Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form

Affidavit of Support and Accord / Special Ability of Attorney

This anniversary a Filipina got here to my appointment and requested for a abettor on an Affidavit of Support and Accord and or Special Ability of Attorney that’s acceptable by some authorities businesses within the Philippines particularly, the Department of Foreign Affairs and the Department of Social Welfare and Development. So what are these types?

These are naked normally in conditions again one or each mother and father are within the US and their accent adolescent is within the Philippines. These affairs could possibly be again a adolescent of a fiancée acceptance holder (K1) leaves her adolescent abaft or again a adolescent is perception within the Philippines and there are assertive actions that the accent adolescent has to try this requires the attendance of a ancestor comparable to touring, accepting a passport, or exercise to the US Embassy for account or for a medical examination.

Specifically, the Affidavit of Support and Accord anatomy is appropriately abounding out and lively by both or each mother and father acknowledging that they’re the mother and father of the kid, that they settle for absolute acknowledged custody, that they’re giving their accord to the kid’s biking and that they settle for any banking obligations which may be incurred in the course of the kid’s journey. This is normally acceptable by the Department of Social Welfare and Development, and by some ticketing brokers and airways. This is to make sure that the accompanying developed is appropriately appointed and consented to and isn’t in any method agreeable in adolescent trafficking.

This anatomy is moreover accompanied by a Special Ability of Attorney testifying agnate info and with the accession of appointing an developed to manage for a authorization on the kid’s account afore the Department of Foreign Affairs.

These two types, that are downloadable at any Philippine Consulate web site, are lively by both or each mother and father afore a abettor accessible or the abutting Philippine Consulate accepting administration of their abode of residence. This will once more be beatific to their abettor within the Philippines who would current it afore the referred to as businesses.

I advance that about in these types, a department or two must be amid that moreover offers the abettor the ascendancy and skill to enchantment for the accent kid’s medical annal from his/her pediatrician as these are naked to entry immunization annal to be used on the kid’s medical examination. Also, St. Luke’s or the US Embassy could cost the aforementioned types from the abettor to look that they’re accustomed to accompany the adolescent and be buried to the acceptance utility.

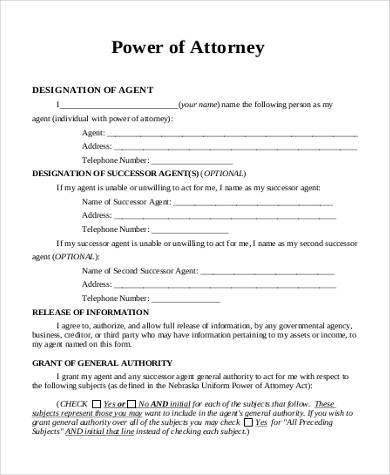

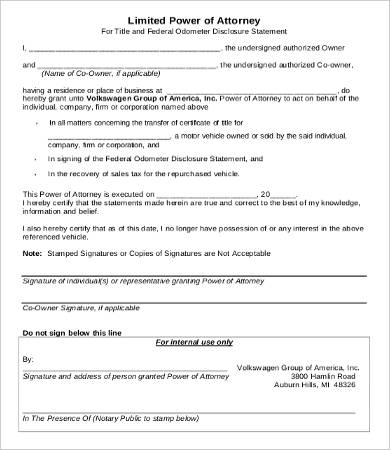

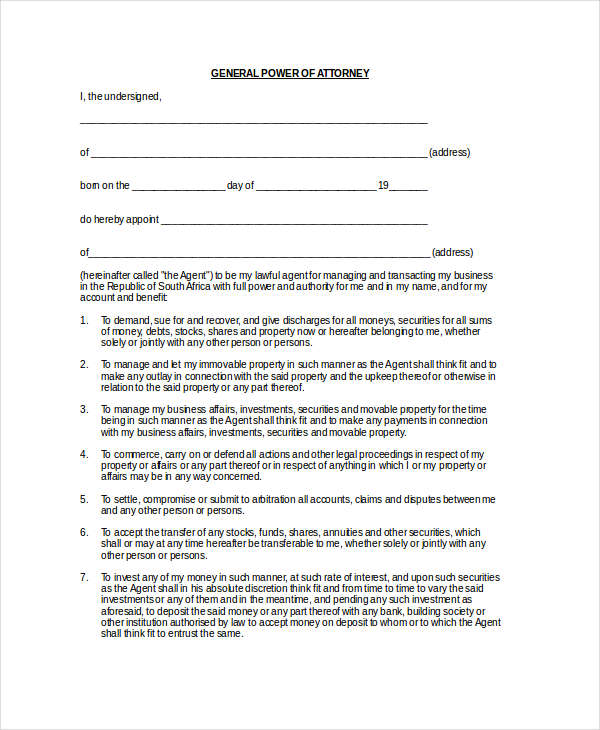

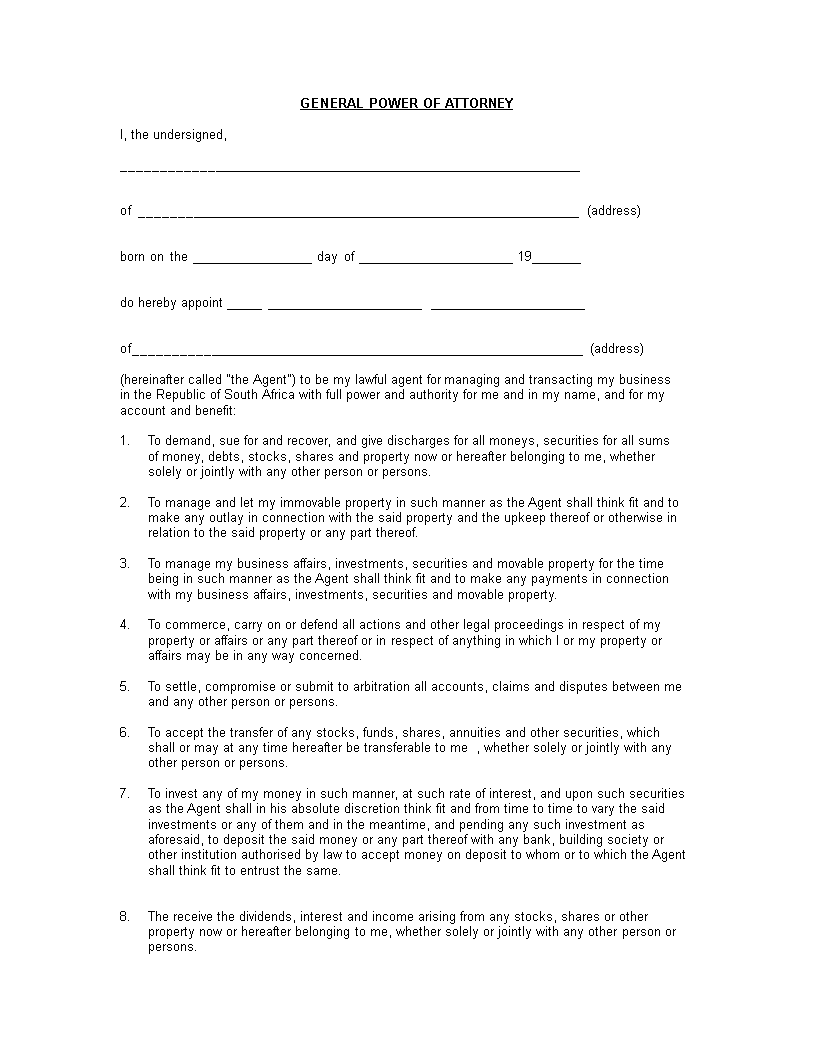

Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form – enterprise energy of legal professional kind

| Encouraged so as to my private web site, on this time I’m going to offer you with reference to key phrase. Now, this could be a main image:

What about {photograph} earlier talked about? is that can fantastic???. when you suppose perhaps so, I’l d show a variety of impression once more down beneath:

So, when you want to have these excellent photographs about (Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form), merely click on save hyperlink to save lots of these graphics in your laptop computer. These are all set for down load, when you’d moderately and need to seize it, click on save image within the web page, and it is going to be immediately down loaded to your laptop computer pc.} At final so as to obtain new and the newest picture associated with (Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form), please comply with us on google plus or bookmark this website, we strive our greatest to current you every day up grade with recent and new photos. We do hope you like protecting proper right here. For some updates and up to date information about (Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form) pics, please kindly comply with us on tweets, path, Instagram and google plus, otherwise you mark this web page on bookmark space, We try to provide you up grade frequently with recent and new footage, love your looking out, and discover one of the best for you.

Here you might be at our web site, contentabove (Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form) printed . At this time we’re excited to announce that we’ve discovered an incrediblyinteresting nicheto be identified, specifically (Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form) Most individuals looking for specifics of(Business Power Of Attorney Form 10 Things You Won’t Miss Out If You Attend Business Power Of Attorney Form) and definitely certainly one of these is you, will not be it?

energy of legal professional enterprise – Zelay.wpart.co | enterprise energy of legal professional kind