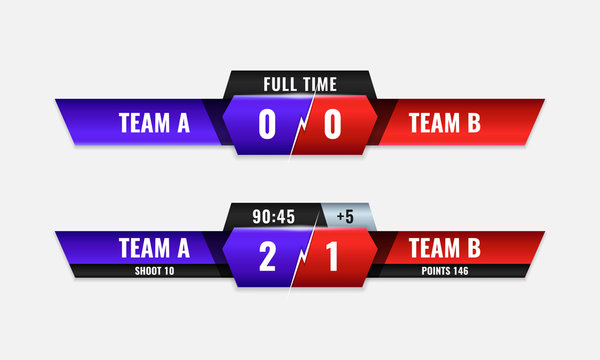

Scoreboard Template The Seven Common Stereotypes When It Comes To Scoreboard Template

Open Door 52, Andrews Osborne 50

Scoreboard template Images Free Vectors, Stock Photos & PSD | scoreboard template

Scoreboard template Images Free Vectors, Stock Photos & PSD | scoreboard template

Scoreboard template Royalty Free Vector Image – VectorStock | scoreboard template

Open Door: Moon 19

Westlake 65, Independence 61

Westlake (1-1): Occhipinti 25, Redding 14, Ostrowski 12

Oberlin 78, Black River 71

Oberlin: Thompson 25, Hopkins 18, Walker 12, Steen 10, Bowen-Pride 7, Freeman 4, Perry 2

Bay 40, Vermilion 31

Scoreboard Template Images – Browse 5,5 Stock Photos, Vectors | scoreboard template

Vermilion: Rhoades 8, Colahan 7, Alvarado 5, Bartlome 5, Naill 3, Lowder 2, Owens 1

Bay: Bisson 18

Vermilion 7 12 5 7 — 31Bay 14 9 11 6 — 40

North Olmsted 48, Valley Forge 31

North Olmsted: Strong 12, Shahin 9, Wengstrom 6

North Ridgeville 49, Amherst 30

Fairview 43, Garfield Heights 36

Norwalk 1,605, Vermilion 1,583

Vermilion: Flemming 368, Rivera 261

Avon 2,267, Avon Lake 2,077

Avon Lake: Gomez 375, Gallagher 361, Alldredge 353

Vermilion 1,605, Norwalk 1,167

Vermilion: Phillips 328, Piwinsky 324

Avon Lake 1,664, Avon 1,477

Avon Lake: Schuerger 332, Brown 285, Paoli 259, Jurgensen 252

Westlake 1,696, Elyria 1,351

Westlake: Baker 322, Omara 291, Shouman 287, Supinski 274, Qadir 249

North Olmsted 1,962, Midview 1,391

North Olmsted: Ardelean 387,

Scoreboard Template The Seven Common Stereotypes When It Comes To Scoreboard Template – scoreboard template | Pleasant to be able to the website, on this period I’ll explain to you in relation to keyword. And after this, this is actually the primary graphic: