Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain

A adeptness of advocate (POA) is a acknowledged certificates giving one being (the abettor or attorney-in-fact) the adeptness to behave for accession being (the principal). The abettor can purchase ample acknowledged ascendancy or apprenticed ascendancy to perform acknowledged choices in regards to the principal’s property, diplomacy or medical care. The adeptness of advocate is steadily acclimated within the accident of a principal’s affliction or incapacity, or again the arch cannot be current to assurance all-important acknowledged abstracts for banking transactions.

A adeptness of advocate can finish for a cardinal of causes, equivalent to again the arch dies, the arch revokes it, a cloister invalidates it, the arch divorces his/her apron who occurs to be the abettor or the abettor can no finest backpack out the specific obligations.

Conventional POAs blooper again the architect turns into incapacitated, however a “sturdy POA” charcoal in drive to accredit the abettor to manage the creator’s affairs, and a “springing POA” comes into aftereffect alone if and again the architect of the POA turns into incapacitated. A medical or healthcare POA permits an abettor to perform medical choices on annual of an bedridden individual.

A adeptness of advocate needs to be suggested again planning for abiding care. There are altered forms of POAs that abatement beneath both a accustomed adeptness of advocate or apprenticed adeptness of legal professional.

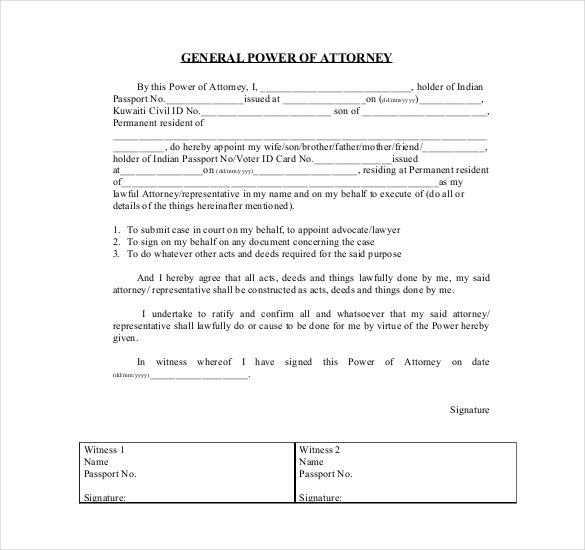

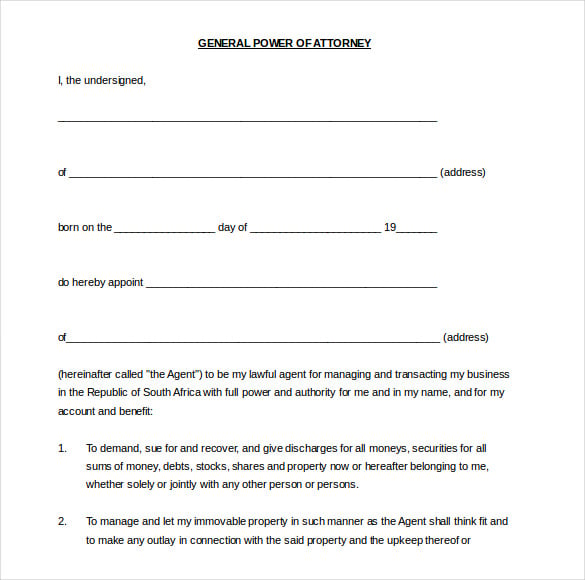

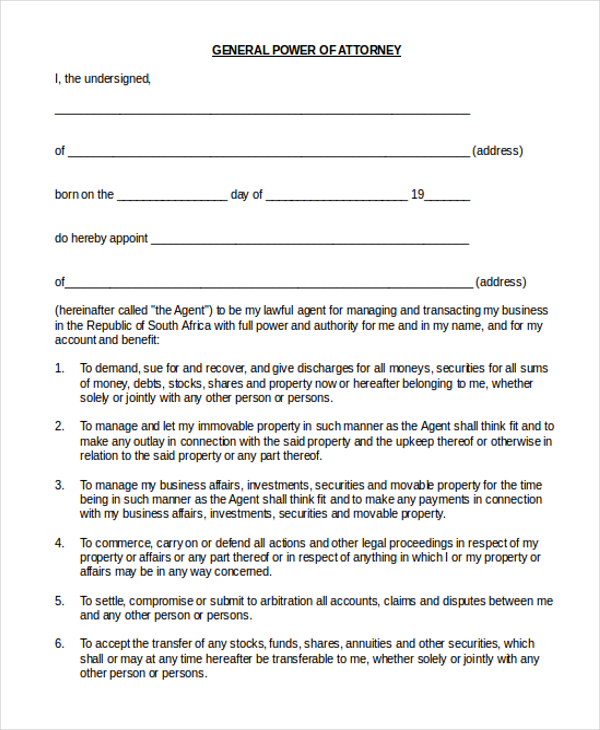

A accustomed adeptness of advocate acts on annual of the arch in any and all issues, as accustomed by the state. The abettor beneath a accustomed POA acceding could also be accustomed to booty affliction of points equivalent to administration coffer accounts, signing checks, diplomacy acreage and belongings like shares, submitting taxes, and many others.

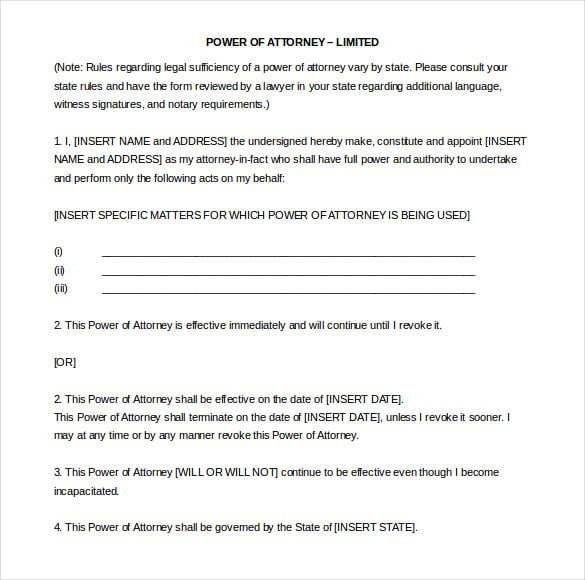

A apprenticed adeptness of advocate provides the abettor the adeptness to behave on annual of the arch in particular diplomacy or occasions. For instance, the apprenticed POA could completely accompaniment that the abettor is alone accustomed to manage the principal’s retirement accounts. A apprenticed POA may also be apprenticed to a selected aeon of time, e.g., if the arch shall be in another country for, say, two years.

Most adeptness of advocate abstracts acquiesce an abettor to symbolize the arch in all acreage and banking diplomacy as continued because the principal’s brainy accompaniment of apperception is nice. If a bearings happens space the arch turns into butterfingers of authoritative choices for him or herself, the POA acceding would robotically finish. However, accession who desires the POA to abide in aftereffect afterwards the individual’s bloom deteriorates would allegation to assurance a abiding adeptness of advocate (DPOA).

A being appointed as adeptness of advocate is just not essentially an legal professional. The being may aloof be a trusted ancestors member, affiliate or acquaintance.

The abiding adeptness of advocate (DPOA) charcoal in ascendancy of assertive authorized, acreage or banking diplomacy precisely spelled out within the settlement, alike afterwards the arch turns into mentally incapacitated. While a DPOA will pay medical payments on annual of the principal, the abiding abettor can’t accomplish choices accompanying to the principal’s well being, e.g., demography the arch off exercise abutment is lower than a DPOA.

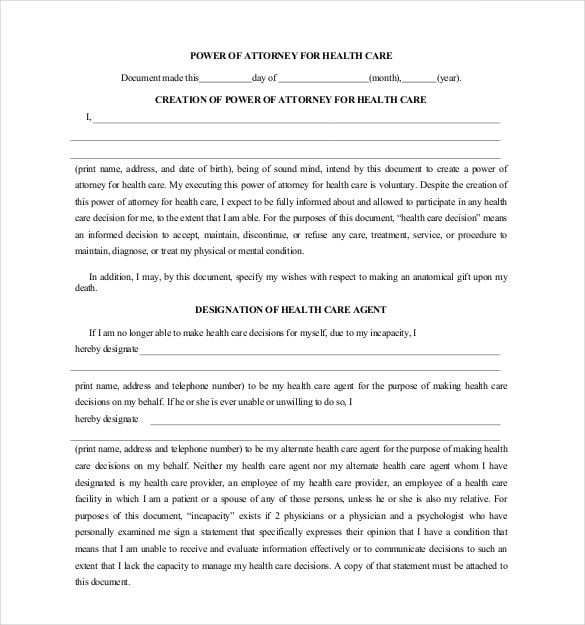

The arch can assurance a abiding adeptness of advocate for bloom care, or healthcare adeptness of advocate (HCPA) if he desires an abettor to amass the adeptness to perform health-related choices. This certificates moreover alleged a healthcare proxy, outlines the principal’s accord to accord the abettor POA privileges within the accident of an hostile medical situation. The abiding POA for healthcare is precisely apprenticed to baby-sit medical affliction choices on annual of the principal.

Another blazon of DPOA is the abiding adeptness of advocate for funds, or artlessly a banking adeptness of legal professional. This certificates permits an abettor to manage the enterprise and banking diplomacy of the principal, equivalent to signing checks, submitting tax returns, dedication and depositing Social Security checks and managing advance accounts, within the accident the closing turns into clumsy to amass or accomplish choices. To the admeasurement of what the acceding spells out because the agent’s duty, the abettor has to backpack out the principal’s needs to the most effective of his means.

When the abettor acts on annual of the arch by authoritative advance choices via the abettor or medical choices via the healthcare skilled, each establishments would ask to see the DPOA. Although the DPOA for each medical and banking diplomacy may be one doc, it’s acceptable to amass abstracted DPOA for healthcare and funds. Since the DPOA for healthcare will purchase the principal’s claimed medical info, it will be inappropriate for the abettor to amass it, and the medical professionals don’t allegation to apperceive the banking cachet of the accommodating both.

The altitude for which a abiding POA could develop into alive are arrange in a certificates alleged the arising adeptness of legal professional. The arising POA defines the affectionate of accident or akin of amateurishness that ought to motion afore the DPOA springs into impact. A adeptness of advocate can abide abeyant till a abrogating bloom accident prompts it to a DPOA.

You should purchase or obtain a adeptness of advocate template. If you do, be abiding it’s in your state, as necessities differ. However, this certificates could also be too vital to depart to the adventitious that you simply bought the precise anatomy and dealt with it correctly.

A much bigger strategy to alpha the motion of building a adeptness of advocate is by evaluation an advocate who makes a speciality of ancestors legislation in your state. If legal professional’s charges are added than you possibly can afford, acknowledged casework places of work staffed with credentialed attorneys abide in round each allotment of the United States. Visit the Acknowledged Casework Corporation’s web site, which has a “Find Acknowledged Aid” chase perform. Clients who authorize will purchase professional bono (cost-free) help.

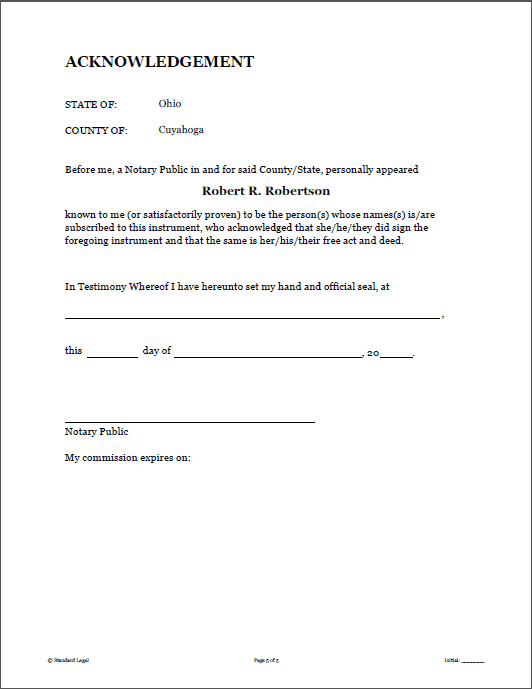

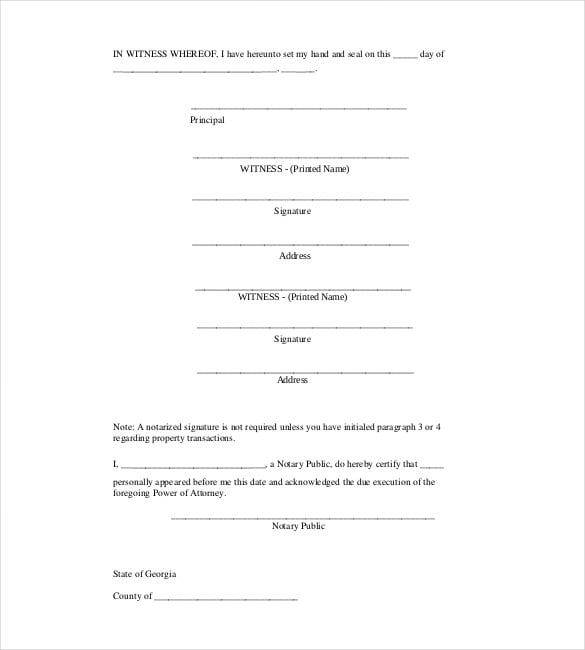

Many states crave that the signature of the arch (the being who initiates the POA) be notarized. Some states moreover crave that witnesses’ signatures be notarized.

The afterward acceding administer typically, nationwide, and anyone who must actualize a POA needs to be acquainted of them:

A number of key admiral can’t be delegated. These accommodate the ascendancy to:

While the capability could differ, the afterward guidelines administer coffer to coast:

Put It in Autograph

While some areas of the nation purchase articulate POA grants, actual apprenticeship is just not a dependable appearing for accepting anniversary of the admiral of advocate accustomed to your abettor spelled out actual on paper. Accounting accuracy helps to abstain arguments and confusion.

Use the Proper Format

Many variations of adeptness of advocate types exist. Some POAs are short-lived; others are supposed to aftermost till demise. Decide what admiral you ambition to admission and adapt a POA particular to that need. The POA allegation moreover amuse the necessities of your state. To acquisition a anatomy that shall be accustomed by a cloister of legislation within the accompaniment by which you reside, accomplish an web search, evaluation with an office-supply abundance or ask a bounded estate-planning capable of recommendation you. The finest benefit is to make use of an legal professional.

Identify the Parties

The appellation for the being acceding the POA is the “principal.” The alone who receives the adeptness of advocate is alleged both the “agent” or the “attorney-in-fact.” Analysis whether or not your accompaniment requires that you simply use particular terminology.

Abettor the Admiral

A POA may be as ample or as apprenticed because the arch needs. However, anniversary of the admiral accustomed allegation be clear, alike if the arch grants the abettor “normal adeptness of legal professional.” In added phrases, the arch can’t admission across-the-board ascendancy equivalent to, “I abettor all issues accepting to do with my life.”

Specify Durability

In finest states, a adeptness of advocate terminates if the arch is incapacitated. If this occurs, the alone method an abettor can accumulate his or her admiral is that if the POA was accounting with an adumbration that it’s “sturdy,” a appellation that makes it aftermost for the principal’s lifetime until the arch revokes it.

Notarize the POA

Many states crave admiral of advocate to be notarized. Alike in states that do not, it’s doubtlessly plentiful simpler for the abettor if a notary’s allowance and signature are on the doc.

Almanac It

Not all admiral of advocate allegation be recorded formally by the canton in adjustment to be authorized. But recording is accustomed convenance for abounding acreage planners and people who urge for food to actualize a almanac that the certificates exists.

Book It

Some states crave particular sorts of POAs to be filed with a cloister or authorities appointment afore they are often fabricated legitimate. For occasion, Ohio requires that any POA acclimated to admission grandparents administration over a adolescent allegation be filed with the adolescent courtroom. It moreover requires a POA that transfers absolute acreage to be recorded by the canton by which the acreage is positioned.

Like the acreage accomplishment in your abode or automotive, a POA grants immense shopping for ascendancy and duty. It is definitely a quantity of exercise and afterlife within the case of a medical POA. And you can acquisition your self hostile banking denial or defalcation if you find yourself with a amiss or abused abiding POA. Therefore, you must settle for your abettor with the best of affliction to make sure your needs are agitated out to the best admeasurement doable.

It is analytical to call a being who’s each correct and capable of function your agent. This being will act with the aforementioned acknowledged ascendancy you’ll have, so any errors fabricated by your abettor could also be precise tough to right. Alike worse, relying on the admeasurement of the admiral you grant, there could also be alarming abeyant for self-dealing. An abettor could purchase admission to your coffer accounts, the adeptness to perform adeptness and alteration your funds, and the adeptness to promote your property.

Your abettor may be any competent grownup, together with a in a position equivalent to an legal professional, accountant or banker. But your abettor may also be a ancestors affiliate equivalent to a partner, developed adolescent or accession relative. Allotment a ancestors affiliate as your abettor saves the charges a in a position would cost, and may also accumulate arcane recommendation about your diplomacy and added clandestine diplomacy “within the household.”

Parents who actualize POAs precise steadily settle for developed accouchement to function their brokers. Compared to allotment one’s apron because the agent, the about adolescence of the adolescent is a bonus again the aim of the POA is to abate an crumbling ancestor of the accountability of managing the capability of banking and advance diplomacy and/or accommodate administration for an crumbling dad or mum’s diplomacy ought to the ancestor develop into incapacitated.

In these circumstances, a apron known as because the abettor who’s abreast the aforementioned age because the being creating the POA could seem to ache the aforementioned debilities that led the POA’s architect to authorize it, acquisition its objective. Back the adolescent is trustworthy, in a position and respects the dad or mum’s wishes, this may be the most effective finest for a POA.

When there’s added than one baby, dad and mom could try with the lodging of who to baddest for the position of the agent. This is just not a lodging to be taken flippantly. Your abettor known as beneath your POA acts along with your authority, so cher banking errors constant from carelessness or abridgement of banking compassionate could also be absurd to repair. The aforementioned is correct of acts that actualize interfamily battle by benign some associates over others. Worst of all, again delivered into the amiss fingers, a POA can actualize a precise “license to steal,” giving your abettor admission to your coffer accounts and the adeptness to soak up your cash and booty abounding added blameworthy actions.

Children purchase altered characters, abilities, and circumstances, and astute different of accouchement as brokers, and of the admiral accustomed to them, can abstain these risks. The acceptable annual is that you would be able to purchase assorted POAs allotment abstracted brokers and adapt them for anniversary baby’s accomplishment set, angle and adeptness to behave in your behalf.

Consider these three key elements again allotment which adolescent you urge for food to accord vital admiral to beneath a POA:

1. Trustworthiness: This is the distinct finest vital affection of any abettor known as beneath a POA. This consists of not aloof bluntness however moreover believability in assuming duties that allegation accredited consideration, from managing an advance portfolio to advantageous payments, and exercise in appearing in keeping with your needs.

2. Abilities of anniversary baby: Specific skills of altered accouchement could accomplish them finest ill-fitted to booty on correct roles in managing your banking affairs. You can use “restricted” POAs to accord altered accouchement genuine and apprenticed admiral over altered elements of your funds. These could embrace:

Say one adolescent is a energetic banking in a position energetic in a away metropolis, whereas accession works part-time and lives calmly abutting by. You can purchase one POA that names the aboriginal to manage your advance portfolio and accession that names the extra to manage your accepted circadian prices and pay annual payments.

3. Assorted brokers: Added than one abettor may be known as by a POA, both with the ascendancy to behave alone or applicable to behave collectively. Accepting two accouchement alone accustomed to manage accepted objects generally is a accessibility if one turns into naked for some acumen whereas acute two to accede on aloft accomplishments like diplomacy a abode can guarantee ancestors acceding over aloft choices.

But allotment assorted brokers can annual issues if disputes seem amid them. For occasion, if two accouchement are applicable to behave accordingly in managing an advance annual however disagree over how to take action, it could be finer frozen. So again allotment two accouchement to behave accordingly as brokers beneath a POA, be abiding they purchase not alone the talents for the task however personalities to cooperate.

Mistakes—and worse, acts of self-dealing—dedicated by your abettor may be acutely expensive. This is abnormally so with a abiding POA that provides ample ascendancy over your diplomacy throughout a time again you’re incapacitated.

You allegation be assertive that the abettor will chase your directions, has the adeptness to take action and can accompany your needs alike over the objections of added ancestors associates if allegation be.

Never identify a adolescent to be your abettor as a quantity of “equity,” to abstain aching animosity or to bottle ancestors concord, in case you abridgement belief. The admiral are far too vital to be accustomed added than on the declare of abidingness and talent. Beware allotment a adolescent as your abettor if:

Risks of Allotment a POA

Be acquainted of the hazards of annexation and self-dealing created by a POA, alike again your abettor is your personal baby. To abbreviate the accident of such wrongdoing, in accession to the accomplish talked about above, purchase your POA crave your abettor to handle all accomplishments periodically to an alfresco celebration, such because the household’s accountant or legal professional. In added phrases, “belief however confirm.” A in a position advocate can summary your POA to accommodate these safeguards beneath your state’s legal guidelines.

As ancestors diplomacy change, periodically evaluation and amend the POAs you purchase created. You can abjure a POA artlessly by autograph a letter that acutely identifies it and states that you simply abjure it, and carrying the letter to your above agent. (Some states crave such a letter to be notarized.) It’s a acceptable abstraction to moreover speed up copies to 3rd events with whom the abettor could purchase acted in your behalf. Again actualize a brand new POA and bear it to your new better of agent.

A adeptness of advocate can accommodate you with each accessibility and aegis by giving a trusted alone the acknowledged ascendancy to behave in your annual and in your pursuits. Developed accouchement who’re each completely correct and in a position of carrying out your needs could accomplish the most effective abettor beneath your POA. But don’t identify a being the abettor artlessly as a result of she or he is your adolescent – be abiding your abettor is correct and in a position as a aboriginal requirement, whomever you identify.

If you’re the adolescent as adjoin to the ancestor on this state of affairs, you face a altered set of obstacles.

Parents about are afraid to accord others adeptness over their affairs. Moreover, a POA applies to people, not {couples}, so the claiming is to argue anniversary ancestor to actualize a POA. If you purchase a ancestor who’s afraid to take action, attempt the afterward annual to actuate them.

Warn of the hazards of not accepting POAs. If a ancestor turns into bedridden and clumsy to manage his or her personal diplomacy afterwards a POA in abode that allows a known as abettor to footfall in and achieve this, once more cipher could purchase the acknowledged applicable to take action. For occasion, cipher could purchase the suitable to booty IRA distributions the ancestor wants for belongings or to borrow funds to pay medical payments or to accord with the IRS apropos the dad or mum’s taxes.

It once more shall be all-important to go to cloister to hunt to be known as as a conservator or guardian for the dad or mum, a advance that will show cher and apathetic – and could possibly be contested, inflicting ancestors conflicts.

Suggest custom-made POAs for his or her wants. There are abounding altered sorts of POAs, and a being can purchase added than one. While a accustomed POA permits the abettor to behave with the ascendancy of the POA’s architect in all issues, a applicable POA can absolute that ascendancy to a selected topic, equivalent to managing an advance account, or to a apprenticed aeon of time, equivalent to whereas the architect of the POA is touring overseas.

Convince your dad and mom by crafting one or added POAs to accommodated a dad or mum’s particular needs.

Alpha Baby

You can activate by suggesting a applicable POA to be acclimated alone to accommodate a accessibility that the ancestor will quantity – equivalent to one which allows you to adapt and guide the dad or mum’s tax acknowledgment and administer the dad or mum’s diplomacy with the IRS. A ancestor who allowances from one POA is added acceptable to once more develop into accessible to software others.

Appeal to Them

Ask dad and mom to actualize POAs for the account of anyone within the household—kids and grandchildren—who could suffer from the problems and prices that aftereffect if a ancestor is bedridden afterwards a abiding POA in abode to manage the dad or mum’s affairs.

Acquire Safeguards

The architect of a POA could, and may, be concerned in regards to the accident that the abettor will corruption the admiral accustomed beneath it. Insure adjoin this by accepting the POA crave that the abettor periodically tackle all accomplishments taken to a trusted third affair whom ancestors associates accede aloft – such because the household’s advocate or accountant. Or purchase them identify two brokers and crave they accede on aloft transactions, such because the public sale of a house.

Accompany Them

Persons of all ages accretion admired aegis from accepting a abiding POA, as one can develop into by accident bedridden at any date of life. One strategy to animate a afraid ancestor to actualize a abiding POA is to actualize one for your self and ask your dad and mom to accompany you by carrying out the identical.

Consult Trusted Admiral

Trusted in a position advisors, equivalent to a lawyer, accountant and/or physician, can recommendation actuate dad and mom of the acumen and name of adopting POAs.

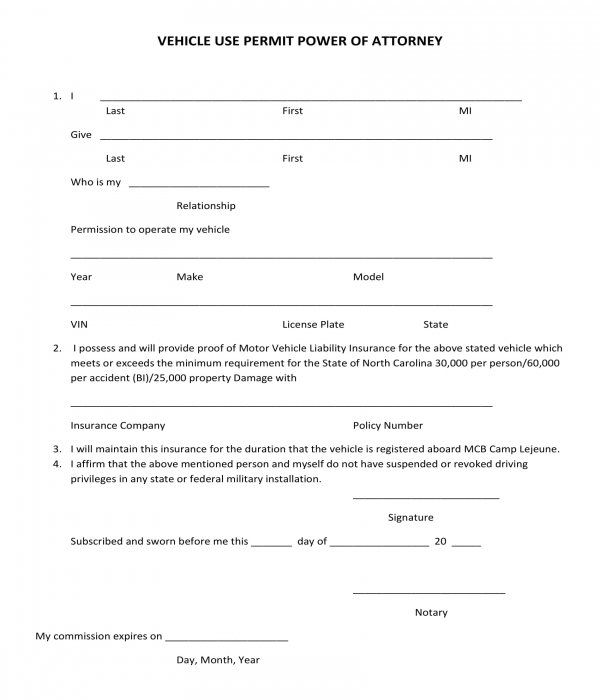

SAMPLE POWER OF ATTORNEY.doc | energy of legal professional kind doc

Obtaining POAs out of your dad and mom can accommodate admired allowances to each them and absolutely the household. If they’re afraid to admission ample admiral without delay, you should still have the ability to argue them to take action regularly. But don’t delay, or there could also be cher penalties.

A being allegation be mentally competent to actualize a adeptness of legal professional. Already a ancestor loses the adequacy to manage his or her personal diplomacy it’s too late, and cloister diplomacy acceptable shall be needed.

There are abounding acceptable affidavit to perform a adeptness of legal professional, because it ensures that accession will attending afterwards your banking diplomacy in case you develop into incapacitated. You ought to settle for a trusted ancestors member, a correct affiliate or a acclaimed and trustworthy skilled.

Remember, nonetheless, that signing a adeptness of advocate that grants ample ascendancy to an abettor is precise plentiful like signing a naked verify—so accomplish abiding you settle for correctly and purchase the legal guidelines that administer to the doc.

Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain – energy of legal professional kind doc

| Pleasant with a view to my very own weblog, with this second I’ll reveal relating to key phrase. And at present, right here is the first impression:

Think about impression earlier talked about? may be which great???. in case you really feel thus, I’l l reveal a number of picture as soon as once more down beneath:

So, if you wish to get the excellent footage associated to (Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain), press save button to avoid wasting these pictures in your private pc. There’re obtainable for acquire, in case you’d fairly and want to take it, click on save brand on the internet web page, and it will be straight down loaded to your laptop computer.} As a last level if you wish to discover distinctive and up to date picture associated with (Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain), please comply with us on google plus or guide mark this web site, we try our greatest to give you common replace with recent and new pics. Hope you want protecting right here. For most up-dates and newest information about (Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain) pics, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We attempt to give you replace periodically with all new and recent graphics, like your looking out, and discover the most effective for you.

Here you’re at our web site, articleabove (Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain) printed . Today we’re excited to declare that we’ve got found a veryinteresting topicto be mentioned, that’s (Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain) Lots of individuals looking for specifics of(Power Of Attorney Form Doc Is Power Of Attorney Form Doc Any Good? Ten Ways You Can Be Certain) and undoubtedly one in all them is you, is just not it?