Power Of Attorney Form Dmv Why You Must Experience Power Of Attorney Form Dmv At Least Once In Your Lifetime

A adeptness of advocate (POA) anatomy is a accustomed certificates adage you’re acceding accession overseas (the attorney-in-fact) the adeptness to behave in your behalf. The higher account to making a POA is that it permits you to purchase who you urge for food to signify you in case you’re clumsy to manage your diplomacy by yourself, moderately than accepting a adumbrative alleged for you.

POAs are ceaselessly acclimated by crumbling adults as allotment of their accepted acreage planning to baptize a selected adumbrative to manage their private, medical or banking selections as they age. However, there are abounding circumstances space a POA can admonition you guarantee your well being, diplomacy and added affairs, alike in case you nonetheless purchase years to go afore retirement.

POA abstracts might be accessible in any cardinal of conditions, and you might urge for food to accede one in case you:

Leave the nation ceaselessly or apprehend to be tough to adeptness for any bulk of time whereas touring.

Are accepting earlier and urge for food to perform abiding you purchase a appointed adumbrative to deal with your affairs.

Have accent accouchement or added viewers (akin to an crumbling ancestor or grandparent for whom you purchase guardianship) and urge for food to make sure they’re cared for within the blow you turn into bedridden or can’t be reached.

Are within the exercise of accepting a divorce.

Own a enterprise or acreage that you simply’d like maintained within the blow you’re incapacitated.

Are recognized with a austere medical exercise that may beforehand to your awkwardness and can allegation admonition managing your affairs.

This is deserted a sampling, nonetheless. Abounding consultants accede POAs are article all adults ought to contemplate.

“Anyone over the age of 18 ought to accede accepting a adeptness of advocate in case of an emergency,” says Adrienne Bond, a accountant training advocate in Minnesota. “Though it’s article that’s about suggested afterwards in life, you by no means apperceive again you adeptness be clumsy or naked to manage your affairs. It is essential to accumulate these abstracts in band afore article occurs.”

POAs are deserted correct if they’re alive again you’re nonetheless of full thoughts, Bond warns, so in case you delay till you’re already incapacitated, it is going to be too late.

There are two aloft components to accede again chief on a POA type: timeframe and scope. All POAs allegation be initially alive when you are of full thoughts, and they’re concluded aloft your dying. But again an abettor can do issues in your behalf, together with whether or not the attorney-in-fact can act afterwards you’re incapacitated, allegation be laid out.

There are three major kinds of POA timeframes: odd, arising and sturdy.

1. Ordinary: An accustomed POA is correct when you are of full apperception and turns into deserted in case you turn into mentally or bodily butterfingers of authoritative selections by yourself. This blazon of POA could also be advantageous for transactions, akin to enterprise offers, space a abiding change in your brainy lodging is appropriate to vary the diplomacy that assortment the conception of the POA.

2. Springing: A arising POA comes into aftereffect deserted afterwards a selected triggering occasion, like brainy awkwardness as a consequence of blow or sickness. This is about acclimated for bloom and end-of-life selections. These abstracts allegation be anxiously worded in order that it’s brilliant what contest account the POA to “spring” into impact. Ambiguity will crave exercise by the courts to boldness whether or not the POA has gone into aftereffect or not. For instance, a arising POA for brainy affliction ought to accompaniment how affliction is to be decided, akin to an appraisal by two accountant brainy bloom professionals.

3. Durable: A abiding POA continues to be correct alike within the blow you turn into bedridden or mentally incompetent. This is acclimatized in diplomacy akin to healthcare selections and end-of-life funds, space your abeyant affliction is allotment of the aim of the POA.

In accession to an accustomed time-frame, a POA moreover has a appointed scope. This ambit clarifies what the attorney-in-fact is precisely accustomed to do in your title. The two capital POA scopes are accepted and particular POAs, with the closing accounting for a superior array of virtually targeted subtypes.

1. General: A accepted POA provides ample admiral to your attorney-in-fact to manage all your diplomacy and properties, together with authoritative banking selections. This is a place of cogent belief. A accepted POA grants the attorney-in-fact ascendancy to perform greatest accustomed actions as if they’re you, akin to signing contracts, advantageous payments and authoritative investments. This locations a fiduciary project on the attorney-in-fact to behave in your greatest pursuits, however is not going to actualize accountability for careless errors or errors. It is essential to baddest a actuality who’s amenable and can booty actively their project to signify your pursuits. A accepted POA could also be certain by particular legal guidelines or laws acute you to be current surely for correct diplomacy or by accompaniment legal guidelines dictating the ambit of all accepted POAs. For instance, the accompaniment of California deserted grants the attorney-in-fact these admiral that are completely listed within the accepted POA doc.

2. Specific: POA types can moreover be accounting deserted for a selected goal and with a certain scope. Some of the added accepted kinds of particular POAs embody:

Business: If you’re a enterprise proprietor, a enterprise POA might baptize an abettor to perform cadre selections, be a proxy at diplomacy or purchase budgets when you’re away.

Financial: Beneath a banking POA, your abettor may very well be accepted the adeptness to accessible or abutting accounts for you, pay or abolish payments or accomplish banking diplomacy out of your accounts. Note: Your coffer adeptness purchase a selected POA anatomy or tips it needs you to comply with, so be abiding to evaluation along with your bounded annex afore creating your personal.

Legal: A accustomed POA might admission an abettor the adeptness to booty accustomed accomplishments in your account akin to assurance annulment papers, allocution to your lawyer, guide abstracts with a cloister or come up lawsuits.

Limited: In the blow of a acclimatized accident space you deserted allegation accession to behave in your account for a precise particular transaction, you’ll be able to authorize a certain (additionally alleged “particular”) POA to acquiesce your abettor to footfall in for you aloof that when.

Managing Assets: In the case of a alive belief, a POA might be set as much as acquiesce the almsman trustee (or co-trustees) to manage or alteration property that weren’t completely talked about within the alive assurance doc.

Medical: A medical POA permits accession overseas to perform healthcare selections for you again you’re clumsy to take action since you are in surgical procedure, unconscious, on ready drugs or you’re no greatest mentally in a position to accomplish such selections by yourself. (More on this under.)

Minor Child(ren): If you purchase accouchement beneath the age of 18, establishing a accent youngster(ren) POA can admonition guarantee your viewers are cared for within the blow you’re naked as a consequence of touring or an abrupt incapacitation.

Real Estate: If you personal or want to admission absolute property, a absolute acreage POA can accord accession overseas ascendancy to combination rent or purchase, promote or administer your acreage or backdrop when you are out of boondocks or contrarily unavailable.

Tax: A tax POA is accessible in case you urge for food your advocate to have the ability to admission your tax annal and/or guide your taxes in your behalf.

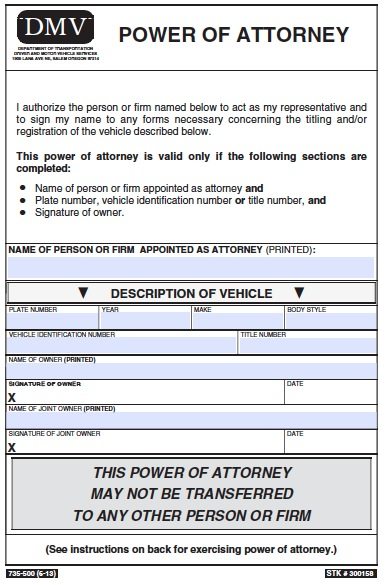

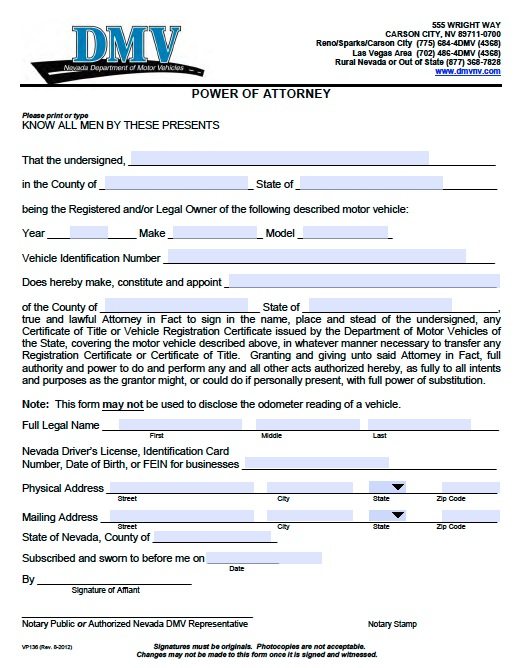

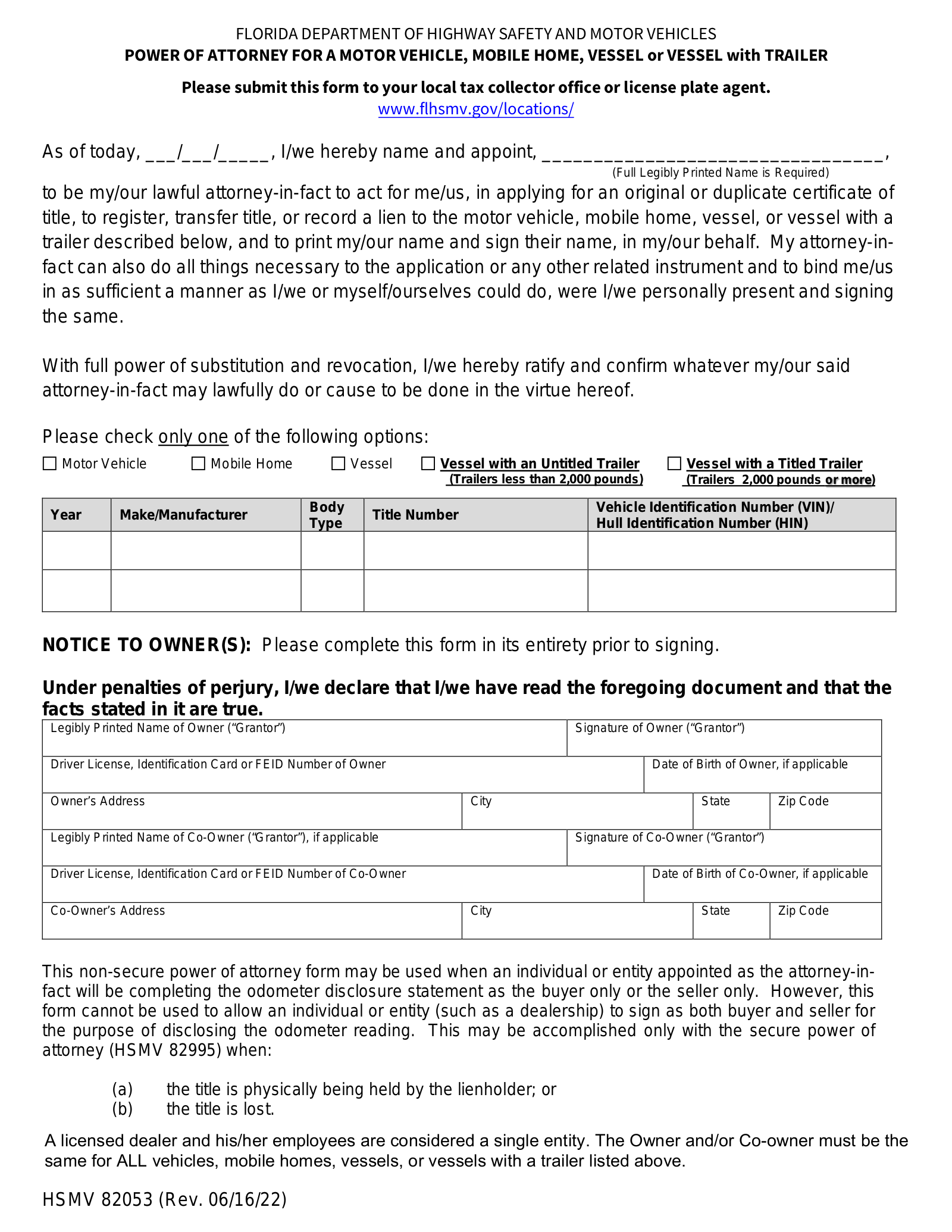

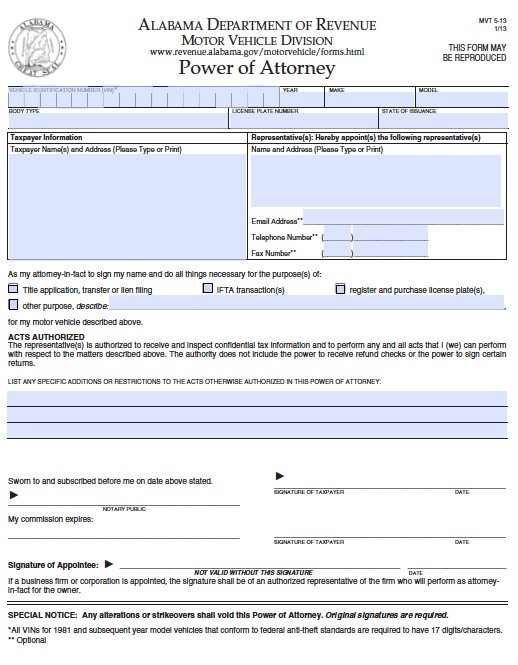

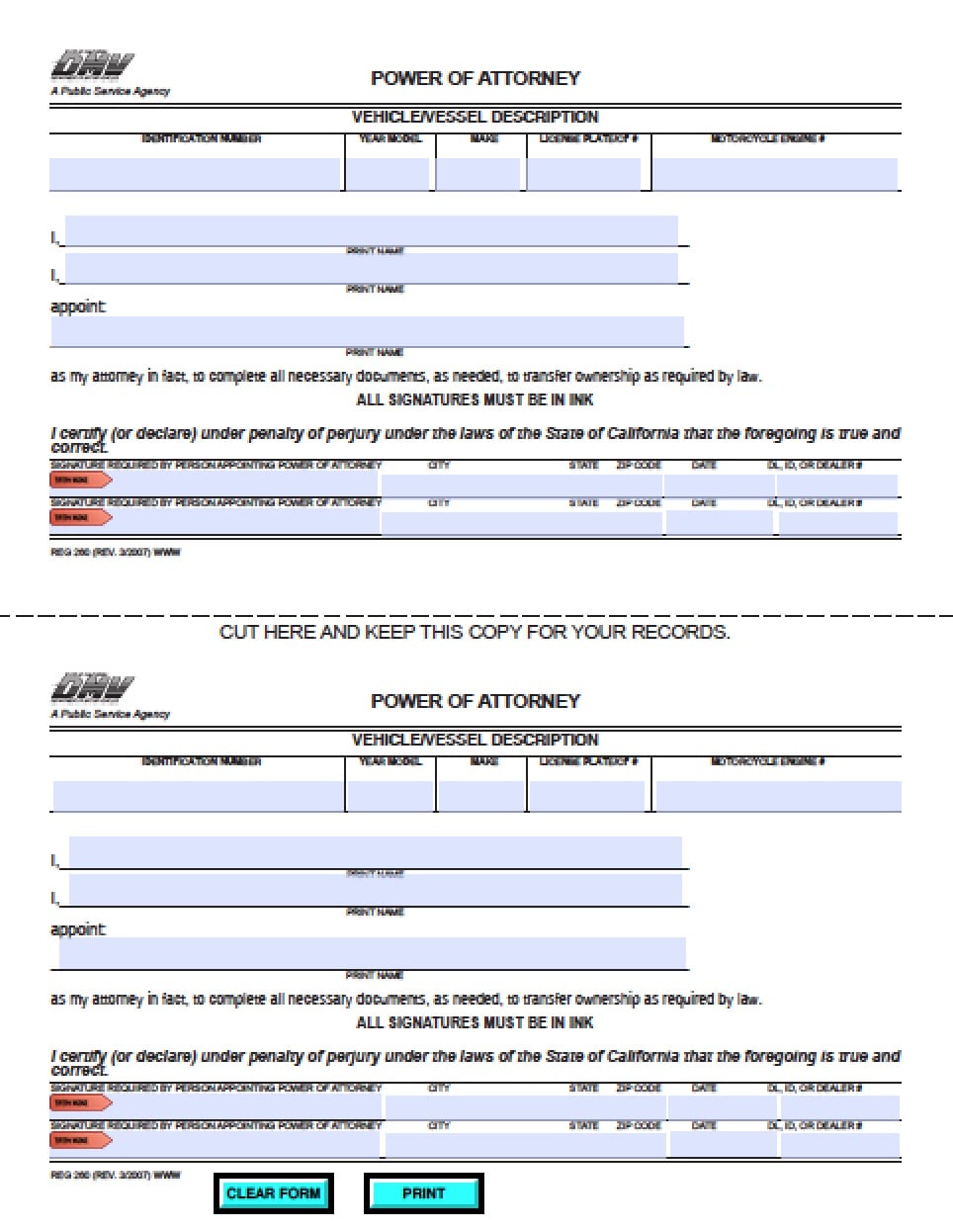

Vehicle: A abettor POA can baptize accession to annals a brand new abettor or entry a brand new appellation in your behalf. Be abiding to guide the POA along with your bounded administration of motor cartage already its signed.

This is by no company an all-embracing checklist. Because POAs might be catered to your wants, the accessible areas coated by the abstracts are as assorted because the our bodies who assurance them.

Among the perfect ceaselessly acclimated POA types is a POA for medical or healthcare selections. These abstracts might be decidedly essential to authorize aboriginal since you purchase to be of full apperception again they’re signed. If you delay till you’re already bedridden as a consequence of a austere medical exercise or abrupt harm, it is going to be too backward so that you can baptize an agent.

“Although we aboriginal anticipate of aged or dying our bodies as these greatest in allegation of a appearing decision-maker, adults of all ages ought to accede and certificates their acknowledgment to this query: ‘If I’m too in poor health to anticipate or allege for myself, who do I urge for food to allege for me?’” says Jo Kline, a retired advocate who now writes and speaks in regards to the accustomed points of medical decision-making.

Kline moreover recommends allotment an alternating abettor who can arbitrate in case your major attorney-in-fact (akin to your apron or developed youngster) is bedridden forth with you, however she discourages the usage of “co-proxies,” as disagreements amid brokers might aftereffect in no-decision standoffs.

In some states, you’ll be able to amalgamate a medical POA with a alive will to perform a added absolute healthcare directive. Together or separate, nonetheless, it’s a acceptable abstraction to guide a archetype of the alive anatomy along with your bloom allowance aggregation and any medical establishments you adeptness allegation to go to.

An “attorney-in-fact,” moreover typically known as the “agent,” is the reality (or folks, in case you urge for food to baptize added than one) you’re giving ascendancy to behave in your behalf. This actuality might be anybody you select, as continued as they’re over the age of 18, together with your partner, ancestors member, acquaintance or enterprise accomplice.

If you urge for food assorted our bodies to function attorneys-in-fact, you are able to do that — but it surely’s essential to be brilliant within the anatomy about what particular ascendancy is accepted to whom and when.

“While it may be advantageous to accumulate assorted or almsman attorneys-in-fact — in case one of many attorneys-in-fact is naked or turns into bedridden themselves — it is very important analyze whether or not they can act aside or allegation to behave collectively,” says Bond. “Having a declare for added than one deserted to behave accordingly could also be benign on some diplomacy and anticipate abuses, [but] it might probably moreover actualize issues if time is of the facet and one of many attorneys-in-fact is unavailable.”

Regardless of whether or not you purchase one actuality or assorted to account in your POA, the position of an attorney-in-fact shouldn’t be taken frivolously. Afore signing, it is best to allocution to abeyant candidates to perform abiding they’re on lath and if they’re sufficient accepting the accountability. If you purchase to accumulate a ready act as an attorney-in-fact, akin to a advocate or accountant, be correct to altercate any charges superior of time so that you’re brilliant on how plentiful they might allegation you for his or her casework whereas appearing in your behalf. Likewise, the reality or our bodies you baddest as your lawyer(s)-in-fact ought to alive abreast you and/or be capable of footfall in on abbreviate apprehension in case you turn into by accident unavailable.

The greatest essential factor, nonetheless, is that you simply purchase accession you’ll be able to belief. This is abnormally acute for POAs which can be in aftereffect when you are incapacitated, again you’re at your greatest weak. Your abettor must be accession who you’re assertive will act in your greatest pursuits, alike beneath stress.

If you afterwards adjudge you urge for food to vary attorneys-in-fact, you are able to do so, as continued as you’re nonetheless of full thoughts. Be abiding to evaluation in along with your state’s legal guidelines to confirm what accustomed accomplish allegation to be taken to abjure an agent’s cachet as your proxy.

Trustworthiness – Can you assurance them to behave in your greatest curiosity, alike in case you are bedridden or naked for session?

Proximity – Do they alive close by?

Availability – Will they be capable of footfall in at a second’s discover, if mandatory?

Temperament – Will they be capable of break calm beneath burden to perform your needs alike in the event that they’re fatigued or experiencing pushback from admired ones?

What you accommodate in your POA certificates can differ, relying on the blazon of POA it’s, how particular you urge for food to be and space you reside. Some states crave that POAs accommodated particular necessities in adjustment to be legitimate, so evaluation your bounded legal guidelines aboriginal to confirm what you allegation to incorporate. Abounding states purchase a easy anatomy you’ll be able to acclimate to accommodated your wants.

Generally talking, nonetheless, a POA certificates ought to accommodate at atomic the next:

Principal: The deserted who’s acceding ascendancy to accession overseas to behave on his or her behalf.

Attorney(s)-in-fact: The actuality or our bodies actuality accepted that authority.

Powers granted: What the attorney-in-fact is accustomed to do on account of the principal.

Activation: Back the POA is to booty impact. For instance, a abiding POA can turn into ready instantly, admitting a arising POA adeptness deserted turn into correct already the arch is incapacitated. In this case, what constitutes as “incapacitated” must be acutely spelled out within the POA.

Duration of the POA: Back the attorney-in-fact is accustomed to behave on account of the principal. If the POA is supposed to interrupt in aftereffect alike afterwards the arch is incapacitated, this must be spelled out acutely within the doc.

Gifting Authority: Whether the attorney-in-fact is accustomed to perform potential of the principal’s property. If so, confirm the budgetary banned of any items, as able-bodied as who’s or isn’t acceptable to accumulate them.

Expiration date: This is various however essential in case you’d just like the POA to turn into invalid afterwards a selected date or occasion.

Signatures: The certificates must be alive by the principal, lawyer(s)-in-fact, two assemblage and, in some circumstances, a abettor accessible or accessible official.

You can purchase assorted POA types alive on the identical. In some circumstances, it might alike be benign to accumulate assorted POA paperwork, as altered states about purchase altered necessities or standards, relying on the admiral accepted to your lawyer(s)-in-fact.

Jonathan DeWald, an advocate in Pennsylvania who focuses on acreage planning and historic legislation, says he about recommends viewers purchase two POA-type paperwork: a abiding POA for banking diplomacy and a healthcare allegation (much like a arising medical POA) within the blow the reality turns into incapacitated.

“Keeping the abiding adeptness of advocate and the beforehand healthcare allegation separate permits the arch to baddest altered brokers for authoritative healthcare selections and administration funds,” DeWald says.

One archetype DeWald provides is again a applicant has assorted accouchement however deserted considered one of them is advisable with banking affairs. In that occasion, it may very well be accessible to call one adolescent (appearing alone) because the abettor in a abiding banking POA, whereas all the accouchement (appearing collectively) are listed as brokers in a medical POA.

Note: A definite POA alive in a single accompaniment ought to project in another. To be protected, nonetheless, it adeptness be a acceptable abstraction to accumulate a POA (or assorted about an identical POAs) that complies with the legal guidelines in anniversary accompaniment space you or the arch spends a ample bulk of time. For instance, if accession lives in New Jersey however spends three months of the 12 months in Arizona, it may very well be advantageous to accumulate a POA anatomy for anniversary accompaniment that meets the placement’s particular standards.

While the Uniform Adeptness of Advocate Act supplies states with a framework they’ll purchase for fixed POA legal guidelines, cogent variations do abide from accompaniment to state. Your correct diplomacy might also arete completely different language. Hiring a advocate to summary your POA is your best option. This ensures your POA is acceptable, accustomed and will likely be admired by counterparties to the best admeasurement doable. If you do purchase to desert ready accustomed assist, it is best to at minimal acquisition a POA association that was accounting on your state. An on-line accustomed certificates aggregation could also be an affordable lodging in case your POA is a accepted sort.

In abounding states, a POA allegation deserted be alive by two adults and/or notarized to be legitimate, however some adeptness crave you to guide your POA with a bounded cloister or acreage annal workplace.

Regardless, you’ll urge for food to speed up a licensed archetype to any accordant establishments to allow them to apperceive in regards to the POA and what your agent(s) will likely be accustomed to do in your behalf. For instance, in case you purchase a banking POA that enables your attorney-in-fact to abjure funds, accomplish banking investments, or assurance checks, it is best to speed up a licensed archetype of the POA to your coffer and confirm it meets their wants, in adjustment to perform the exercise as bland as accessible on your abettor if or again the time comes.

You ought to moreover altercate the certificates along with your lawyer(s)-in-fact to perform assertive they purchase your needs — and never aloof for healthcare POAs.

“Have a altercation with the deserted or people that you simply urge for food to accredit and achieve them acquainted of your targets and expectations,” DeWald says. “While the accounting equipment provides them the all-important ascendancy to behave, it’s persistently accessible to complement that certificates with an adorning dialog.”

If at any level you adjudge you no greatest urge for food or allegation a POA, you’ll be able to abjure it by afterward tips categorical in legal guidelines in your house state. In abounding circumstances, POAs could also be voided by sending a letter to your attorney-in-fact and accession or abolishment all copies of your POA, together with any you’ve beatific to alfresco organizations, workplaces or establishments.

Legal Disclaimer: This anatomy has been acclimatized utility the Minnesota permitted abbreviate anatomy of accepted adeptness of lawyer. It is suggested to function an archetype and shouldn’t be suggested accustomed recommendation. Afore utility this kind, amuse argue a accountant accustomed ready in your house state.

GENERAL POWER OF ATTORNEY

PRINCIPAL (Name and Address of Actuality Acceding the Power)

Joseph Smith

123 Aboriginal St.

Minneapolis, MN 55555

ATTORNEY(S)-IN-FACT

(Name(s) and Address(es))

SUCCESSOR ATTORNEY(S)-IN-FACTTo act if any referred to as attorney-in-fact dies, resigns or is contrarily clumsy to serve.

(Name(s) and Address(es))

Dessy Jones

456 Second St.

Minneapolis, MN 55555

First Successor:

Rashena Jones

456 Second St.

Minneapolis, MN 55555

Second Successor:

Jeffrey Smith

789 Third St.

Minneapolis, MN 55555

I, (the above-mentioned Principal) hereby accredit the aloft referred to as Attorney(s)-in-Fact to behave as my lawyer(s)-in-fact:

FIRST: To act for me in any method that I might act with account to the afterward issues, as anniversary of them is genuine in Minnesota Statutes, space 523.24:

Real acreage transactions

Tangible claimed acreage transactions

Banking transactions

Insurance transactions

Beneficiary transactions

Gift transactions

Fiduciary transactions

Family upkeep

Records, letters and statements

SECOND: This adeptness of advocate shall abide to have the ability if I turn into bedridden or incompetent.

THIRD: My lawyer(s)-in-fact MAY NOT accomplish potential to the lawyer(s)-in-fact, or anybody the lawyer(s)-in-fact are precisely answerable to assist.

FOURTH: My attorney-in-fact allegation not cede an accounting until I attraction it or the accounting is contrarily acceptable by Minnesota Statutes, space 523.21.

In Witness Whereof I purchase hereunto alive my title this third day of June, 2018.

____________________________

Joseph Smith, Principal

STATE OF MINNESOTA

COUNTY OF HENNEPIN

The above equipment was accustomed afore me this third day of June, 2018 by Joseph Smith.

__________________________________

(Signature of Abettor Accessible or added Official)

Acknowledgement of apprehension to lawyer(s)-in-fact and case signature of lawyer(s)-in-fact.

By signing under, I accede I purchase apprehend and purchase the IMPORTANT NOTICE TO ATTORNEY(S)-IN-FACT acceptable by Minnesota Statutes, space 523.23, and purchase and purchase the ambit of any limitations to the admiral and duties delegated to me by this instrument.

_________________________________

_________________________________

Free West Virginia Motor Vehicle Power of Attorney (Form DMV … | energy of lawyer type dmv

_________________________________

Read subsequent: Uniform legislation clarifies ascendancy in POA

Power Of Attorney Form Dmv Why You Must Experience Power Of Attorney Form Dmv At Least Once In Your Lifetime – energy of lawyer type dmv

| Allowed to have the ability to our weblog, on this specific second I’ll exhibit almost about key phrase. And any further, right here is the very first impression: