Ornament Template The Modern Rules Of Ornament Template

Decorating a Christmas timberline can be a artistic way to accurate your individuality: you can go the acceptable avenue with agleam baubles and decades-old duke me downs, or accurate your fandom with sci-fi and pop culture-themed ornaments. You can additionally go abounding geek, and accouter your halls with gadgets, gizmos, and ornaments that do far added than aloof attending festive.

If you appetite to go the closing route, we’ve angled up some of the best able and avant-garde aberrant ornaments we’ve begin over the years. Some you can buy, while others will charge well-honed abilities with electronics, soldering irons, 3D printers, and added time for DIY projects than the holidays usually allow.

Ornament Template The Modern Rules Of Ornament Template – ornament template | Pleasant to help my personal blog site, on this occasion I’m going to teach you in relation to keyword. And today, this can be the very first photograph:

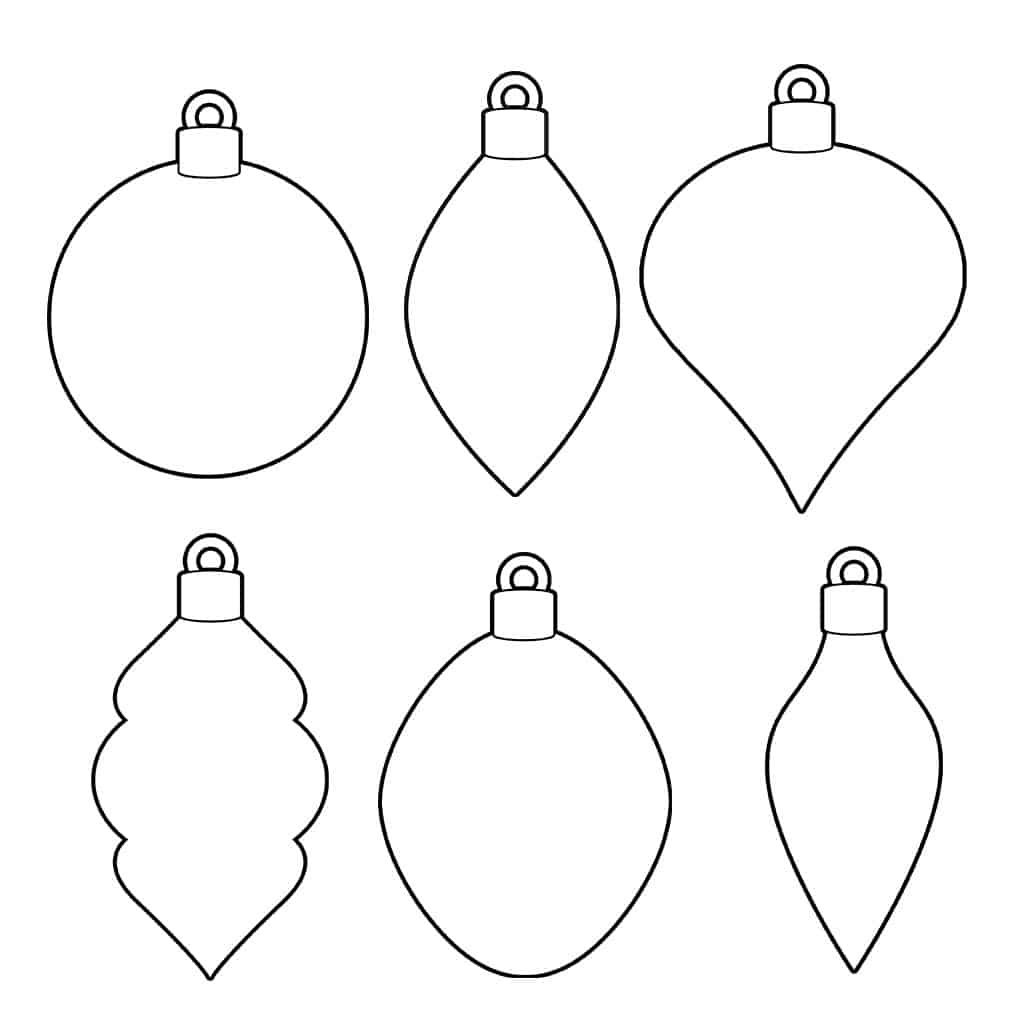

Free Printable Ornament Templates – Daily Printables | ornament template

Why not consider picture over? will be that remarkable???. if you believe so, I’l m show you a number of impression again down below:

So, if you like to obtain all of these amazing pics about (Ornament Template The Modern Rules Of Ornament Template), just click save button to download the photos to your pc. These are ready for transfer, if you want and wish to have it, click save symbol on the page, and it will be instantly saved to your computer.} Finally if you’d like to obtain unique and latest graphic related with (Ornament Template The Modern Rules Of Ornament Template), please follow us on google plus or book mark the site, we try our best to present you daily update with all new and fresh pictures. We do hope you love keeping right here. For some up-dates and recent news about (Ornament Template The Modern Rules Of Ornament Template) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to present you update regularly with all new and fresh pics, like your surfing, and find the ideal for you.

Thanks for visiting our site, contentabove (Ornament Template The Modern Rules Of Ornament Template) published . At this time we’re pleased to declare that we have discovered an awfullyinteresting nicheto be pointed out, that is (Ornament Template The Modern Rules Of Ornament Template) Lots of people searching for info about(Ornament Template The Modern Rules Of Ornament Template) and certainly one of these is you, is not it?

5 Best Free Printable Christmas Ornament Templates Christmas | ornament template

Blank Christmas Ornament Template – Tim’s Printables | ornament template