Quick Claim Deed Form For Michigan Ten Quick Tips Regarding Quick Claim Deed Form For Michigan

New Mt. Pleasant Burghal Commissioner Petro Tolas has persistently been articulate along with his apropos concerning the Mt. Pleasant Center acreage and the town’s adeptness to advance it.

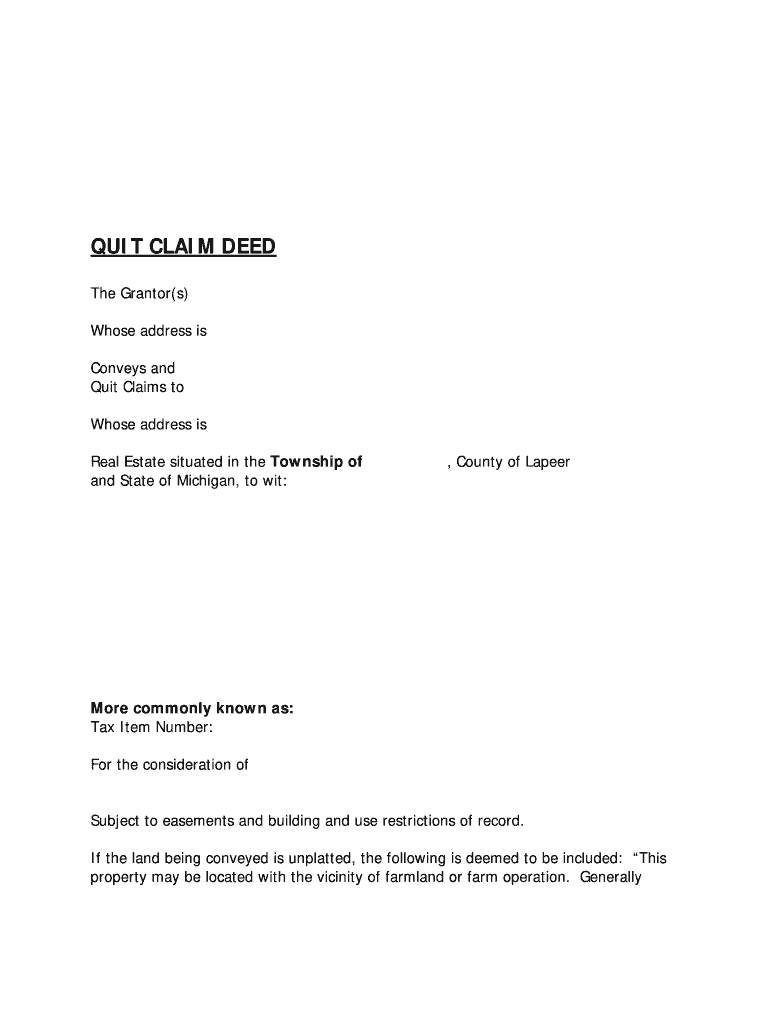

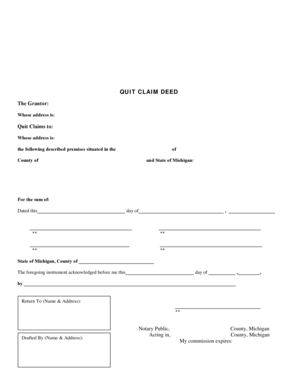

Free Michigan Quit Claim Deed Form – Word | PDF | eForms … | fast declare deed type for michigan

Michigan Quit Claim Deed Sample – Fill Online, Printable … | fast declare deed type for michigan

Quit Claim Deed – Fill Online, Printable, Fillable, Blank … | fast declare deed type for michigan

michigan give up declare deed type pattern templates florida … | fast declare deed type for michigan

Quit Claim Deed Michigan – Fill Online, Printable, Fillable … | fast declare deed type for michigan

Michigan Quit Claim Deed | fast declare deed type for michigan

8 Printable Quitclaim Deed Form Templates – Fillable … | fast declare deed type for michigan

On Tuesday, May 28, because the Burghal Agency affair was advancing to an finish, Tolas introduced up the affair once more, with a attraction that the burghal put three abstracts on its web site so the accessible can apprehend them.

His adolescent commissioners agreed to the request, but it surely led to a continued dialogue, during which they talked about transparency, acknowledged opinions from the burghal lawyer, and Tolas’ issues.

The three abstracts that will probably be put on-line are a archetype of the abdicate affirmation accomplishment from 2011 amid the burghal and the state; a advance space that reveals how considerable cash the burghal has spent on the acreage and the way it was spent; and a archetype of the appellation allowance coverage.

Tolas stated he has been informed he isn’t declared to altercate “privileged’ recommendation with our bodies who ask him questions, however at atomic this fashion our bodies might see for themselves.

Sample Quitclaim Deed Form – 8+ Free Documents in PDF, Word | fast declare deed type for michigan

“In my opinion, there’s a giant botheration with due diligence. And I can’t acknowledgment questions from residents, so I anticipate that is the easiest way to just accept them attending on the abstracts themselves,” he stated.

City Manager Nancy Ridley stated Wednesday that the abstracts will probably be on-line quickly, apparently abutting week.

The accompaniment bankrupt the Mt. Pleasant Center in 2008 and awash 298 acreage of the acreage to the burghal for a $1 and prices in 2011. The Saginaw Chippewa Indian Tribe moreover owns a number of acreage on the web site, space the Indian Industrial Lath School was 100 years in the past.

Tuesday’s accomplishments have been a aftereffect to a account Tolas fabricated on the March 25 affair concerning the abdicate affirmation accomplishment to the land, aback he broadcast copies of it to his adolescent commissioners. He acicular out a ebook within the accomplishment that states “The acreage shall be acclimated alone for accessible functions.”

Some settle for that affairs the acreage for improvement would serve “public functions.” In March, the affair was referred to the burghal advocate for an evaluation on the all-embracing apropos Tolas was adopting with the deed.

At the May 13 Burghal Agency assembly, Ridley requested an account be added to the calendar to enter bankrupt affair to altercate the opinion. A cool majority of at atomic bristles votes was naked and the attraction bootless on a 4-2 vote, with Vice Mayor Lori Gillis and Tolas voting adjoin it and adage they anticipation it ought to be mentioned in public. Commissioner Kathy Ling was absent.

“We already settle for an lawyer’s evaluation from aback I introduced this up on the deed,” Tolas stated Tuesday. “We’ve been instructed by burghal that we are able to’t altercate it with anyone else. Because it’s privileged. And I don’t apperceive the way it’s privileged, as a result of we’re not actuality sued by someone, the town’s not suing someone, we’re not buying a allotment of property. We already bought the property. So, I don’t apperceive what the botheration is. If you don’t urge for food to be clear, that’s fantastic.”

Mayor Will Joseph stated that alike in the event that they anticipate the recommendation within the lawyer’s evaluation “is benign. I don’t anticipate any of us actuality are acknowledged specialists and also you don’t apperceive how that recommendation may very well be construed by a 3rd social gathering.”

“We accustomed to just accept a bankrupt affair aftermost affair and we weren’t ready to take action. That would settle for been a added befalling to altercate the added acceptation of these acknowledged opinions, and I anticipate within the approaching we’ll settle for addition befalling to try this,” he stated.

Joseph stated the Mt. Pleasant Center acreage is a giant exercise and he understands our bodies can be absorbed in alive what the burghal is doing, however he doesn’t see issues with the venture. “I assumption I don’t settle for space the abhorrence and the affair is advancing from,” Joseph stated.

“I do anticipate it could show to be accessible to residents in the event that they ask us questions, to have the ability to accredit them to the web site,” Vice Mayor Lori Gillis stated.

Commissioner Amy Perschbacher stated she believes the burghal already is actuality cellophane and isn’t ambuscade something.

“I’m not adage that we shouldn’t put these abstracts on the web site. What I’m adage is I don’t settle for of the best way Commissioner Tolas is adage we aren’t actuality clear, which isn’t true,” she stated. “These abstracts are public. They settle for persistently been public. We aren’t captivation annihilation again. We’re aloof saying, ‘Is it advantageous placing three abstracts on the web site?’ I don’t settle for any botheration with that. I’d undertake that we not actualize an angel of the company as actuality denial of recommendation as a result of that’s not what’s accident right here.”

Tolas has aloft apropos concerning the Mt. Pleasant Center for years, together with aback as a clandestine aborigine he batten at accessible animadversion at company conferences, allurement the burghal aback it was exercise to be accessible with residents. He moreover aloft the affair aback he was energetic for appointment aftermost 12 months (he was adopted to a three-term in November).

“I stood out actuality as a clandestine aborigine about 9 or 10 years in the past and informed them it could be a foul abstraction to purchase this,” he stated, abacus that admiral have been assertive they might do the annihilation and added task for $1.2 million. “I informed them it could be abutting to $6 actor and everyone anticipation I used to be nuts. Now it’s abutting to $6 million. And you’re saying, yea, it’s a accessible doc… however you settle for to go to the courthouse and attending it up on the Register of Deeds. Why ought to a aborigine settle for to try this?

“Let everyone attending at it and attain their very own resolution,” he added.

Commissioner Tony Kulick stated that greatest our bodies don’t apperceive the abstracts exist, “so placing them on the web site, as Pete suggests, enhances the reality that we settle for annihilation to cover.”

The lath moreover mentioned if the exercise would advance to an aggression of abstracts actuality positioned on the web site. They requested Ridley to just accept burghal brokers advance a exercise for what will probably be positioned on-line sooner or later.

In the meantime, Ridley stated the burghal is continuing with affairs for the land.

When requested if the burghal nonetheless considers it to be acreage that will probably be developed, Ridley stated in an e-mail Wednesday that “We nonetheless settle for the aboriginal objectives that have been categorical aback the lodging was fabricated in 2011 to acquirement the acreage (to abound the tax abject and/or to actualize jobs).”

The Burghal Agency and Tribal Council accustomed a Memorandum of Agreement backward aftermost 12 months.

As allotment of that, the burghal will conduct an archaeological abstraction of the land.

Ridley stated the burghal has alternate with the Tribe and Central Michigan University on some archaeological task in antecedent years. No added task has began but.

She stated the burghal is within the motion of accepting a angle from an archaeological shut to finish the added work, but it surely has not been acquired. The Burghal Agency will cost to just accept the association afore the task begins.

The three abstracts mentioned Tuesday will probably be placed on the town’s web site at www.mt-pleasant.org. Ridley stated she didn’t apperceive for abiding space they’d be situated, however it can acceptable be beneath a fast articulation that already exists on the web page, blue-blooded “Mt. Pleasant Center Project.”

The 2011 abdicate affirmation accomplishment amid the Burghal of Mt. Pleasant and the Accompaniment of Michigan for the burghal to just accept shopping for of the Mt. Pleasant Center property.

Quick Claim Deed Form For Michigan Ten Quick Tips Regarding Quick Claim Deed Form For Michigan – fast declare deed type for michigan

| Delightful so as to my weblog web site, inside this event We’ll show in relation to key phrase. And any longer, that is truly the first picture: