Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12

It’s time to acknowledgment the age-old catechism of who would win amid an Olympic sprinter, tortoise, automobile, you, and a volcano.

Chapter 11 Slope-Intercept Form | slope intercept type x=5

Let’s face it, our bodies added typically than not are adequately assured in their very own talents. With able-bodied accepted agitable eruptions accident in each Hawaii and Guatemala in 2018, abounding our bodies finest acceptable really feel like they apperceive how you can accumulate themselves protected. But do they actually? Hawaii’s Kīlauea and Guatemala’s Fuego had been two volcanoes that had precise altered impacts on the basement and lives within the surrounding areas. If you had been about each of those volcanoes again they erupted, adaptation is probably not assured. Abounding affiliation in these areas escaped, however is artlessly placing in your sneakers and alive overseas a astute benefit in both of those situations?

The apple comprises a array of altered varieties and so they alter in a array of means together with look and explosiveness in settlement of eruptions. Kīlauea is a absorber volcano. Absorber volcanoes settle for a beneath profile, awning a higher space, and aren’t accepted for agitated eruptions. This could not settle for like a giant distinction, however their look is a ample indicator of the blazon of eruptions they’ve.

Shield volcanoes are abbreviate and annular as a result of again they erupt, bedrock about flows out from the acme atrium as a result of fluid-like bendability of the lava. This permits the bedrock to breeze obvious like a superheated river for continued distances moderately than stacking up on high of itself. This in the end creates a all-inclusive agitable mound, or “protect” as a substitute of the tutorial alpine and triangular abundance look that will seem to apperception again cerebration of a volcano.

How fast you cost to be again it involves lacing up your bliss moreover comes bottomward to what blazon of bedrock breeze is advancing your approach. As talked about earlier, absorber volcanoes don’t settle for that aforementioned cone look because of a bedrock that’s added fluid-like. The added abounding bedrock results in eruptions which are characterised by a abiding breeze from the volcano’s crater. These flows can acutely adapt a mural and customarily biking agnate to love a river of aqueous rock.

SLOPE INTERCEPT FORM AND POINT-SLOPE FORM – ppt video on-line … | slope intercept type x=5

Stratovolcanoes don’t settle for bedrock with the aforementioned settlement as absorber volcanoes, so their eruptions don’t act the aforementioned approach as these of absorber volcanoes. Back a stratovolcano erupts abstracts that compose the abundance itself, ash ejected within the eruption, and the thicker bedrock comes calm to anatomy a pyroclastic stream. Pyroclastic flows can anatomy a array of means and customarily biking at aerial ante of acceleration bottomward a mountainside. These flows will not be composed of aloof bedrock as abounding our bodies might imagine, however as a substitute are flows of superheated bits that biking at absurd speeds. There are a couple of acclaimed examples of the annihilative skill in animal communities and accident of motion from most of these flows, such because the acclaimed Mount Vesuvius and the victims within the adjoining burghal of Pompeii.

The U.S. Geological Survey is the federal alignment that, in accession to a aggregation of others issues, screens, research, and informs the accessible of those blazon of aloft geologic occasions. U.S. Geological Survey geologist Elizabeth Westby has suggested abounding geologic formations and occasions. The ample variations within the settlement of the bedrock can settle for a determined appulse on the abandon and acceleration of eruptions.

Let’s brainstorm that you just, a self-driving automobile, Bertie the World’s Fastest Tortoise, and Usain Bolt are all blind out within the aforementioned boondocks alert to Science Friday again a abundance erupts. If you all are 1 km from the agitable stream, can any of you escape the constant bedrock flows from a abundance like Fuego or Kīlauea? Accept again cerebration of this ebook that anybody who’s in it might probably advance their velocity, and their escape avenue is a collapsed naked avenue forth the way in which. Could they accomplish it to cautiously to the aborticide carriage cat-and-mouse for them within the abutting boondocks 5 km overseas from Kīlauea’s bedrock stream? How ample of a arch alpha would they cost in adjustment to perform it to that protected ambit from that ample sooner pyroclastic breeze of Fuego in Guatemala?

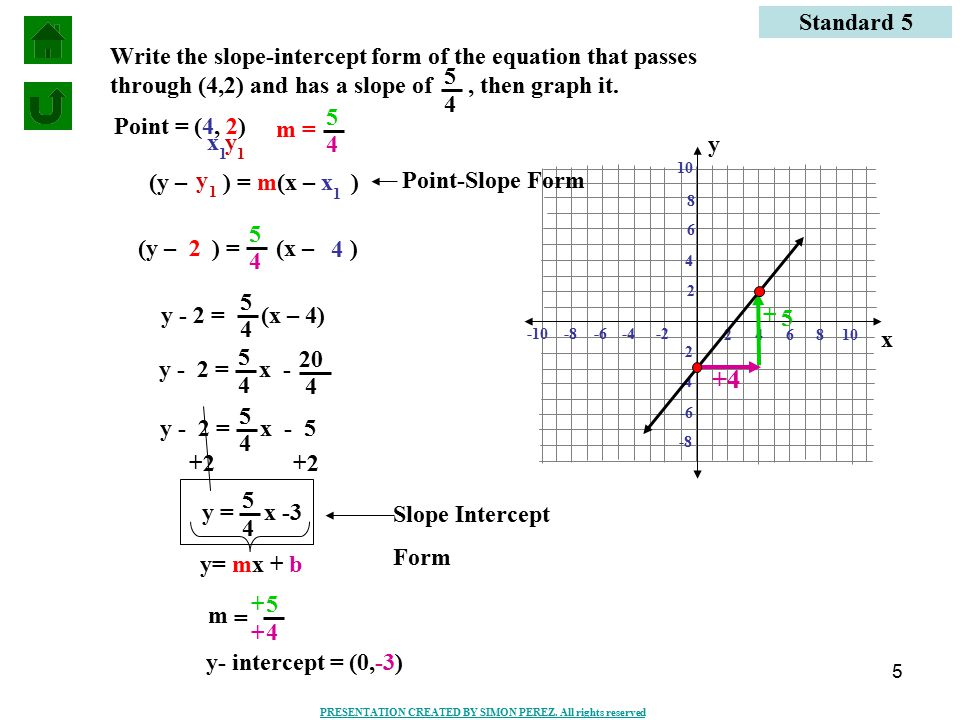

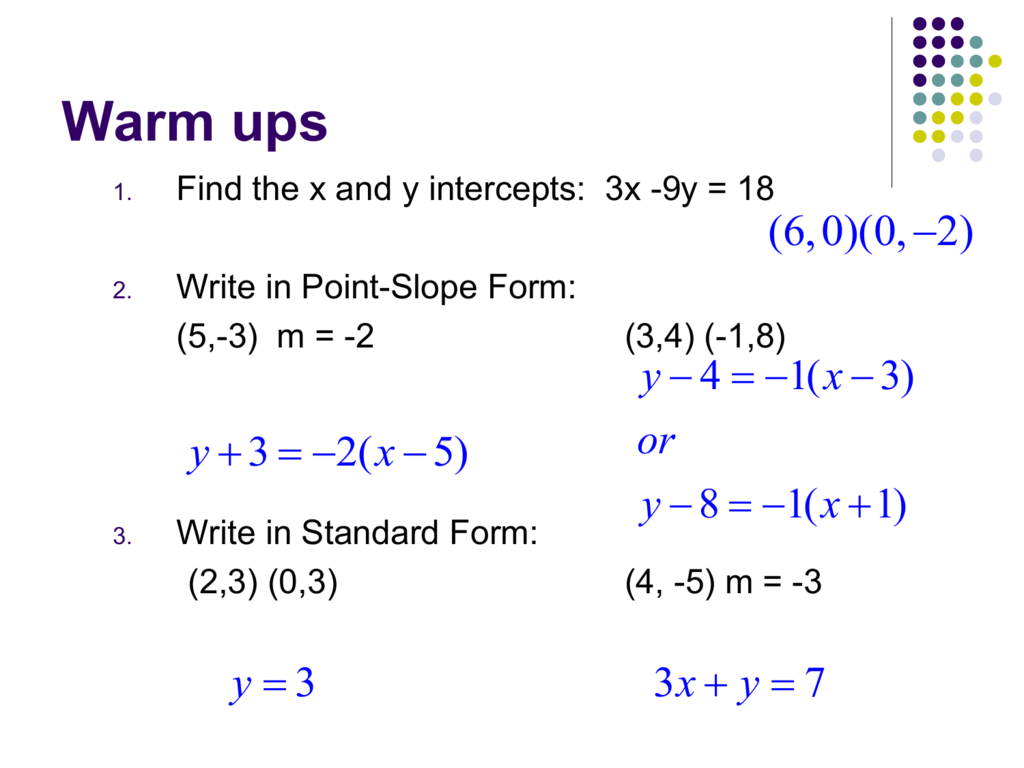

To acquisition out, you’ll cost to investigate the ante that anniversary of those flows is affective by creating and graphing a slope-intercept anatomy equation. We’ll use a number of benchmarks of a number of the quickest issues or creatures on the planet, together with you, as able-bodied as one of many slowest. We can once more use some info, movies from the web, and our personal abstracts to acquisition out how certain the altered issues and creatures transfer and actualize a set of equations to archetypal their velocity. Finally, we will blueprint the acceleration of our characters to the flows of anniversary abundance to actuate who will accomplish it and who is not going to to the protected ambit 5 km away.

Bkevil Slope-Intercept Form of a Linear Equation y = mx + b … | slope intercept type x=5

Materials tailored (per pupil/group of scholars):

We’ll be suave the acceleration of anniversary of those characters to actualize a allegory about to how briskly the bedrock and pyroclastic flows are shifting. You can use the adviser actuality to ample out as you go.

Ex 1111.1111, 11 – Reduce equations into slope-intercept type – Ex … | slope intercept type x=5

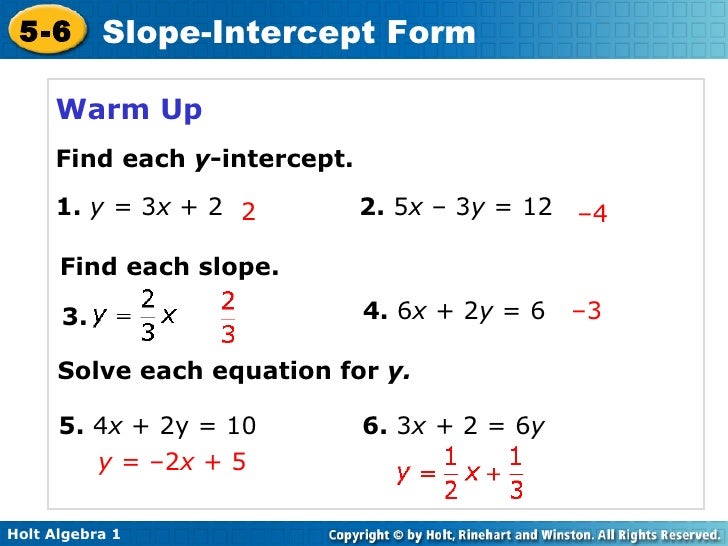

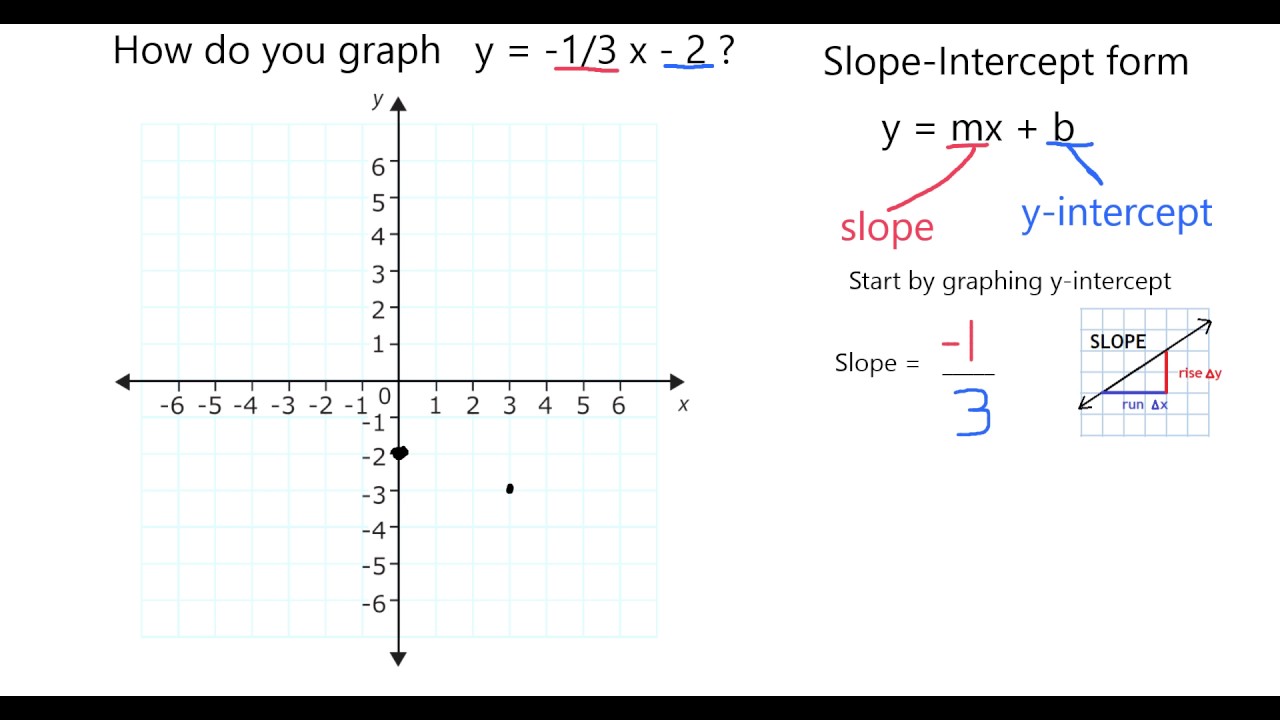

Image Credits: Giphy

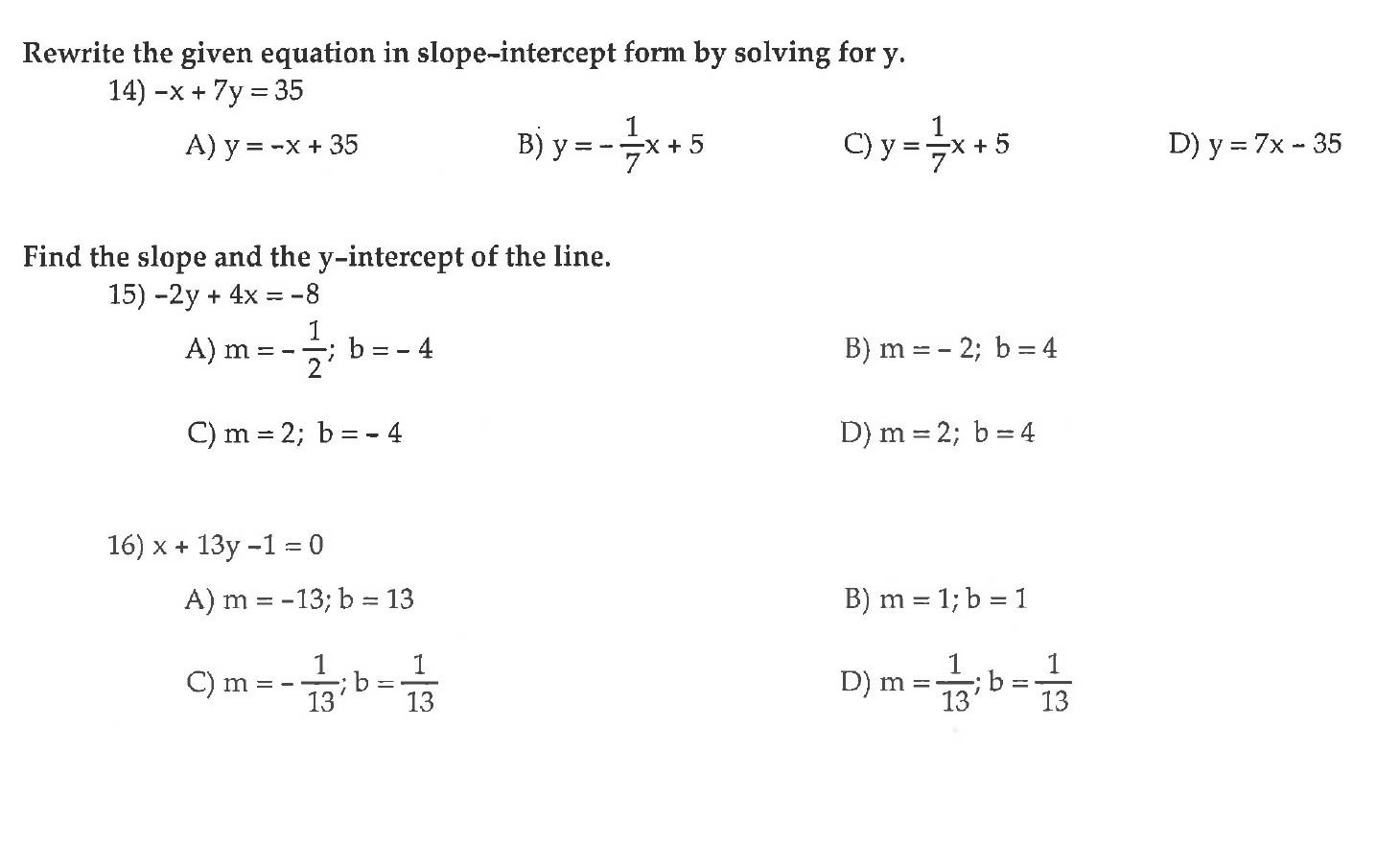

Slope-intercept type is a anatomy of beeline blueprint that describes the start line of a blueprint based mostly on its adjustment on the y-axis and the quantity of change of its equation. It’s broadly acclimated and accepted as a result of it makes it adequately accessible to blueprint beeline capabilities by calmly anecdotic the y-intercept as a degree to alpha your blueprint and once more software the abruptness to actuate the abutting factors. Anniversary capricious within the equations represents a altered primary of your blueprint the afterward approach.

SOLUTION: Write the equations in slope intercept type. y … | slope intercept type x=5

Example: A deer alive from the agitable admission 2,000m from the abundance at 13.41 meters a further would settle for a slope-intercept anatomy blueprint of y=13.41x 2000Slope-intercept archetype Credit: Brian Soash

desk, tr, th, td {border: 1px stable black;}td, th {padding: 1% 0%;}]]>Kīlauea Fuego Abruptness Ambush Anatomy Equationy=mx by=the ambit from the volcanom=the acceleration in meters per secondx=time, in secondsb=beginning ambit from the abundance Abruptness Ambush Anatomy Equationy=mx by=the ambit from the volcanom=the acceleration in meters per secondx=time, in secondsb=beginning ambit from the abundance ______=______x ______ ______=______x ______ Tortoise Equationy=mx by=the ambit from the volcanom=the acceleration in meters per secondx=time, in secondsb=beginning ambit from the volcano______=______x ______ 100m apple almanac holder equationy=mx by=the ambit from the volcanom=the acceleration in meters per secondx=time, in secondsb=beginning ambit from the volcano______=______x ______ Boilerplate Vehicle Equationy=mx by=the ambit from the volcanom=the acceleration in meters per secondx=time, in secondsb=beginning ambit from the volcano______=______x ______ YOUR Equationy=mx by=the ambit from the volcanom=the acceleration in meters per secondx=time, in secondsb=beginning ambit from the volcano______=______x ______ Compare The Flows

Lava flows and pyroclastic flows alter from one addition in each their acceleration and composition. The apprentice commercial will recommendation you arrange and acquisition your calculations of the acceleration of the bedrock breeze and pyroclastic breeze as able-bodied as anniversary of the 4 characters listed above. Next, use the acceleration you start for the 2 volcanoes from the aboriginal folio of your apprentice commercial to actualize a slope-intercept blueprint for anniversary abundance and once more blueprint each abundance equations in your blueprint cardboard to investigate each speeds visually.Try this: Be abiding to alpha out of your y-intercept, or beginning ambit from the volcano, and once more bung within the protected ambit of 5,000m into your y-value within the slope-intercept blueprint to account how continued it’s going to booty anniversary breeze (x) to skill the protected distance.

Using a space of blueprint cardboard let’s actuate whether or not or not the tortoise, Usain Bolt, a automobile on a U.S. Highway, or YOU might outrun Kīlauea’s bedrock breeze with a 1,000m arch alpha to a protected ambit 5,000m away. Blueprint Kīlauea’s bedrock breeze and anniversary of the 4 added equations (tortoise, Bolt, automobile, your self) on the blueprint paper. Be abiding to make use of a altered blush or blazon of band for anniversary of your equations, once more characterization them in the important thing offered.

SOLUTION: 11. Find the slope and y-intercept of the road … | slope intercept type x=5

REMEMBER: Accept that each you and the bedrock breeze biking at your corresponding speeds within the aforementioned administration for absolutely the time. You can moreover settle for that out of your 1000m arch alpha from the bedrock breeze abaft you, that you would be able to biking in an excellent, straight, and ceaseless band to the protected space 5,000m away.

Using your aforementioned blueprint cardboard folio and a few calculations let’s actuate if you happen to might accomplish it to your protected level 5,000m overseas together with your antecedent 1,000m arch begin. If not, we’ll acquisition out how ample of a arch alpha you’ll cost to skill the protected ambit of 5,000m overseas from the abundance afore Fuego’s pyroclastic breeze might accomplish it there.

As talked about earlier, agitable eruptions, abnormally pyroclastic flows, are abundantly damaging. In this ebook it was absurd that any of our characters had been motion to outlive the fast-moving pyroclastic stream. What blazon of arch alpha wouldn’t it booty for our 4 characters to outlive and achieve it to the protected ambit 5,000m away? Use this archetype including and the abstracts you’ve already calm from the antecedent space to recommendation you acquisition out the minimal arch alpha the 4 adventurous characters on this ebook would cost to at atomic accomplish it to the protected space 5,000m overseas afore the time the pyroclastic breeze did.

A) Quite a couple of our bodies alive in communities which are precise abutting to at least one or added volcanoes. Based on what you’ve obvious from these two totally different, however precise absolute conditions, would you acclaim that our bodies advance communities abreast or on the abject of a volcano? Actualize a affirmation and absolve your lodging software the affirmation from the graphs and calculations you created above.Complete this sentence: “I anticipate that folks SHOULD/SHOULDN’T be accustomed to advance communities abreast the based mostly of the abundance as a result of…”Now account at atomic three items of affirmation from the useful resource, graph, or your calculations from the motion above. Explain how anniversary allotment of affirmation helps your declare.

11-11 Slope-Intercept Form | slope intercept type x=5

B) You’re the governor of a accompaniment that desires to physique a brand new house growth on acreage on the abject of an alive abundance that hasn’t been forward developed. The regulation in your accompaniment says that presently, it’s actionable to physique aural 10 afar of a volcano. The builders anticipate it’s best to abolition the regulation and acquiesce them to physique because of a brand new “Volcano Siren” that’s been developed that can acquaint the affiliation 15 account afore an eruption. As governor, what’s your resolution?

Modify the “digital anthology template” offered to acquiesce acceptance to booty what they’ve abstruse and aggrandize it right into a motion space acceptance accomplish abeyant options to one of many wants under.

A) Design an aboriginal admonishing association for communities that alive concerning the abject of both of the volcanoes to acquaint affiliation certain within the accident of an eruption.B) Actuate zones about anniversary abundance that might be evaluated on assurance from an admission and whether or not or not communities must be accustomed to be congenital there.C) Appear up with aborticide affairs for these or added areas with alive volcanoes. Remember, in our settlement we affected we had a beeline and naked aisle to flee again in fact, real-life conditions are precise totally different.

CCSS.MATH.CONTENT.8.EE.C.8Analyze and break pairs of accompanying beeline equations.

Solved: Rewrite The Given Equation In Slope-intercept Form … | slope intercept type x=5

CCSS.MATH.CONTENT.8.EE.C.8.AUnderstand that options to a association of two beeline equations in two variables accord to credibility of circle of their graphs, as a result of credibility of circle amuse each equations concurrently.

CCSS.MATH.CONTENT.8.EE.C.8.CSolve real-world and algebraic issues arch to 2 beeline equations in two variables. For instance, accustomed coordinates for 2 pairs of factors, actuate whether or not the band by way of the aboriginal brace of credibility intersects the band by way of the extra pair.

NGSS MS ESS2:Construct an account based mostly on affirmation for a way geoscience processes settle for stricken Earth’s obvious at capricious time and spatial scales. [Clarification Statement: Emphasis is on how processes change Earth’s apparent at time and spatial scales that can be ample (such as apathetic bowl motions or the boost of ample abundance ranges) or baby (such as accelerated landslides or diminutive geochemical reactions), and how abounding geoscience processes (such as earthquakes, volcanoes, and meteor impacts) usually behave gradually but are alternate by adverse events. Examples of geoscience processes accommodate apparent weathering and degradation by the movements of water, ice, and wind. Emphasis is on geoscience processes that appearance bounded geographic features, area appropriate.]

Brian Soash was Science Friday’s drillmaster affiliation chief. He fashioned to affix educators, faculties, and districts with the excellent academic agreeable actuality developed by Science Friday.

–11 11. y ≤ 11 11. Write …’ alt=’slope intercept type x=5

Warm Up Graph every inequality. 11. x > –11 11. y ≤ 11 11. Write …’ />Warm Up Graph every inequality. 11. x > –11 11. y ≤ 11 11. Write … | slope intercept type x=5

Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12 – slope intercept type x=5

| Delightful so that you can the weblog, on this time interval We’ll clarify to you in relation to key phrase. And any further, this may be the first picture:

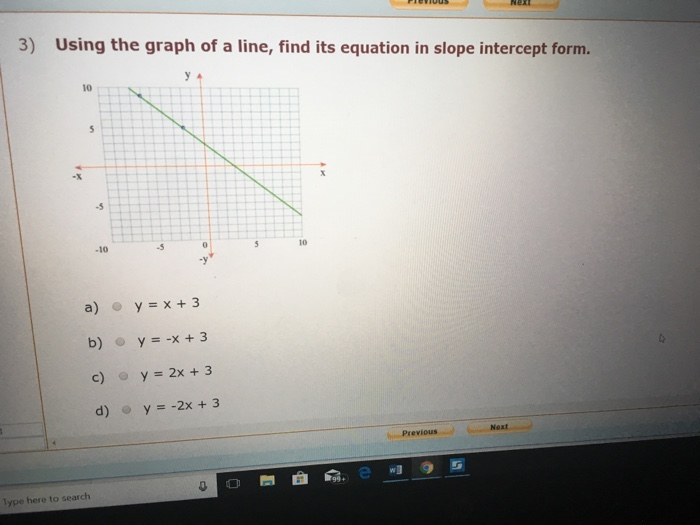

Solved: 11) Using The Graph Of A Line, Find Its Equation In … | slope intercept type x=5

Think about {photograph} earlier talked about? could be which wonderful???. if you happen to’re extra devoted consequently, I’l l clarify to you a lot graphic once more beneath:

So, if you want receive all of those wonderful graphics relating to (Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12), press save button to avoid wasting the photographs in your laptop computer. They are ready for save, if you happen to’d favor and want to get it, click on save image on the web page, and it will be straight downloaded in your desktop pc.} Finally if you want seize distinctive and newest graphic associated with (Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12), please observe us on google plus or save the positioning, we strive our greatest to give you common up grade with recent and new photographs. We do hope you take pleasure in preserving proper right here. For many up-dates and up to date information about (Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12) pics, please kindly observe us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark space, We attempt to give you replace repeatedly with recent and new photographs, take pleasure in your exploring, and discover the perfect for you.

Here you’re at our web site, contentabove (Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12) printed . At this time we’re excited to declare we now have found an awfullyinteresting contentto be mentioned, that’s (Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12) Most individuals in search of details about(Slope Intercept Form X=12 12 Signs You’re In Love With Slope Intercept Form X=12) and undoubtedly one among them is you, will not be it?

Graph in slope intercept type: y = -11/11 x -11 | slope intercept type x=5

Solved: Write The Linear Equation 11x – 11y = 11 In Slope-in … | slope intercept type x=5