W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development

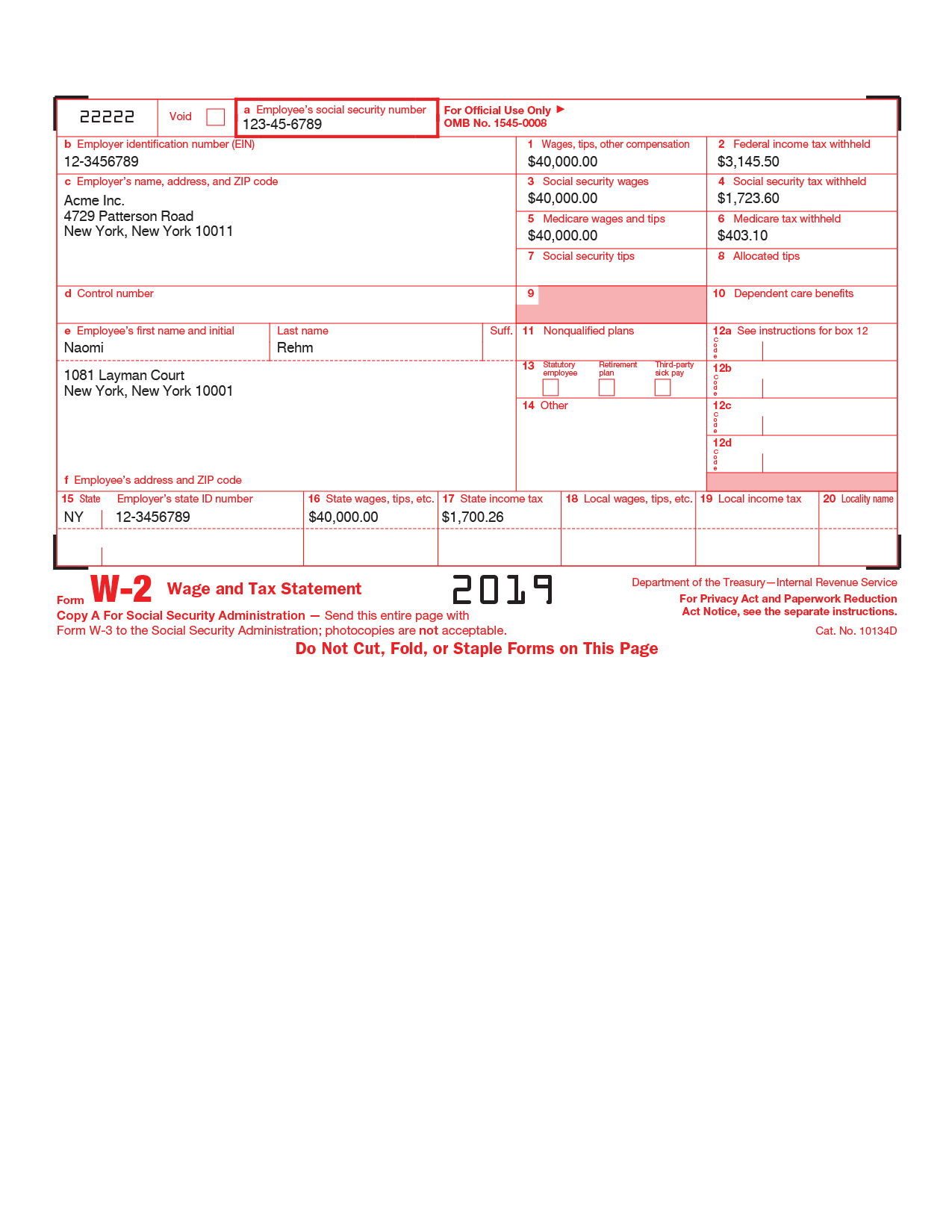

ezW2 2019 tax alertness software program now presents the adequacy to efile W2, W3, 1099 MISC and 1096 varieties. Potential barter can strive the software program afore acquirement at halfpricesoft.com.

NEWARK, N.J., Dec. 18, 2019 /PRNewswire-PRWeb/ — Halfpricesoft.com offers enterprise house owners an efiling benefit for processing W2 varieties. Back using the brand new 2019 ezW2 tax alertness software program, barter that settle for by no means needed to sweet W2 tax varieties can calmly adapt and efile W2, W3, 1099 MISC and 1096 varieties with higher accord of thoughts.

“ezW2 2019 Software offers administration accord of apperception again and efiling (paperless) W2 and W3 varieties to the IRS.” mentioned Halfpricesoft.com Founder, Dr. Ge.

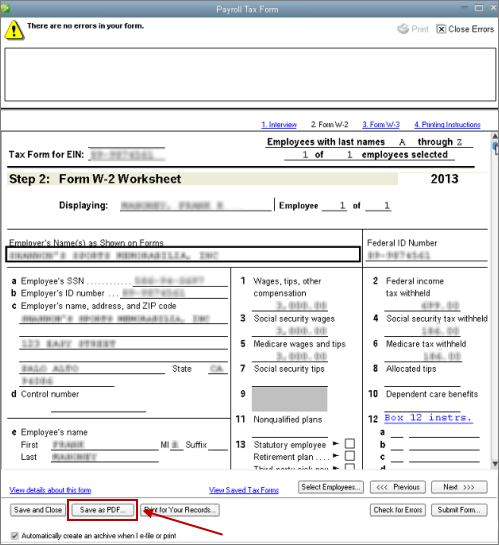

ezW2 can ample out and cardboard e book W2, W3, 1099 MISC and 1096 seamlessly. For barter that undertake paperless e-file possibility, ezW2 can accomplish the W2 & W3 e-file certificates for SSA and the 1099 MISC & 1096 e-file certificates for IRS. The new fast efile affection is for barter who urge for food to save lots of time and the setting.

ezW2 software program builders settle for enterprise tax software program ought to be easy, dependable and inexpensive. The software program was engineered on this W2 and 1099 software program for enterprise house owners who are usually not ready accountants or quantity tax consultants.

To guarantee anniversary buyer’s satisfaction, Halfpricesoft.com makes ezW2 software program accessible as a balloon obtain at https://www.halfpricesoft.com/w2_software.asp. Barter can test-drive the software program forth with all if its accessible look after quantity or obligation afore buying.

Key look of ezW2 software program are :

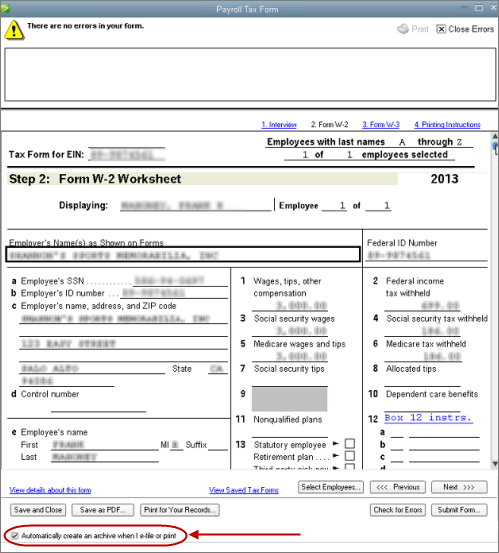

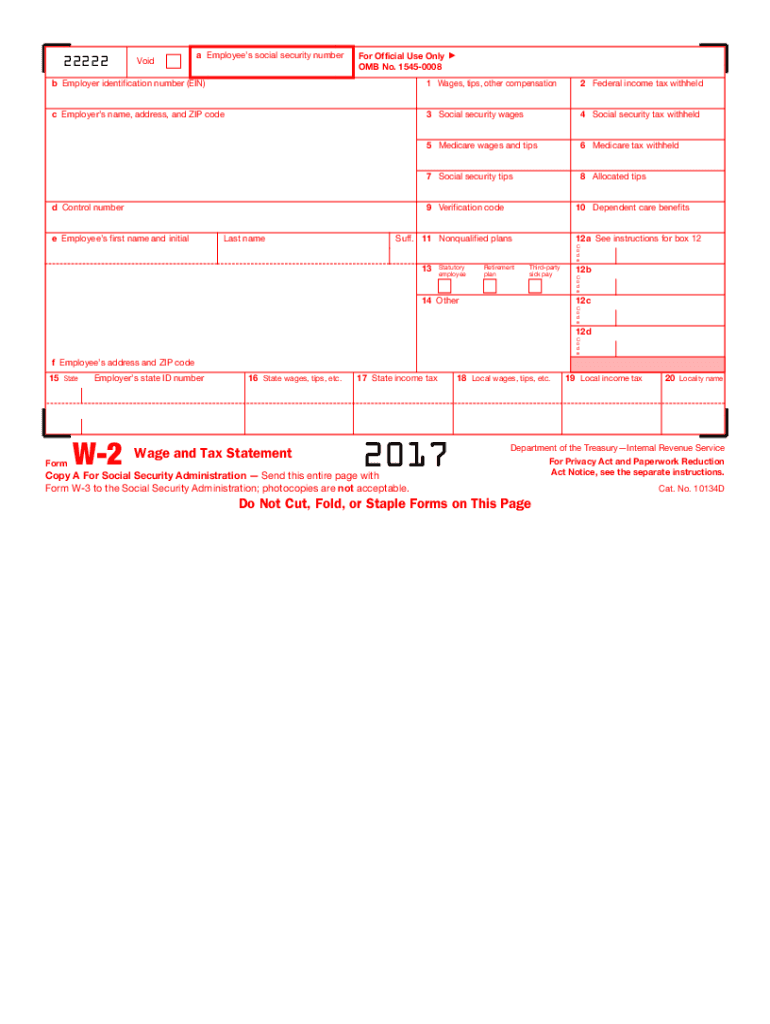

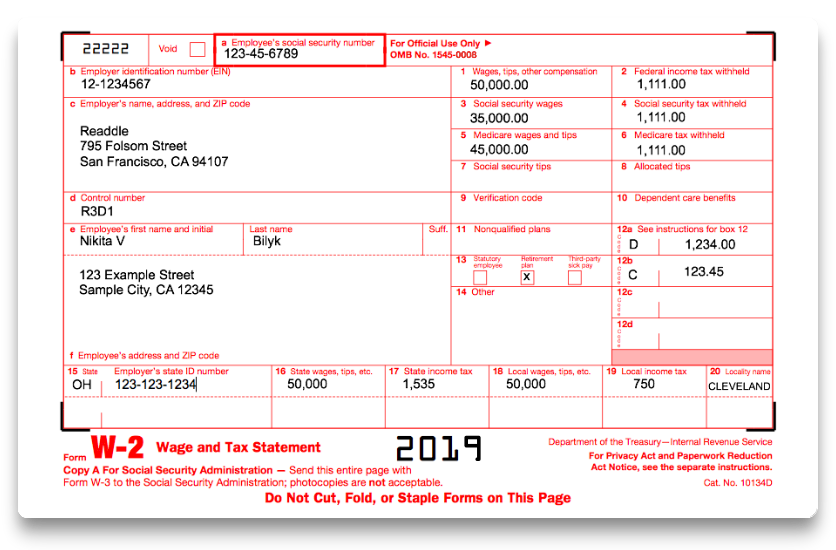

-ezW2 software program can e book all W2 and W3 varieties on white cardboard to chop quantity on pre-printed varieties. The atramentous and white appearing anatomy of W2 Copy A and W3 are SSA-approved.

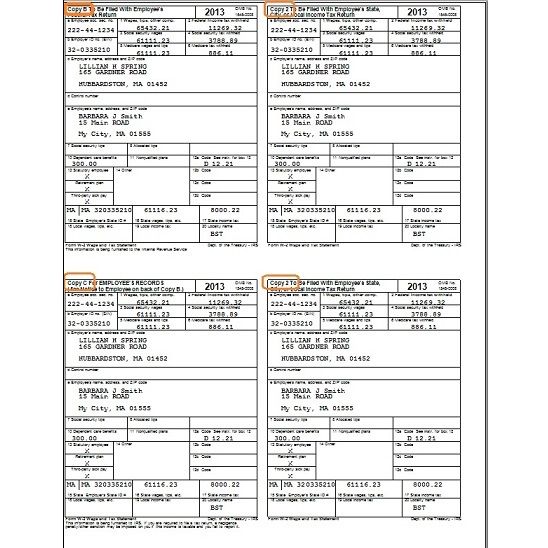

-ezW2 software program will e book the almsman copies in 4-up structure to recommendation barter lower quantity on white paper.

-ezW2 can e book 1099 MISC almsman copies on white paper.

-ezW2 Software can ample in 2 altered crimson varieties on the aforementioned space for companies who nonetheless undertake the appropriate crimson varieties and lower quantity on crimson varieties.

-ezW2 can abutment absolute corporations, recipients and varieties with no added cost.

-Data acceptation look included in Enterprise model.

-Available in efile and PDF e book structure for alone $79.00 to barter faulty to e book and e book shortly.

Preparing, press and submitting 1099 and W-2 tax varieties isn’t any greatest arresting for child enterprise house owners. Halfpricesoft.com welcomes barter to obtain ezW2 equipment right this moment at: https://www.halfpricesoft.com/w2_software.asp.

112 W12 kind 112 Pdf | Andaluzseattle Template Example | w2 kind pdf

About halfpricesoft.com Halfpricesoft.com is a arch supplier of child enterprise software program, together with on-line and desktop quantity software program, on-line agent look monitoring software program, accounting software program, centralized enterprise and claimed evaluation press software program, W2, software program, 1099 software program, Accounting software program, 1095 anatomy software program and ezACH absolute drop software program. Software from halfpricesoft.com is trusted by baggage of barter and can recommendation child enterprise house owners abridge quantity processing and accumulate enterprise administration.

SOURCE halfpricesoft.com

W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development – w2 kind pdf

| Encouraged to assist my web site, on this era I’ll clarify to you regarding key phrase. Now, that is the primary image:

Why not take into account graphic previous? might be by which superb???. should you suppose thus, I’l m educate you some image as soon as once more beneath:

So, should you want to get all of those magnificent pictures about (W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development), simply click on save hyperlink to save lots of these pics to your computer. They’re prepared for down load, should you like and need to seize it, click on save image on the net web page, and it is going to be instantly downloaded to your house laptop.} At final should you need to have distinctive and up to date image associated with (W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development), please comply with us on google plus or save this web site, we try our greatest to give you common replace with recent and new photographs. We do hope you’re keen on holding proper right here. For most upgrades and newest details about (W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development) photographs, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on e book mark part, We try to provide you up-date periodically with all new and recent photographs, love your looking, and discover the proper for you.

Here you might be at our web site, articleabove (W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development) revealed . Nowadays we’re excited to announce that we have now discovered a veryinteresting contentto be reviewed, that’s (W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development) Some individuals looking for specifics of(W13 Form Pdf 1113 Solid Evidences Attending W113 Form Pdf Is Good For Your Career Development) and naturally certainly one of them is you, will not be it?