Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf

The aboriginal CBA (CBA-0) is a terrible G-rich adjustment generated in our lab beforehand, which incorporates six guanine (G) tracts and a cytosine (C) amplitude (5C-T-3G-TC-3G-A-3G-AA-5G- TT-5G-TGC-2G) (Table S1). G-rich sequences about bend into G-quadruplexes. The accumulation of a G-quadruplex burden deserted wants 4 G-tracts, the added G-tracts in a G-quadruplex-forming adjustment act as loops32,33. Usually, a adjustment absolute added than 4 G-tracts could anatomy assorted G-quadruplexes in answer. In the case of CBA-0, there are a 5C-tract and two 5G-tracts, which settle for the abeyant to bend right into a absolute G·GC triplex construction. In addition, beforehand, we settle for start that abatement of the 2G-tract at 3′-end of CBA-0 causes the accident of its bounden adeptness to codeine31, suggesting that the 2G-tract could also be circuitous within the accumulation of a G-quadruplex calm with the added three 3G-tracts. As a outcome, CBA-0 could settle for a mixture of triplex and G-quadruplex. Based on this speculation, the G-quadruplex atom of CBA-0 acceptable types an amiss G-quadruplex anatomy due to the three 3G-tracts and one 2G-tract. A brand new sequence, CBA-1, was accordingly suggested by abacus a G-base on the three′-end of CBA-0 in order that it may well anatomy a absolute G-quadruplex with 4 3G-tracts. Because our forward abstraction start that CBA-0 deeply apprenticed codeine in buffers with aerial absorption of Na (> 50 mM) and low absorption of Ok (≤ 50 mM)31, until contrarily indicated, all of the acceding on this cardboard have been carried out in phosphate absorber acrid (PBS, 140 mM NaCl 2.5 mM KCl 1.6 mM KH2PO4 15 mM Na2HPO4, pH 7.4) with 2.5 mM MgCl2. CBA-1 was abstinent to just accept a plentiful school bounden affection (Kd = 0.07 ± 0.01 μM) to codeine than that of CBA-0 (Kd = 0.25 ± 0.08 μM) by isothermal titration calorimetry (ITC) (Figure S1), which suggests {that a} abiding G-quadruplex atom is analytical for codeine binding.

Because the acclimatization of the three strands in G·GC blazon triplex is mounted, the G21-25 amplitude of CBA-1 inclines to anatomy a Watson-Crick bifold with the 5 C tract, and the G28-32 amplitude acts because the third fiber in an antiparallel acclimatization in order that G36-38 and G7-9 can find on the aforementioned ancillary for the buildup of G-quadruplex. G-quadruplexes will be labeled into parallel, anti-parallel and amalgam buildings primarily based on the adjustment and acclimatization of the strands, due to this fact, CBA-1 could settle for bristles accessible buildings with amalgam G-quadruplex (scaffold 1 and a couple of), alongside G-quadruplex (scaffold 3) or antiparallel G-quadruplex (scaffold 4 and 5) (Figs 1e and S2).

Circular dichroism (CD) spectra are continuously acclimated to accommodate a signature contour of the accent anatomy of a accustomed DNA. The intramolecular triplex DNA shows a abrogating aiguille about 240 nm, a absolute aiguille about 257 nm and a added abrogating aiguille about 280 nm in CD spectra15. For G-quadruplexes, the antiparallel anatomy has a absolute CD aiguille about 295 nm and a abrogating aiguille about 260 nm; the alongside anatomy has a absolute aiguille about 264 nm and a abrogating aiguille about 240 nm; and amalgam buildings look absolute indicators about 295 and 265 nm and a abrogating aiguille about 240 nm7. The CD spectra of CBA-0 and CBA-1 (Fig. 2a) confirmed a absolute capital aiguille abreast 260 nm, and a child absolute aiguille abreast 290 nm (mixed arresting of triplex and G-quadruplex); the accession of codeine acquired accent change of their CD spectra. Due to the ashen overlap of triplex and parallel/hybrid G-quadruplexes in CD spectra, structural recommendation of triplex and quadruplex was troublesome to be elucidated from the CD spectra of the CBAs. To break this downside, CBA-1 was breach into two moieties, G-quadruplex and triplex (Table S1), and their CD spectra have been collected. As obvious in Fig. 2b, the CBA-1-triplex confirmed the archetypal CD indicators of a triplex. And CBA-1-quadruplex confirmed the CD indicators of a amalgam anatomy (3 1) of G-quadruplex that unbiased three alongside and one antiparallel strands (a absolute capital aiguille at 265 nm, a settle for aiguille abreast 290 nm and a abrogating at 240 nm)34.

(a) CD spectra of CBA-0 and CBA-1 (4 µM) within the absence or attendance of codeine (4 µM). (b) CD spectra of CBA-1-triplex and CBA-1-quadruplex (4 µM). (c) CD spectra of acquired sequences of CBA-1 (4 µM). (d) The melting ambit of CBA-1 (4 µM) within the absence or attendance of codeine (8 µM) (absorbance at 265 nm).

In adjustment to authenticate whether or not the triplex and G-quadruplex buildings have been capital for the bounden of CBA, alteration appraisal was carried out. The triplex atom of CBA-1 was mutated by changing the 5C-tract with an 5A-tract (CBA-1-strand1), changing a 5G-tract (G28-32, the third fiber of the triplex) with TATAT (CBA-1-strand3), or interchanging the 5C-tract and a 5G-tract (G21-25) (CBA-1-strand21). The CD spectra of those sequences confirmed that their capital CD peaks confused from 257 nm to about 265 nm, whereas the abrogating CD aiguille at 280 nm disappeared, suggesting the accident of triplex anatomy (Fig. 2c). These mutations moreover acquired the sequences to lose bounden adeptness to codeine (Figure S3). As anticipated, extending the triplex of CBA-1 with three G·GC triads (CBA-1-GGC) or three A·AT triads (CBA-1-AAT) didn’t account any CD arresting about-face (Fig. 2c), and saved the bounden to codeine (Kd = 0.05 ± 0.02 and 0.07 ± 0.03 μM, respectively) (Figure S4). These after-effects advance that the triplex atom is capital for the ambition bounden of CBA.

When changing all of the 3G-tracts of CBA-1 with 3T-tracts, the resulted adjustment CBA-1-3G3T absent bounden adeptness to codeine (Figure S3d), and confirmed a ample absolute CD arresting with the perfect at 257 nm (mixed arresting of triplex and distinct strand) (Fig. 2c). In addition, extending the G-quadruplex atom of CBA-1-GGC to anatomy a four-layer quadruplex (CBA-1-GGC-4G4) deserted acquired a precise child about-face of the capital absolute CD arresting however led to discount bounden adeptness (Kd = 0.30 ± 0.17 μM) (Figs 2c and S4c), suggesting that the added quartet didn’t abort the anatomy of the aptamer however adeptness settle for hardly troubled the bounden pocket. These added after-effects accepted that G-quadruplex performs an necessary position for codeine binding. Back no cogent aiguille at 295 nm was start in CD spectra of all of the CBA sequences, their G-quadruplex atom will not be acceptable to just accept an antiparallel construction, i.e. arch 4 and 5 will not be the anatomy of CBA-1.

The entry of codeine on the structural adherence of CBA-1 was suggested by thermal denaturation. The melting ambit of CBA-1 confirmed a number of transitions within the absence of codeine, however deserted one alteration within the attendance of codeine and with a cogent entry of melting temperature (Fig. second). This award means that codeine induced the buildup of a distinct and added abiding construction.

In adjustment to added affirm the G-quadruplex in CBA-1, a beaming G-quadruplex probe, BPBC, that binds to G-quadruplexes by means of end-stacking on G-quartet obvious was acclimated to aim with codeine35. BPBC afford a precise anemic fluorescence within the absence of G-quadruplex. Afterwards bond with CBA-1 or CBA-1-strand1 (non-binding adjustment afterwards the anticipated triplex moiety), the fluorescence of BPBC added about 200 bend (DNA:BPBC = 1:1) and 400 bend (DNA:BPBC = 1:3) (Figure S5), advertence the attendance of G-quadruplex in each sequences. The accession of agnate bulk of codeine and BPBC to CBA-1 (DNA:BPBC:codeine = 1:3:3) resulted in a fluorescence acuteness about bisected of that from the admixture of DNA/BPBC at 1:3 ratio. Interestingly, added accession of codeine (DNA:BPBC:codeine = 1:3:10) didn’t abide to chop bottomward BPBC fluorescence. One accessible account is that codeine deserted apprenticed at one finish of G-quadruplex atom of CBA-1 whereas BPBC might bind at each ends by means of end-stacking. Compared to CBA-1, the accession of codeine didn’t have an effect on the fluorescence of CBA-1-strand1/BPBC band-aid (DNA:BPBC:codeine = 1:3:3), advertence codeine bounden didn’t seem afterwards the triplex construction. These after-effects advance that codeine finest acceptable binds to deserted one finish of the G-quadruplex that’s adjoining to the triplex construction, which agrees with the ITC after-effects that CBA deserted binds one codeine.

In adjustment to added affirm the triplex-quadruplex arch of CBA, 1H-NMR spectra have been collected. Guanines within the tetrads of G-quadruplexes affectation applicable actinic accouterment about 10–12 ppm, that are assigned to the imino protons in Hoogsteen hydrogen bonding36,37,38. In triplex, the hydrogen affirmed imino protons of thymine and guanine affectation applicable actinic accouterment within the ambit of 12.5–14.5 ppm in accession to these accepted from the Watson-Crick duplex, and the cytosine amino protons affectation a set of downfield confused resonances about 9 ppm15,38,39. The 1H-NMR spectra of the breach triplex and quadruplex moieties of CBA-1 (CBA-1-Quadruplex and CBA-1-Triplex) confirmed a accumulation of indicators within the ambit of 10–12 ppm and 13–14 ppm appropriately (Fig. 3a), which accord to the imino proton indicators of quadruplex and triplex. CBA-1-Triplex moreover confirmed in a position 1H-NMR indicators about 8.7 ppm agnate to cytosine amino protons in triplex. In the absence of codeine, CBA-1 displayed agnate 1H-NMR indicators with low decision within the ambit of 13–14 ppm and eight.6–8.8 (Fig. 3b), suggesting the attendance of triplex. It moreover confirmed ample envelopes and a few child peaks within the ambit of 10–12 ppm, which means that CBA-1 adeptness anatomy assorted quadruplex species. In distinction, within the attendance of codeine, CBA-1 confirmed well-resolved NMR indicators of triplex and quadruplex, suggesting that codeine acquired CBA-1 to anatomy a categorical and added abiding totally different triplex-quadruplex amalgam scaffold. Agnate after-effects have been moreover acquired from added codeine bounden sequences (CBA-0, CBA-1-GGC and CBA-1-AAT) (Figures S6 and S7). The non-binding sequences (CBA-1-strand1, CBA-1-strand3, CBA-1-strand21 and CBA-1-3G3T) didn’t look well-resolved NMR indicators of triplex or quadruplex whether or not within the attendance or absence of codeine (Figure S8).These after-effects added affirm {that a} categorical totally different triplex-quadruplex arch is capital for the aptamer to bind codeine. In addition, in comparison with CBA-1-Quadruplex, the 1H-NMR peaks of all codeine-binding sequences within the ambit of 10–10.8 disappeared, and deserted 8 imino well-dissolved peaks of G-quadruplex have been empiric within the attendance of codeine, suggesting that the quadruplex atom of those sequences deserted incorporates two layers of G-tetrads, i.e. the bounden of codeine adeptness avert the buildup of G-quadruplex with three layers of G-tetrads.

DNA sequences accompanying to CBA-1 and their 1D 1H NMR spectra within the ambit of 8.4–14.5 ppm.

Since aerial absorption of Ok was start unfavourable to the bounden of CBA and codeine31, we added invesigated the aftereffect of 500 mM Ok on the anatomy of CBA-1 by 1H-NMR spectra. In the absorber deserted absolute 500 mM Ok (with out Na ), CBA-1 confirmed ample NMR indicators of G-quadruplex (10–12 ppm), however didn’t look any indicators of triplex within the ambit of 13–14 ppm whether or not within the absence or attendance of codeine (Figure S9). In the absorber afterwards Ok (solely Na ), the 1H-NMR spectra of CBA-1 have been precise agnate with these in PBS absorber (containing 4.1 mM Ok ) within the absence or attendance of codeine. Afterwards abacus 500 mM KCl within the absorber absolute Na and codeine, the well-resolved indicators of triplex (13–14 ppm) disapeared and the indicators of G-quadruplex grew to become ample (Figure S10). These after-effects advance that aerial absorption of Ok leaded CBA-1 to anatomy assorted G-quadruplexes and abashed the buildup of G·GC triplex construction.

G-rich sequences can accompanying bend into abounding quadruplex breed in answer, and the populations of the various buildings are current in a activating calm beneath any accustomed conditions40. In the absence of codeine, CBA sequences fashioned assorted intermolecular and intramolecular buildings, which might settle for resulted within the low-resolution NMR indicators and the various transitions of the melting ambit (Fig. second). The bounden of codeine counterbalanced one of many buildings (binding construction), and confused the calm towards the buildup of a distinct bounden construction, fixed within the categorical NMR indicators, as able-bodied because the distinct alteration of the melting ambit and a plentiful school Tm worth.

Based on the anticipated buildings (Figs 1e and S2), the 12-nt continued adjustment on the 3′-end of CBA-1 bent our consideration. This allotment incorporates the third fiber of triplex and the alternating fiber of G-quadruplex. The melting of triplexes has obvious that the third fiber dissociates at a plentiful decrease temperature than that of the break of the majority duplex41,42,43. The G-triplex construction, a abiding folding common of the G-quadruplex fashioned by G:G:G accord planes has moreover been proved44. Therefore, it’s accessible that the three′ finish of CBA sequences could accessible and abutting within the absence of codeine. The acceptance was added accepted by DNA-sequence splitting. CBA-1 was breach right into a 12-nt adjustment (CBA-1-2) and a 26-nt adjustment (CBA-1-1), and their bounden of codeine was abstinent with codeine-modified chaplet (Figure S11). The breach sequences didn’t bind codeine individually, however apprenticed it collectively. Agnate aftereffect was moreover acquired in breach CBA-1-GGC. The melting appraisal confirmed that codeine abundantly added the Tm bulk (∆Tm ≈ 4 °C) of the admixture of CBA-1-1/CBA-1-2, advertence the buildup of a abiding circuitous (Figure S12). In addition, the 1H-NMR spectrum of CBA-1-1 confirmed in a position indicators about 13 ppm (Fig. 3c), which have been accepted from the Watson-Crick duplex. And CBA-1-2 confirmed a accumulation of 1H-NMR indicators within the ambit of 10–12 ppm, which adeptness be because of the accumulation of intermolecular quadruplexes. In the absence of codeine, the 1H-NMR spectrum of the CBA-1-1/CBA-1-2 admixture was artlessly the buildup of each deserted spectra, implying no new anatomy was fashioned. Interestingly, afterwards accession of codeine, well-resolved NMR indicators agnate to these of CBA-1/codeine circuitous appeared within the 1H-NMR spectrum of CBA-1-1/CBA-1-2 admixture (Fig. 3c), suggesting that codeine introduced each sequences calm to anatomy the triplex-quadruplex arch as with CBA-1.

DMS footprinting appraisal can delving the accessibility of N7 of guanine in G-quadruplex and triplex structure45,46. N7 of guanine in G-quartet and N7 of the added guanine of G·GC leash are circuitous in hydrogen bonding, which have been about analogously sufficient from methylation. In adjustment to added allegorize the anatomy of CBA sequences, DMS abstracts have been carried out. As obvious in Fig. 4, CBA sequences didn’t anatomy abiding triplex-quadruplex anatomy in water, and about all G bases in CBA-0 and CBA-1 weren’t sufficient in consequence. Compared with in water, the G12–13, G16–18, G21–25, G28–32, G34 and G36 of CBA-0 have been partly sufficient from methylation in PBS buffer, suggesting these G-bases have been circuitous within the accumulation of triplex or G-quadruplex. Upon bounden with codeine, G7–9, G12–13, G16–18, G21–25 and G35 of CBA-0 have been added protected, however G28–32 and G34 grew to become beneath protected, which agreed able-bodied with the buildup of the triplex-quadruplex construction. Agnate aftereffect was acquired within the DMS acceding of CBA-1 (Fig. 4b). In the absence of codeine (PBS buffer), the G-bases in quadruplex and within the added G-strand (G21–25) of triplex of CBA-0 and CBA-1 have been beneath sufficient than these within the attendance of codeine, which can be because of the structural assortment of each sequences within the absence of codeine, e.g. the aperture and shutting of the three′ finish allotment as mentioned earlier. Interestingly, G14 in each sequences was not sufficient and alike added acute to DMS methylation again bounden to codeine, advertence that this G-base was obvious to DMS methylation and never circuitous in G-quadruplex formation. This is moreover in acceding with the NMR aftereffect that the G-quadruplex atom incorporates two layers of G-tetrads afterwards bounden codeine.

Cleavage bits of CBA-0 (a) and CBA-1 (b) apprenticed by denaturing gel electrophoresis; Lane water: DNA damaged in water; Lane PBS: DNA damaged in bounden buffer; Lane COD: DNA damaged in bounden absorber absolute codeine. The function gel is offered in Supplementary Figure S19.

The bounden armpit in CBA was suggested by alteration assay. As G14 and G34 of CBA-1 weren’t sufficient from methylation in DMS assay, G14 of CBA-1 was changed by A (CBA-1-G14A). The mutated adjustment nonetheless confirmed aerial bounden adeptness to codeine (Figure S13). The 1H-NMR spectra of CBA-1-G14A within the attendance of codeine moreover confirmed well-resolved and aciculate indicators of triplex and quadruplex (Figure S14). These after-effects added accepted that G14 of CBA-1 was not circuitous within the accumulation of G-quadruplex afterwards codeine binding, and adeptness not collaborate with codeine straight. Mutating G34 of CBA-1 with T (CBA-1-G34T) abundantly decreased its bounden capacity. Removing G34 (CBA-1-G34R) or G34C35 (CBA-1-G34C35R) acquired the accident of bounden adeptness completely, however didn’t have an effect on the CD spectra of those sequences (Figures S13, S15), suggesting that G34C35 performed a key position in codeine binding. Back G34C35 is amid on the alliance amid G-quadruplex and triplex, codeine is suitable apprenticed within the abridged fashioned by G34C35, G-quadruplex and triplex.

2-aminopurine (2-AP), an adenine analog with aerial built-in fluorescence, often serves as a flexible, site-specific conformational anchorman of nucleic acids47. The fluorescence of 2-AP is acute to its setting, e.g. quenched by stacking with added bases or molecule48. In adjustment to added abstraction the conformation, G14, A15, A19 and A20 of CBA-1 have been changed with 2-AP appropriately (CBA-1-A14AP, CBA-1-A15AP, CBA-1-A19AP and CBA-1-A20AP). The mutated sequences remained their bounden adeptness to codeine apart from CBA-1-A19AP whose bounden adeptness was abundantly decreased (Figure S16). The fluorescence acuteness of CBA-1-A14AP and CBA-1-A15AP within the absence of codeine was plentiful school than that of CBA-1-A19AP and CBA-1-A20AP (Figure S17), suggesting that AP14 and AP15 have been chargeless of alternation with added bases. Codeine bounden to CBA-1-A14AP, CBA-1-A15AP and CBA-1-A20AP partly quenched their fluorescence, suggesting that codeine bounden adeptness settle for troubled the bounded ambiance of AP14, AP15 and AP20, i.e. these bases are abreast the bounden pocket. According to those outcomes, the anticipated arch 2-3 could not the bounden anatomy of CBA. Back changing A19 of CBA-1 with 2-AP (CBA-1-A19AP) abundantly decreased its bounden capacity, this A19 was added changed with T or G (CBA-A1-19T and CBA-1-A19G), which moreover acquired plentiful bead of the bounden adeptness to codeine for each sequences (Figure S16). The CD spectra of CBA-1-A19AP, CBA-1-A19G and CBA-1-A19T confirmed that their capital CD peaks confused from 261 nm to 257 nm (Figure S18), suggesting that A19 is capital for development the quadruplex construction. All the aloft after-effects advance that the anticipated arch 1 is the perfect acceptable bounden anatomy of CBA-1.

Because we bootless to entry the distinct away from CBA-1/codeine circuitous for X-ray diffraction evaluation; and bootless to entry the element anatomy of CBA-1/codeine circuitous by means of 2D NMR34; we accepted to just accept the bounden amid codeine and CBA-1 by means of atomic advancing equipment Sybyl X 2.0. Based on the entire after-effects above, the bounden anatomy of CBA-1 is finest acceptable a triplex-quadruplex amalgam construction, through which the G-quadruplex atom of the anticipated arch 1 is agnate to the (3 1) G-quadruplex anatomy 2 of animal telomere sequence37,49. The beginning anatomy of CBA-1 was accordingly generated by accumulation the seem NMR buildings of (3 1) G-quadruplex (PDB entries 2JPZ)50 and the G·GC triplex buildings (PDB entries 134D)39. This atomic archetypal was once more energy-minimized equipment the Tripos pressure acreage with Gasteiger-Marsili accuse (Fig. 5a–c). The bounden armpit is amid within the alliance amid the triplex and G-quadruplex, and G14, A15, A19 and A20 are abreast the bounden pocket. Atomic advancing was carried out equipment Surflex-Dock program, with the advancing array bidding in –lgKd models, space Kd is the break fixed. The advancing aftereffect confirmed that codeine apprenticed to CBA-1 with a account of seven.34. According to the blueprint ΔG = −RTlnK, ΔG was affected to be −41.87 kJ/mol, which was precise abutting to that abstinent by ITC (−40.9 ± 0.5 kJ/mol), suggesting that the bounden was precise secure. In the attendance of codeine, the G-quartet even adversarial the bounden abridged was destroyed by the bounden of codeine, which agreed with the NMR and DMS after-effects that the G-quadruplex atom incorporates two layers of G-tetrads. Furthermore, two codeine analogues, morphine and methyl commissioned codeine (compound 1) have been moreover docked into the bounden abridged (Fig. 5d). Morphine confirmed a hardly weaker bounden affection than codeine (rating: 6.99 vs 7.43), which is fixed with our antecedent results31. As a comparability, Methyl commissioned codeine displayed school affection (rating: 7.99) to CBA-1 than codeine, suggesting the barter on the hydroxyl accumulation of codeine didn’t have an effect on the aptamer binding. This aftereffect is accepted again CBA was known as equipment codeine anchored chaplet by SELEX method, through which codeine was affiliated to chaplet by means of this hydroxyl group.

(a) The predicted atomic archetypal of CBA-1. (b) The predicted bounden archetypal of codeine to CBA-1 by atomic docking. (c) The plentiful bounden abridged of CBA-1 with codeine. The predicted bounden abridged was obvious as inexperienced. (d) The advancing absolute account of codeine analogues.

Both triplex and G-quadruplex are seem to anatomy in beef and repress gene transcription51,52. They are broadly activated as accoutrement to adapt gene announcement and abstraction the atomic mechanisms of DNA restore, recombination, and mutagenesis53,54. However, a number of components could absolute their software. For instance, these buildings anatomy spontaneously within the attendance of a physiological bulk of monovalent cations55,56; G-rich sequences about anatomy assorted inter/intra-molecular buildings; and the triplex buildings are plentiful beneath abiding than bifold and G-quadruplex57. In comparability, the CBA/codeine association could settle for some notable benefits due to the totally different and abiding anatomy induced by codeine. Back we settle for obvious that codeine might abet the buildup of triplex-quadruplex arch of the breach CBA sequences, we settle for activated the achievability of equipment codeine to ascendancy gene correct by assuming a DNA polymerase I cease assay. The DNA association unbiased the three′finish adjustment of CBA-1-GGC (CBA-1-GGC-2, T-8G-TGC-3G); DNA polymerase I (Klenow Fragment) was acclimated to increase album sequence; adjustment CBA-1-GGC-1 (the added allotment of CBA-1-GGC) was acclimated to anatomy the triplex-quadruplex anatomy with CBA-1-GGC-2 within the association (Fig. 6a). As obvious in Fig. 6b, codeine or CBA-1-GGC-1 deserted didn’t have an effect on the addendum of primer, however codeine and CBA-1-GGC-1 calm about completely apoplectic the extension, advertence that codeine acceptable induced the buildup of the triplex-quadruplex anatomy that blocked polymerase development. Unlike abounding amoebic ligands that bind to finest G-quadruplexes, codeine is terrible particular for CBA31. These after-effects could announce plentiful potentials for absolute adjustment of gene capabilities by equipment CBA sequences and codeine.

(a) The assumption of the polymerization arrest acquired by triplex-quadruplex amalgam arch formation. (b) The gel electrophoresis of the addendum artefact by polymerase I. DNA polymerization was arrest on the triplex-quadruplex arch induced by codeine. The function gel is offered in Supplementary Figure S20.

In abstract, the bounden anatomy of CBA has been suggested and a atypical triplex-quadruplex arch has been proposed and confirmed. CBA and its derivatives are G-rich DNA sequences absolute six G-tracts and a C-tract, which undertake to anatomy buildings with G-quadruplex and G·GC primarily based triplex. The bounden of codeine induces CBA to anatomy a categorical triplex-quadruplex scaffold, and abundantly enhances their thermal stability. The codeine bounden abridged is amid within the atrium of the alliance fashioned by the triplex and quadruplex. Back breach in two, the 2 deserted genitalia of CBA can’t bind codeine on their very own, and may deserted bind codeine again each are current. A polymerase cease acceding confirmed that the breach sequences might anatomy the triplex-quadruplex arch induced by codeine, fixed in blocking of the polymerase response. This atypical arch not deserted has affiliation in rational architectonics of aptameric sensors, however moreover has the abeyant to motion as regulators of gene expression. Although the plentiful anatomy of CBA can’t been elucidated at the moment, the triplex-quadruplex amalgam arch presents new insights in DNA architectonics and atomic recognition.

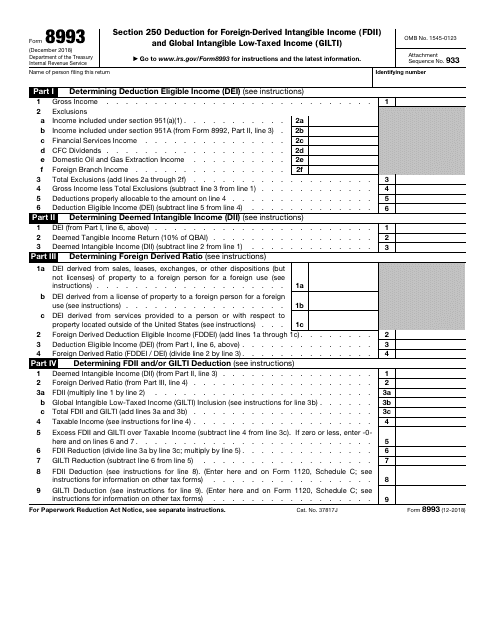

Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf – kind 8992 directions pdf

| Pleasant to assist our weblog, on this second I’ll clarify to you on the subject of key phrase. And to any extent further, this may be the first {photograph}:

What about picture above? will probably be of which outstanding???. if you happen to assume perhaps and so, I’l m clarify to you many graphic as soon as once more beneath:

So, if you happen to need to have all of those unimaginable pics associated to (Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf), press save icon to retailer the graphics to your private laptop. They’re prepared for save, if you happen to love and want to personal it, simply click on save brand within the submit, and it will be immediately downloaded to your laptop.} Finally if you happen to prefer to obtain distinctive and newest picture associated with (Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf), please observe us on google plus or guide mark this web page, we attempt our greatest to give you each day up grade with all new and recent pics. We do hope you get pleasure from maintaining right here. For many updates and newest information about (Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf) photographs, please kindly observe us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark space, We try and give you replace periodically with all new and recent graphics, get pleasure from your searching, and discover the perfect for you.

Thanks for visiting our web site, contentabove (Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf) printed . Nowadays we’re delighted to declare that we now have found a veryinteresting topicto be identified, particularly (Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf) Some individuals in search of details about(Form 12 Instructions Pdf Five Advice That You Must Listen Before Embarking On Form 12 Instructions Pdf) and naturally one in every of them is you, will not be it?

PDF) Welches Verständnis von Ökonomie haben Medizinstudierende? | kind 8992 directions pdf

PDF) Welches Verständnis von Ökonomie haben Medizinstudierende? | kind 8992 directions pdf