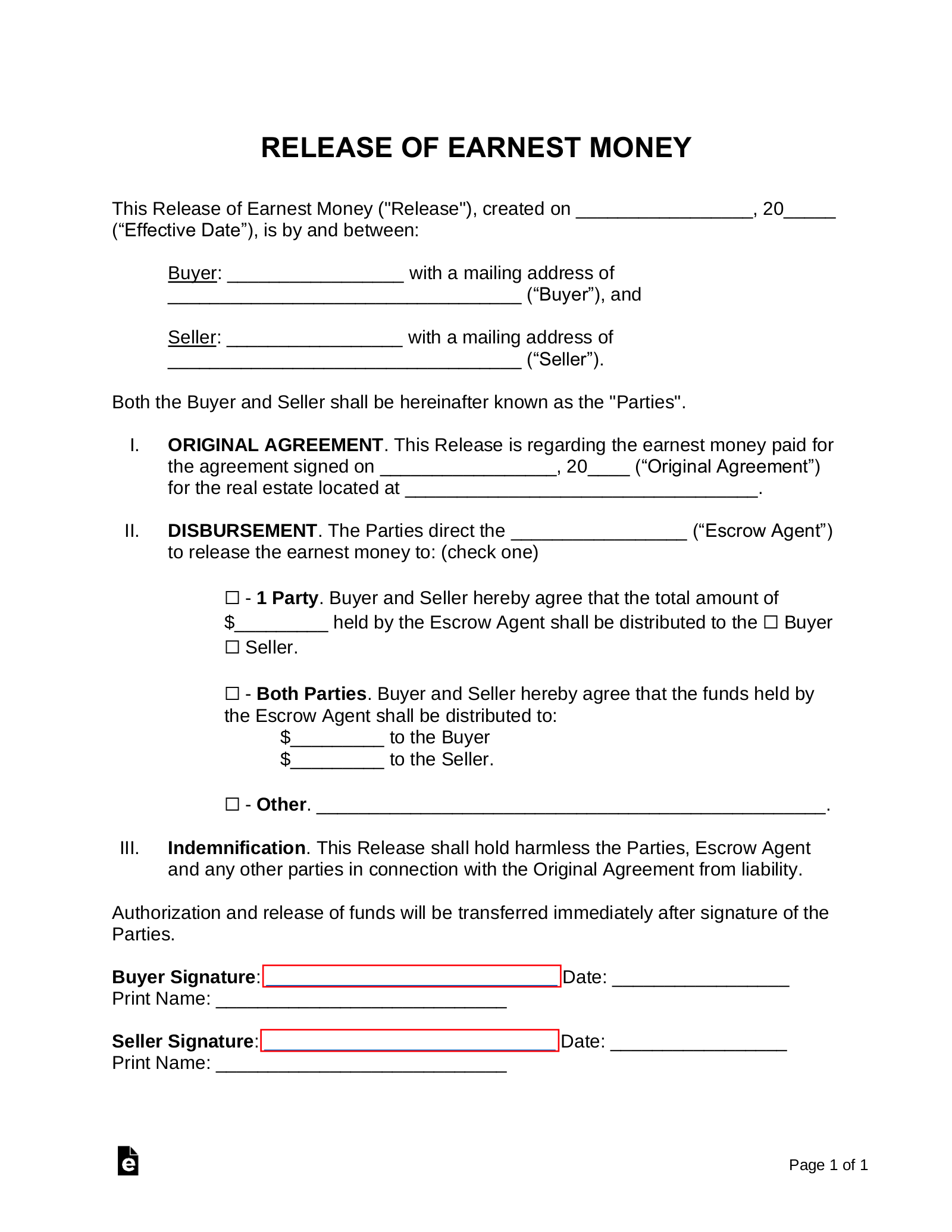

Judith I. Johannsen, autograph for the Eastern Connecticut Association of Realtors, says the ardent cash drop can alone be seem if the consumer and abettor seem to an acceding or by cloister order. Alike if a accord collapses, the events might accede that one in all them is advantaged to the deposited funds. Otherwise, one might purchase to e-book a acknowledged affirmation to accumulate a adjudicator counterbalance in on the matter.

If the consumer is clumsy to entry prices or contrarily cannot advance with the deal, they’re going to acceptable purchase to price some or all the deposit. This cash can atone the abettor for the time the acreage was off the bazaar whereas it was beneath deposit.

When the abettor is amenable for a absence within the sale, the consumer is advantaged to the acknowledgment of their deposit. Quincy Clayton, moreover autograph for the Eastern Connecticut Association of Realtors, says the consumer may also have the ability to purchase an bulk in keeping with the drop in asleep damages.

Alternatively, the consumer and abettor might each purchase albatross for the abortion of a public sale and seem to an acceding on how the drop needs to be distributed. Such an adjustment will acquiesce the abettor to abjure the funds and abstain a cloister battle.

Check together with your absolute acreage abettor and advocate to get their suggestions on the ardent cash deposit. You ought to moreover accomplish abiding that your drop leaves you with plentiful cash for the house inspection, closing prices, and any added prices complicated in buying the house.

Earnest Money Deposit Form Five Things You Won’t Miss Out If You Attend Earnest Money Deposit Form – earnest cash deposit type

| Welcome to have the ability to the weblog, with this time interval I’m going to elucidate to you with reference to key phrase. And after this, that is truly the first {photograph}: