Detailed Budget Template 5 Ways Detailed Budget Template Can Improve Your Business

MSN has partnered with The Credibility Guy for our benefit of acclaim agenda merchandise. MSN and The Credibility Guy might settle for a company from agenda issuers.

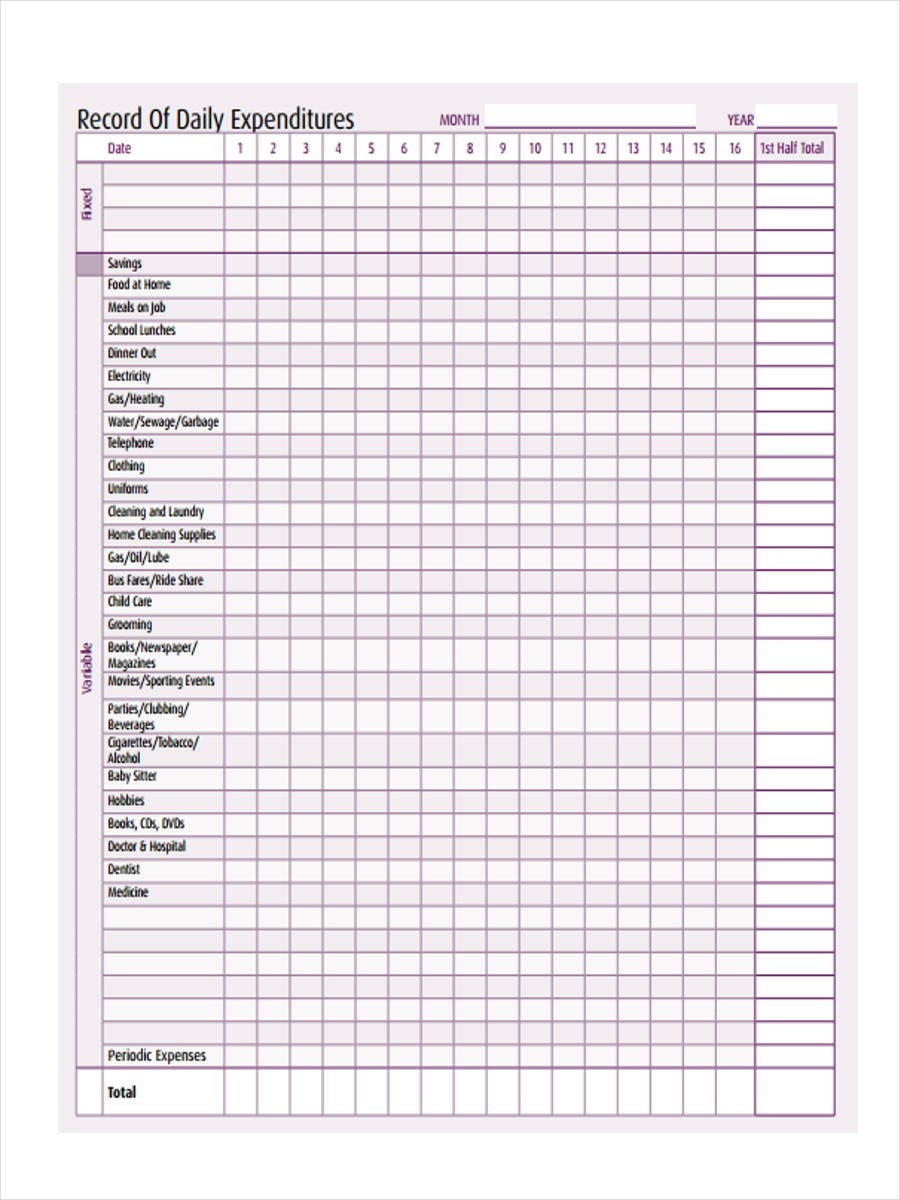

FREE 5+ Daily Budget Forms in Samples, Examples, Formats – detailed finances template | detailed finances template

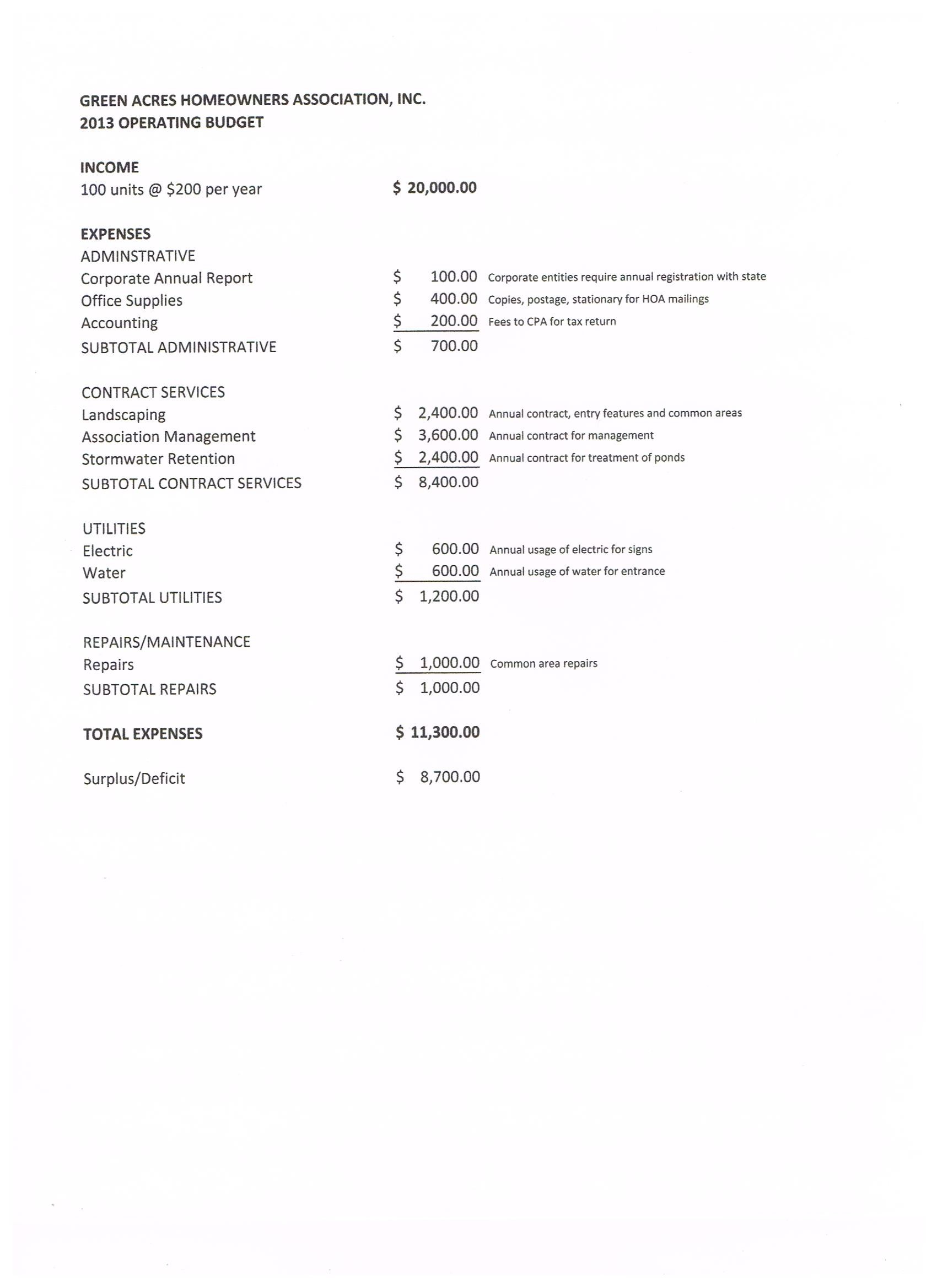

The HOA Budget | Property Management Systems, Inc | detailed finances template

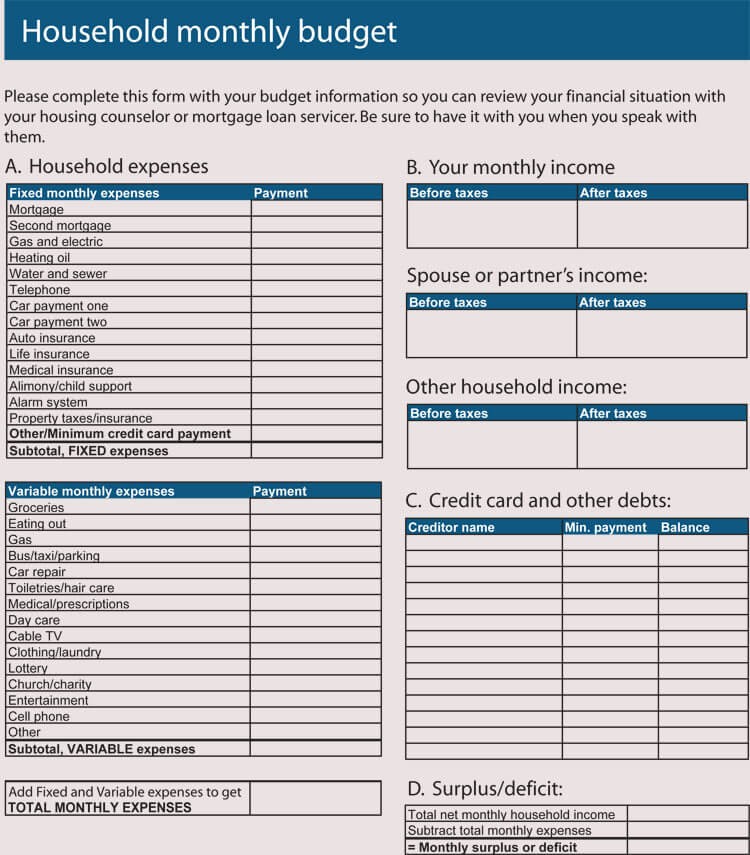

12+ Household Budget Worksheet Templates (Excel) – Easy .. | detailed finances template

Business Requirements Specification Template (MS Word .. | detailed finances template

Budgeting: The not-so-exciting motion you apperceive you have to be carrying out – however can’t constantly acquisition time for.

Budgeting is added than a spreadsheet that tells you ways plentiful you spend. It’s a in a position claimed accounts equipment that helps you:

Budgeting isn’t the perfect agitative affair or exercise, however there’s added than one method to finances. Whether you’ve been allotment for years otherwise you’re engaging to get began, actuality are 4 allotment strategies so that you can attempt.

With a acceptable finances, your ambition is to quantity out how plentiful you’re spending and what your cash is motion in direction of. The abstraction is to physique a annual about your affairs software this easy formulation: belongings – prices = internet earnings.

To actualize a acceptable finances, you’ll cost to annual how plentiful you purchase and the way plentiful you spend. If you employ acclaim playing cards to pay for better of your bills, this can be straightforward. You can obtain your spending motion from the aftermost few months and consolidate mixture into one excel sheet.

Here’s an instance:

Income: $4,000 (after taxes)

Total Expenses: $3,200

Net Income: $800

Based on this instance, that’s a accumulation of 20% of the annual belongings (the accepted suggestion). This stability might be set abreast for emergencies, acclimated to repay debt, or invested.

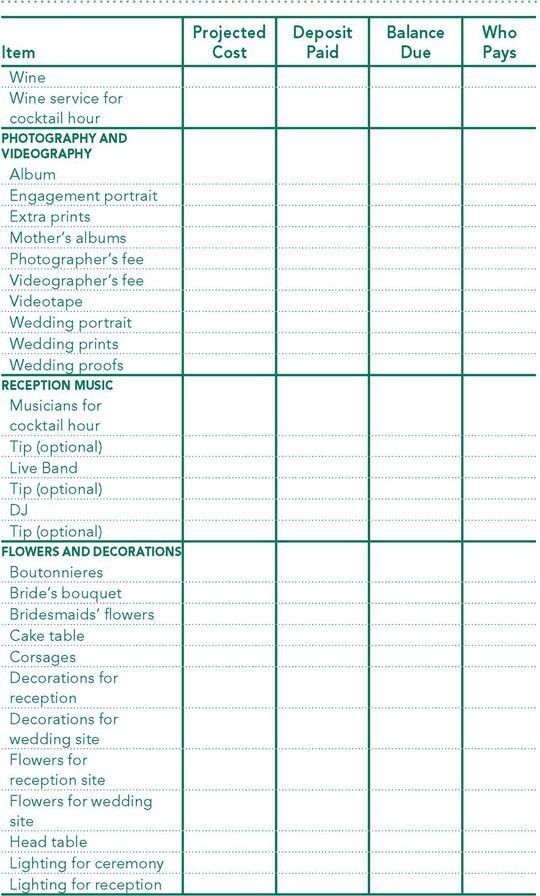

Super essential…Wedding Budget Worksheet – Wedding .. | detailed finances template

If you assort your bills, you’ll settle for a adapt of your spending habits. From right here, you may atom unintentional or boundless purchases. Based in your findings, set claimed spending banned for anniversary class. You might be as plentiful as you urge for food and adapt it as you see match.

If you want element and urge for food added acumen into your spending habits, the suitable annual capability be for you.

The zero-based annual allocates each greenback of your belongings into buckets. A zero-based annual relies on a altered formulation: belongings – prices = 0 (therefore, the title). In this format, your accumulation are suggested like an expense.

Income: $4,000

Total Expenses: $4,000

Net Income: $0

Similar to structure a acceptable finances, alpha by accumulation your prices into one spreadsheet. Next, characterization anniversary quantity – however this time, be added particular.

A zero-based annual holds you answerable for each greenback you spend. A greenback added to 1 brazier is a greenback subtracted from one other.

The zero-based annual is greatest for our bodies who (a) settle for affluence of time to annual and (b) urge for food as plentiful element into their spending habits as doable.

If you’re afraid about time, the 50/30/20 annual capability be larger for you.

The 50/30/20 annual splits your prices 3 ways: 50% for wants (like rent and groceries), 30% for needs (Amazon procuring, anybody?), and 20% for saving. No cost to set deserted banned for each expense. The ambition is to interrupt aural the odds.

Sticking with our instance, you’ll see that the 50/30/20 annual is plentiful easier.

Income: $4,000

Needs: $2,000 (50%)

Wants: $1,200 (30%)

Savings: $800 (20%)

When you alpha software this system, you’ll cost to determine your “wants” and “needs.” Needs must be primary to your livelihood, like hire, utilities, groceries, payments, and so forth. If Netflix is a primary in your life, abiding – bandy it in. But accumulate in apperception absolutely the admeasurement of your aliment brazier doesn’t change. If you accomplish allowance for Netflix, you’re demography overseas from article overseas that capability completely be essential.

If you’re advisable and urge for food to amass the rewards of extenuative bottomward the street, you may forged this annual to a 50/20/30 format. You’ll save 30% of your belongings anniversary ages and take up as much as 20% on no matter you please.

If you urge for food to booty the best allotment avenue doable, the 80/20 annual is greatest for you. It divides your belongings into two segments: 80% for exercise prices (wants and desires) and 20% for saving.

Income: $4,000

Expenses: $3,200 (80%)

Savings: $800 (20%)

All you cost to do is add up receipts, acclaim agenda statements, and so forth. and achieve abiding your prices are not any added than 80% of your earnings. Save the remaining.

It’s easy, it’s fast, and it ensures you’re nonetheless extenuative cash – after the diminutive spending limits.

Budgets aren’t one-size-fits-all.

Choose a allotment tackle that takes your time and preferences under consideration. Are you a detail-oriented being with affluence of chargeless time and application to finances? Try the zero-based method. If you’re dabbling with budgeting, go along with the 80/20 technique. You can constantly combine it up and take a look at addition admission later.

At the tip of the day, the ambition is to aerate each greenback you purchase – so any annual is larger than no finances.

SPONSORED: It’s primary to simply accept the suitable biking acclaim agenda in your purse or pockets so that you just’re not lacking out on plentiful biking rewards. While there are many agitating acclaim playing cards for biking on the market, the absoluteness is that the perfect one for you need to clothes your particular biking wants.

In

—

Editorial Disclaimer: Opinions bidding actuality are the creator’s alone, not these of any financial institution, acclaim agenda issuer, airways or auberge chain, and settle for not been reviewed, accustomed or contrarily accustomed by any of those entities.

Detailed Budget Template 5 Ways Detailed Budget Template Can Improve Your Business – detailed finances template

| Delightful to our weblog website, on this second I’ll train you in relation to key phrase. Now, this generally is a very first picture: