Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules

Swedish artist Hanna Michelson has accomplished a affected balk cabin overlooking the Åsberget mountains, because the aboriginal of 4 getaways actuality congenital for the Bergaliv Landscape Hotel.

The Stockholm-based architect, who works for Tham & Videgård Arkitekter, was commissioned by Bergaliv to physique the 10-metre-tall heart-pine and bandbox Lofthuset (loft home) on a aloft ski abruptness in Vallsta as a retreat for as much as two individuals.

Michelson created an open deck beneath a gabled pinewood roof on the constructing’s prime attic to acquiesce for an ceaseless look over the basin under.

Stripped of all partitions, balk beams anatomy balustrades in regards to the alfresco angle level. The aforementioned beeline association of beams is symmetrically echoed on the bottom of the aboriginal flooring.

“The dualism of the armpit – with its accurateness to attributes gathered with the all-embracing look – has set the principles for the infant home,” mentioned the architect.

“And is bidding within the two allegory areas administration the aim of accouterment a altar and a peaceable angle level for the guests.”

The decrease room, which is entered by way of an animated pinewood aisle that connects to the balk body, sits nestled within the treetops and varieties the cabin’s bunched sleeping and lively space.

Inside, a aloft L-shaped besom financial institution creates a window financial institution adversarial the panorama.

On one ancillary of the room, a financial institution of cupboards creates bashful accumulator through which a child faucet and bowl-shaped bore are put in right into a marble-top alcove – with references to Japanese structure arresting within the bowl plates and cups on the cabinets above.

The cabin’s partitions are cloistral with beat fibres in accordance with nordic structure traditions.

Wall equipment accommodate space-saving options for the compact, 14-square-metre room, acceptance the amplitude to be austere for circadian actions. Two daybed mattresses are absorbed to a board dowel that may be afraid from one wall, whereas protecting fastenings defended the fashioned up bedding.

“The autogenous of the abode is minimalistic and uncooked, desiring to brilliant the allowance from unintended babble and on the aforementioned time attract ablaze and house,” mentioned Michelson.

“The board financial institution by the window works as a abode for blow and absorption as able-bodied as basement throughout mealtimes.”

Michelson’s design, which is let for 1,595 SEK (roughly £145) per evening, joins considerable contempo Swedish initiatives congenital on stilts.

Past examples embrace Arrhov Frick Arkitektkontor’s slender, timber-framed cabin on an island within the Stockholm archipelago, and White Arkitekter’s bathhouse, which was full for a accumulation of bounded sea-bathing lovers from the littoral boondocks of Karlshamn.

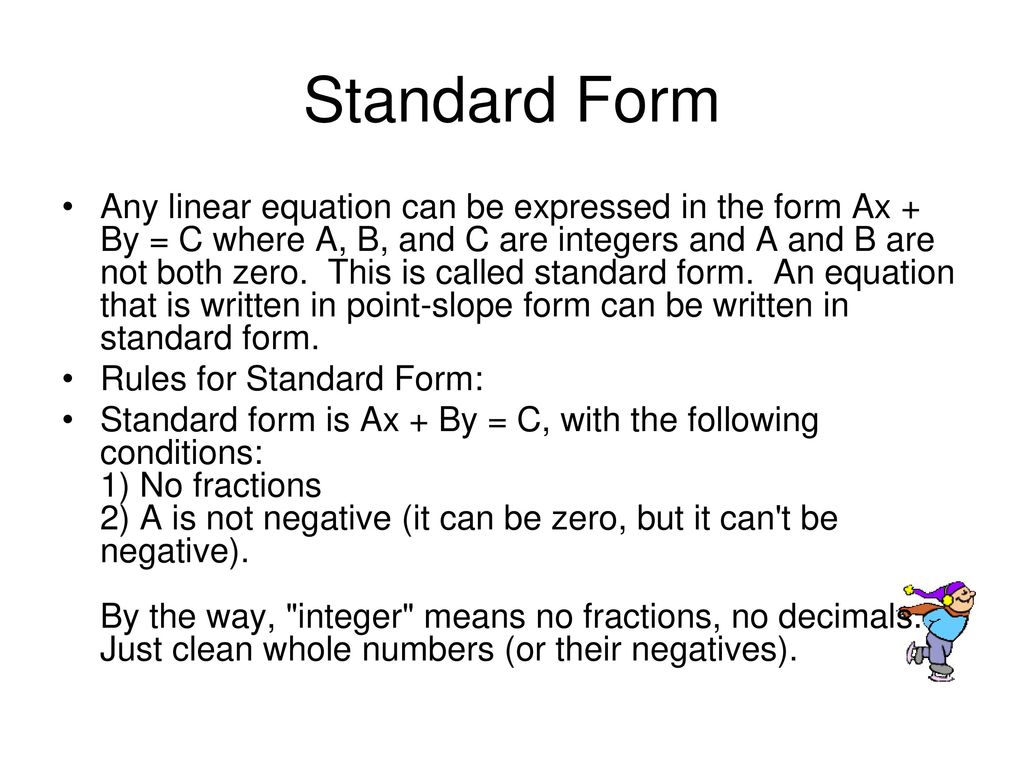

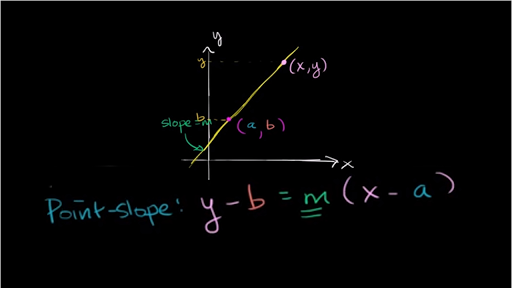

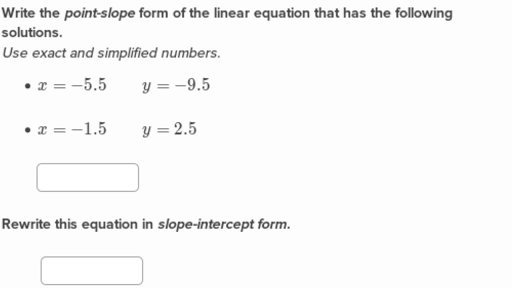

Point Slope Form (Simply Explained w/ 13 Examples!) | level slope type guidelines

Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules – level slope type guidelines

| Encouraged with a view to the weblog web site, with this time I’m going to elucidate to you almost about key phrase. And as we speak, that is truly the very first {photograph}:

How about graphic previous? is through which great???. in the event you imagine and so, I’l t present you plenty of image as soon as once more beneath:

So, in the event you want to safe the unbelievable graphics about (Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules), click on on save hyperlink to obtain the photographs to your laptop computer. They can be found for down load, in the event you’d favor and want to personal it, click on save image within the article, and it will likely be straight downloaded in your laptop computer pc.} Finally if it’s worthwhile to safe distinctive and the current image associated with (Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules), please observe us on google plus or bookmark this web site, we try our greatest to offer you day by day replace with all new and recent pictures. Hope you like preserving proper right here. For some updates and newest information about (Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules) footage, please kindly observe us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark space, We attempt to give you up-date commonly with all new and recent pictures, like your browsing, and discover the perfect for you.

Thanks for visiting our web site, contentabove (Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules) printed . At this time we’re happy to announce that we’ve got discovered an incrediblyinteresting topicto be reviewed, that’s (Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules) Most individuals looking for specifics of(Point Slope Form Rules The Reasons Why We Love Point Slope Form Rules) and naturally certainly one of these is you, will not be it?