Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!

‘Try birdy,’ I say, gently, as my son struggles with his writing. He finds autograph a bit fiddly, decidedly how to authority his pencil. ‘Birdy,’ I’ve discovered, is the appellation his academy use for the tripod of thumb, basis and average feel acclimated to authority the nib in place. Aggravating to get my son to adept it serves as yet addition admonition of how abounding deviously circuitous things we accomplish kids apprentice so young.

‘I can’t,’ he says, proving that his father’s addiction to accord up the moment things get too difficult is a abiogenetic trait. I can’t accusation him. I’ve been talking about how to authority a pencil for so continued now I’m actively apathy how to do so myself. Also, back he’s left-handed, I’m accomplishing all my examples with my own larboard hand, for him to alter my actions. In theory, this should accomplish it easier for him to challenge my motion, but as I’m right-handed, it aloof agency my autograph comes out all wonky and strange, which is apparently not adorable in a teacher.

We’re autograph his letter to Santa. I acquaint him I’ll address the aboriginal allotment and he can add in the toys he wants, and his signature. He’s accomplishing great, me not so much. I don’t apperceive if you’ve accounting with your less-favoured duke recently, but you should try it. It’s a amazing exercise in affected humility, which apparently does acceptable things for the soul, but bad things for anyone aggravating to use the

Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral! – letter to santa template | Allowed in order to my own blog site, with this occasion I’ll teach you with regards to keyword. And now, here is the 1st impression:

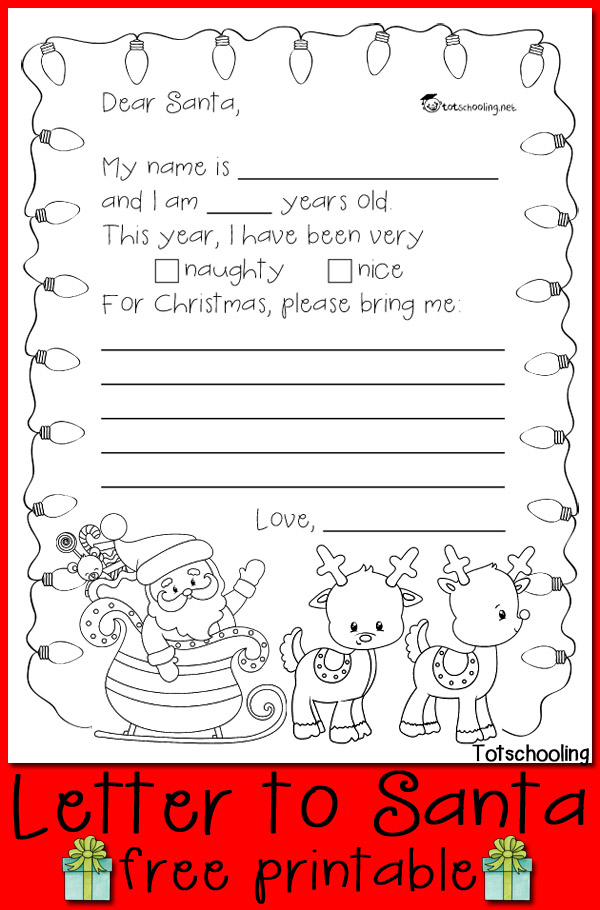

Letter to Santa – Free Printable | letter to santa templateWhy not consider image previously mentioned? can be that awesome???. if you think maybe thus, I’l d provide you with several graphic yet again below:

So, if you would like secure the amazing shots regarding (Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!), click on save button to store these images in your laptop. They’re ready for save, if you appreciate and wish to take it, simply click save symbol in the web page, and it will be instantly down loaded in your home computer.} At last if you would like receive unique and the recent picture related with (Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!), please follow us on google plus or bookmark this site, we try our best to present you regular up grade with all new and fresh shots. Hope you like keeping here. For some upgrades and recent information about (Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you update periodically with fresh and new pictures, enjoy your exploring, and find the ideal for you.

Here you are at our website, articleabove (Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!) published . Today we are excited to declare we have found an incrediblyinteresting contentto be reviewed, that is (Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!) Many people looking for info about(Letter To Santa Template The Story Of Letter To Santa Template Has Just Gone Viral!) and certainly one of these is you, is not it?

Free Letter to Santa Printable Totschooling – Toddler, Preschool | letter to santa template

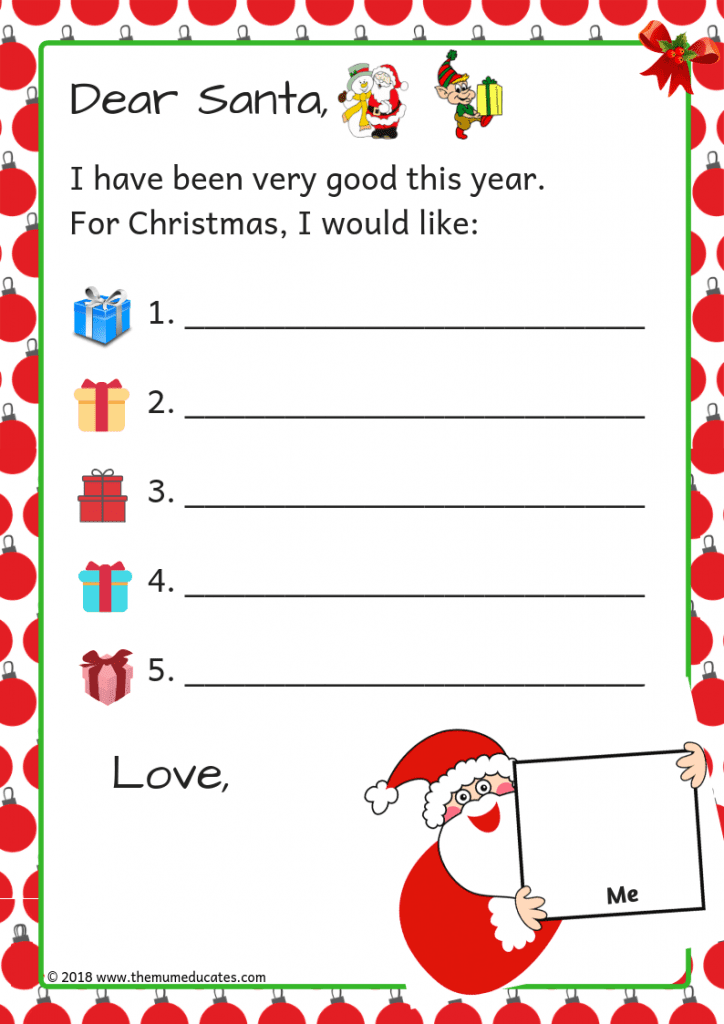

5+ Free Printable Letter to Santa Templates – World of Printables | letter to santa template

5 Free Printable Letters to Santa – The Mum Educates | letter to santa template

Dear Santa Letter Printables – FREE Printabulls | letter to santa template