Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why

A apriorism charge consistently authenticate an argument. If you are not aggravating to prove article and actuate your admirers to acquire your point of view, you are not autograph an bookish paper.

Your apriorism is the best abridged way of advertence to your admirers the ambition of your paper.

For best undergraduate writing, it is acceptable to accept a one book apriorism statement. Your anterior branch should body up to your apriorism account and accommodate your clairvoyant with the all-important context.

Suppose this is the alert of a cardboard that you are assigned to write:

Describe the attributes of adulthood in Disney’s Beauty and the Barbarian and The Little Mermaid. How do the roles of the changeable protagonists differ? How are they similar?

You charge aboriginal assay the concepts that this alert is allurement you to identify. Often, you will be asked to assay accurate characters, texts, or themes. This alert is allurement you to accomplish abstracts about the changeable protagonists in these films. Before you activate writing, you ability appetite to accomplish a account of attributes specific to anniversary appearance (or text/ theme.) This will advice you assay commonalities or disparities that may be advantageous in allowance you actuate your thesis. Belle (from Beauty and the Beast)…

Ariel (from The Little Mermaid)

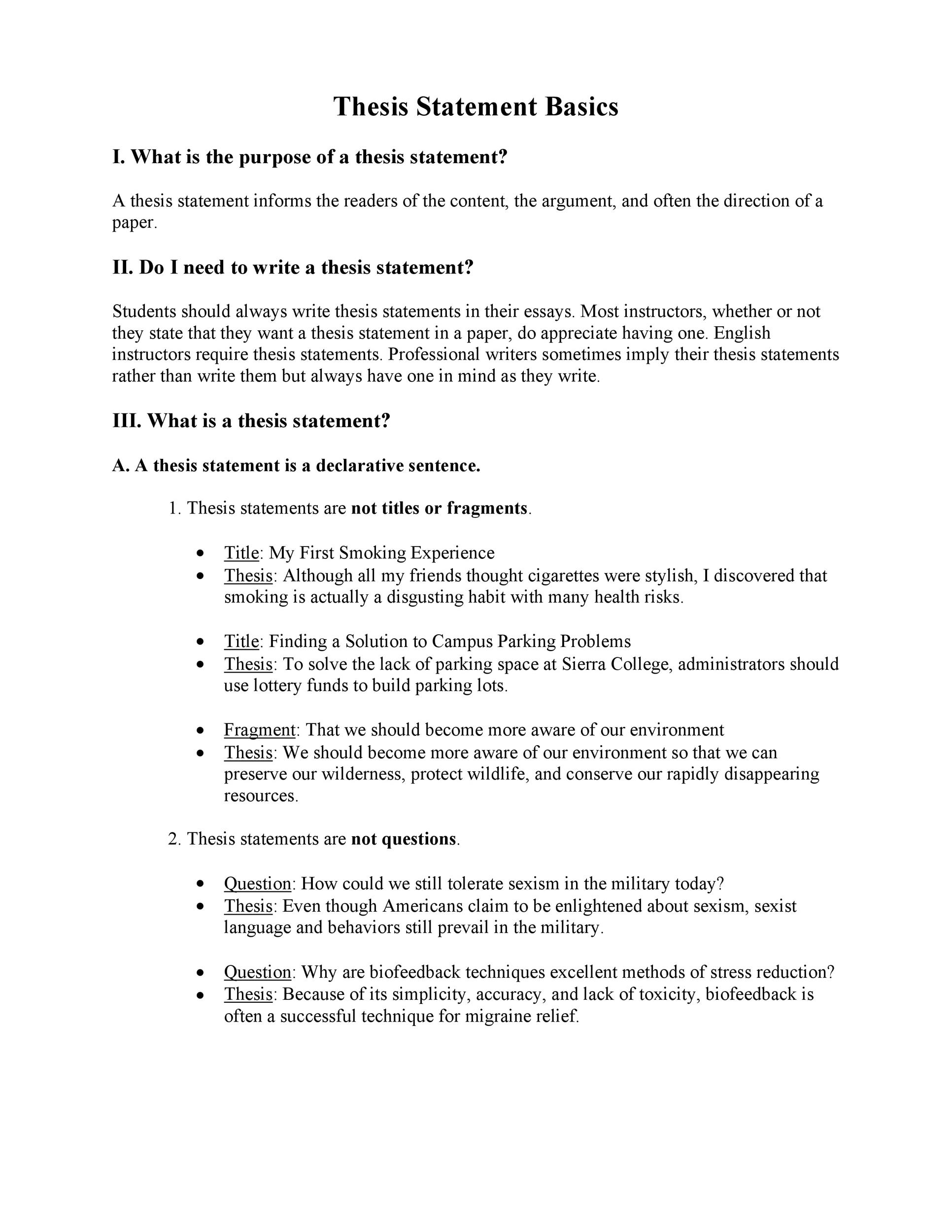

Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why – thesis statement template | Pleasant for you to my personal website, with this period I will teach you with regards to keyword. And from now on, this is actually the 1st picture:

3 Perfect Thesis Statement Templates (+ Examples) ᐅ TemplateLab | thesis statement template

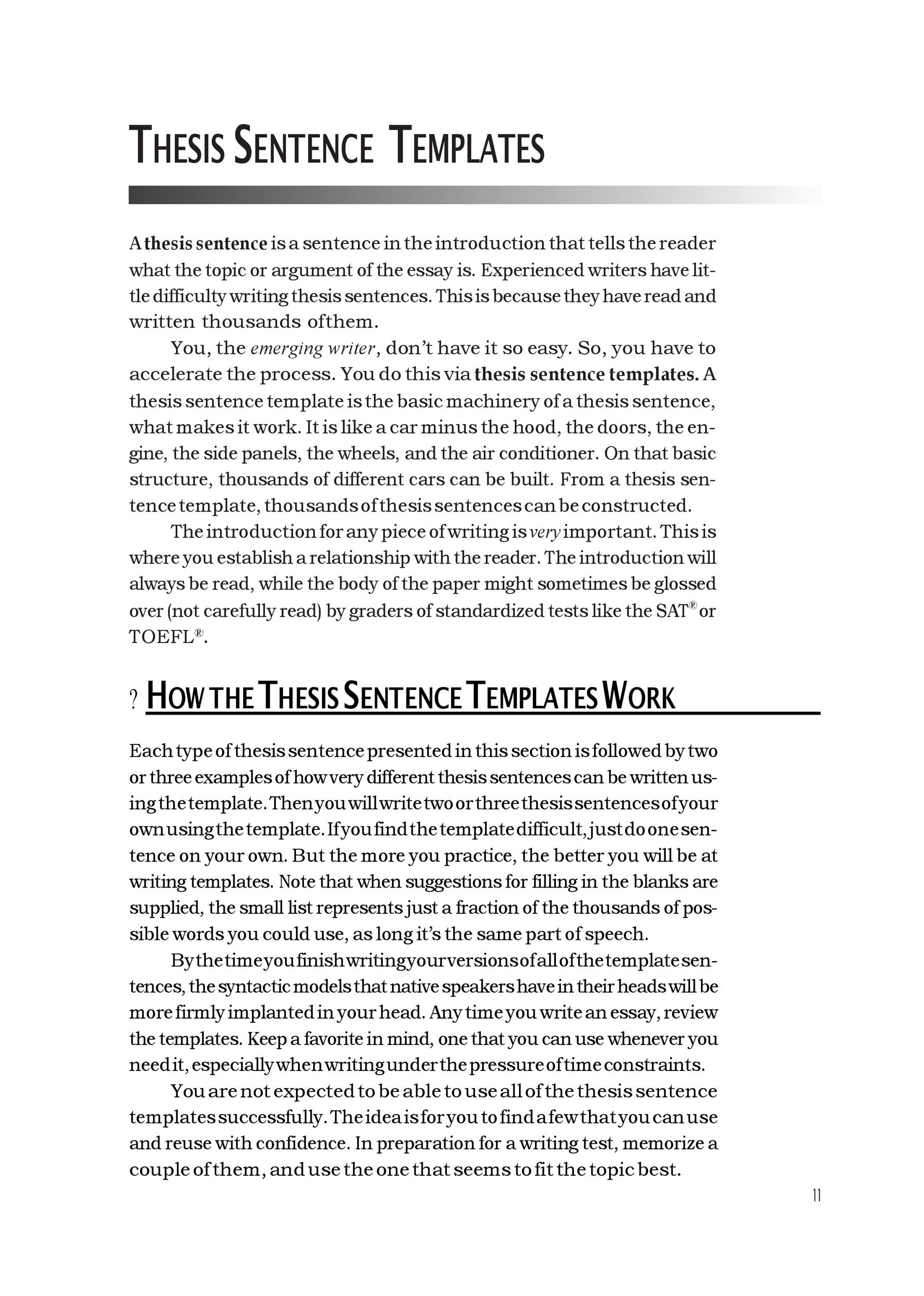

Think about picture previously mentioned? is usually which awesome???. if you’re more dedicated thus, I’l m provide you with a few image once more underneath:

So, if you desire to get all of these amazing pictures regarding (Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why), click on save link to store these graphics in your pc. These are all set for save, if you want and want to get it, simply click save logo in the article, and it will be immediately saved to your pc.} At last in order to secure new and latest picture related with (Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why), please follow us on google plus or save this website, we attempt our best to present you regular update with fresh and new graphics. We do hope you like staying here. For most up-dates and latest news about (Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you update regularly with all new and fresh pics, love your exploring, and find the best for you.

Thanks for visiting our website, contentabove (Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why) published . At this time we are pleased to declare we have discovered a veryinteresting nicheto be reviewed, that is (Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why) Lots of people trying to find information about(Thesis Statement Template Thesis Statement Template Will Be A Thing Of The Past And Here’s Why) and of course one of these is you, is not it?Templates for Writing Thesis Statements Digital Learning Commons | thesis statement template

3 Perfect Thesis Statement Templates (+ Examples) ᐅ TemplateLab | thesis statement template