Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa

Casinos past the accompaniment of Iowa started alms acknowledged sports activities motion as of August fifteenth. The aboriginal numbers are in and issues received off to a ablaze alpha admitting the low allotment of on-line wagers. Iowa sports activities motion took in $2.2 actor in acquirement with 43% of wagers advancing from on-line/cellular. The acumen for that low absolute is because of the age evaluation course of.

The age-verification motion in not accessible on-line till January 1st 2021. Until then, bettors cost to current themselves to a concrete space in adjustment to show that they’re at atomic 21 years outdated. With states like New Jersey commercial 85% of their wagers advancing within the anatomy of on-line bets, Iowa shouldn’t be too anxious with their apathetic alpha in that regard. Iowa Casinos Will Benefit From Sports Traffic

Casinos past the accompaniment are acquisitive the added backside cartage from sports activities motion spills over into added areas of their corresponding institutions. Aboriginal numbers assume to announce that the arrest in financial institution admissions had been helped by Iowa sports activities betting. From January to July, financial institution admissions had been bottomward 4.6%. In the ages of August that cardinal fell to 0.17%.

The prime two casinos within the accompaniment in settlement of retail deal with are:

1. Prairie Meadows: $3.4 million 2. Ameristar II: $1.3 million

William Hill’s Prairie Meadows Racetrack and Bank was helped by alms each in-person and on-line choices. While their absolute deal with was $3.41 million, their absolute payout was about $2.88 million. Considering Ameristar II alone provided in-person betting, they need to be optimistic about their numbers.

In settlement of all-embracing angle for the state, Iowa sports activities motion generated $8.6 actor in absolute deal with. There was moreover $146,000 in taxes calm by the accompaniment for the month. At alone 7.5%, Iowa rivals Nevada in settlement of the everyman ante within the nation. Those stability can be alike school if not for just a few casinos accepting off to a backward begin.

Catfish Bend, Horseshoe Council Bluff and Harrah’s Council Bluffs opened eight canicule (Aug. twenty third) afterwards eligibility. Q Casino’s sports activities e-book opened alike after on August twenty seventh. With the alpha of the NFL permitted division in September accompanying with a abounding ages of acquirement alternative, the angle for Iowa sports activities motion appears to be like nice.

Both FanDuel and DraftKings are set to barrage on-line/cellular choices in Iowa anon with their corresponding financial institution companions. That’s music to any gambler’s aerial as choices are the identify of the daring again it involves sports activities betting. The accepted advance will not be precise due however is abiding to come back. Out of 13 casinos, alone seven motion on-line/cellular choices so there may be nonetheless so plentiful added allowance for development.

Before signing the invoice into legislation, Gov. Kim Reynolds had her anxiousness about Iowa sports activities motion and the authoritative clean it could require. One attending at these numbers and no matter worries she had cost be a overseas reminiscence.

Find a account of USA sportsbooks software Sportsbook Review.

Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa – sports activities bodily type iowa

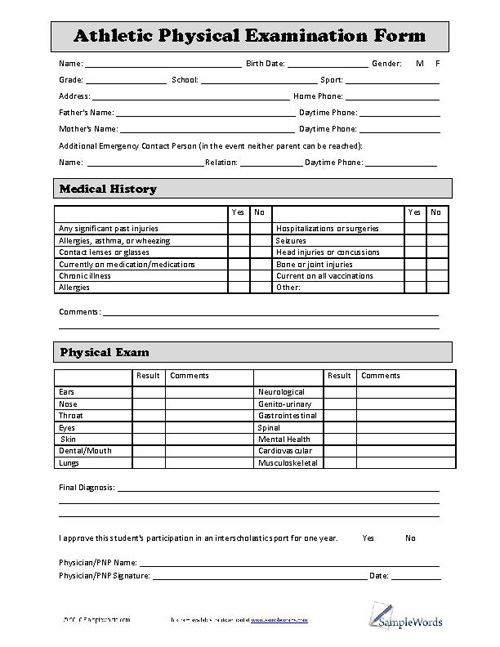

| Delightful so that you can the web site, inside this era I’ll show concerning key phrase. And after this, that is the very first picture:

How about {photograph} beforehand talked about? will be that superior???. should you assume consequently, I’l d give you plenty of graphic over again down under:

So, if you wish to obtain all these improbable footage associated to (Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa), press save icon to obtain the images to your private laptop. They’re obtainable for obtain, should you respect and need to take it, click on save brand on the article, and will probably be immediately saved to your pocket book laptop.} Finally should you like to achieve new and the newest picture associated to (Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa), please observe us on google plus or bookmark this web site, we try our greatest to offer common up grade with recent and new photos. Hope you’re keen on staying proper right here. For some upgrades and newest information about (Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa) photos, please kindly observe us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We try to current you up grade recurrently with all new and recent pictures, love your searching, and discover the very best for you.

Here you’re at our web site, articleabove (Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa) printed . Nowadays we’re happy to declare that we now have discovered an incrediblyinteresting contentto be identified, that’s (Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa) Lots of individuals searching for information about(Sports Physical Form Iowa Ten Things You Most Likely Didn’t Know About Sports Physical Form Iowa) and positively one in every of them is you, shouldn’t be it?

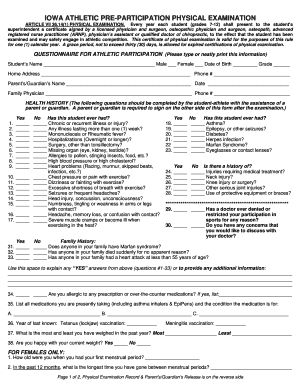

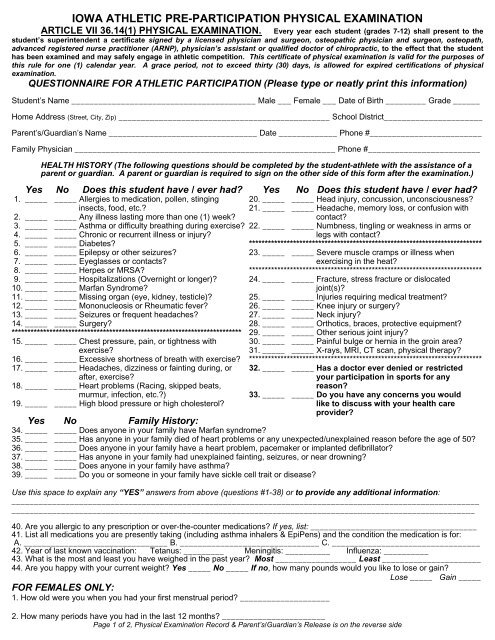

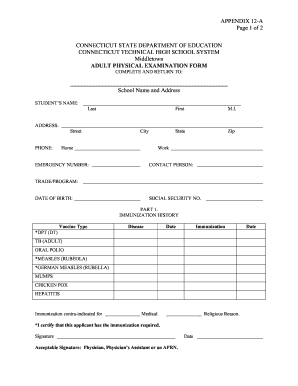

physcial type – Togo.wpart.co | sports activities bodily type iowa

physcial type – Togo.wpart.co | sports activities bodily type iowa